From Boom and Gloom to Prune and Perfume: Producers Refine to Redefine the Return Line

General Thoughts: Westlake is repositioning toward integrated building systems, using rationalization and downstream integration to enhance structural durability, cash consistency, and through-cycle returns.

Supply Chain/Commodities: Petronas Chemicals Group underscores Asia’s structural divide between pockets of strength and broad petrochemical oversupply, with recovery hinging on global supply rationalization.

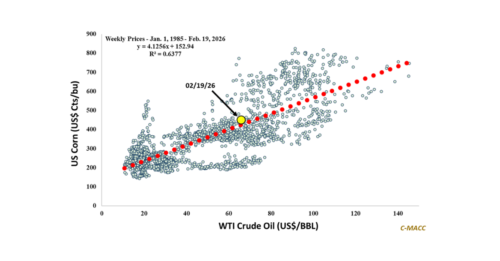

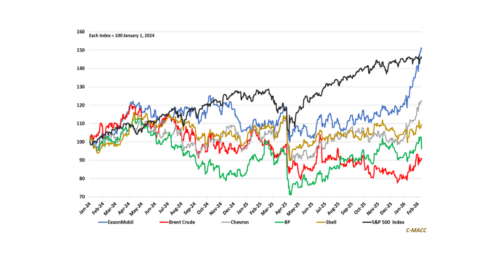

Energy/Upstream: Integrated US