Global Agriculture Report

Against the Wind – Crop Price Weakness Disfavors Farm Spending & Sustainable Practices, Favors Biofuel Investment

Key Findings

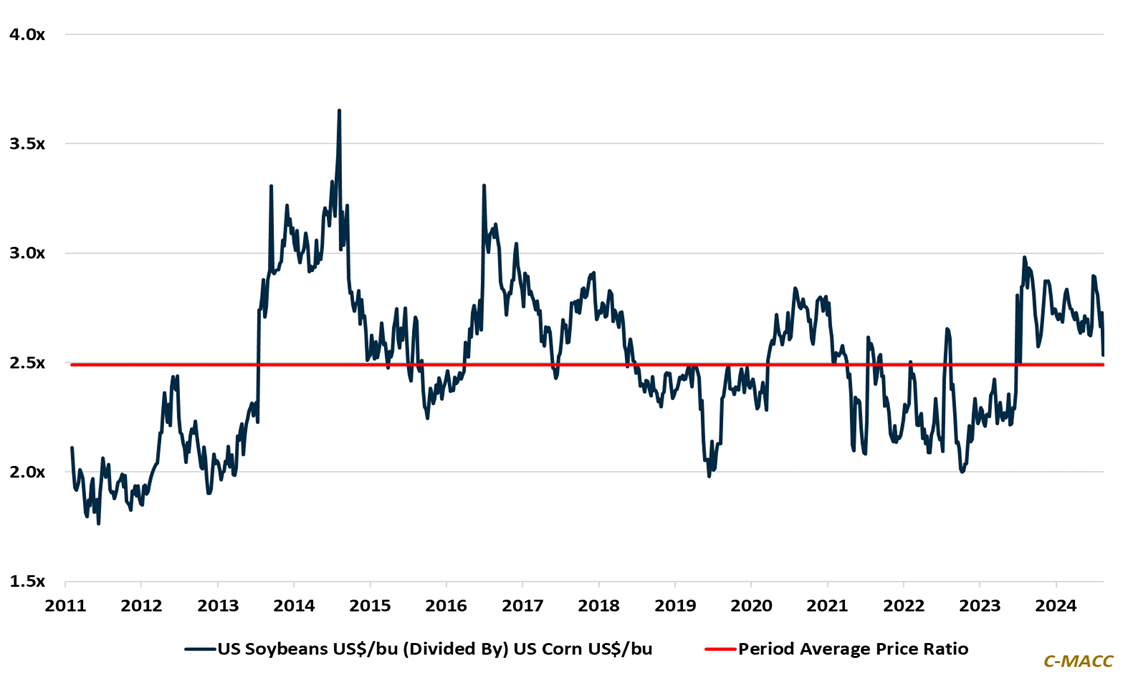

- General Thoughts: US corn and soybean prices have fallen to YTD lows in August, but soybean values have fallen relative to corn, potentially putting in motion a push that favors more corn plantings and crop-input use next year.

- Supply Chain/Inputs: We have held a bearish view of the agriculture economy in 2024, and our 2H24 view remains unchanged, as we see more risk of input-supplier downgrades before a constructive 2025/26 setting develops.

