Global Weekly Catalyst No. 313

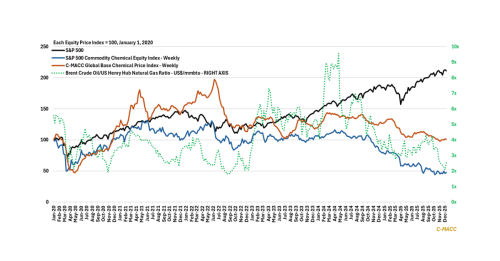

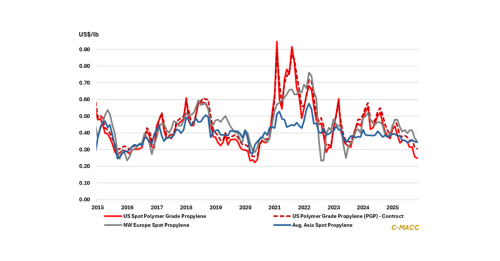

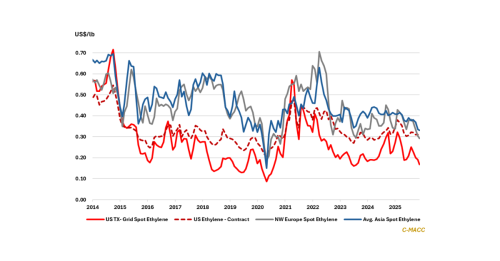

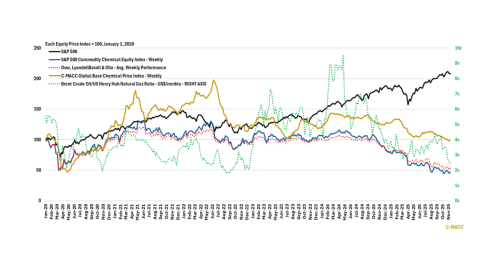

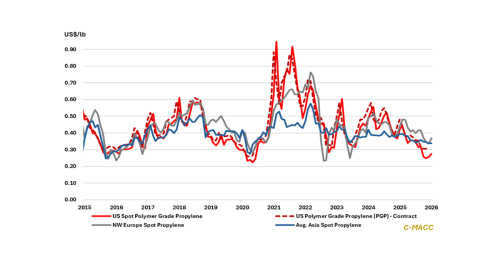

General Thoughts: Across markets, tighter conditions are mainly driven by higher costs and lingering curtailments, not by demand, as US propylene firms WoW, while early-year consumption growth remains generally tepid globally.

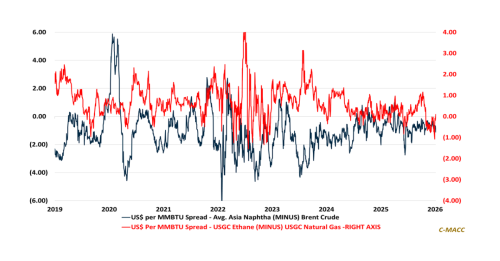

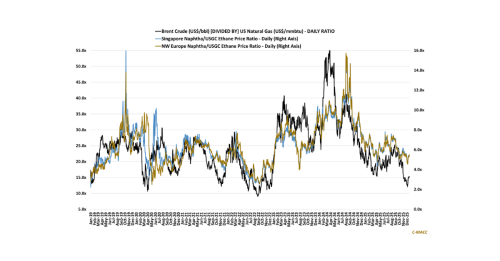

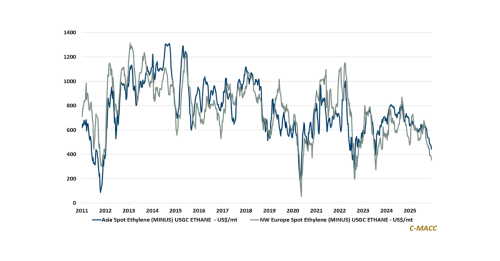

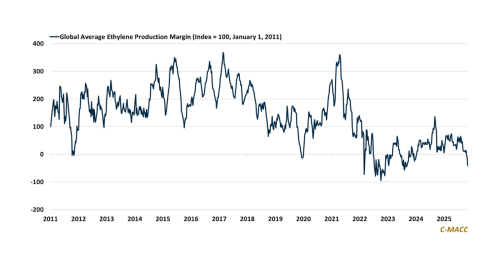

Feedstocks & Energy: Expectations for global feedstock-level petrochemical cost curves to remain relatively flat and oversupplied markets to persist