C-MACC-PXi Polymer Price Expectations Service

Polyethylene – November Monthly Report

Table of Contents:

See the PDF below for the full report

Loading…

Loading…

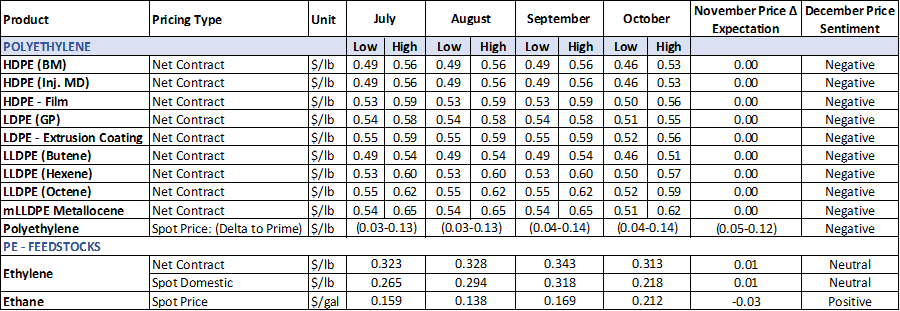

Polyethylene (PE)

Notes: Due to differing underlying variables, some PE grades can have a wider price range than others. For example, Metallocene (mLLDPE) has a wide range because the density is a substantial factor in setting its price, as a .902 density can cost much more than a .918 density, regardless of other fundamental market factors. Their monthly price moves also may not coincide with the rest of the PE market. Hexene is another such case (different hexene grades have different prices). The price assessment report does not report on specialty resins, such as Plastomers.

The November PE Net CP assessment is a Rollover.

Although a $0.03lb increase remains on the table, there is no fundamental support for higher prices, and we observe no evidence of buyers receiving additional concessions; therefore, our November assessment is for flat prices.

Calculated market fundamentals:

- Ethylene prices: +0.3%.

- Inventory significant gain.

- Exports volume: hefty improvement.

- Export prices: down $0.01lb to $0.08lb (product dependent)

- Spot prices: down $0.02lb to $0.05lb.

Supply chain concerns:

- The Eastern Port Strike that was deferred until after the Presidential election is set to resume in January.

- Several labor strikes in Canada could disrupt NA operations. The Vancouver Port (largest container port) and the Prince of Port Longshoreman/Warehouse and Dock workers went on strike the third week of November; after Canada’s second & third largest ports, Port of Montreal & Prince Rupert, Public employees went on strike.

- Twenty percent of all US trade flows through these ports.

- An estimated $800MM in trade flow to NA per day could be affected.

US tariff concerns:

- Trump’s reelection (Tariff implications) is causing some manufacturers (Breville and Steve Madden) to move their operations from China to NA preemptively.

- Uncertainties surrounding Trump administration tariff policy remain high. See commentary in the article: Trump vows new Canada, Mexico, China tariffs that threaten global trade.

- Reshoring is being discussed throughout the manufacturing community in anticipation of tariffs.

- China is infusing its banks and local governments with $1.4 trillion to support GDP growth and mitigate the potential impact of any Trump tariffs.

Amcor (Swiss-owned) is acquiring Berry Global Group for $8.4 Billion. Amcor had previously bought another competitor, Bemis, in 2019. Amcor will now be a powerhouse in the food and medical packaging industry.

Another PE producer is closing a PE unit in Europe. Eni (Italian-owned) announced they would shutter their PE plant in Ragusa before year-end. They also stated they would be shutting several ethylene crackers (within the next 18 months) at their Brindisi and Priolo plants and plan to support their remaining PE operations with imported ethylene.

Feedstocks

Ethylene: The October CP settled at $0.3125lb (down $0.03lb). The November CP has not settled, but we anticipate a modest $0.01 uptick based on recent fundamental movements. We take a Neutral view of December.

November has been mostly uneventful regarding the spot ethylene price movement. Prices are currently averaging ~$0.006lb higher than in October.

Monomer traders reported:

- Crackers are running hard as margins are favorable.

