Global Weekly Catalyst No. 319

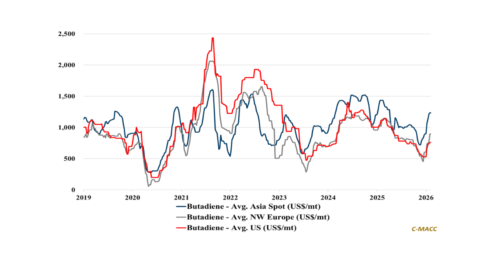

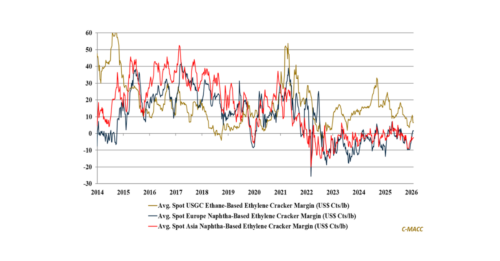

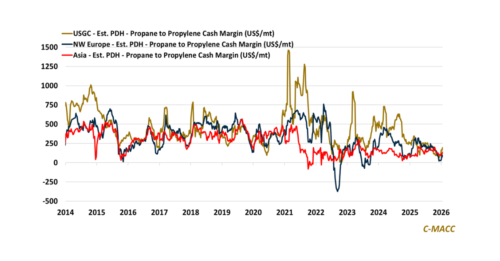

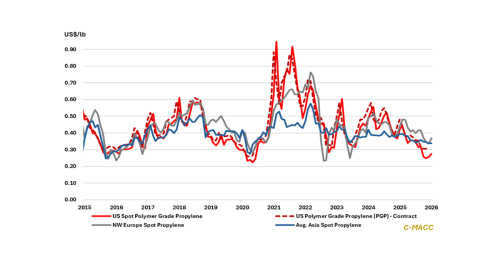

General Thoughts: Oil-to-gas dispersion, cracker co-product volatility, and logistics bottlenecks signal that 2026 returns will reward integration and execution over scale, while accelerating needed sector rationalizations.

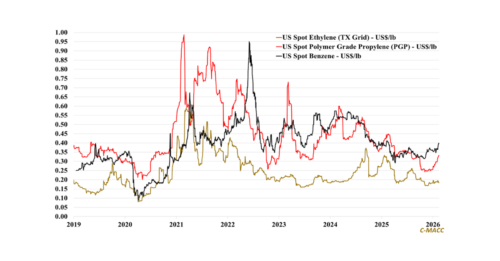

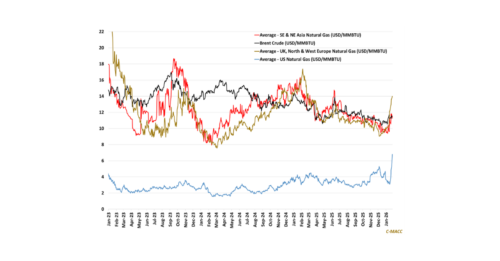

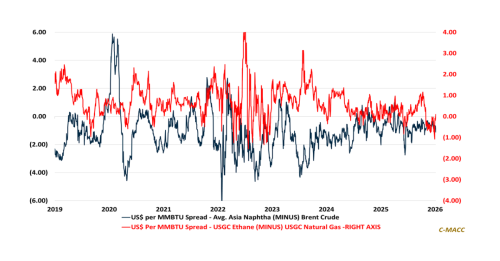

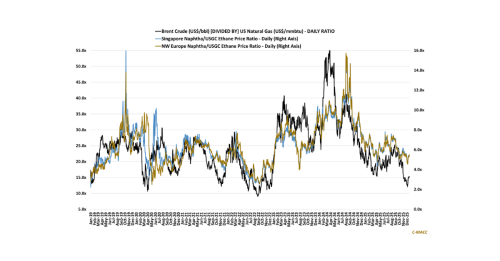

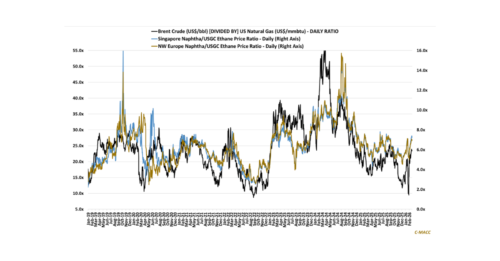

Feedstocks & Energy: Crude’s renewed strength amid easing natural gas and ethane prices is widening global cost differentials, strengthening North America’s petrochemical cost advantage