C-MACC Sunday Thematic and Weekly Recap

Polyethylene 2025 and Beyond: Possibly Years of Dramatic Change; Global Insights Become Important

- A tariff war is just one factor that could upend global polyethylene markets in 2025, with US exports most at risk in our view, adding to risks of changing production economics, economic growth, and more China capacity.

- A more protectionist Europe, which could happen if US relations sour, could drive import tariff increases to help local industry. Still, without weaker oil prices, the tariffs would need to be significant to matter, such as in Brazil.

- Local protectionism could see North America, the Middle East, and China fight more for export share in 2025. While China is in a PE net deficit position, it is grade-specific, with surpluses of HDPE and LDPE emerging already.

- Understanding global pricing and trade arbitrages will become increasingly important for polyethylene sellers or buyers in 2025 – the C-MACC ChemOrbis partnership is ideally positioned to help with insights and strategy.

- Otherwise, we discuss falling refinery profitability, more signs that Europe is vulnerable and needs a grand US bargain, and we look for scraps in hydrogen and question whether others are vulnerable, like Air Products.

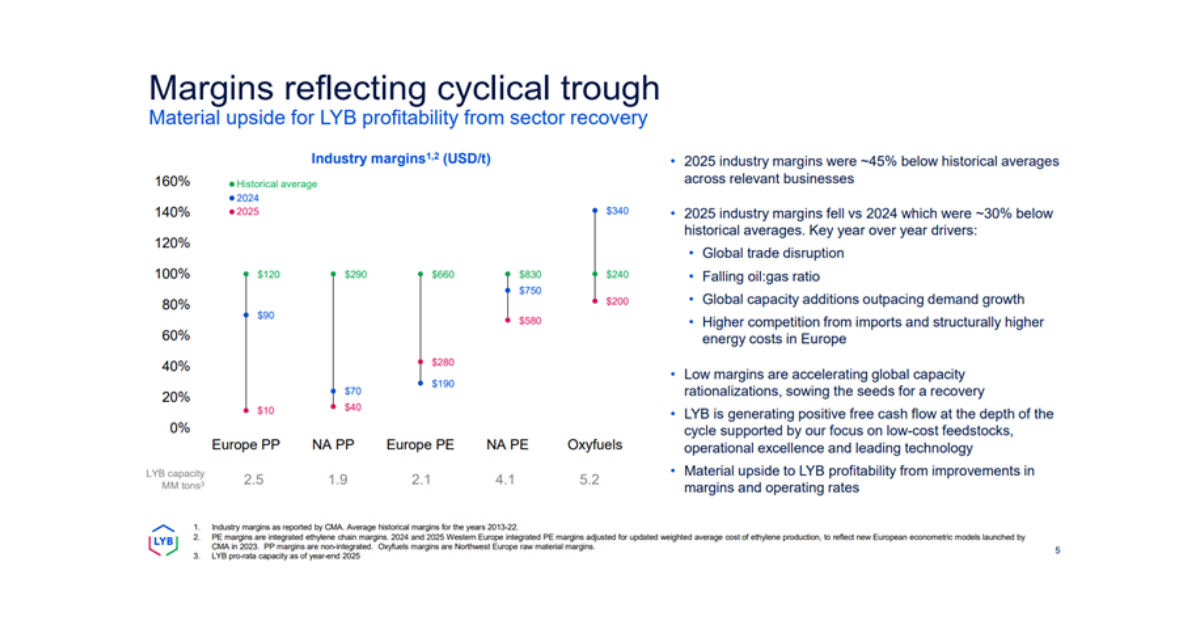

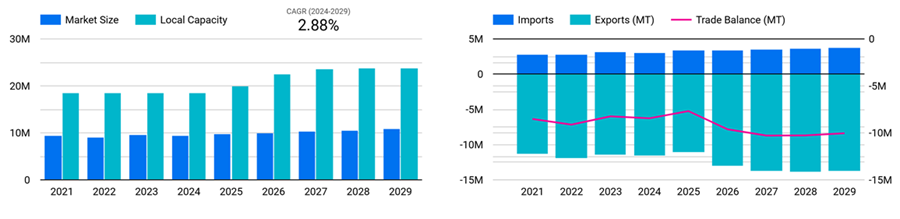

Exhibit 1: Global polyethylene surpluses to rise – 75% operating rates possible through 2029 if economic growth slows

Source: ChemOrbis, November 2024

See the PDF below for all charts, tables, and diagrams

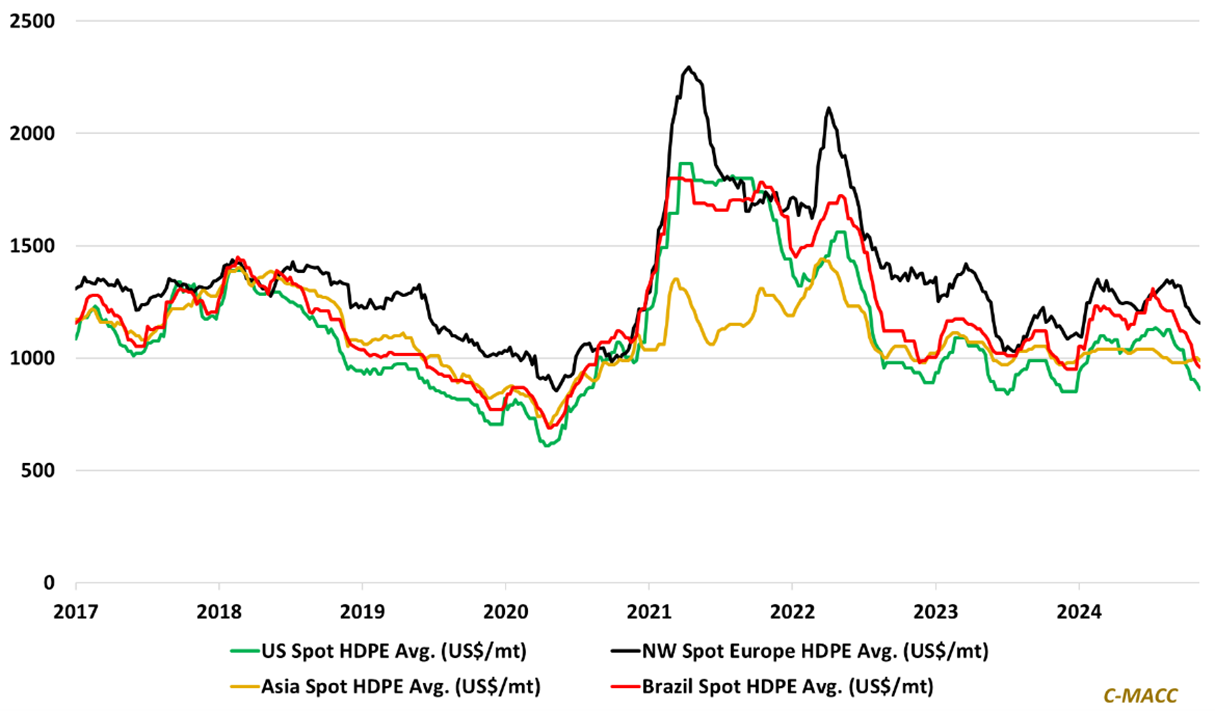

Polyethylene is heading into a very uncertain 2025, with new construction adding capacity to already oversupplied markets and trade disagreements likely to put US polyethylene in the crosshairs. As Exhibit 2 shows, US polyethylene surpluses have grown meaningfully over the last few years, and they now represent around 50% of domestic US polyethylene production. The considerable cost advantage that oil and gas production in the US has brought to the chemical industry has enabled this development, but at the same time, low-cost polyethylene exports from the US are harming producers in export target markets, prompting significant tariffs imposed on several polymers heading into Brazil, starting this month. As we enter 2025, we have much more capacity to start up in a relatively slow-growth China market, limited domestic growth in the US, maintaining the export surplus, the risk of slower growth globally, uncertainty around oil prices, and the Trump trade promises. With Brazil as a good recent example, polyethylene is an easy retaliatory trade target, especially if the EU and the UK feel a need to both react to Trump tariffs and protect local industry.

- Trump trade war will drive end of globalisation for chemicals

- Sinopec starts up new cracker at Tianjin

Exhibit 2: US polyethylene trade balance

Source: ChemOrbis, November 2024

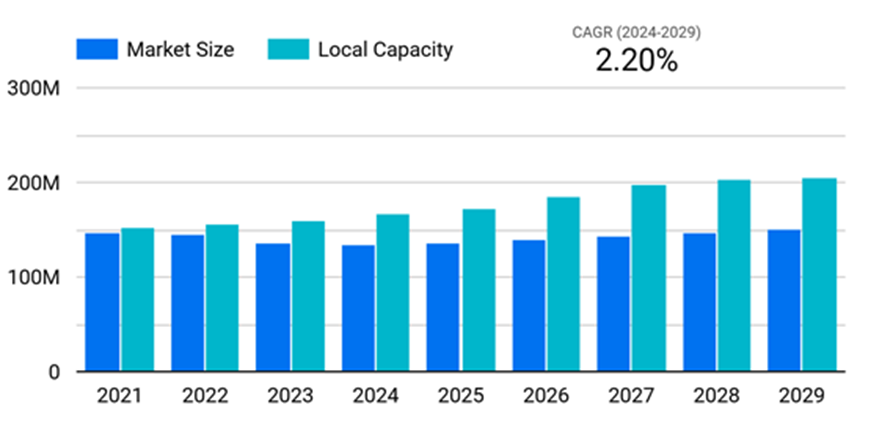

In Exhibits 3 and 4 we show the rapidly changing trade balance in China and the surpluses in the Middle East, with the analysis taken from a new and very powerful global tool soon to be released by ChemOrbis. This analysis may differ from other forecasts in the market, in part because the analysis is current (we did the work this week), and in part because we have chosen to show the trade surplus effect of lower economic growth in 2025, which is the consensus expectation if the Trump Administration ramps up tariffs. We have taken the recent IMF economic estimates and reduced each year in each region by 100 basis points of growth. This increases the US surplus and speeds up the swing to surplus in China, although below we are assuming that Chinese capacity does not operate fully – evident from the chart to the right – this assumption may be too hopeful. For these net trade estimates to work, the economics must work such that the exporters can squeeze their way into target markets. If we see retaliatory tariffs on polyethylene, the US will struggle to move all the material implied in Exhibit 2, and either operating rates in the US will need to be reduced or the US will need to push export prices lower. In Exhibt 1 we show a market that has a third more capacity than is needed, and we have seen some demand forecasts that take an aggressive view of recycling and have lower demand growth than we are showing here.

Exhibit 3: Chinas deficit sinks and net trade will be zero if Chinese capacity operates at high rates

Source: ChemOrbis, November 2024

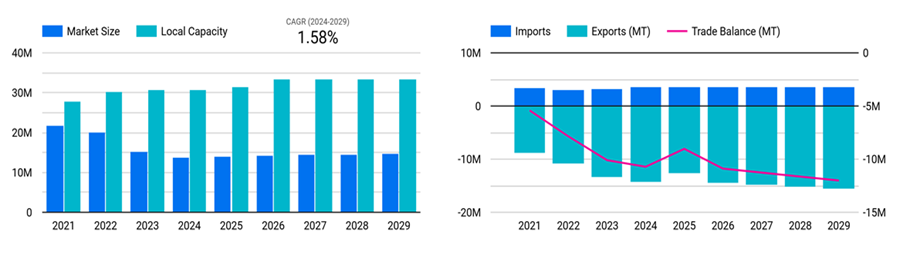

Exhibit 4: Middle East surpluses continue, and this is some of the lowest cost polyethylene in the World, like the US.

Source: ChemOrbis, November 2024

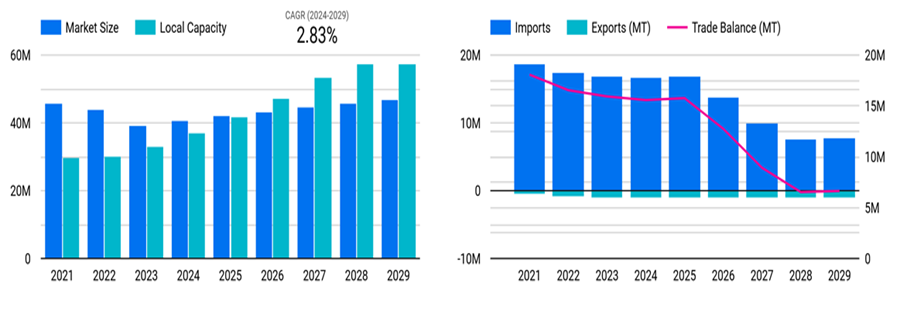

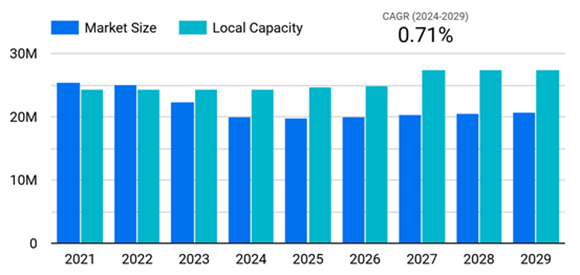

Losing China as a large import sink is a big deal for the industry, and if China runs at higher rates, we could see the region become a net exporter. We have talked about some of the higher cost producers in Asia, such as South Korea, Japan and Taiwan, but the real pressure will come in Europe – which as you can see from the chart below is in theory also long polyethylene. Some of the surprise here is because the analysis includes Russia, but also, we have not assumed the inevitable shutdowns that will take place in Europe unless we get retaliatory tariffs in Europe, aimed at supporting the local industry. What the chart does show, is that if there were aggressive protectionist practices in Europe, the region has enough capacity to be self-sufficient – throwing the surplus problem back on North America, the Middle East, and possibly China. But the US and the Middle East can go lower!

