Resin To Riches: Weekly Plastic Market Insights

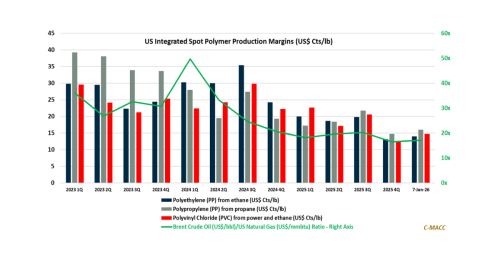

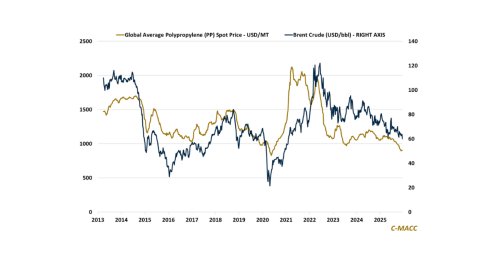

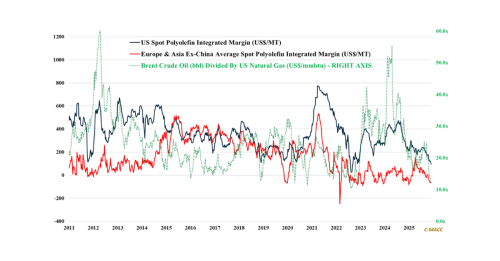

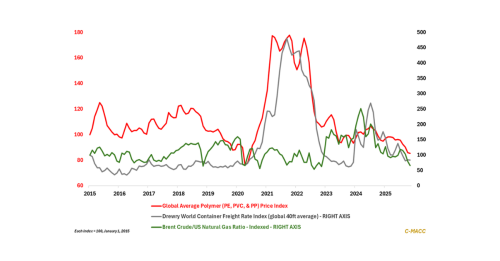

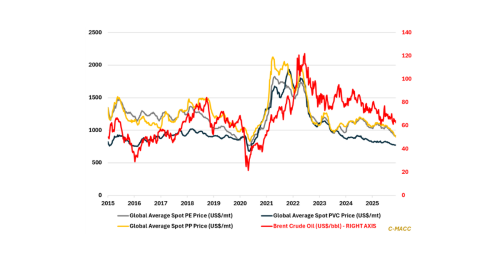

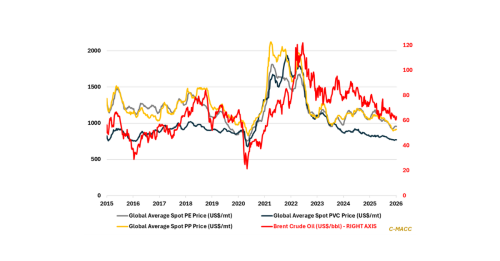

General Thoughts: Spot polymer prices reflect stabilization in early 2026 as crude strength, feedstock dispersion, and production curbs lift price floors, with 1H26 favoring margin defense and selective upside over demand-led recovery.

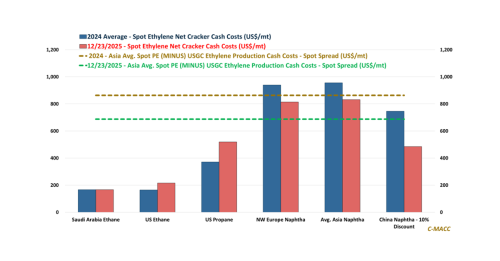

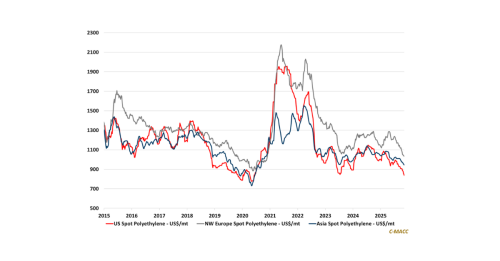

Polyethylene (PE): Early-2026 PE prices firm on rising ex-US naphtha costs and operating discipline, with cautious global buying