Global Agriculture Monthly Report

Is This The Bottom? Crop Price Weakness Drives Sector Underperformance; Supportive Long-Term Factors Emerging

Key Findings

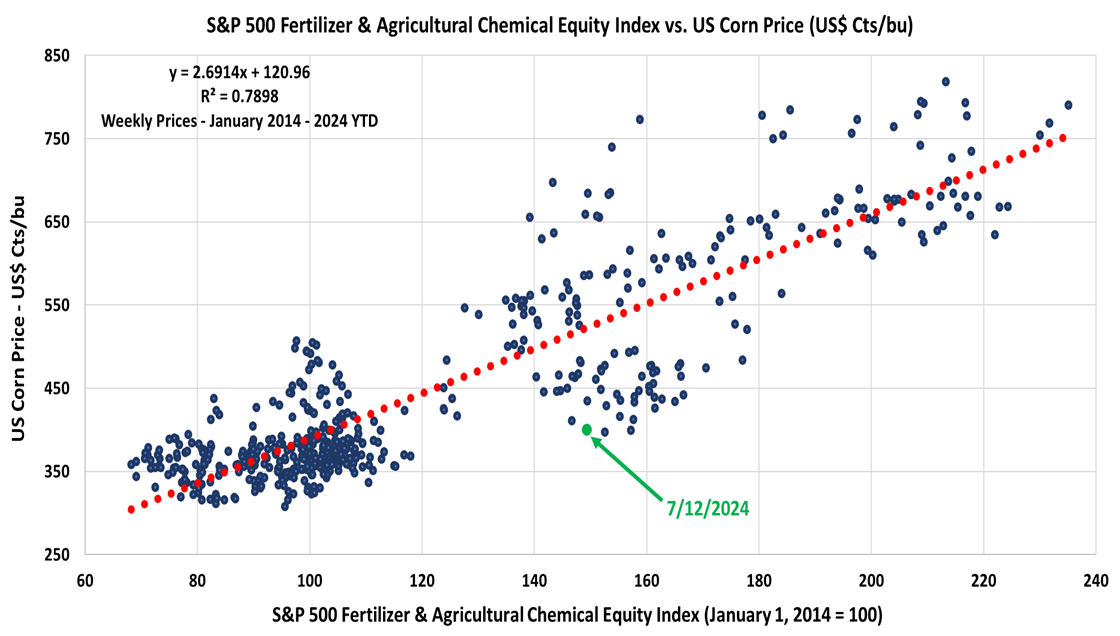

- General Thoughts: The S&P 500 Fertilizer & Agricultural Chemical equity index has underperformed in 2024, but several factors have partly offset crop market weakness to keep sentiment levels higher than many had feared.