Exhibit 5: Europe – Some surplus and growing capacity below is because it includes Russia – where there are some expansions, one of which has recently started up. This model assumes no closures beyond already stated

Source: ChemOrbis, November 2024

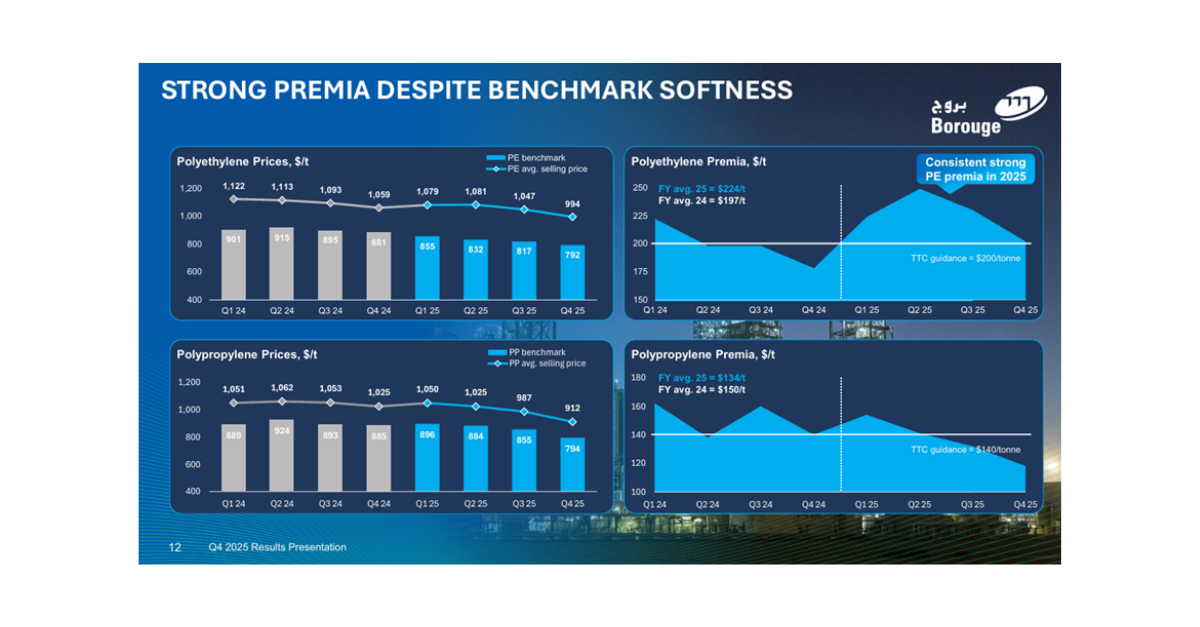

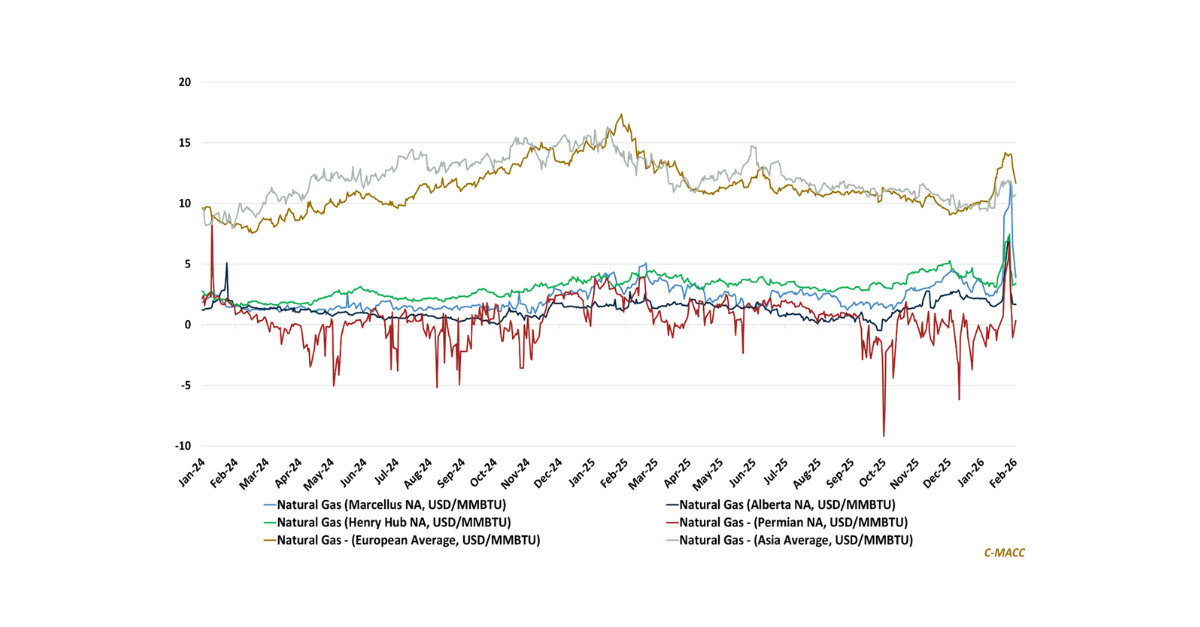

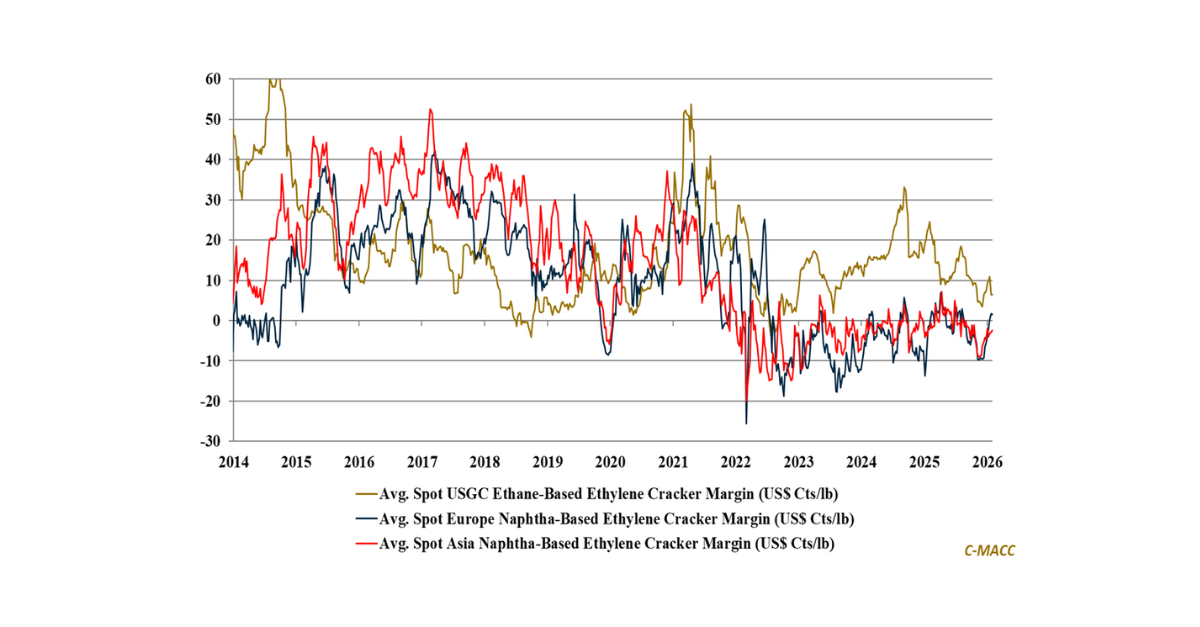

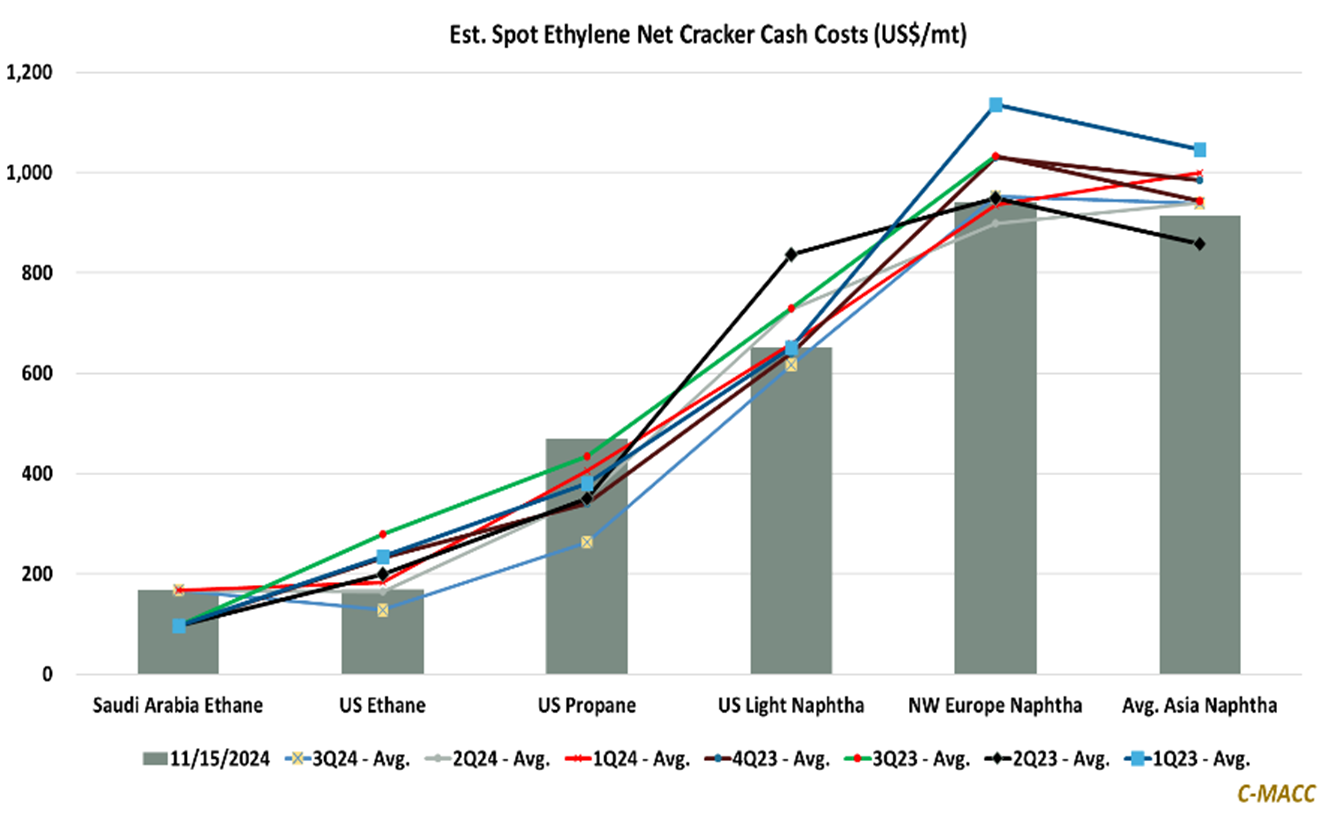

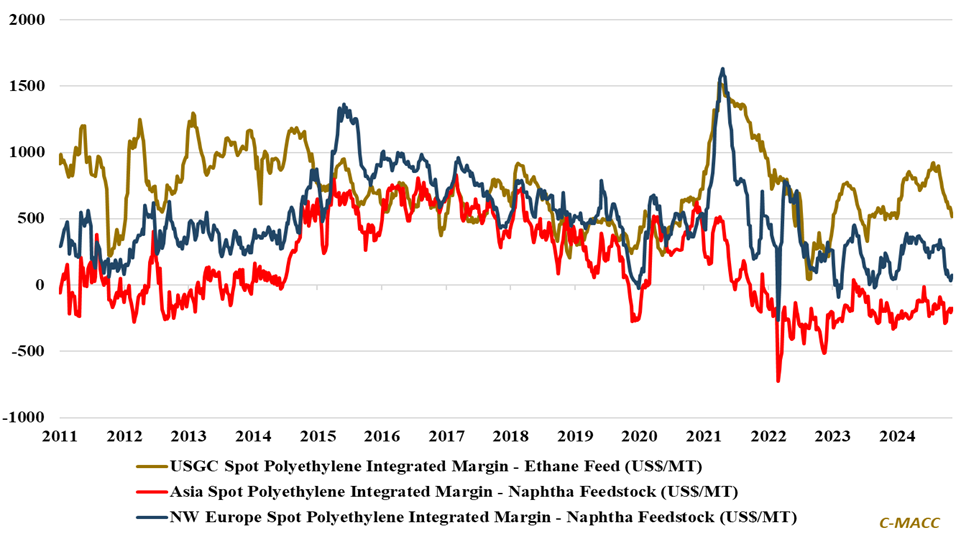

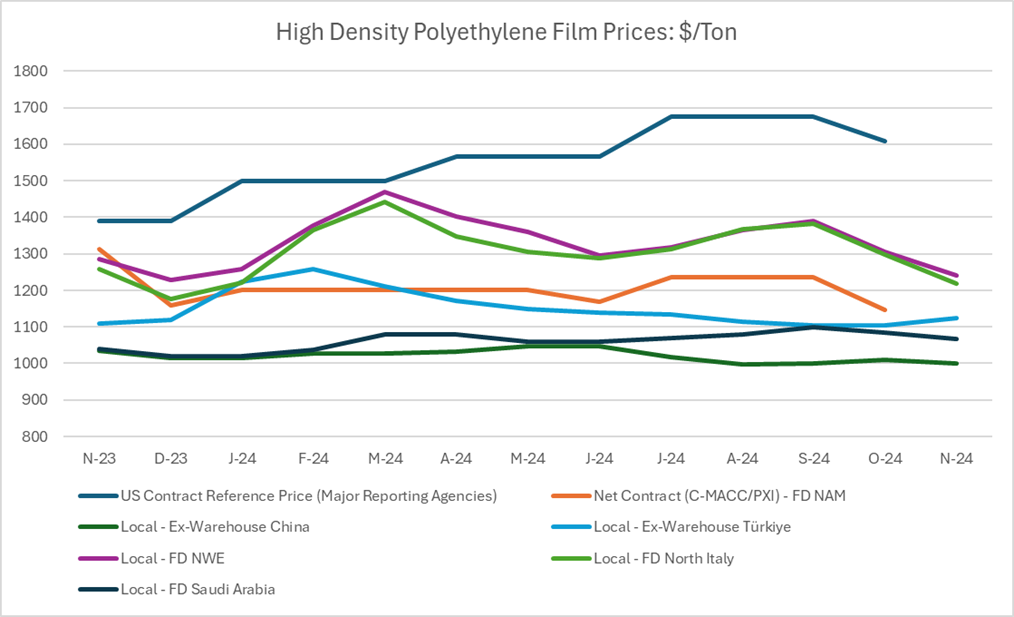

The ability for the US to lower prices further rests on the relative economics between the regions and we show the analysis on ethylene in the Exhibit below each week in our “Weekly Catalyst” reports, which focuses on chemical and polymer production economics. The US (and Canadian) advantage relies on the significant price difference between US natural gas and global crude oil, as well as the very high co-production of NGLs with both US shale oil and natural gas. If we see a meaningful decline in oil prices, this cost advantage will shrink. A decline would come from slower economic growth, more US production and lack of willingness to cut back supply from OPEC+ members. A resolution of the Russia/Ukraine war might also weaken oil prices. On the flip side, tension in the Middle East is rising and it unclear what impact the Trump Administration would have here. But it is a reasonable bet that lower economic growth and more polyethylene supply globally will have a negative impact on US polyethylene sellers and exporters even if oil prices remain stable. In the second chart below note that the US integrated polyethylene margin is around $500 per metric ton – 22.5 cents per pound – while margins in Asia are below zero and in Europe are breakeven. The Asia margins are misleading for many of the China based producers as they do not account for the possible benefit of both refinery integration and access to discount inputs for those refineries. This chart does not include the benefit of discounted naphtha in China, which is hard to model, because depending on how you value the naphtha through an integrated refinery with discounted crude you could have ethylene costs close to zero. This logic would suggest that Chines operating rates and surpluses could be higher than suggested above

Exhibit 6: The US cost advantage remains significant for ethylene

Source: Bloomberg, C-MACC Analysis, November 2024

Exhibit 7: Western integrated polyethylene (PE) margins have declined relative to Asia in 2H24.

Source: Bloomberg, C-MACC Analysis, November 2024

We get plenty of questions about the pace of expansion in China and when/if it may slow. This is a debate we have regularly with our friends at Dragoman, and one of the interesting discussions is around the fact that the Chinese chemical industry is not cash flow negative – some companies are making money, and most are making positive cash – the exceptions are those buying arm’s length naphtha, several of whom are making cash loses. But the takeaway from this, is that rationalizing the chemical industry is likely not high up the list of priorities in China, with other industries in more trouble and provincial debt also on the front burner. Chemical profits in China would need to deteriorate meaningfully for the industry to get more focus. So further capacity may be added, and further deterioration is likely inevitable.

Source: Bloomberg, C-MACC Analysis, November 2024

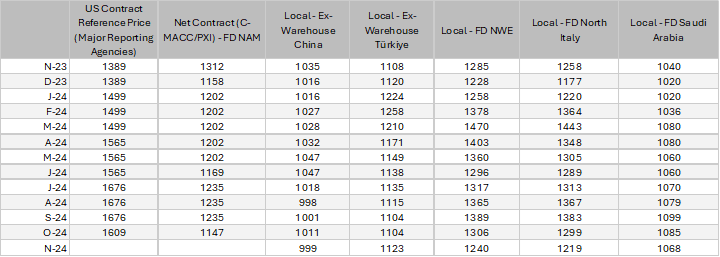

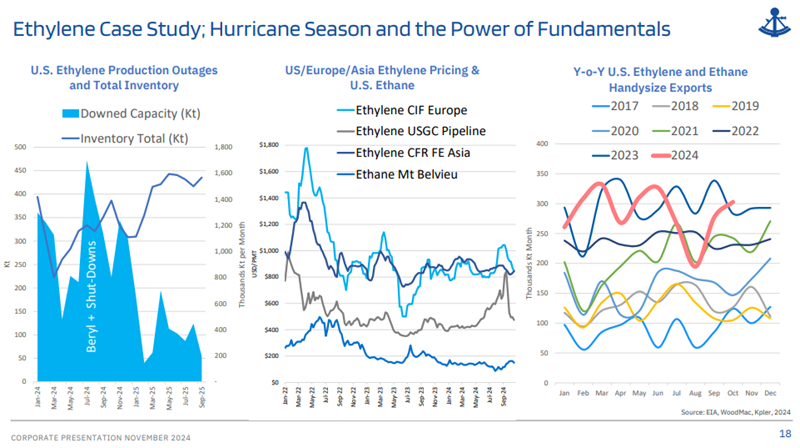

Relative pricing matters as there is plenty of trade in products made from polyethylene – the US imports goods made from exported polyethylene – the price arbitrage is there. One of the most interesting consequences of our partnership with ChemOrbis is a much better understanding of why we are seeing relatively stagnant polyethylene demand growth in the US in many segments. Prices for polyethylene outside the US are far enough below what many US consumers are paying, that importers of US polyethylene can turn around and sell what they make back into the US. This is a risk that we, at C-MACC, have been highlighting for years, that one of the consequences of high reference prices for polyethylene within the US will be slower growth, but with access to more real time pricing it is easier to see the direct evidence. Often importers of polyethylene-based products are selling goods made for an identical polymer (same supplier and same grade) as the local US competitor. By maintaining high prices in the US, polyethylene sellers are making a short-term gain but are setting up for medium to long term problems. It will be interesting to see what happens with this trend and possible tariffs. Countries deriving significant export revenues by exploiting the opportunity to buy cheap polymers from the US, which helps to maintain low prices from other polyethylene suppliers, may be less keen to impose retaliatory tariffs on US polyethylene. Note that in both the table and the chart below we show the price reported by the major agencies as well as our estimated net price for average buyers. First, it is clear than another “non-market adjustment” is imminent for the reference price, and second, anyone paying a price pegged to this number cannot compete with anyone importing goods made from the same polyethylene almost anywhere else in the World – without tariffs!

Exhibit 9: Recent HDPE Film pricing by country/region

Source: ChemOrbis & C-MACC/PXi

