Daily Chemical Reaction

Ethylene and Lithium Similarities: Too Much Supply and Investment; Cost Position is Critical!

Key Findings

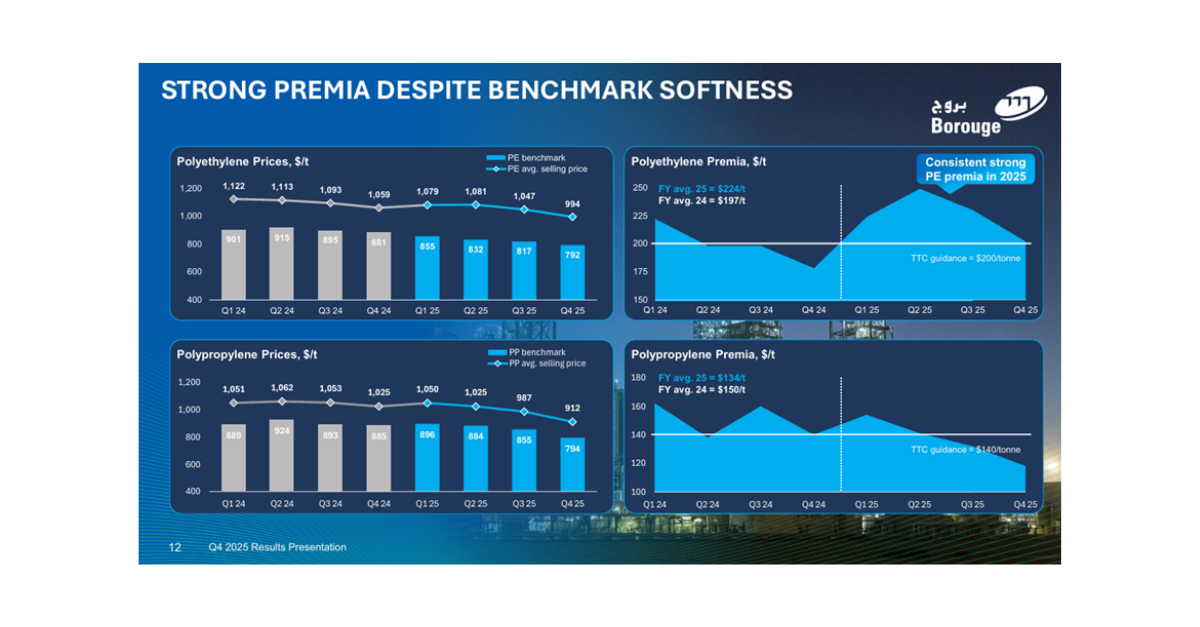

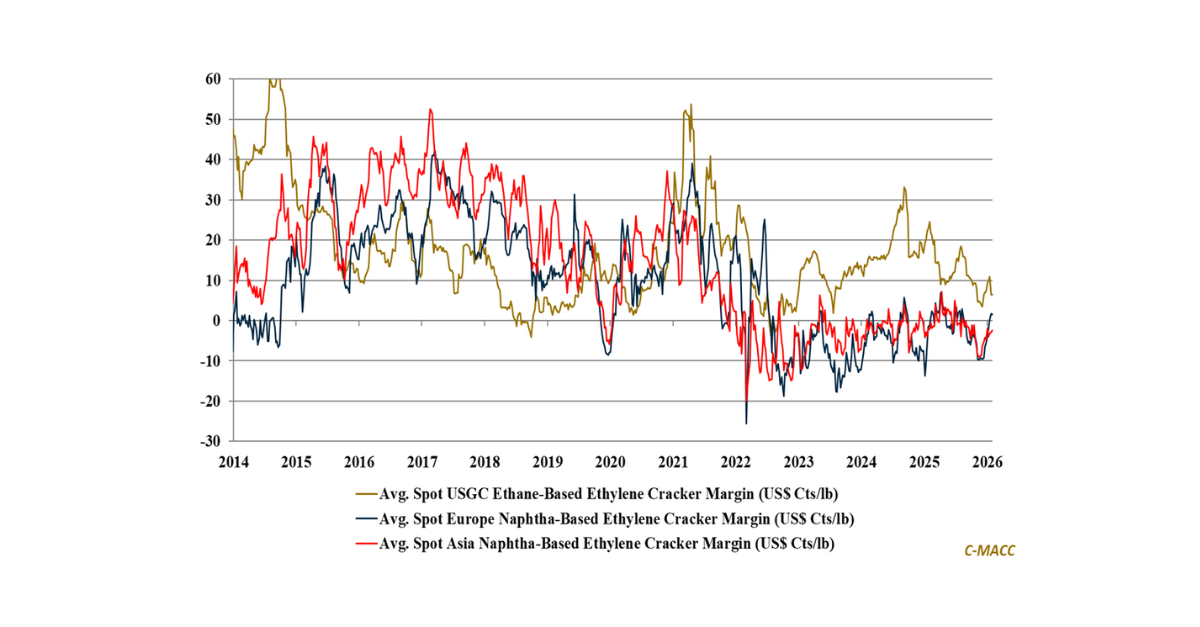

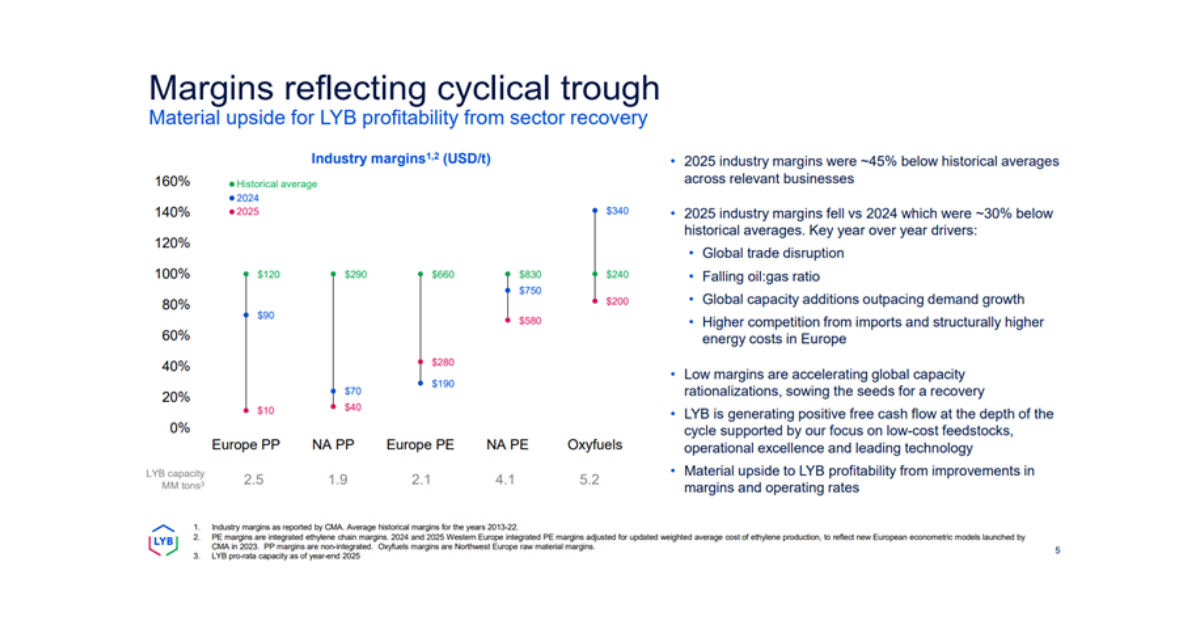

- General Thoughts: Market developments suggest that in the medium- to long-term, US merchant ethylene buyers will see their advantage shrink relative to buyers abroad as the relative benefits for US ethylene producers grow.

- Supply Chain/Commodities: We discuss SQM 3Q24 results and their continued push to grow lithium capacity despite recent price weakness – we see challenges persisting for those with high-cost global production positions.