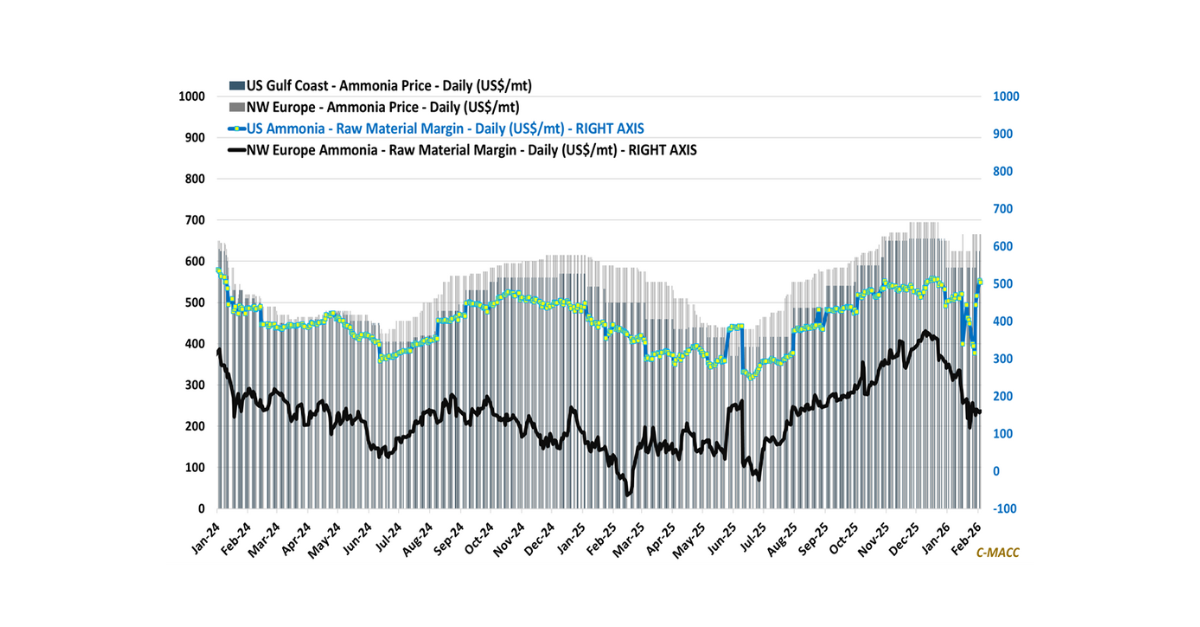

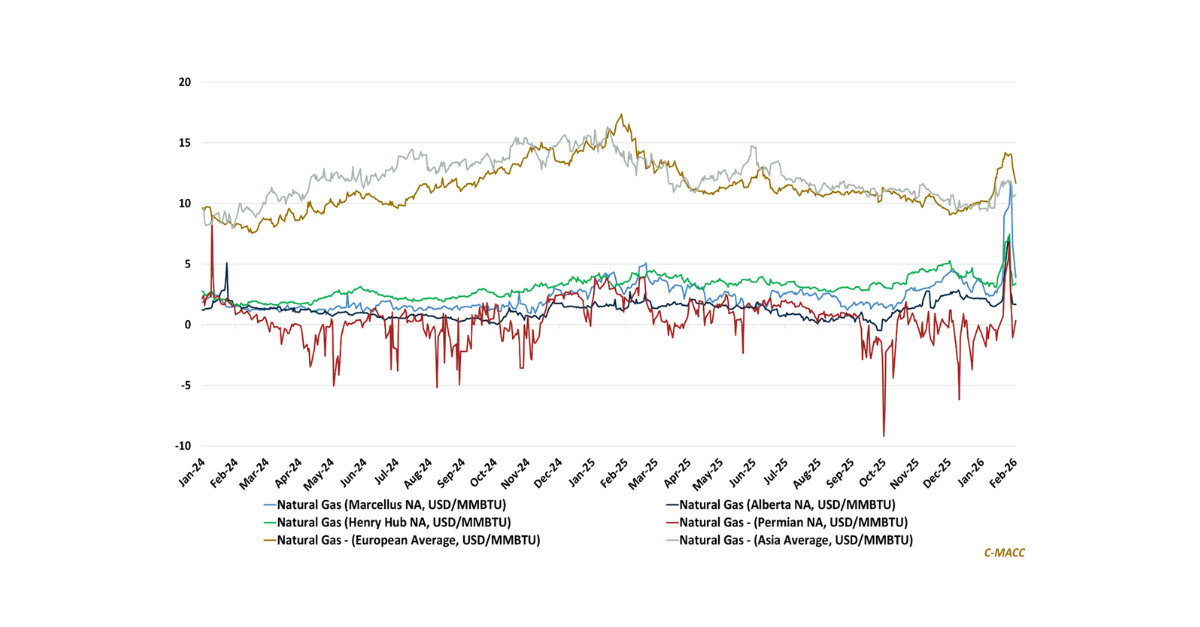

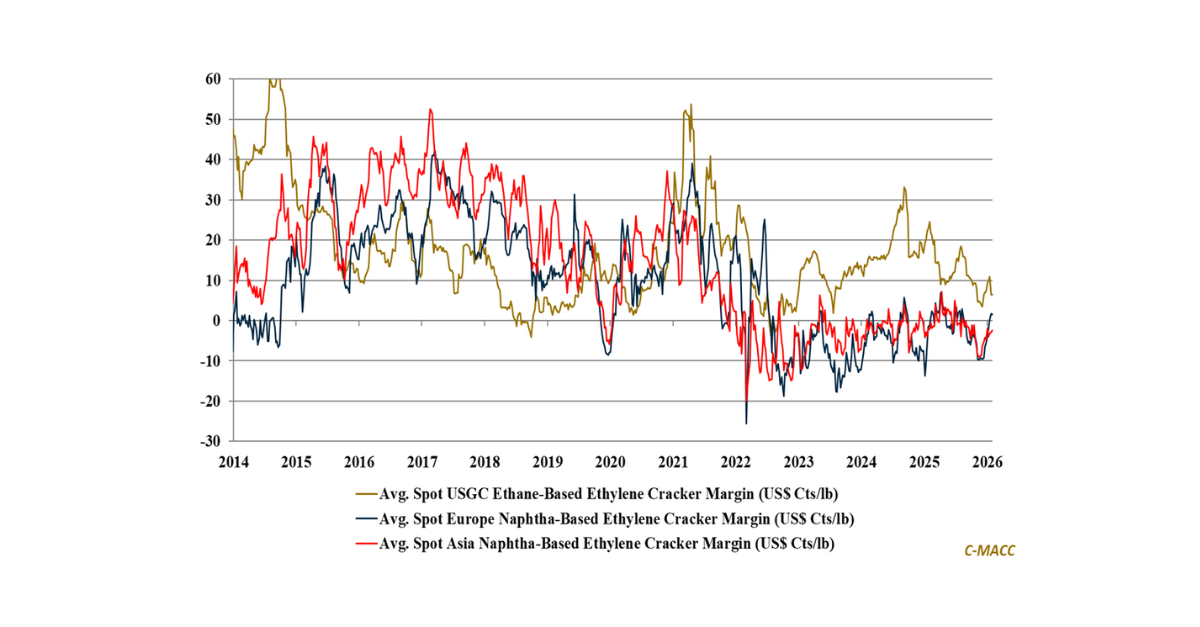

- Supply Chain/Inputs: We have held a bearish view of the agriculture economy in 2024. However, we maintain a more constructive view of 2025/26. Our optimism is selective in the near term and focuses mainly on cost position.

- Biofuel: We highlight strategic moves from BP in SAF and ethanol, takeaways from the latest American Airlines sustainability report, and that weak crop prices benefit ethanol producers, though it could prove short-lived.

- Sustainability/Energy Transition: We discuss the Fertiglobe winning H2Global bid to push low-carbon ammonia into Europe and the CF Industries collaboration with POET to spur farmer use of low-carbon fertilizer in the US.

- Downstream/Other: We discuss the drivers of food prices, which has seen some relief with crop price weakness that we think will persist into year-end, and we flag cutbacks at Deere amid agriculture economy weakness in 2024.

Exhibit 1: S&P 500 Fertilizer & Agriculture equity performance has been closely tied to corn price shifts and implied farmer income but has recently held up in absolute terms better than corn (and most crop prices). Also, see Ex. 2.

Source: Bloomberg, C-MACC Analysis, July 2024

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!