1st Topic of the Week: As US ethanol production hits...

Read MoreOur Base Chemical & Polymer Analysis reports offer a comprehensive, data-rich snapshot of global market dynamics every week. Each edition delivers actionable insights backed by curated charts and margin models to help you stay ahead of market movements, arbitrage trends, and structural shifts.

Weekly reports on base chemicals and polymers provide data-driven insights and charts to help understand market changes and trends.

Offers an update on global supply chains, chemicals, energy, sustainability, and industry changes, tracking key developments.

Provides weekly updates on global plastic resin markets, focusing on polyethylene, polypropylene, and polyvinyl chloride.

The report examines global energy transition trends, focusing on sustainability, hydrogen, clean tech, and circular economy themes.

A concise weekly briefing that ties it all together—highlighting the most important themes, shifts, and strategic insights across our research coverage.

Independent monthly guidance from C-MACC on expected U.S. contract prices for PE, PP, PS, and PVC—grounded in fundamentals, not post-settlement reporting.

1st Topic of the Week: As US ethanol production hits...

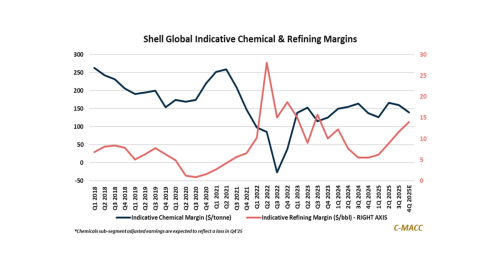

Read MoreGeneral Thoughts: Early 2026 chemical sector updates signal margin defense...

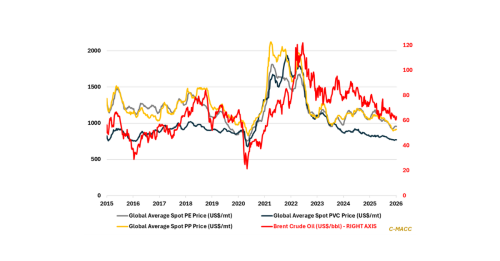

Read MoreGeneral Thoughts: Spot polymer prices reflect stabilization in early 2026...

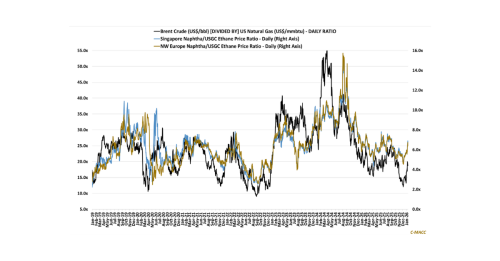

Read MoreGeneral Thoughts: Early-2026 cost-curve shifts amid persistent chemical market oversupply...

Read More

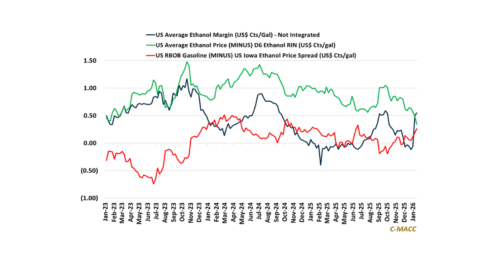

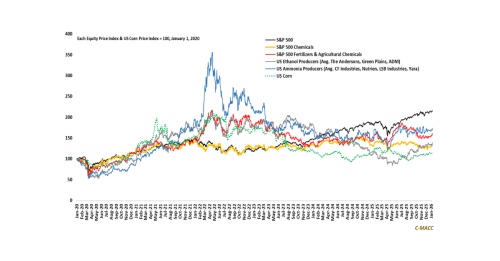

1st Topic of the Week: As US ethanol production hits records, will exports and chemical pathways replace gasoline blending as the dominant clearing mechanism by

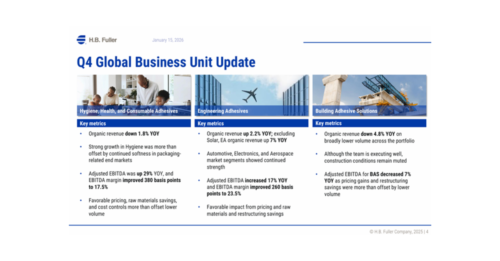

General Thoughts: Early 2026 chemical sector updates signal margin defense over volume, as pricing, self-help, and restructuring offset weak demand, policy uncertainty persists, and capacity

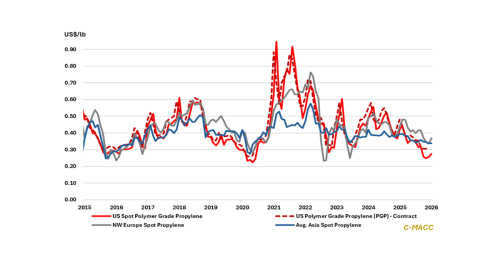

General Thoughts: Spot polymer prices reflect stabilization in early 2026 as crude strength, feedstock dispersion, and production curbs lift price floors, with 1H26 favoring margin

General Thoughts: Early-2026 cost-curve shifts amid persistent chemical market oversupply are forcing restructuring, with clear evidence likely emerging in 4Q25 results and more decisive 2026

General Thoughts: Across markets, tighter conditions are mainly driven by higher costs and lingering curtailments, not by demand, as US propylene firms WoW, while early-year

The fundamental health of the global ammonia market increasingly hinges on logistics, reliability, and timing constraints, making basis risk and seasonal timing more decisive than

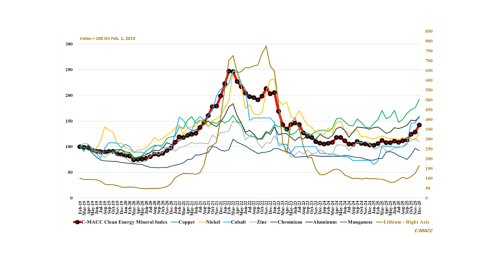

1st Topic of the Week: Are copper and lithium entering a policy-anchored price regime where security-driven supply caps upside while speculative flows amplify volatility across

General Thoughts: Global chemical downturn into 2026 will force ownership change and capital discipline, restructuring across Europe and Asia ex-China, while redefining low-cost integration as

Sign up below to get updates on our events, publications, and insights—straight to your inbox.