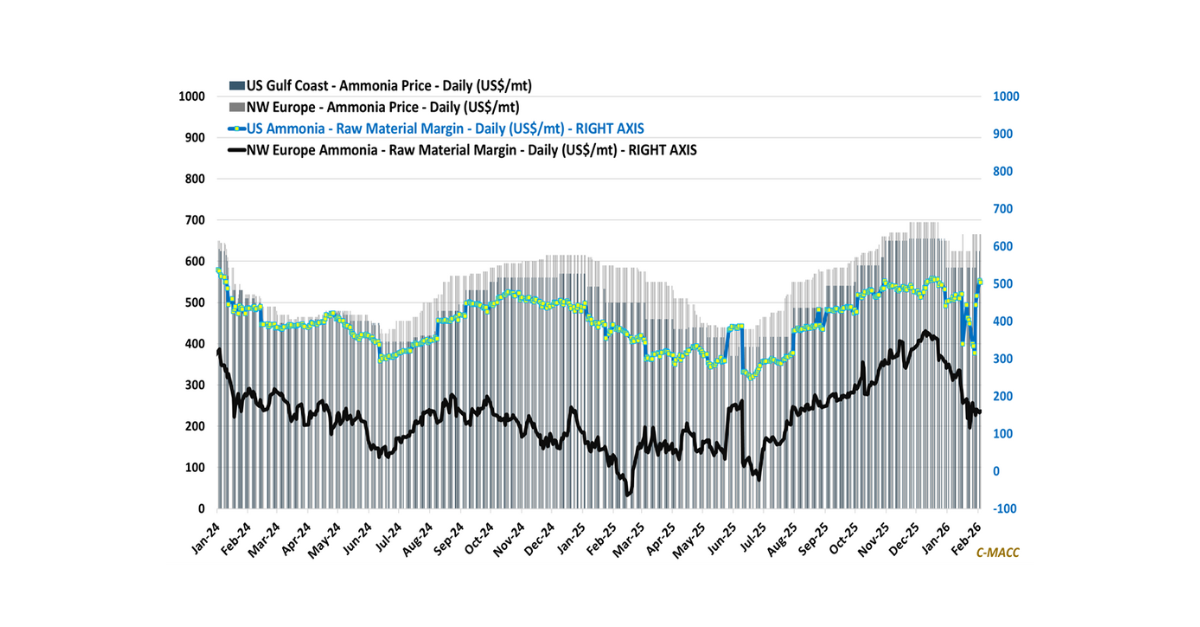

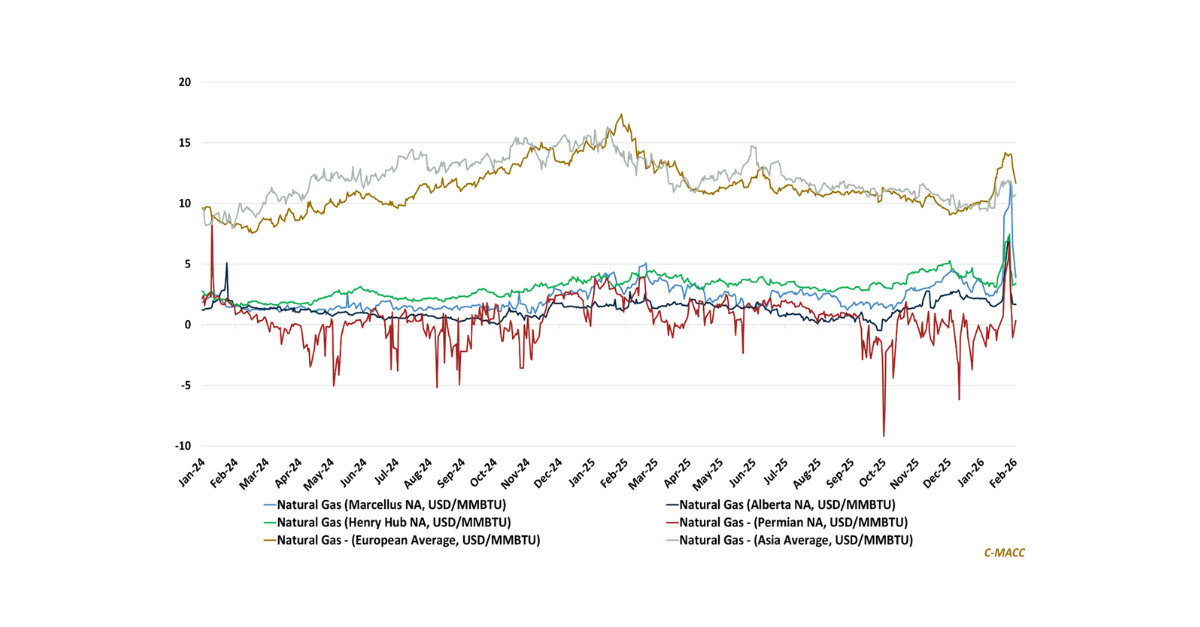

- Energy/Upstream: We highlight US natural gas prices relative to Europe and Asia and our positive view of supply keeping domestic prices relatively low despite demand, especially for power, likely exceeding most expectations.

- Sustainability/Energy Transition: Most medium- to long-term critical mineral demand outlooks are bullish. Still, the current oversupply raises concern about some seeking to serve this global market, such as battery recyclers.

- Downstream/Other Chemicals: We discuss recent weakness in global freight rates, following their brief rebound after hitting 2H24 lows, and trade and tariffs before our Sunday thematic on this topic as it relates to polyethylene.

Exhibit 1: US ethylene prices reflect discounts to Europe and Asia, but factors are in motion to lessen this benefit.

Source: Bloomberg, C-MACC Analysis, November 2024

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!