Exhibit 10: There is lots of opportunity for polyethylene derivative product trade

Source: ChemOrbis & C-MACC/PXi

The next year or two look very challenging for the global chemical and polymer industries, and the US, despite its cost advantage, is unlikely to come out unscathed. Look for a proposal from us (including our collaborators at ChemOrbis and Dragoman) shortly for a multiclient which will try to frame the range of probable outcomes for the polyethylene markets for the next couple of years and beyond. We will look at trade policy, China investment and demand growth, relative feedstock costs, trade costs and potential tariff scenarios. The report will form around a base view, but we will identify the circumstances which could make the outlook much brighter or much darker, and we will try to look beyond the next 5 years, based on some assumptions around industrial strategies in the main regions, but especially China.

- If you are a producer of polymers in a high-cost region it will help frame the question of whether you should try to hang on, or just cut your losses now, and if you are in a low-cost region we will focus on how much margin might be able to hold on to.

- If you are a buyer of plastics, it will help you understand what your trade based competitive pressures will be – will you be subject to imports of derivatives of plastics, or will you be able to exploit distress polymer prices to drive export growth.

The report will be comprehensive but as always, we will offer the option to customize the output for specific clients (for an additional cost). We believe that the merger of talents, between C-MACC, ChemOrbis and Dragoman can drive a product that is based on sound geopolitical logic, is not overly influenced by what may be a stale “house” economic or oil price views and is dynamic enough to accommodate specific scenarios as required by individual clients. We plan to focus on polyethylene, but we are well set up to look at both polypropylene and PVC. We will likely not offer polystyrene as we do not believe anyone in the business should spend what little they have left so that we can tell them what they should already know!

Multi Client Prospectus Sign Up – Click here to ensure that you are on the list for the prospectus

The trade impact of more US supply (of everything). It is important to note that it’s not just polyethylene that is exported from the US, and we expect continued pressure to increase US exports of many hydrocarbon-related products if the “drill-baby-drill” promise, drives higher oil and gas production. In the headline below, Navigator orders two more ships to move ethane/ethylene out of the US (this adds to a 2-ship order over the summer). The logistics of moving ethylene and ethane are very different than polyethylene, as you need dedicated receiving terminals and pipeline infrastructure, including expensive storage, while polyethylene moves by container. The benefit for the possible buyers of ethane and ethylene is that they can keep some chemical/polymer business operating in-country versus outsourcing the whole value chain to the US. This is particularly relevant for Europe, where converting an ethylene plant to ethane, or simply importing ethylene to make derivatives, may be a lower cost option than abandoning a whole chain, especially if that would involve a site closure and the associated costs of remediation in Europe. If I can avoid $400 million shutdown costs, I should be willing to pay almost as much to retool so that I can use advantaged feedstocks. Now, in a less “global” world, with increased geo-political risk, it is unclear how safe any country would feel increasing dependence on the US, but in the “grand bargain” scenario we have been proposing – this may work for Europe – see – Blue Christmas Without You (“You” Being Green Policies in Europe) – and –Are the “Better Owners” of European Chemical Sites Playgrounds, Theme Parks, or Forests?

Exhibit 11: We highlight the ethylene case study slides from the Navigator Gas investor day presentation…

Source: Navigator Gas – Investor Day Presentation, November 2024

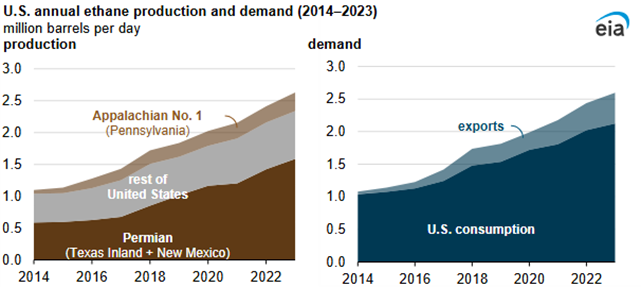

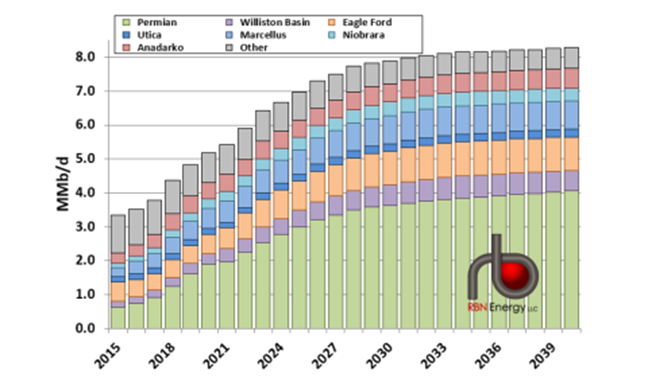

Do you invest elsewhere based on US ethane availability? The charts below show the expected US NGL supply and the historic rise in ethane demand in the US and for exports. We have substantial capacity to consume US ethane in China already (Satellite) and more on the way (Wanhua/ADNOC/Borouge). Without supply of US ethane, these China projects would be in trouble as there are few other places that can supply ethane and none at volumes required to supply the China needs and other large centers of imported ethane demand – such as Europe and Mexico. More protectionist policies in the US are unlikely to attract retaliatory tariffs on US ethane, as any country taking this path would be shooting themselves in the foot as their own industry would suffer. The risk comes from the US shutting off supply because of some larger geopolitical agenda, which is possible with China, Europe, and Mexico given the uncertainty around the Trump Administration’s likely foreign policy. Still, the US would have no use for ethane if exports fell, and unless the US also curtailed LNG exports, we would have distressed volume of ethane in the US, selling at very discounted fuel values, but helping the economics of the US chemical producers. This all seems very unlikely, but we are in a much less predictable world.