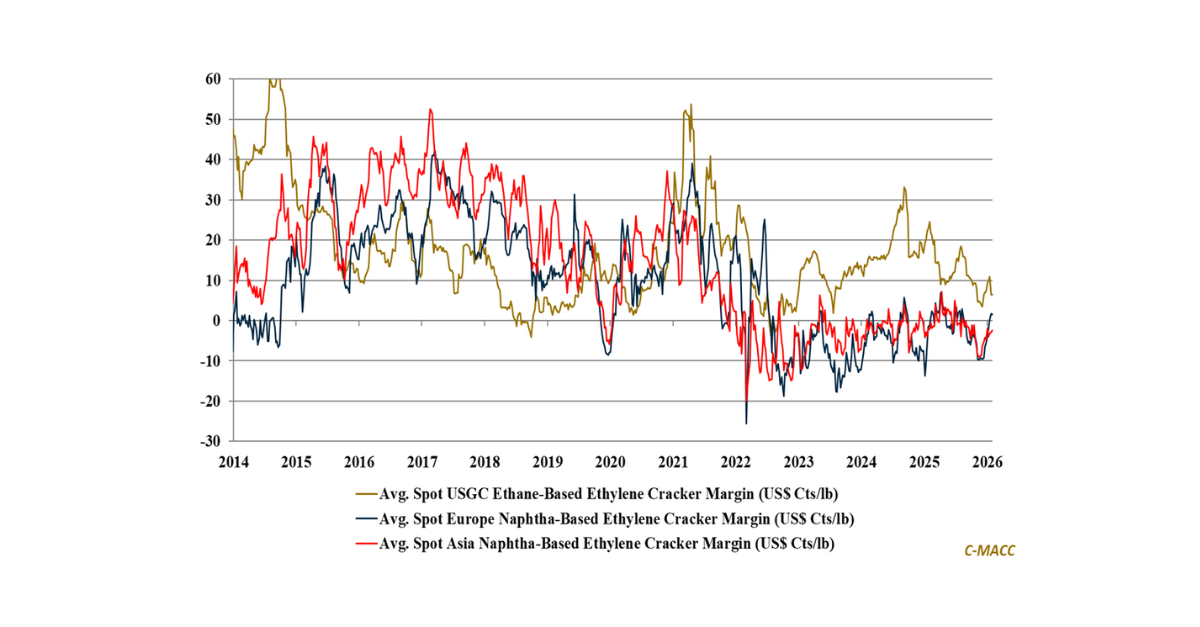

- Biofuels: We think the current benefits flowing to biofuel producers from weak crop prices/inputs favor capacity growth investments. However, for now, we observe many biofuel investments on a net basis on hold or in reverse.

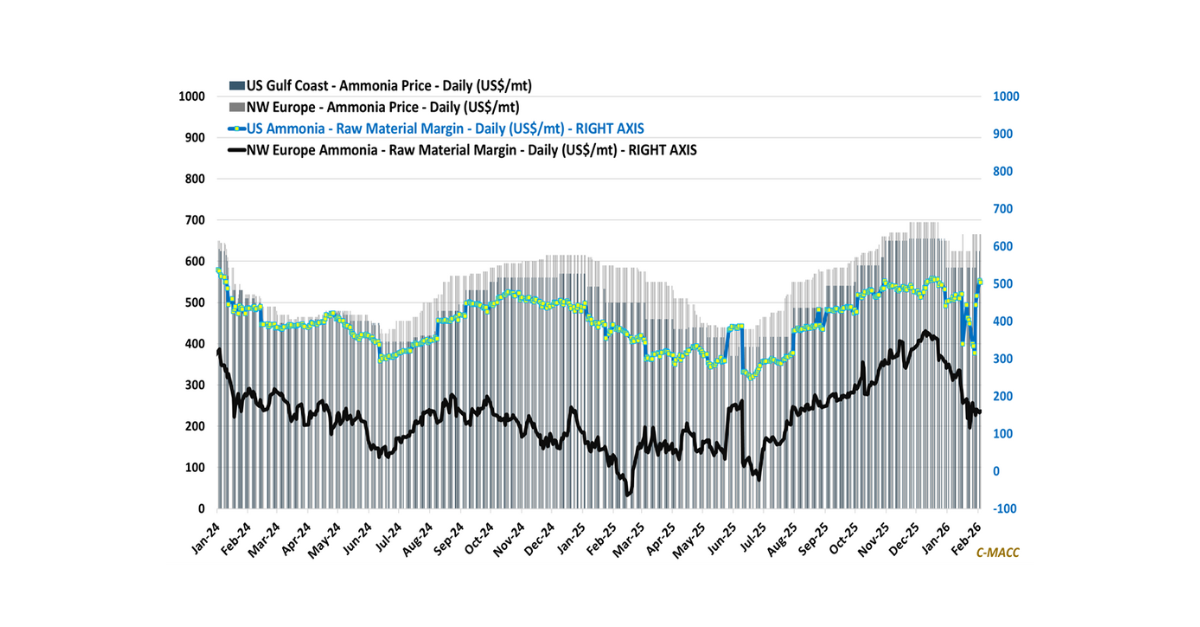

- Sustainability/Transition: We discuss the optimism surrounding low-carbon ammonia market growth, which favors existing producer expansion plans and climate risk likely shifting some crop production to alternate markets.

- Downstream/Other: We discuss the latest USDA crop market reports, highlighting ample corn and soybean supply amid near record US yield estimates, and we discuss the rise in soy and corn plantings in the US relative to wheat.

Exhibit 1: US soybean prices have fallen relative to corn, favoring a potential shift to more corn plantings next season.

Source: Bloomberg, C-MACC Analysis, August 2024

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!