Global Agriculture Report

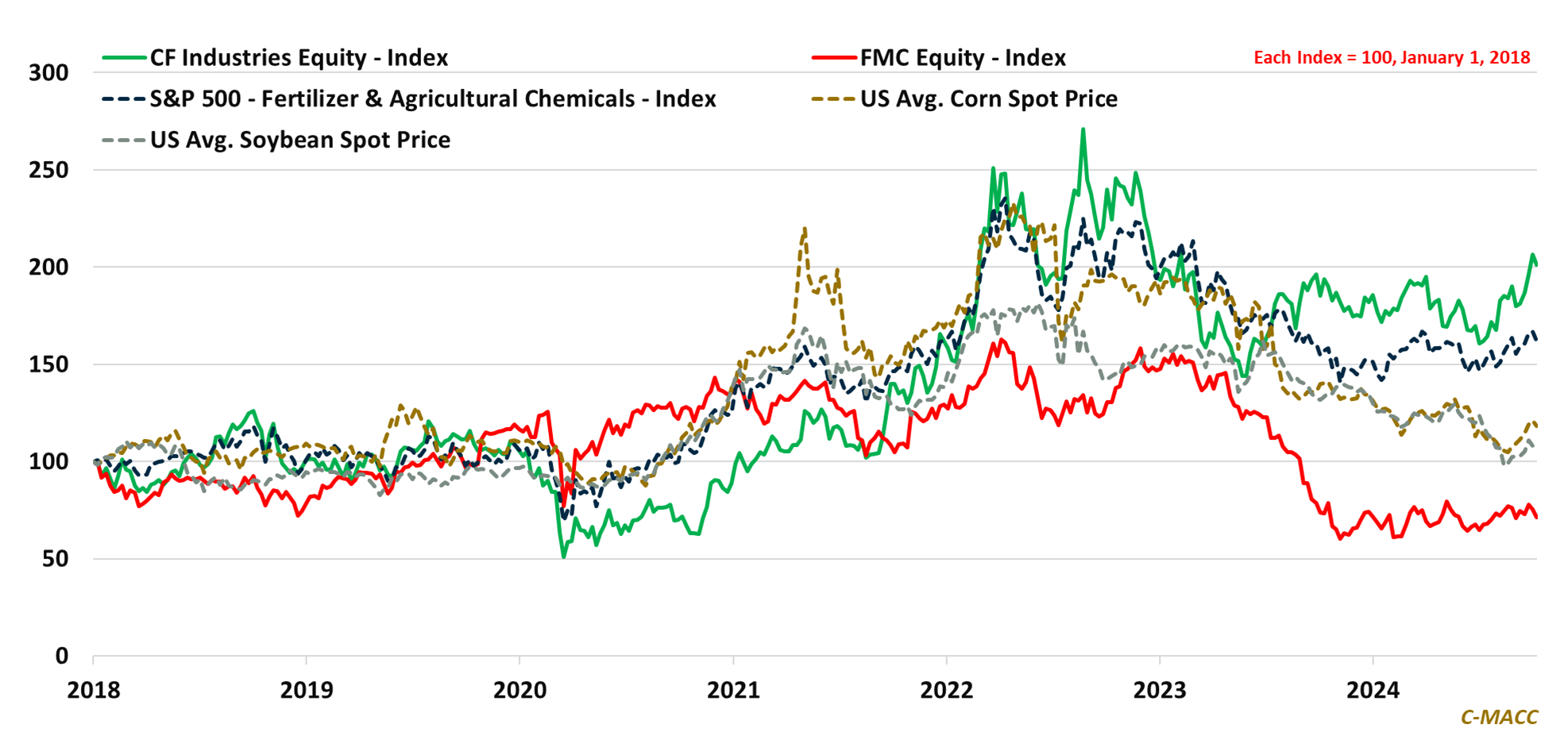

It’s All Relative – 2024 Agriculture Sector Underperformers Now In Focus Ahead of Likely Improved Conditions In 2025

Key Findings

- General Thoughts: The agriculture market has faced a challenging 2024 amid weak crop prices and trade concerns – we take a more constructive view of 2025 that could prove most beneficial for 2024 sector underperformers.

