Margin Defense Mode Activated: Cost Curves Strike Back Globally

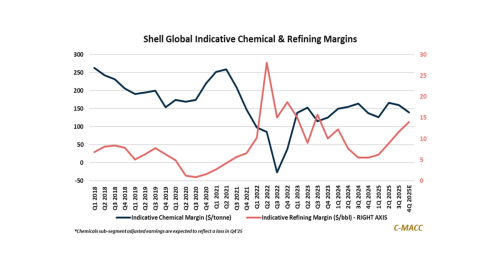

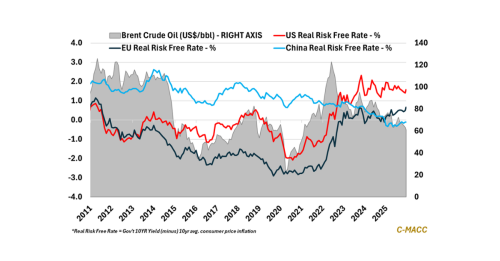

General Thoughts: Early 2026 chemical sector updates signal margin defense over volume, as pricing, self-help, and restructuring offset weak demand, policy uncertainty persists, and capacity shifts shape outcomes.

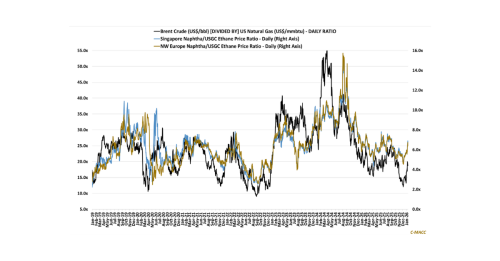

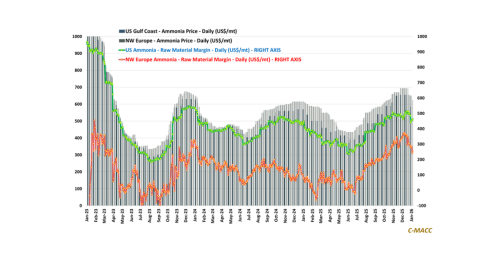

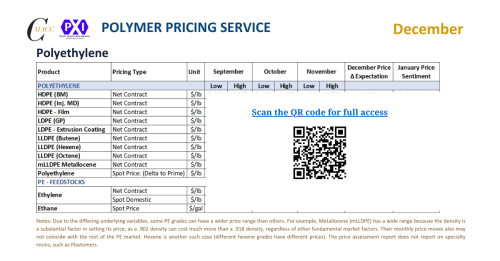

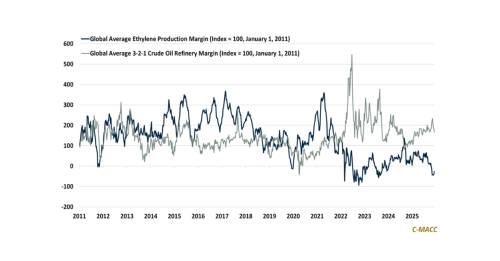

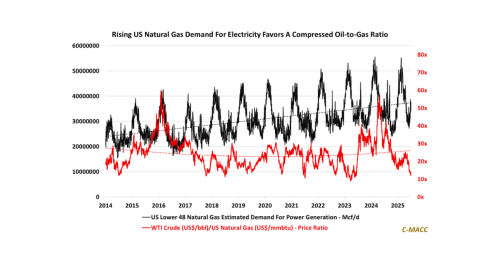

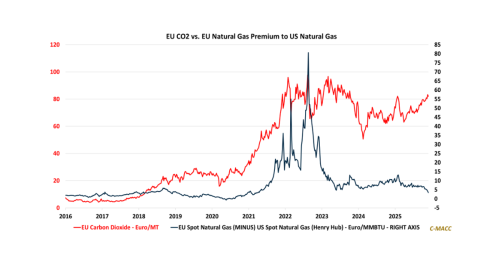

Supply Chain/Commodities: Cost shifts anchor polymer markets, with price stabilization favoring disciplined global producers, as feedstock divergence and restructuring pressures redefine margin