Daily Chemical Reaction

Global Corporate Restructuring & Strategic Alignment Activity Stays Elevated; Everything That Glitters Is Not Gold

Key Findings

- General Thoughts: We discuss critical mineral prices and producer equity performance considering news of Rio Tinto talks to acquire Arcadium Lithium after its equity collapse with lithium prices YTD – is now the best time?

- Supply Chain/Commodities: We provide a few thoughts on the recent activist investor entrant in Air Products, resulting in a confidence jolt – some sell-side upgrades imply confidence will rise further, and we discuss this view.

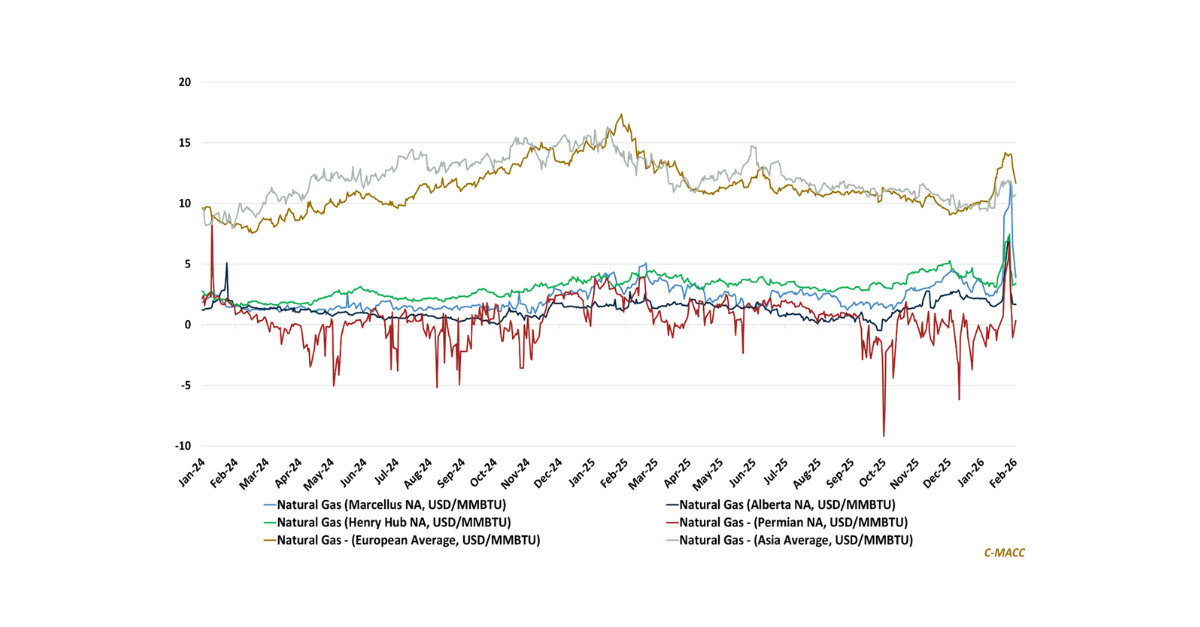

- Energy/Upstream: We highlight a few natural gas demand data points suggesting that its use for power remains on the rise, with 2024 reflecting record demand levels and why natural gas likely has a bright future in this area.

- Sustainability/Energy Transition: We discuss the higher costs of US batteries relative to China and electricity price volatility and consistency needs supporting their demand (even at higher prices) in energy storage but not for EVs.

- Downstream/Other Chemicals: We focus on the potential for Hurricane Milton to disrupt phosphate and other fertilizer transport/shipping operations in Florida, focusing on impacts from 2022 Hurricane Ian as a loose guide.

Exhibit 1: Lithium producer equities have trended lower with lithium prices since early 2023 – is now the time to buy?

Source: Bloomberg, C-MACC Analysis, October 2024

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!