Daily Chemical Reaction

US Energy Exports – Giving The Trump Administration A Lot of Leverage?

Key Findings

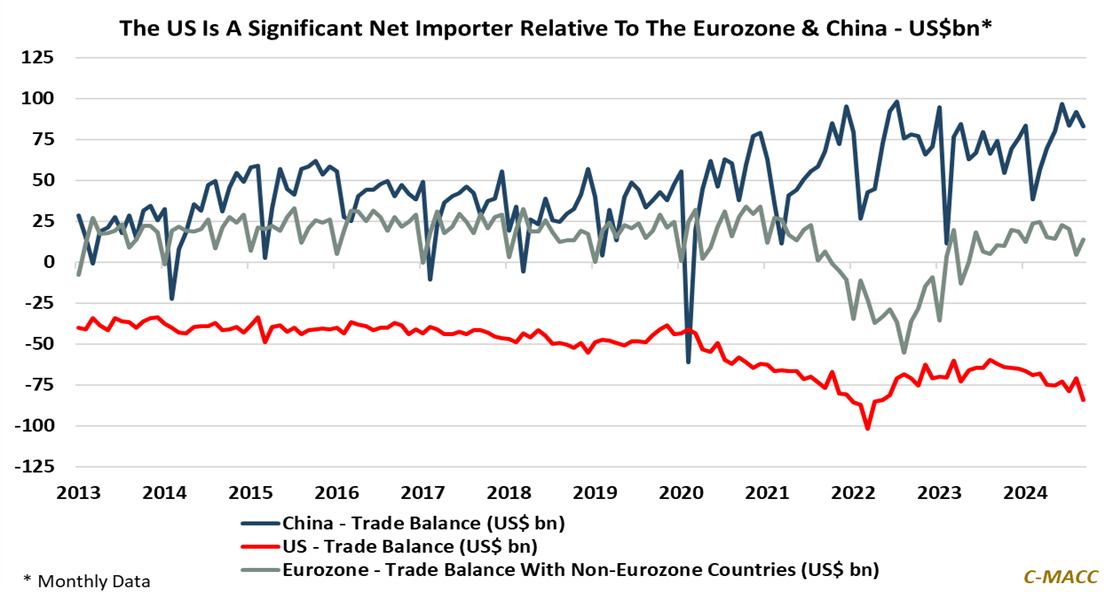

- General Thoughts: The US runs a significant trade deficit relative to trade surplus positions in China and Europe, putting the US in a good net bargaining position on trade. However, energy and plastics are major exceptions.

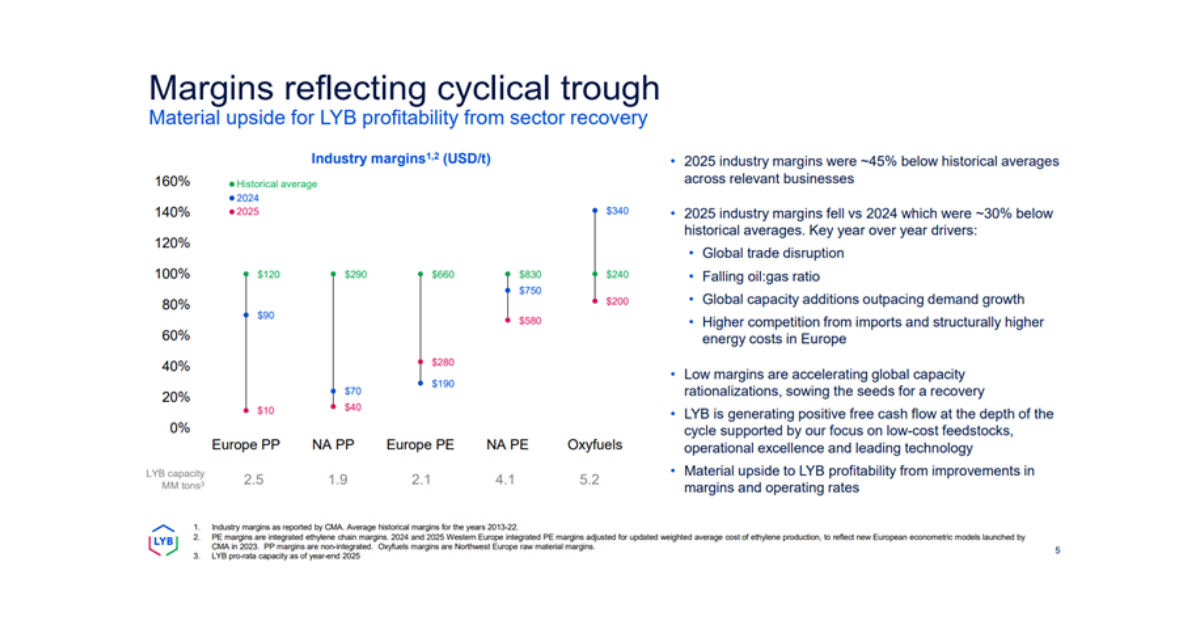

- Supply Chain/Commodities: We flag Navigator gas efforts to grow its ethylene shipping capabilities and provide views on polymer trade before publishing a thematic report on polyethylene and the importance of global insights.

- Energy/Upstream: We discuss growth in US oil, gas, and NGL supplies, whether the benefits will spur the build-out of domestic industry or serve an overseas market build-out, and uncertainty facing crude oil markets in 2025.

- Sustainability/Energy Transition: The rush for biofuels is a natural reaction to higher green hydrogen costs, but they are no panacea because there are insufficient inputs. Meanwhile, the DOE is pushing money out of the door.

- Downstream/Other Chemicals: New trade policies will create new trade workarounds, with Mexico being a massive beneficiary if the two sides agree on immigration issues. De-minimis import volumes could rise.

Exhibit 1: The US has a lot of leverage in trade negotiations with China and Europe. However, this does not mean that it does not have exposure in the export market, especially in energy and petrochemicals.

Source: Bloomberg, C-MACC Analysis, November 2024

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!