Resin To Riches: Weekly Plastic Market Insights

General Thoughts: Polymer markets are shifting toward supply security economics amid logistics disruptions, feedstock shocks, and precautionary buying, which are shifting global trade flows and

Providing value-added research and strategic consulting services using chemical industry expertise

Stay ahead in dynamic markets, streamline your supply chain, and plan with confidence through unmatched insights into global chemical trends.

Gain clarity on oil, gas, and feedstock markets to uncover opportunities, manage risks, and guide smarter investment decisions.

Explore complex data on renewable power, carbon emissions, and recycling—translated into strategic guidance to help decision-makers manage risks and navigate an ever-evolving industry.

General Thoughts: Polymer markets are shifting toward supply security economics amid logistics disruptions, feedstock shocks, and precautionary buying, which are shifting global trade flows and

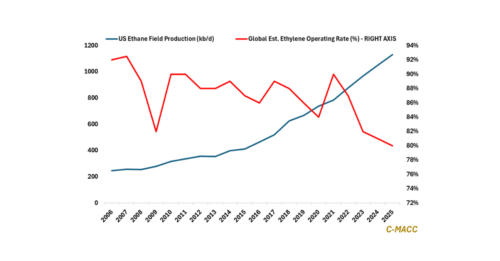

General Thoughts: Integration, logistics flexibility, and feedstock advantage are increasingly replacing scale as the chemical sector’s defining competitive edge, steering capital toward integrated production platforms.

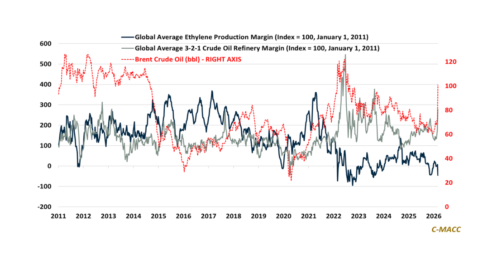

General Thoughts: Energy shocks are redistributing profitability across industrial value chains as surging ex-US energy costs compress petrochemical margins, tighten fertilizer markets, and strengthen North

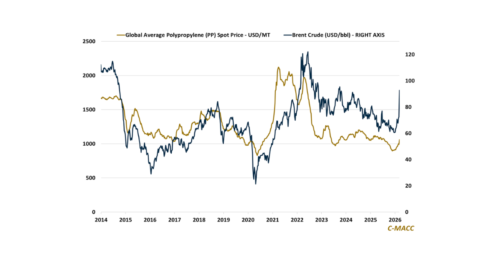

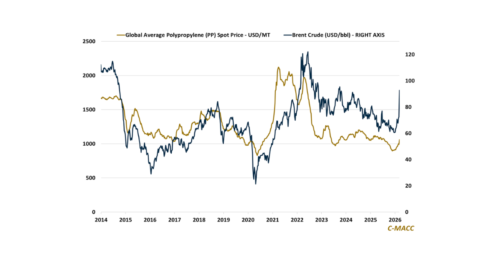

Surging crude prices and widening feedstock spreads are steepening the global petrochemical cost curve. Cheap regional gas and NGLs may support selective integration, but not

Comprehensive market intelligence and analysis spanning chemicals, energy, sustainability, and industrial value chains, designed to facilitate strategic business decisions.

Real-time pricing data and analytics for polymer markets with detailed trend analysis and forecasting.

Our strategic partner, ChemOrbis, is a leading global platform offering real-time pricing, news, and market insights across chemical, polymer, and related markets.

Strategic consulting and advisory services to help navigate complex market dynamics and opportunities.

Ready to access premium market intelligence?

Contact us to learn more about subscription options and pricing.

Fill out the form below and our team will contact you within 24 hours

Sign up below to get updates on our events, publications, and insights—straight to your inbox.