Global Weekly Catalyst No. 321

General Thoughts: Energy shocks are redistributing profitability across industrial value chains as surging ex-US energy costs compress petrochemical margins, tighten fertilizer markets, and strengthen North

Providing value-added research and strategic consulting services using chemical industry expertise

Stay ahead in dynamic markets, streamline your supply chain, and plan with confidence through unmatched insights into global chemical trends.

Gain clarity on oil, gas, and feedstock markets to uncover opportunities, manage risks, and guide smarter investment decisions.

Explore complex data on renewable power, carbon emissions, and recycling—translated into strategic guidance to help decision-makers manage risks and navigate an ever-evolving industry.

General Thoughts: Energy shocks are redistributing profitability across industrial value chains as surging ex-US energy costs compress petrochemical margins, tighten fertilizer markets, and strengthen North

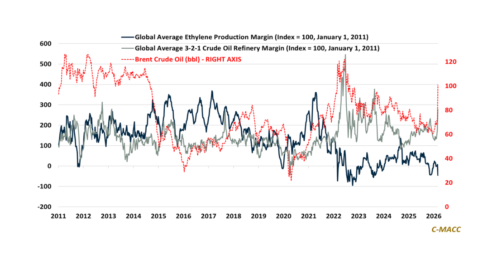

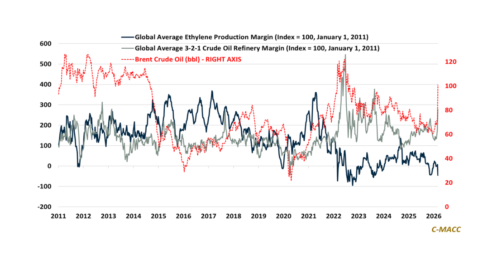

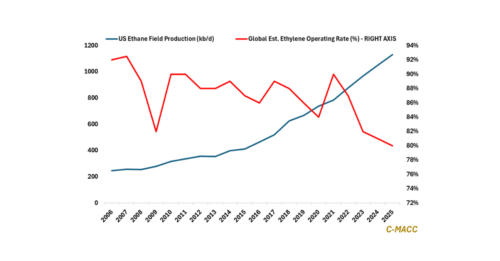

Surging crude prices and widening feedstock spreads are steepening the global petrochemical cost curve. Cheap regional gas and NGLs may support selective integration, but not

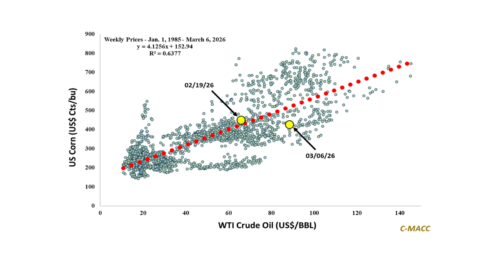

1st Topic of the Week: Oil-corn price dispersion is reviving the policy case for permanent E15 expansion. Could energy inflation accelerate ethanol demand faster than

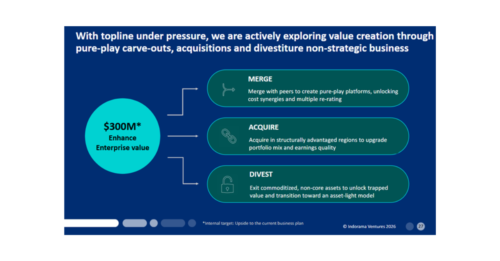

General Thoughts: Feedstock volatility, still weak demand, and supply chain stress accelerate global chemical restructuring as companies actively reshape portfolios to improve long-term risk-adjusted returns.

Comprehensive market intelligence and analysis spanning chemicals, energy, sustainability, and industrial value chains, designed to facilitate strategic business decisions.

Real-time pricing data and analytics for polymer markets with detailed trend analysis and forecasting.

Our strategic partner, ChemOrbis, is a leading global platform offering real-time pricing, news, and market insights across chemical, polymer, and related markets.

Strategic consulting and advisory services to help navigate complex market dynamics and opportunities.

Ready to access premium market intelligence?

Contact us to learn more about subscription options and pricing.

Fill out the form below and our team will contact you within 24 hours

Sign up below to get updates on our events, publications, and insights—straight to your inbox.