Exhibit 12: US ethane production, consumption, and exports set new records again in 2023

Source: EIA – Today In Energy, November 2024

Exhibit 13: This exhibit shows RBN Estimates of NGL production by basin through 2040, and we flag this exhibit with the one below and in consideration of the article: US Ethane Exports Set to Surge with New Gulf Coast Capacity.

Source: RBN Energy, November 2024

Otherwise, Last Week – Our monthly look at Ag chemicals

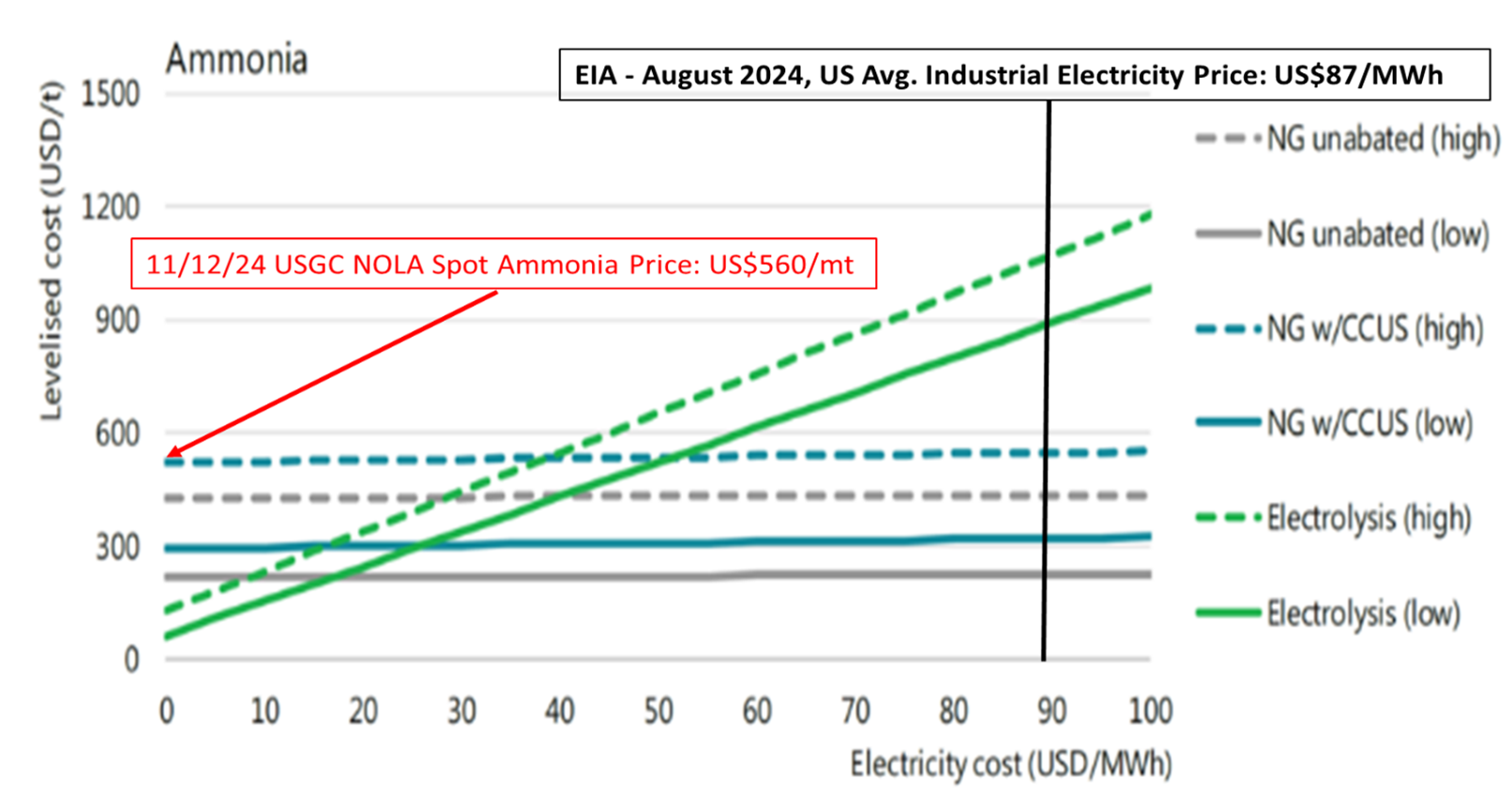

The North American ammonia production advantage is well understood, so we revert to our comments after the Fertiglobe 3Q24 report to highlight its efforts to position itself for low-cost and low-emission market growth. A stand-out item in the Fertiglobe earnings release for us was the discussion of low-carbon ammonia growth and its ambitions to be the largest producer of low-carbon ammonia by 2029. For a bit of background, as part of ADNOC’s strategy to integrate its low-carbon ammonia initiatives under Fertiglobe, the company will transfer its 35% stake in the 1 million-ton-per-year low-carbon ammonia project in Baytown, Texas, developed in partnership with ExxonMobil, as well as its stakes in two UAE-based projects, to Fertiglobe. These transfers will occur at cost when the projects are ready for startup, contributing immediately to earnings and improving project returns while preserving ADNOC’s balance sheet during development. The addition of the US project, which ExxonMobil and Fertiglobe are representing at AEA, marks a significant step in the company’s transformation into a global low-carbon ammonia platform, with combined capacity from these projects set to exceed 2.4 million tons, more than doubling Fertiglobe’s current ammonia capacity. By 2029, this will position Fertiglobe as the world’s largest producer of low-carbon ammonia, with a total capacity of 9 million tons of ammonia and urea. Still, it also has some significant capabilities “under the hood”, combining a significant low-cost multi-national production network that high-cost producers, such as Yara in Europe, and low-cost producers, such as CF Industries in the US, mostly lack. However, there are benefits reflected in their strategies and buildouts as well, but the cost positions in Fertiglobe and its ambitions to expand stand out to us, and we view its network of projects and activities as geared for advancement.

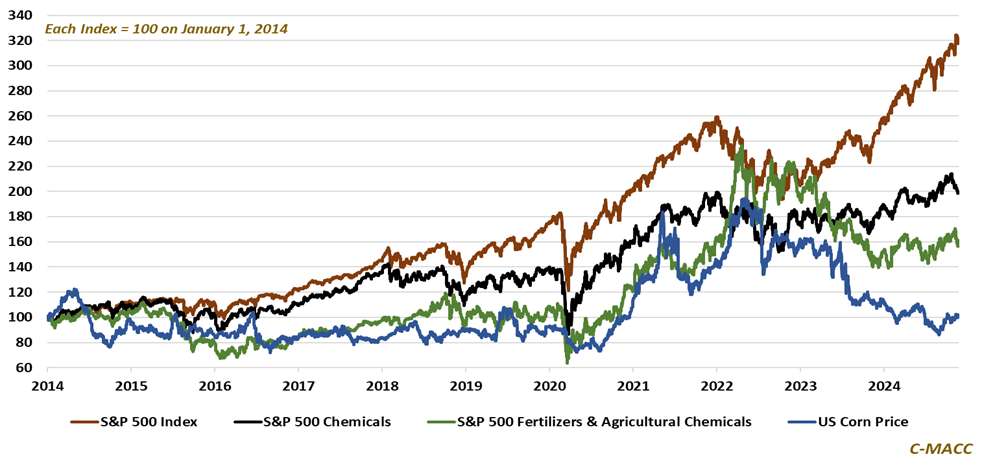

Exhibit 14: S&P 500 Fertilizer & Agriculture sector equities have underperformed the S&P 500 and the S&P 500 Chemical sector YTD, though they have outperformed crop prices. Our sector outlook for 2025/26 is constructive.

Source: Bloomberg, C-MACC Analysis, November 2024

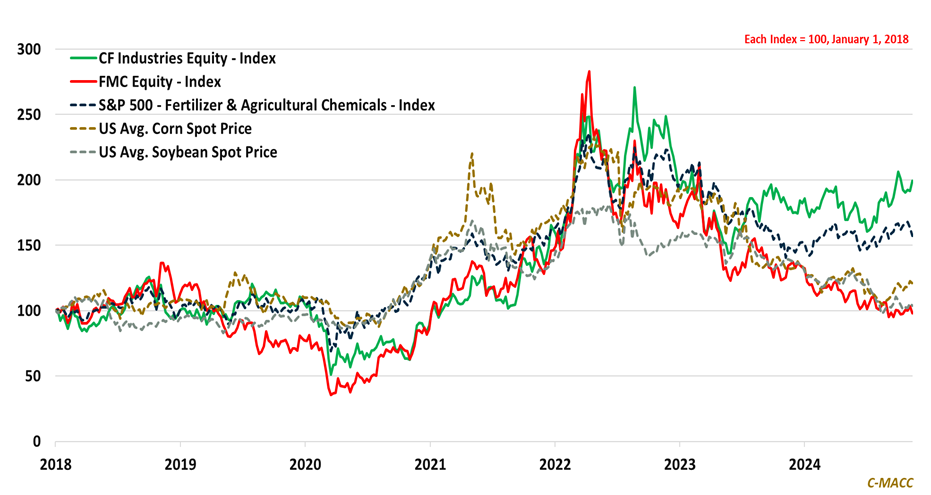

Exhibit 15: Ammonia fertilizer producers, such as CF Industries, have, on average, outperformed global crop protection players, such as FMC, who are seeing greater pressure in Latin America in terms of relative use and price competition.

