Structural Dispersion Endures: Integration, Not Scale, Secures Superior Returns

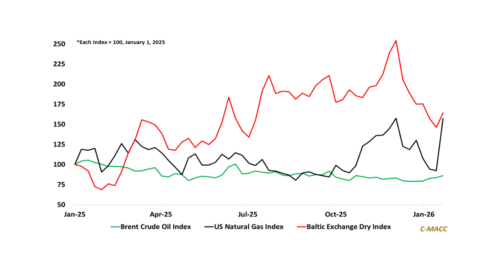

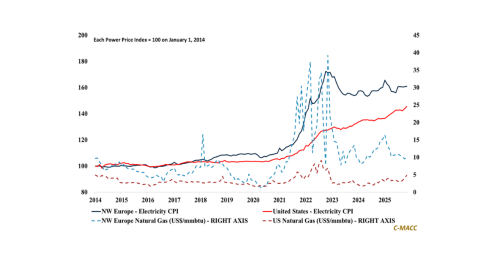

Persistent European premiums over Henry Hub confirm LNG marginal clearing as the dominant marginal price-setting mechanism, anchoring US export-linked gas economics and long-cycle infrastructure returns.

Integrated midstream systems convert dispersion and basin volatility into contracted earnings visibility, with storage depth and routing density increasingly more valuable than pure throughput scale.