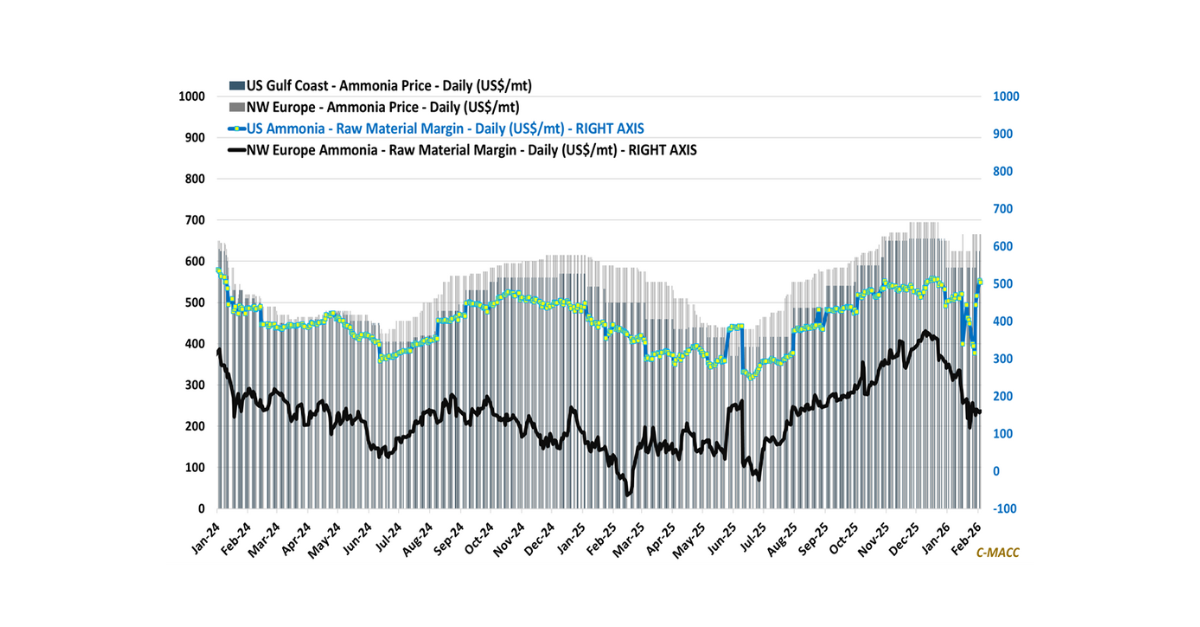

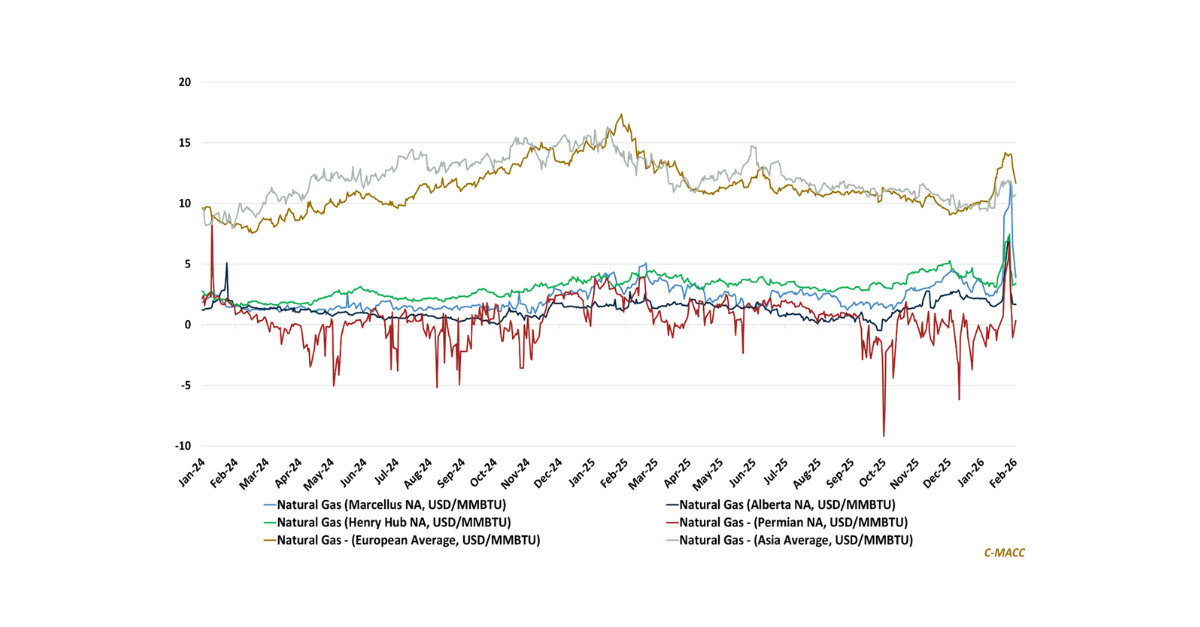

- Supply Chain/Inputs: US ammonia producers are in an enviable position, as their margins are near YTD highs and crop prices favor more corn plantings, but most are aware of it, which could hinder near-term equity performance.

- Biofuels: We highlight recent weakness in US ethanol margins, though run rates remain strong. We also highlight the different crops used in advanced and emerging economy biofuels and their relative demand growth profiles.

- Sustainability/Transition: We flag soybeans rising in popularity across many sustainable/regenerative agriculture initiatives relative to corn, partly due to greater soy yield efficiency and differing global end-demand expectations.

- Downstream/Other: We discuss a few concerns we are hearing from farmers, ranging from still elevated interest rates to agriculture equipment depreciation, and we also highlight recent relative US Dollar strength.

Exhibit 1: The S&P 500 Fertilizer & Agricultural Chemical Equity Index has outperformed crop markets YTD, though some sub-sectors, such as ammonia fertilizer producers, are notably outperforming others, such as in crop protection.

Source: Bloomberg, C-MACC Analysis, October 2024

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!