Source: Bloomberg, C-MACC Analysis, November 2024

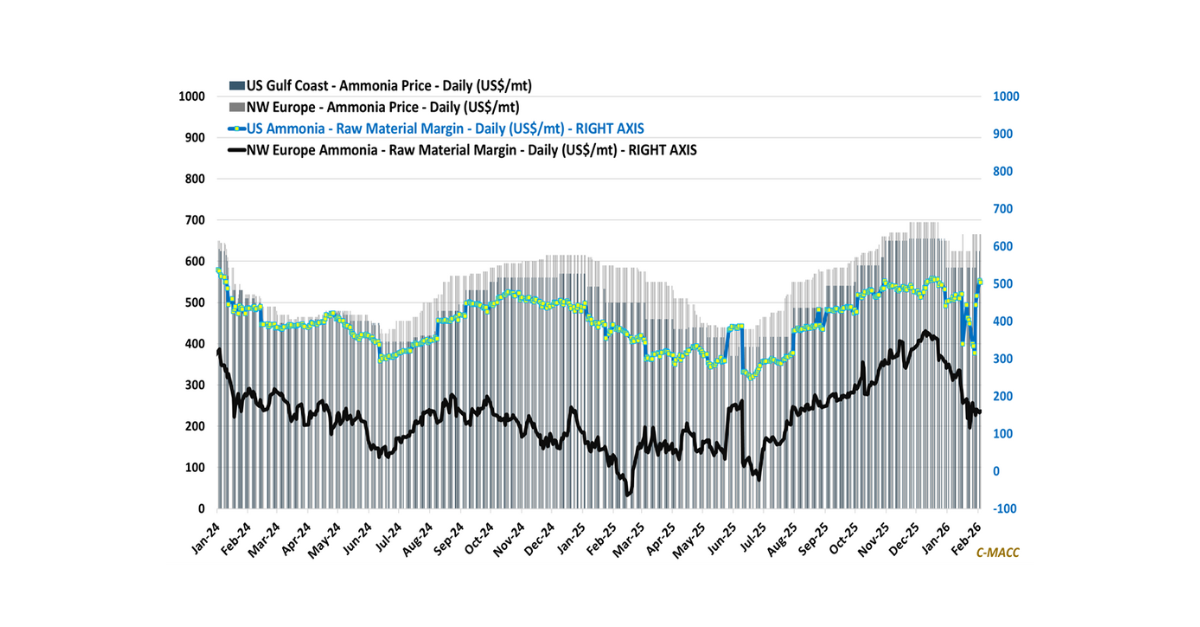

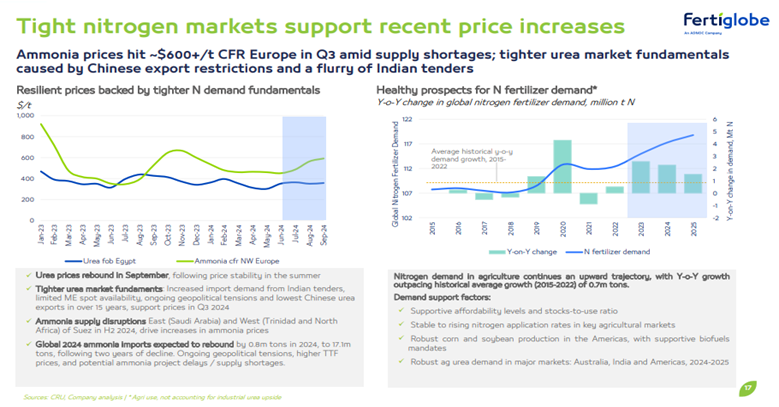

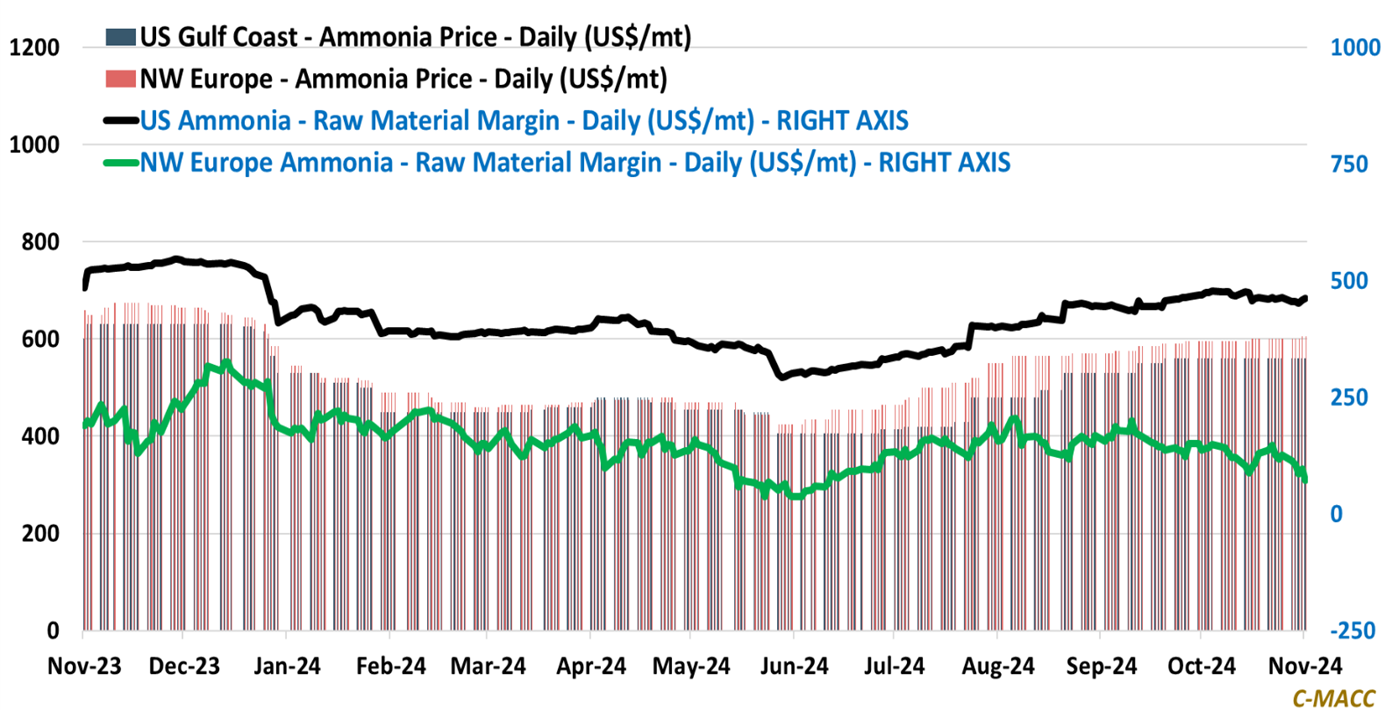

Ammonia markets are tight – will it last? The US and Europe ammonia markets tightened in 2H24, with ammonia prices rising QoQ by 16% and reflecting levels up 15% YoY. Tight markets, combined with low Chinese urea exports, support a favorable short-term outlook for nitrogen fertilizers, while the long-term outlook benefits from improving demand and limited supply growth from greenfield projects. Ammonia prices have risen due to a mixture of production disruptions in key hubs such as Egypt, Trinidad, Algeria, and the Middle East, crop price improvement, limited Chinese exports, a positive response to India tender activity, and the start of the buying season for several major markets. At the same time, the cost position in NW Europe also eroded, as shown below. In the short term, stable prices are expected as Middle Eastern and North African production helps meet demand from regions like the US, India, and Morocco. A recovery in global ammonia trade is anticipated in 2025, with Russia’s exports rebounding following the commissioning of the Taman terminal and US exports growing from the startup of the Gulf Coast ammonia project. Overall, we continue to favor low-cost ammonia producers relative to high-cost ones globally during this period, and we view CF Industries, LSB Industries, Nutrien, Fertiglobe, and Koch Fertilizer as in a good position.

Exhibit 16: Fertiglobe highlights the prospect of a tight ammonia market into year-end 2024.

Source: Bloomberg, C-MACC Analysis, November 2024

Exhibit 17: US gray (and blue) ammonia production costs are significantly below European levels

Source: Bloomberg, C-MACC Analysis, November 2024

Crop-input market views continue to display challenges. While this was well highlighted across producer reports with 3Q24 results, we flag below that Bayer missed 3Q24 expectations, adding to a list of others, and Bayer expects sales to decline by as much as 3% this year at its crop science unit, hurt by low prices for agricultural products. We highlight this general view, as the commentary in the crop science unit at Bayer aligns with our takeaways from the Corteva and Nutrien 3Q24 releases, which we discussed last week in our research: Is Green More Than A Dream? Remain Constructive On Ammonia, But Not At All Costs (& All Colors)! We have remained cautious on agriculture since the start of 2024, as highlighted in the general comments above, but we also see expectations dropping for late 2024 (and 2025), which we view as a general positive for potential investors, as few appear likely to be surprised if 2025 conditions remain difficult, as also highlighted in the exhibits below showing farm income expectations for next year. As farm incomes shrink, so do the efforts to add land and expand outside of existing producer consolidation efforts to scale, which adds to our case that crop prices are more likely to tighten ahead given our demand views than notably loosen relative to current levels.

Exhibit 18: Is green more than a dream? We do not see a clear near-term path to broad-based global green ammonia production growth beyond select locations with ample cheap power – few viable examples currently exist.

Source: Bloomberg, C-MACC Analysis, November 2024

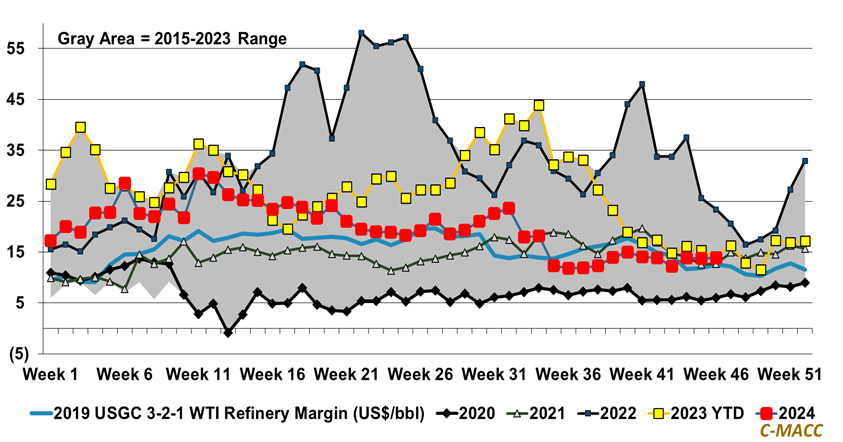

US refinery capacity cuts are likely needed for margin support, much less improvement referring to the latest EIA short-term energy outlook. This report predicts that US refinery capacity will decrease to 17.9 million barrels per day (bpd) by the end of 2025, about 3% lower than at the start of 2024. Despite this decline, EIA forecasts that refinery margins, or crack spreads, for gasoline and diesel, will remain stable in 2025. The closure of LyondellBasell’s Houston refinery in 1Q25 and Phillips 66’s Los Angeles refinery in 4Q25 are two of the cuts included in the forecast and will further reduce US refining capacity by nearly 400,000 bpd. However, reduced gasoline and diesel prices continue to weigh on refinery margins, and the EIA projects average US gasoline prices at $3.20 per gallon, which compares to the report below showing US gasoline below US$3.00 per gallon ahead of Thanksgiving, and the EIA estimate is based on diesel at $3.60 per gallon in 2025, with the current US average at US$3.52 for diesel. EIA also expects global liquid fuels consumption to rise by 1.2 million bpd in 2025, largely driven by growth in Asia, particularly India. Additionally, US distillate fuel consumption is projected to grow by 4%, supported by increased manufacturing and trucking activity, and we highlight the EIA’s Brent crude price forecast for 2025 at US$76/bbl, with uncertainty linked to Middle East conflicts and OPEC+ production cuts. US Brent Crude opened this morning at US$73/bbl. Overall, we foresee some seasonal improvement in refinery margins in 1H24, but overall, for the year, we remain cautious that current margin levels may still have a bit of downside risk YoY in 2025 relative to 2024. And, while the EIA STEO highlighted above mostly discusses trends in the US, we also highlight its recent report, Global refinery margins fall to multiyear seasonal lows in September, which aligns with our general view of lower global margins.

Exhibit 19: US Gasoline Prices Set To Fall Below $3 per Gallon Ahead of Thanksgiving. We highlight this in the context of downward pressure on US crude oil refinery margins, which are down YTD but mostly reflect 4Q23 levels.

Source: Bloomberg, C-MACC Analysis, November 2024

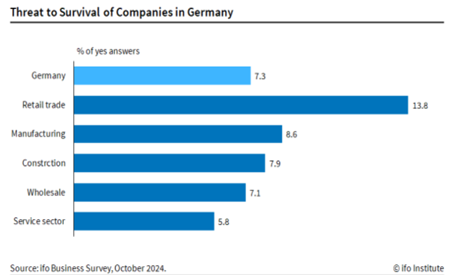

Economic concerns for German businesses have mostly worsened YoY. In Germany, the share of companies fearing for their survival has risen to 7.3% in October 2024, up from 6.8% in October 2023, per ifo Institute data, with a steady rise in corporate insolvencies expected. This growing concern is mainly due to a lack of orders, increased operating and personnel costs, reduced consumer spending, and rising bureaucratic requirements. Additionally, high energy costs and intensifying international competition are exacerbating the situation. The manufacturing sector is particularly affected, with 8.6% of companies reporting severe economic problems, while the retail industry has seen a sharp increase in insolvency concerns. Despite construction and residential building challenges, the situation has slightly improved in the services sector. When we also add in potential Trump actions towards Europe, with some viewing it as constructive to force Europe to get its act together, as highlighted in the article, Maybe Europe Needs Trump, though we continue to view rising government protectionist policy as a risk to Europe, as highlighted in our research, Tariffs: Trading One Problem for Another! With all of this in mind, in a humorous addition that we have to plug after seeing the article, one would think that this development in Germany would be freeing up forklifts to make its forklift racers more competitive, but this does not appear to be going well either, per the WSJ report: Germany Got a Chance to Show It Rules the World of Forklift Racing. It Didn’t Go Well. Maybe the fastest forklifts in Germany are still in action, so at least this is a plus. Per this article, the US and Canada are expected to send teams to this competition next year. Hopefully, this will not signal an economic domino effect!

Exhibit 20: More Companies in Germany See Their Survival Threatened | Facts | ifo Institute

Source: ifo Institute, November 2024

The hope versus the data – driving different lithium strategies: The tactics in lithium seem diverse today, with companies like SQM posting very weak results but still aggressively pursuing expansion plans, while others, like Albemarle, are cutting capital plans. We see a couple of very different drivers of thinking here. The first is the overly bullish views of expected EV and battery storage demand that existed a couple of years ago and that many still see as valid, suggesting a surge in lithium demand growth and expected severe shortages 5 years from now, suggesting that you should invest regardless of current economics. The second set of assumptions, one that we subscribe to, is that the lithium market looks very different today than it did two years ago, and the old views are no longer appropriate. The very high price of lithium at its peak is one of the problems, as it drove and continues to drive, research and development to either find more lithium or find ways to use less of it. Shale oil and gas in the US may be a good proxy for lithium from DLE for example. This is a process that was seen to be too expensive, but high lithium prices caused enough development work to get people interested and it is likely to follow the same path as shale oil and gas in the US with break-even costs falling quickly with experience – this route to lithium may never have got off the ground without the peak in pricing. Add to that the development of other battery technologies, such as sodium-based, and the willingness of those looking at large storage projects to look for cheaper but less power-dense alternatives, as you do not need the density if you are working alongside a solar or wind project on land. Add to this the current slowing EV market growth and you run the risk that even with the cutbacks in investment, you maintain an oversupply in lithium for the longer term with the projects that are still underway. Consequently, you should only be in this business today with new capacity plans if you are convinced that you not only have a low-cost project today but that your cost of production will stack up against a cost curve that will likely decline further. The auto industry has managed to engineer exactly what it wants here – an oversupply of lithium feeding into an oversupply of battery capacity. As we head into 2025, the auto industry needs this dynamic as the global markets are weak and auto prices will be under extreme pressure.

