Daily Chemical Reaction

3Q24 Good, 4Q24 Bad, 2025 Off to The Races?!?

Key Findings

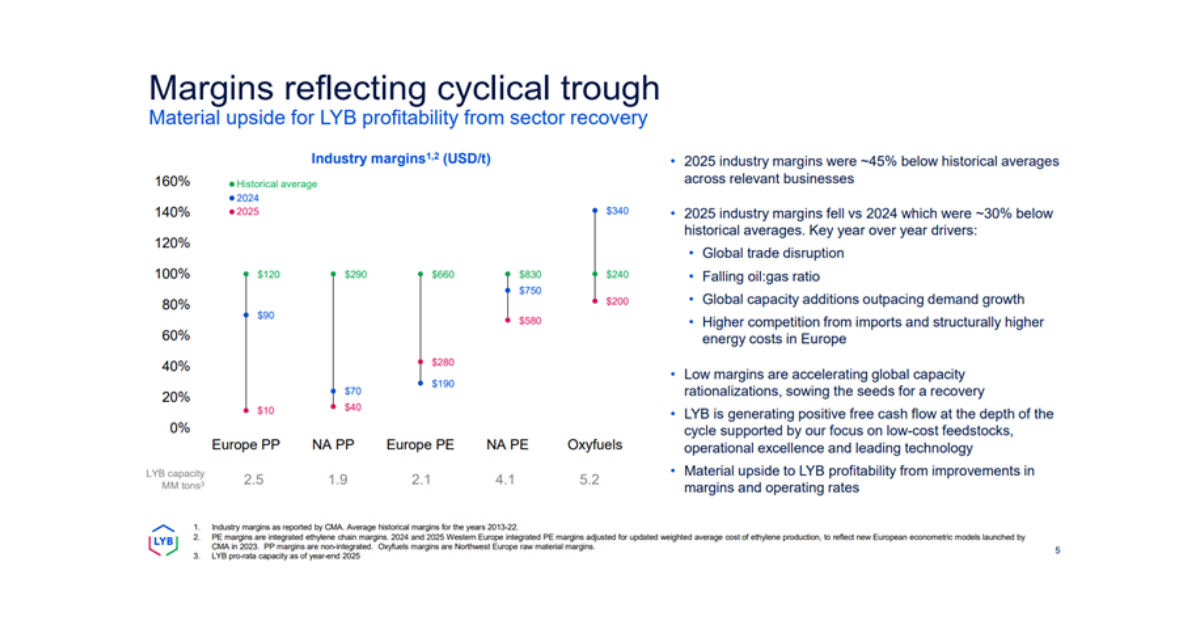

- General Thoughts: We discuss takeaways from a few global chemical sector earnings reports, which mostly expect a weak 4Q24 but anticipate improvement in 2025 – beyond seasonal factors, some will still face a rocky 2025.

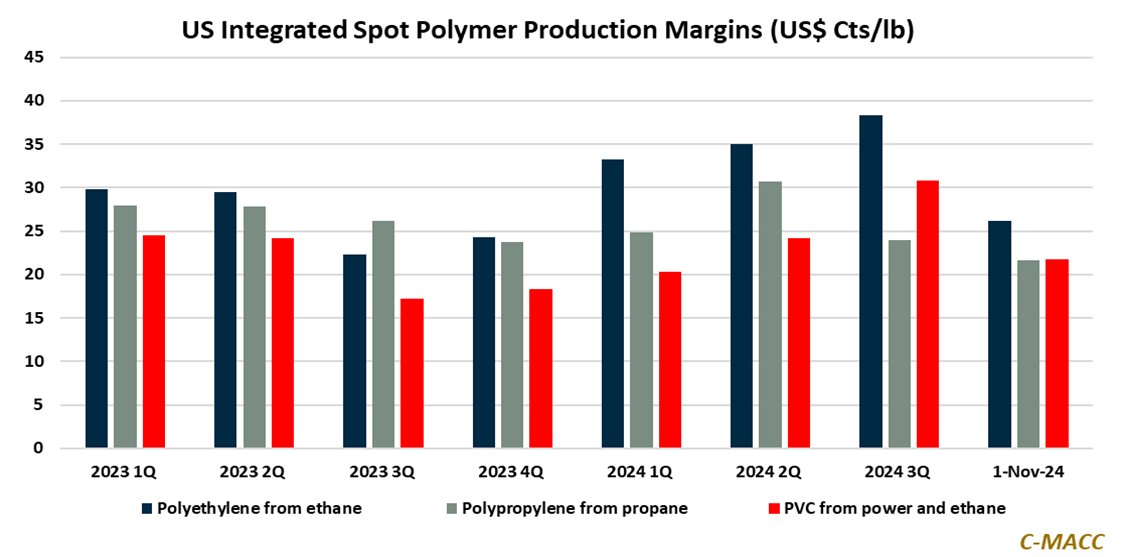

- Supply Chain/Commodities: We highlight takeaways from LyondellBasell on domestic PE and PP markets from its 3Q earnings call, Linde results related to their strategy compared to Air Products, and other sector 3Q reports.

- Energy/Upstream: We highlight ExxonMobil and Chevron results, discuss differing views of crude oil refinery margins in 2025 among operators, and flag the planned closure of the LyondellBasell Houston refinery in 2025.

- Sustainability/Energy Transition: We discuss Linde’s involvement in a Dow Fort Saskatchewan growth project and flag LyondellBasell and Eastman projects in advanced recycling, among other relevant sector updates.

- Downstream/Other Chemicals: We discuss most chemical sector management teams signaling better demand conditions globally in 2025, following interest rate cuts and government stimulus, and its impact on expectations.

Exhibit 1: US integrated polymer margins have fallen relative to 3Q24 average levels, and upside risk in 4Q looks low.

Source: Bloomberg, C-MACC Analysis, November 2024

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!