The Hydrogen Economy #70

It’s All Over Now Baby Blue (& Green).

Key Points

- Europe is seeing a wave of green hydrogen cancellations, and an FT article over the weekend latched on to the story we have been telling for a while – this is all too expensive, and projects and equipment are too early.

- The ramification for the electrolyzer makers will be as harsh as we have suggested in prior work, with bankruptcies/restructuring inevitable, and residual values unclear: what is a factory worth if no one needs it?

- Other routes to hydrogen or hydrogen derived fuels and products will get more attention – blue in the US, the UK and the Middle East, gasification/pyrolysis everywhere and novel technologies, like Utility Global.

- Climate goals will need to change and the cancellations in Europe come just ahead of COP29 and will get attention and likely cause much wringing of hands. Nuclear power is an answer, but it is long-term.

- Otherwise, we look at the strength in pricing for European methanol – good for US producers. We also discuss the competitive edge in China outside of electrolyzers.

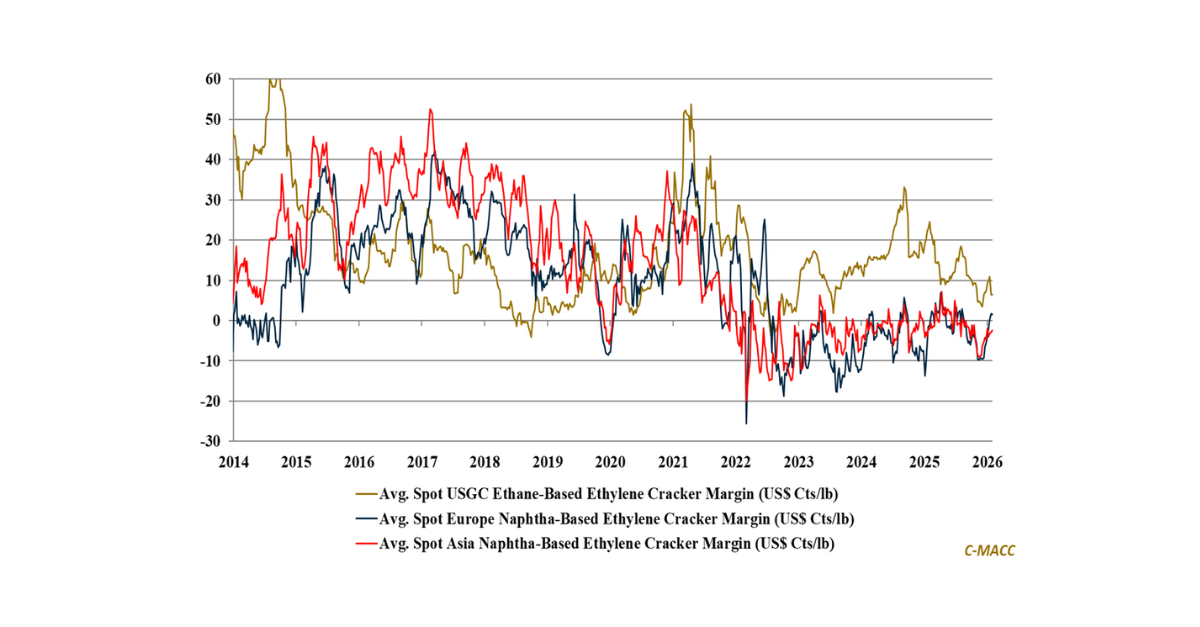

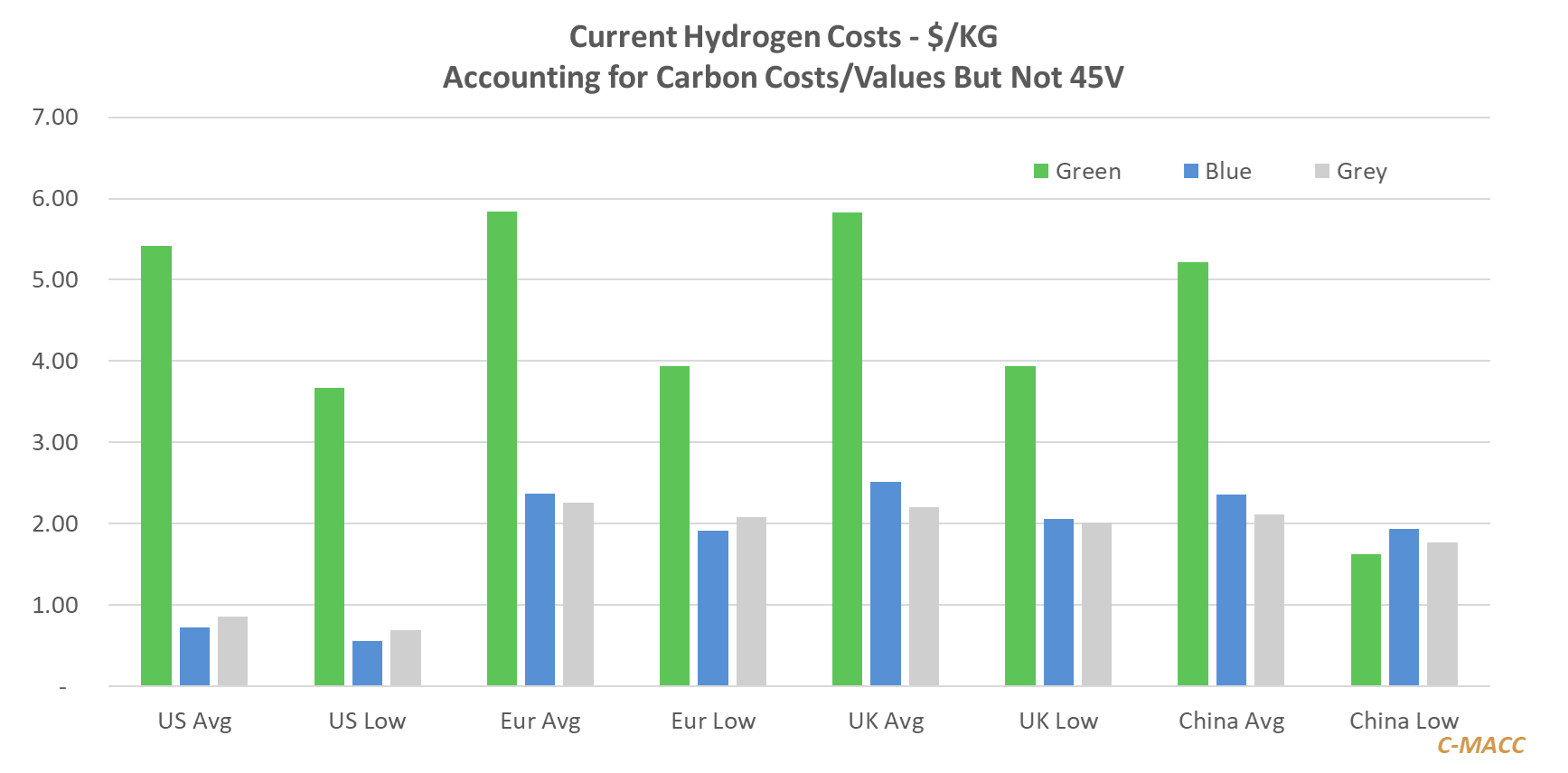

Exhibit 1: Note that these are cash costs. Capital charges can double the costs, especially where power is intermittent. Even the low power price-based costs in each region are too high – except possibly in China.

Source: Capital IQ and C-MACC Analysis

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!