- E3 Lithium Secures Site for Alberta’s First Lithium Production Facility

- ExxonMobil & LG Chem Sign MOU for 100,000 Tons of Lithium Carbonate to Boost US Critical Mineral Supply Chain

- ExxonMobil names second potential customer for South Arkansas lithium

- Geothermal cooperation: BASF flirts with geothermal energy, Vulcan with lithium plant

- Have lithium prices bottomed yet?

Exhibit 21: SQM’s net profit slips on lower lithium prices

Source: SQM – 3Q24 Earnings Presentation, November 2024

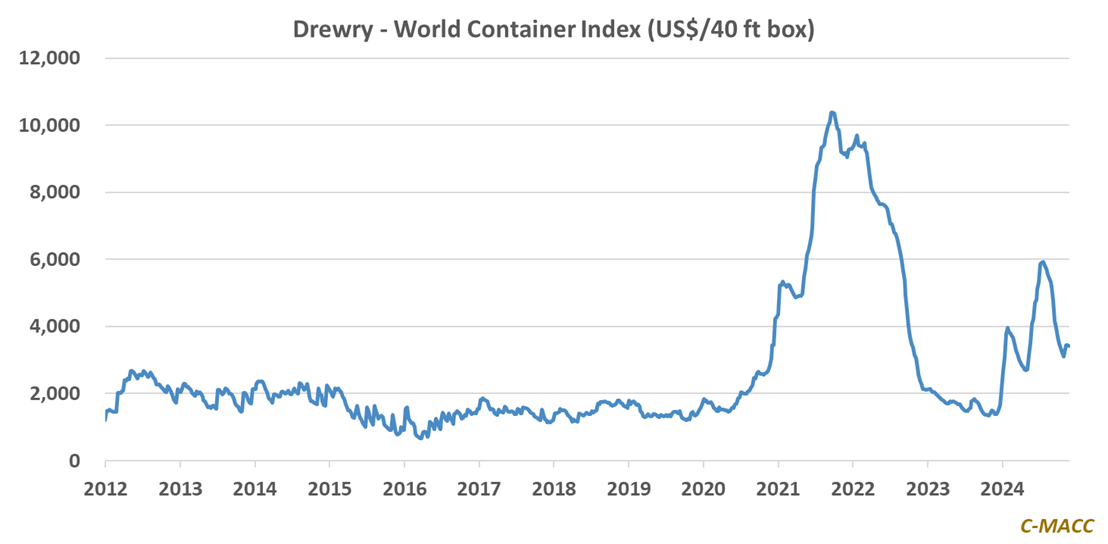

Freight, trade, and tariffs: We regularly publish data around freight costs, and this has been especially relevant during the periods of extreme freight cost volatility that we have seen over the last few years. As we head into 2025, we may see a world with more isolationist behavior and attempts to limit trade. One more logical conclusion might be that less trade drives an oversupply of ships and containers and that freight rates fall and remain much lower for the foreseeable future. Some of the inflation that we see today in the index below, versus the longer-term history is a function of restrictions on both major canal routes – water levels in the case of Panama and terrorism in the case of the Suez Canal. In our upcoming weekend report, we will focus on polyethylene trade, in a market where we will likely continue to see significant oversupply and potential changes in trade flows because of relative economics and possibly changing tariffs. At the peak freight rates we saw in 2021 and 2022, the cost of shipping was a very significant piece of the overall trade costs – today it is much less relevant, with the cost of moving polymers in most directions around 10% of polyethylene prices, such that regional price differences for the polymer are wide enough to encourage polymer trade and also trade of products with large polymer content – things like polyethylene film or grocery bags, as well as some polymer heavy consumer durables.

- Drewry WCI eases 1%; freight rates vary across routes globally

- Key Bulk Vessels Index Down 10% Despite Freight Rate

Exhibit 22: Global freight rates moderate following recent bounce from 2H24 lows

Source: Bloomberg, C-MACC Analysis, November 2024

Hydrogen Economy – The writing is on the wall for European Green Hydrogen

- The battle lines are clear at COP29, with the “we can’t afford it” group growing in numbers while the “we have to do it anyway” group keeps chanting. Bankruptcies are increasing and compromise is needed to avoid trauma

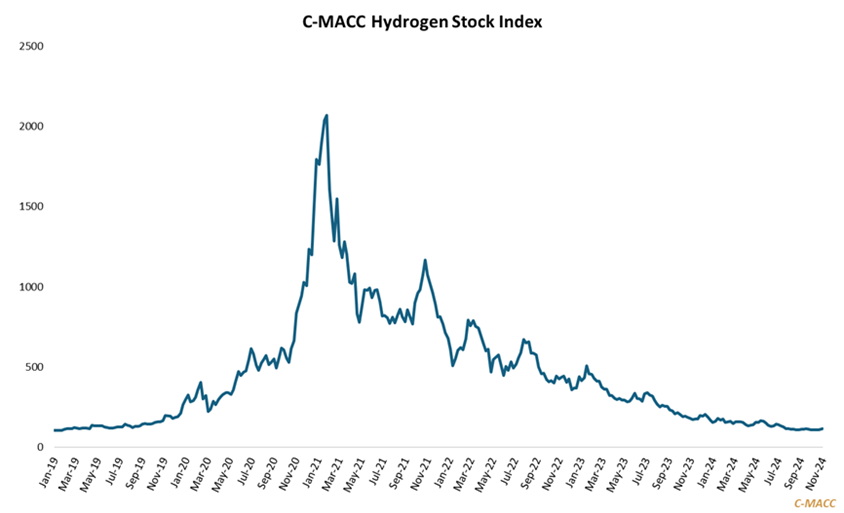

- A year ago, we created a list of companies that we thought would not make it, and while we have not published that list, we have been quite vocal about Plug Power. HH2E was on the list – even free power is not enough!

- We also see an increase in the number of stories talking about the challenges with German manufacturing economics – of all the European countries, Germany can least afford green hydrogen – blue from the US works.

- To seize the blue opportunity, the US will need to pay more attention to methane emissions, and this might be an incentive program that fits well with the Trump drill doctrine, ease regulations but push back on emissions

Many of the COP29 related headlines last week and over the weekend talk about disagreement rather than agreement, with a couple of countries walking away and fear of a larger breakdown causing some senior government figures in Europe to fly into Baku over the weekend. Affordability is at the forefront of disagreements, whichever sleeve of argument or debate you choose. It is the same for renewable power as it is for hydrogen and e-fuels – everything costs more than expected and countries are backpedaling because they cannot work out how to pay for it – note the story below about trying to find new taxes to meet the costs – the funding is just not there. Adding to the challenge, the more projects that get cancelled, the lower the demand for equipment, and the costs move higher, with continuing projects running the risk of supplier bankruptcy – note that we are still seeing more companies join the electrolyzer race (to the bottom).

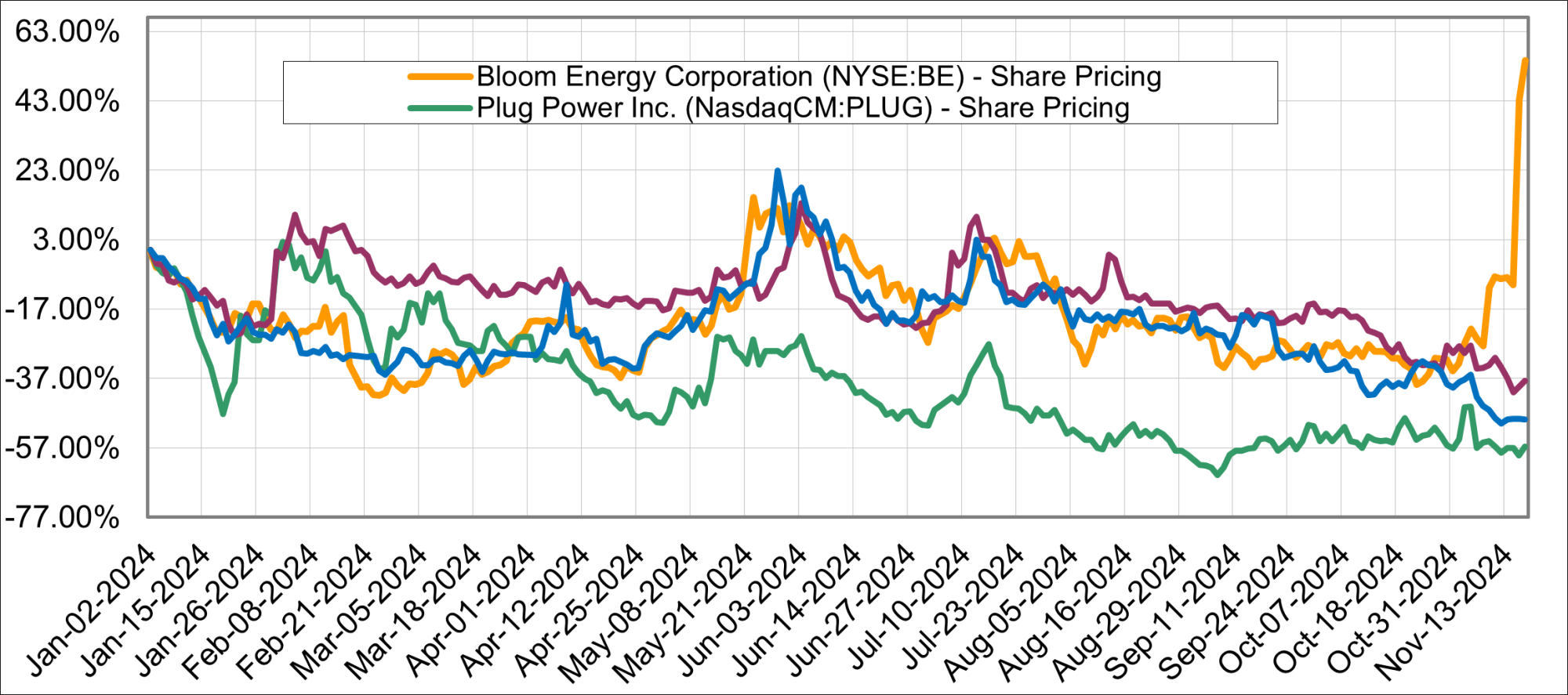

Exhibit 23: Despite Bloom’s great week we have an overall index that is looking weak, but likely not weak enough

Source: Capital IQ and C-MACC Analysis

- The search for targeted taxes to fund climate action

- Ministers land in Baku to help break finance stalemate at COP29

We have noted in prior work that disagreement over climate change mitigation pathways and costs could be the straw that breaks the camel’s back on EU unity. The EU states are already at odds over defense spending and immigration, and it is almost impossible for the region to agree on the current climate change plans when several states risk deep recession and social unrest if they try to pay for it. This is likely a case of cutting off a limb to save the body, and the limb, for now is electrolyzer-based hydrogen and derivatives of that hydrogen. The workaround is a broad trade framework with the US for a couple of decades of blue hydrogen from the US, as either methanol or ammonia. This could be wrapped up in an agreement that the EU (and the UK) will spend more on defense instead, and by so doing keep the US in NATO. This is a win-win for both sides as the US gets to produce and export more hydrocarbons, and gets a closer relationship with Europe, which will be necessary if the trade battle with China matters to both. Europe gets a solution – not ideal – to build out a low carbon infrastructure – which can be converted slowly from blue to green over the long term. Whether anything this formally gets agreed will depend on how the Trump administration wants to approach Europe, but it makes a lot of strategic sense for both sides.

In the meantime, the Europeans are likely meandering slowly towards this conclusion but still with too much entrenchment in the original plans and too much hope. Failures like the HH2E announcement below will help sharpen thinking, not just because it will draw attention to the unworkable economics, but because project abandonment will have a knock-on effect on the equipment providers and we will see electrolyzer makers also declare bankruptcy, with each move likely triggered by the loss of a specific deal – i.e. the final straw. This is a downward spiral that looks inevitable to us as the only thing that can stop it would be a massive injection of inefficiently allocated capital, which Europe and the rest of the world cannot afford.

