Compressed Gas, Compressed Margins: Why Integration, Not Relief, Defines 2026 Returns

General Thoughts: Simultaneous natural gas and carbon price compression eases Europe’s cost burden, yet demand fragility, structural import dependence, and risk of renewed global tightening cap competitiveness.

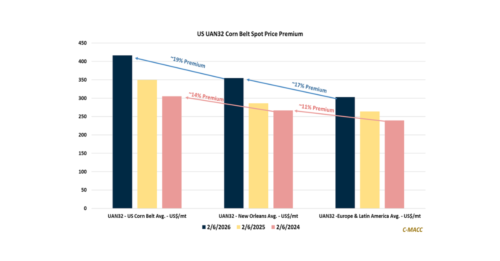

Supply Chain/Commodities: Inland ammonia allocation and logistics drive nitrogen margin durability, rewarding producers who actively flex product placement rather than relying on global