- Gigawatt-scale green hydrogen developer files for insolvency after it loses major backer

- HH2E files for self-administration as Foresight withdraws funding for 1GW hydrogen project

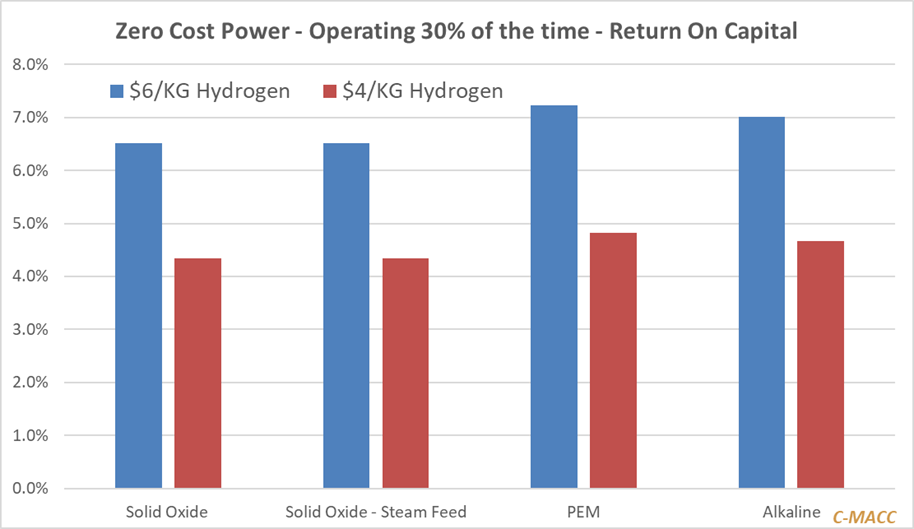

Exhibit 24: Free power does not work at low capacity-factors – note that free power on a wind or solar array is less than 30% of the time – more likely 10%.

Source: Corporates reports and C-MACC Analysis

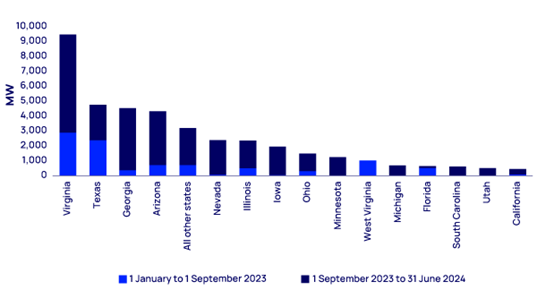

Exhibit 25: Announced data centers since 1 January 2023 (MW)

Source: Wood Mackenzie

And then there is the benefit of having a more diverse business. We have never included Bloom Energy on our list of vulnerable hydrogen stocks because the company has been building a solid foundation in its natural gas fuel cell business, with much of the business to date focused on backup power-based installations. The Trump win in the US, suggesting less clean power insistence, together with what we are seeing with data center growth – see Exhibit 3 – drives new opportunity for Bloom Energy, especially in regulated power states, as you can generate natural gas-based power behind the meter. Bloom not only has capacity to meet significant demand in its fuel cell business but could utilize the capacity that it built for electrolyzers for fuel cells with little modification. The stock reaction for Bloom to the announcement has been significant as 1GW of power is a huge order – billions of dollars – and will transform the finances of the company overnight. While this may not be the priority when it comes to securing the power, the CO2 stream from the fuel cells is in a greater than 50% concentration, which makes capture significantly cheaper than it would be from a gas turbine generating power. It would not take many orders like these to drive real success at Bloom Energy, and the company can now afford to wait on hydrogen, unlike many others. Ordering an electrolyzer from Bloom could be the smart move, as, even though they are not cheap, they are the most efficient with power use – more important as power costs rise – see charts in the appendix – and the company is likely to be around to deliver the equipment.

Exhibit 26: It does help to have a second business – the odds are that Bloom is still here in 2026

Source: Capital IQ and C-MACC Analysis

As we noted in last week’s Sustainability report – Blue Christmas Without You (“You” Being Green Policies in Europe) – while all of this may still take some time to sink in within the EU, we see the odds of the green hydrogen challenges helping the blue hydrogen industry dramatically, benefitting the US, Canada and select countries in the Middle East. Those looking for green hydrogen will be drawn to the Middle East but more likely North Africa and will have to accept that what makes these projects attractive is not just the abundant solar resource, but also the use of much cheaper Chinese equipment. Countries/companies may be reticent about buying Chinese electrolyzers in Europe – even where the power costs make sense – but they will still import hydrogen made with Chinese equipment elsewhere. What we are seeing today are the foundations underneath the European green ambitions crumble, slowly at first. The trickle of insolvencies will turn into a flood in our view, and the best of a bunch of uncomfortable options for Europe will be to cozy up to the US. Hopefully, the Trump administration will see this as the great opportunity it should become and play ball.

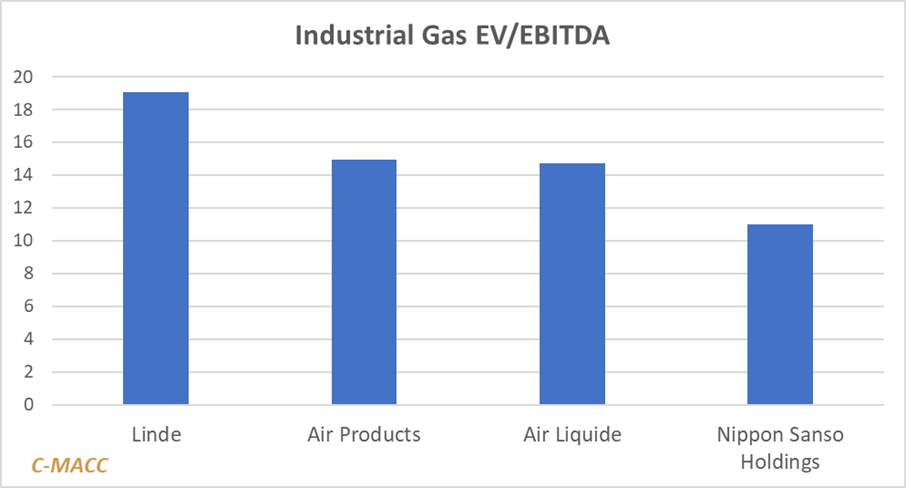

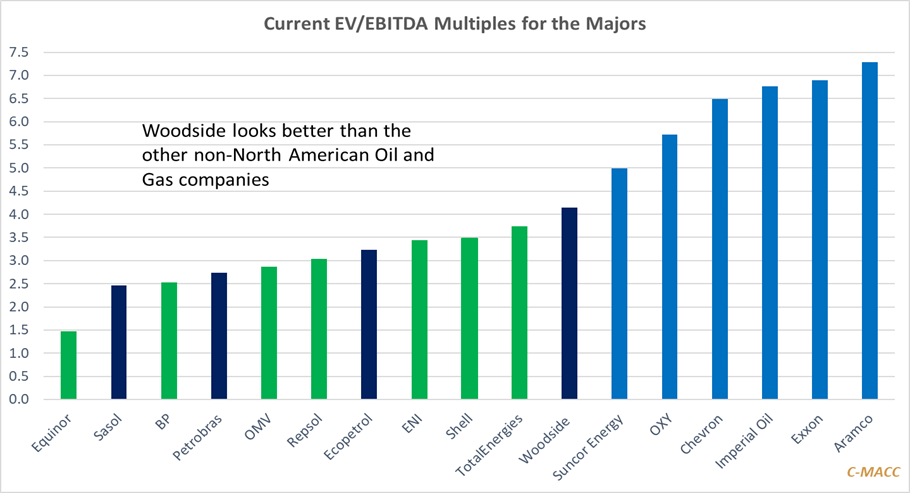

Sustainability and Energy Transition: More on activism

The activism against Air Products is not specifically focused on a sustainability push but perceived poor capital allocation and the assumption of too much risk, with projects that happen to be focused on producing low-carbon hydrogen. The poor capital allocation claims could have applied if the company was chasing too many projects regardless of motivation. The Air Products activist focus is simple – if we took this risk off the table, we would have a foundation that could be worth a lot more. Finding other companies with similar opportunities is much harder, but not impossible. The pure plays in many of the transition sectors are generally small, failing, and with few degrees of freedom to create value from a radical rethink. In many cases, where there might be valuable assets, investors would be better off waiting for bankruptcy, perhaps looking for senior debt or asset backed debt options today to get leverage in a restructuring. The more interesting and more conventional activism opportunities might be the European energy companies, especially those trading at a significant discount to peers because of overly ambitious transition strategies. We have shown the chart below several times this week as it demonstrates the huge discount the “transition-heavy” Europeans have versus their US peers. It would be a brave activist to take on a European oil major and ask for a more aggressive oil and gas strategy, but that, combined with a push to re-domicile to the US might make sense.

Exhibit 27: The activists at Air Products are focused on EBITDA and EBITDA growth, if they get that right the multiple expansion will follow

Source: CapitalIQ and C-MACC Analysis

Exhibit 28: The European oil majors trade at a dramatic discount to the US

Source: Capital IQ and C-MACC Analysis

Pushing a European oil and gas company to move its listing is a relatively straightforward request for an activist and likely would not involve pushing for a lot of leadership changes. The change in strategy around less onerous transition spending might also be welcome at the management level, and give any management team an excuse to abandon what they likely already know is a failing plan. The other option for the ailing European names on this list would be M&A and you may see some activism aimed at trying to get some mergers and some synergies happening. There may also be opportunities for break-ups – or a combination of both – to merge and then spin off an old energy company in the US!

What the Trump Administration decides to do with both the energy transition incentives and with trade policy also matters, and it is possible that some opportunities that are harder to see today emerge over the next 6 months as policy in the US is rolled out. We could see some quite interesting valuation swings in some stocks based on alignment or misalignment with any new policy and this could open even greater arbitrages for mergers or divestments.

The activism at Air Products is a lot more nuanced and it requires a comprehensive assessment of the working of the company, as well as the industry in which it operates. There is broad acceptance from all participants that the company needs a succession plan, but it is then much more about the task that a new CEO would face and at that point, you need to think about the time value of money and risk. The CEO and Board of Directors at Air Products are defending against the activists, saying all the right things on conference calls, abandoning a green hydrogen project in the US, and offering a broad refresh. All things being equal, this would be a strategy that investors should get behind. But all things are not equal because Mantle Ridge offers a superior medicine, tailored specifically for Air Products ailments. Both Bob Patel and Alfred Stern are very strong possible CEO candidates, as was Scott Sutton (proposed by DE Shaw), but they do not have the history in the industrial gases business that the team proposed by Mantle Ridge brings, and while all are capable of learning the ropes – they would not have been as successful as they have been to date were that not the case – we need to consider both time and risk. It always takes time for a new CEO to get up to speed with his or her new job, but Mr. Menezes and Mr. Reilley will come out of the gate far faster than anyone unfamiliar with the drivers of value in the industrial gas industry. Equally important, they will be able to recruit the right talent quickly, and all our investigations suggest that the core of Air Products is fairly hollow – some have been let go and others have left the company. There is no team to turn the company around and if either Mr. Patel or Mr. Stern takes over – which is likely the next defensive proposal from Air Products – they will have very limited internal talent to work with and they will not know who to recruit – adding to any possible turnaround timeline. Nor will they have the credibility to attract the kind of talent that we believe the others could bring on board. A transition to a better leadership team and a better strategy will take a long time for either of the proposed Air Products board members – far faster with the Mantle Ridge team. In our opinion, there is also a much higher risk of failure with Mr. Patel or Mr. Stern than there is with the Menezes/Reilley team, although nothing is risk free. Shareholders should want both speed and lower risk, so it is likely worth the fight that Mantle Ridge seems willing to pursue.

The gloves coming off, but politely. The day after the Air Products board nominee announcement, Mantle Ridge released a proxy statement, outlining the campaign’s timeline and the dialogue between Air Products and Mantle Ridge, and listing a slate of possible alternate directors. It is important to remember that some on the Mantle Ridge team were responsible for placing the current CEO at Air Products and this is reflected in the tone of all the correspondence shared as the statements are very complimentary of the success that Mr. Ghasemi has had at the company. In our opinion, Mantle Ridge has found the right next leader for Air Products in Mr. Menezes, (with the right mentor in Dennis Reilley) and if there is any failing on the part of the current Air Products team it is that they did not go after Mr. Menezes directly when he left Linde and that they are not supportive of his appointment now. None of the direct leadership experience that Mr. Patel and Mr. Stern have had puts them in a better position than the Mantle Ridge team for this role although they would be top of our list of candidates to run traditional chemical/polymer businesses or, in the case of Mr. Stern, anything in energy and energy transition. It is also interesting to note that the slate of board directors that Mantle Ridge is proposing brings very relevant adjacent and direct experience, which would be valuable to any CEO looking for guidance from the Board. Many in our view are far more qualified than several on the current Air Products board. It is also interesting to note that Mantle Ridge is offering these suggestions to the company and is not demanding a complete board refresh.

- Air Products Announces Two New Independent Director Candidates as Part of Ongoing Board Refreshment

- Air Products Refreshes Board Ahead of Face-Off With Activists

- Exclusive: Mantle Ridge nominates new board for Air Products, pushes for new CEO

The US sell-side focus here will be on Bob Patel as a possible replacement CEO, as he is well known to the US analysts and very well liked. We have the advantage of knowing both the nominees as our business at C-MACC is global, and our links with Borealis and OMV are strong – Mr. Stern is the better of the two candidates in our view. LyondellBasell did not have the best of times under Mr. Patel, who embarked on two completed acquisitions, neither of which we would have recommended and both of which have seriously underperformed, and then also distracted investors with a long (and terrifying) courtship of Braskem, which thankfully was abandoned. Mr. Patel is a good operator and Air Products needs that. Mr. Stern, by contrast, has experience in regions that matter and more broadly than just chemicals and refining. His early career with DuPont is relevant and he is well regarded within the broader industry. OMV is a hard business to manage, and the task is relatively thankless, in our view, because of the matrix of joint ventures and the interwoven and ever evolving relationship with ADNOC – Mr. Stern has done well here. While we would view Mr. Stern as the better qualified potential CEO replacement at Air Products, assuming he wanted the job, the derisked strategy is Mr. Menezes. Still, we think that both Mantle Ridge and the proposed management team may be underestimating the recruitment need at Air Products, in addition to the project restructuring that will also likely be a priority. With the gaps in the management structure at Air Products today, we fear that both Mr. Patel and Mr. Stern would be set up to fail from day 1, with the risk of a sizeable step backwards before they can move forward. We would assume that Mr. Menezes and Mr. Reilley already have a list of who they would call on. We also see the need for one or two write downs at Air Products; the Louisiana project, the World Energy venture in California, and possibly NEOM. The activist team will be given the benefit of the doubt for dealing with this relatively quickly (as Mr. Ghasemi was with the Tees Valley write down), whereas any internal handover at Air Products will leave the incoming CEO with a potential mess to clean up.

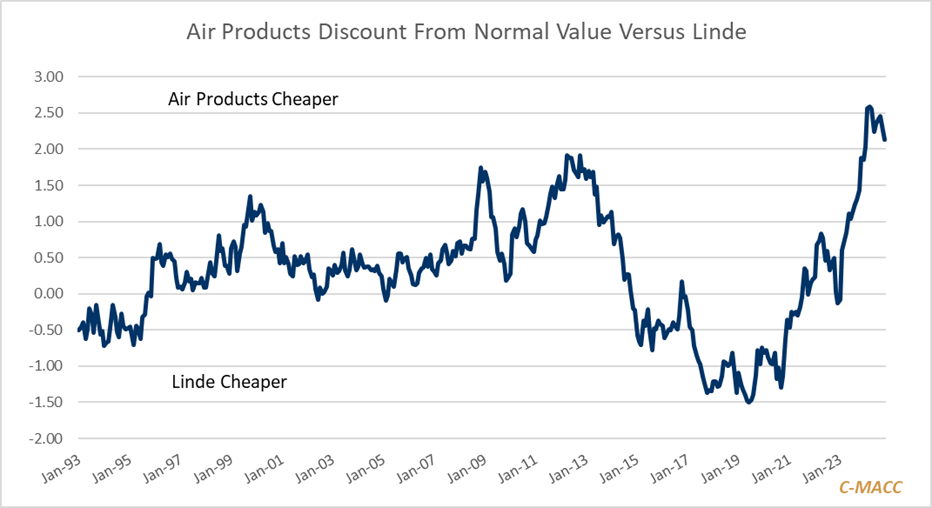

As we think about normalized return on capital and valuation for this industry (with correlations that go back to the 70s) and if we use Linde as a proxy, there is a lot of relative valuation upside from getting Air Products on a Linde path – and we show the comparative chart again below.

Exhibit 29: The recent Air Products gains are dwarfed by the potential RELATIVE upside. We might short Linde and buy Air Products if the activist is successful to derisk against the very high US market multiple.

Source: CapitalIQ and C-MACC Estimates

Throwing money out of the door before it closes: As we have noted in recent work, we expect the DOE to keep pressing the gas on funding allocations until the transfer of power, with the hope that once allocated these grants and/or loan guarantees cannot be revoked by the new administration. We are concerned that some bad loans will be made and poor projects supported over the next few weeks and that this could backfire on those hoping that energy transition momentum can continue in the US. The risk is that bad loans/grants are made to companies that fail and this can be used appropriately by the incoming administration to justify a lending moratorium at best or complete program cancellation in the worst case. Neither of the hydrogen hubs being supported in the story below makes even limited economic sense to us. We would be surprised if any of the hydrogen hubs championed by the DOE got off the ground. Some of these moves may also create activist opportunities to change corporate strategies such that less money is wasted, although the DOE loans are very prescriptive – you cannot take the money and then change what you do with it without approval. That said, a Trump Administration might approve a change.

- Biden-Harris Administration Announces Awards for Up to $2.2 Billion for Two Regional Clean Hydrogen Hubs to Bolster America’s Global Clean Energy Competitiveness and Strengthen Our National Energy Security

- DOE Invests $20.2 Million in Algae-Based Biofuel and Bioproduct Research

Company Conclusions

If Air Products’ board of directors prevails and we have an internally chosen successor for Mr. Ghasemi, we would expect some challenges, with management and with write downs. There could also be some step changes (negatively) in return on capital as the projects under construction are consolidated. The stock could go backwards, while at the same time, Linde could appreciate as investors assume that Air Products journey to catch up would be slower, if at all. The new outside team from Mantle Ridge would get a pass, as long as they acted quickly with large decisions, and uncovered any additional bad news equally quickly. It took Linde 2-3 years to get the acquisition on track – faster than we had expected. Much of this was because of Mr. Menezes, so we would be quite hopeful if he took over, given the upside suggested above.

Meanwhile, we might be tempted to buy a basked of the beaten down European oil and gas companies, as something will change, redomiciling to the US, M&A, and changes in strategy to reduce the risk that money is wasted on transition projects that will need to be written down etc. – From our previous sustainability report, referencing Exhibit 28 – Among the publicly traded companies, Woodside may look back in a couple of years and say that the timing of the two US deals could not have been better. US LNG will get a boost from overall global power demand growth and a slower renewable transition in most places outside China, while being first to market with large scale US blue ammonia may also be a benefit. The traditional US ammonia producers also have blue expansion projects, and these could also prove to be well timed. Woodside trades at a low and declining multiple of EBITDA, but as noted in the chart below – things could be worse, they could be domiciled in Europe. It will be interesting to see whether the pro-energy Trump administration tips any of the Europeans over the edge in terms of redomiciling in the US. The Europeans look like an interesting trade here on that basis, or on the basis that Europe needs to relax its transition rules and this could derisk some of the energy company strategies in Europe. Both Shell and TotalEnergies have openly discussed with investors the idea of redomiciling to the US. You could also speculate around the opportunity for US companies to buy Europeans again. ExxonMobil could pay a 50% premium for BP and still have an accretive deal. Buying the European oil and gas majors today feels counterintuitive, but it may be a good trade.

The week of November 18th – click on the day or the report title for a link to the full report on our website.

Monday – Weekly Margin and Pricing Analysis

Global Polymer Prices Face Downward Pressure In 4Q24; Western Margins, On Average, Trend Lower Relative To Asia

- Polymer Market Trends: Global spot polymer prices were mainly lower (again) WoW, with Europe reflecting the most severe price declines, on average, while North America and Asia markets were much more mixed.

- Chemical Market Trends: US spot ethylene margins declined WoW in absolute terms and relative to Europe and Asia. US spot PDH margins improved WoW, and we think more weakness in US propylene is likely in 4Q24.

- Feedstock Market Trends: Ex-US naphtha and crude prices fell relative to US natural gas and ethane, and US natural gas prices rose relative to Europe and Asia – the relative North American cost advantage fell WoW.

- Agriculture Market Trends: Global ammonia producers saw their production costs increase WoW, which we view as a plus for price support. However, US producer margins declined WoW relative to Europe and Asia.

Whole Lotta Shakin’ Going On – From Consolidation to Management Shifts, Efforts to Boost Value Are Rising!

- General Thoughts: Global M&A transaction values have fallen from their 2021/22 highs, but they are recovering from their 2023 lows – the potential for lower interest rates and better demand in 2025/26 favors more activity.

- Supply Chain/Commodities: We discuss the Air Products announcement of two potential board candidates, flag our recent reports on global trade and polymers, an upcoming report on this topic, and other industry trends.

- Energy/Upstream: We highlight weakness in gasoline values in the US ahead of the Thanksgiving holiday, and we broaden the discussion to comment on the current level of US refinery margins and the EIA outlook for 2025.

- Sustainability/Energy Transition: We discuss the valuation decline in downstream companies tied to solar and wind, and other clean energy sector components that are selectively spurring M&A activity in this area.

- Downstream/Other Chemicals: We discuss worsening economic conditions in Germany, as displayed by a recent ifo survey showing survivability concerns for some companies, and other global chemical end-market news.

Wednesday – Monthly Agriculture Report

Down On the Farm? Most Cautious Views Target Near-Term Trends, Medium-to-Long Term Trends Remain Constructive

- General Thoughts: The S&P 500 Fertilizer & Agricultural Chemical Equity index has underperformed YTD, and the highlighting of cautious views for 2025 following expectedly weak 3Q reports may set many up for upside surprises.

- Supply Chain/Inputs: We are cautious on the agriculture economy in 2024 but more constructive on 2025/26. We discuss farm-input markets and recent profit outlook cuts preceding a potential sentiment shift to the positive.

- Biofuels: We discuss recent downward pressure on US ethanol margins, though we continue to see 2024 as a record year for domestic ethanol exports. We also flag varied biofuel ambitions among new entrants and oil majors.

- Sustainability/Transition: We highlight developments in sustainable and regenerative agriculture, focusing on bio-stimulant, bio-crop protection, and bio-fertilizer developments, and farm-input player growth in this area.

- Downstream/Other: We look at crop market developments, expectations for farmer income to remain under pressure in 2025, which we agree with, and why positive surprises could develop in the setting of low expectations.

US Energy Exports – Giving The Trump Administration A Lot of Leverage?

- General Thoughts: The US runs a significant trade deficit relative to trade surplus positions in China and Europe, putting the US in a good net bargaining position on trade. However, energy and plastics are major exceptions.

- Supply Chain/Commodities: We flag Navigator gas efforts to grow its ethylene shipping capabilities and provide views on polymer trade before publishing a thematic report on polyethylene and the importance of global insights.

- Energy/Upstream: We discuss growth in US oil, gas, and NGL supplies, whether the benefits will spur the build-out of domestic industry or serve an overseas market build-out, and uncertainty facing crude oil markets in 2025.

- Sustainability/Energy Transition: The rush for biofuels is a natural reaction to higher green hydrogen costs, but they are no panacea because there are insufficient inputs. Meanwhile, the DOE is pushing money out of the door.

- Downstream/Other Chemicals: New trade policies will create new trade workarounds, with Mexico being a massive beneficiary if the two sides agree on immigration issues. De-minimis import volumes could rise.

Ethylene and Lithium Similarities: Too Much Supply and Investment; Cost Position is Critical!

- General Thoughts: Market developments suggest that in the medium- to long-term, US merchant ethylene buyers will see their advantage shrink relative to buyers abroad as the relative benefits for US ethylene producers grow.

- Supply Chain/Commodities: We discuss SQM 3Q24 results and their continued push to grow lithium capacity despite recent price weakness – we see challenges persisting for those with high-cost global production positions.

- Energy/Upstream: We highlight US natural gas prices relative to Europe and Asia and our positive view of supply keeping domestic prices relatively low despite demand, especially for power, likely exceeding most expectations.

- Sustainability/Energy Transition: Most medium- to long-term critical mineral demand outlooks are bullish. Still, the current oversupply raises concern about some seeking to serve this global market, such as battery recyclers.

- Downstream/Other Chemicals: We discuss recent weakness in global freight rates, following their brief rebound after hitting 2H24 lows, and trade and tariffs before our Sunday thematic on this topic as it relates to polyethylene.

Weekly Climate, Recycling, Renewables Energy Transition and ESG Report (CRETER) No 207

Activism and Sustainability, Is Air Products Unique, Or Should Others Be Worried?

- 1st Topic of the Week: Sustainability activism has, until recently, focused on criticisms around companies not doing enough, but the tide has turned, and some chasing sustainability goals are now likely to be accused of destroying shareholder value. Air Products is in the crosshairs for capital misallocation among other things.

- 2nd Topic of the Week: We look at the rising biofuel ambitions which coincide with declining green hydrogen ambitions (because of costs) and question whether there are enough inputs. We also look at the amount of money the DOE is authorizing short term and question how wise this is.

- Otherwise: We provide our monthly look of clean agriculture, look at feedstock intensity and its impact on the cost of green/clean products, undervalued solar and wind stocks (maybe) and trade barriers

Weekly Hydrogen Economy Update No 73

COP(romise): Unlikely Yet, But The Playing Field is Taking Shape

- The battle lines are clear at COP29, with the “we can’t afford it” group growing in numbers while the “we have to do it anyway” group keeps chanting. Bankruptcies are increasing and compromise is needed to avoid trauma

- A year ago, we created a list of companies that we thought would not make it, and while we have not published that list, we have been quite vocal about Plug Power. HH2E was on the list – even free power is not enough!

- We also see an increase in the number of stories talking about the challenges with German manufacturing economics – of all the European countries, Germany can least afford green hydrogen – blue from the US works.

- To seize the blue opportunity, the US will need to pay more attention to methane emissions, and this might be an incentive program that fits well with the Trump drill doctrine, ease regulations but push back on emissions

- Otherwise, we talk about Bloom Energy – the safest bet for electrolyzers now! We found projects – some large scale outside the Europe, we recap the AEA conference and show more support for higher power costs.

Loading…

Loading…

[/restrict]