- The pipelines are full.

- Exports of 200mmlbs per month are flowing again.

- The price moved back above the $0.23lb mark and was a product of traders buying for Q1 2025 positions because Q1 2025 is expected to have several crackers offline due to planned turnarounds (TAR).

Natural gas: Mid-month, NG prices spiked above the $3.00btu mark due to nationally wintry weather. The November monthly average price is >30% above October.

Crude oil (CO): (WTi) prices during November dropped ~$2bbl on poor Demand. The weakening prices have prompted OPEC to delay a planned production increase for December.

The preliminary Supply/Demand data for October:

Total PE:

- Inventory: +242MMlbs (>700MMlbs gain in 3-months).

- Operating rates: -1% (86%).

- Domestic Demand: +1%.

- Total Demand: +2%.

- DOI: +1.9 days (5 days above the 12-month average).

- Total Exports: +4%.

HDPE: The entire supply/demand spectrum posted gains. Operating rates (~89%) and total Demand both grew by ~4%. Domestic Demand saw a 3% bump-up with a modest DOI gain of 1 day. Most notable is the ~5% spike in exports.

LDPE: Operating rates (~88%) dipped slightly by 0.7%, with domestic Demand following with ~ a 2% dip. Total Demand mildly improved by 0.09%, but exports (+4%) and DOI (3 days) had sizeable gains.

LLDPE: Operating rates plunged ~4% (83%) followed by a 2% dip in domestic Demand. Similar to LDPE, exports (4%) and DOI (3.5 days) had sizeable improvements.

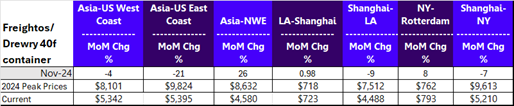

The Major Ocean Freight rates:

The Panamanian Authority is expressing concerns over potential Trump tariffs. There is speculation that Trump could implement a 60% tariff on LNG exports, most of which pass through the Panama Canal. Although the US is not the largest exporter of LNG to China, they hold the largest long-term contracts. Last year it was estimated that $600mm of LNG exports went to China. The Panamanian Authority recently invested $9mm in structural and software improvements to mitigate drought impacts and improve lock slate reservations.

The December PE Net CP assessment is pegged as “Negative.” Demand is expected to collapse as extended Christmas breaks are being given.

Methodology & Disclaimer

This service is structured to capture and report on the market and make directional estimates, not to set market prices. It focuses on net contract prices and is designed to help buyers/sellers decide on pricing. For example, regarding PP, we will move the PP price relative to PGP, but we will not make arbitrary decisions on whether to add/delete margin. If the market reports they are taking an increase above the PGP settlement, we will report that.

We have established a high-low number to capture the market price variances and to avoid making non-market adjustments. The prices reflect reasonable prices for small, medium, and large buyers. We will provide a two-month historical price settlement and short-term forward price movements (current and 1-month market sentiment). For example, the PP Homopolymer assessment may appear as Dec $0.59/lb.-$0.63/lb. Jan $0.62/lb.-$0.66/lb. Feb +$0.03/lb., March, Positive (+) or Negative (-). The market sentiment is geared toward providing what the tone of the market feels and/or how the market fundamentals are trending. Does the market believe an increase or a decrease is possible? What direction are the price drivers moving?

We do not intend to report the extreme lows and highs in net contract prices but capture a range representing the bulk of the markets. Again, note that these are “net” contract price estimates – after discounts.

We will base the assessments on the following:

- Feedback from buyers, producers, brokers, and traders.

- Market fundamentals

- Feedstocks

- Supply/Demand

- Production

- Inventory draws/gains

- Outages (planned/unplanned)

- Spot prices

- Imports/exports

- Global event impacts

- Logistics/Supply Chain

- Weather events

- Labor/Strikes

Not all the fundamentals will hold the same weight every month on the influence of the polymer price direction.

For example, if there are no weather events, it may have little to no value in the price assessment.

Because this report is designed for the market, we welcome any feedback from participants on how to improve it and add value to meet your needs. As we grow, we will also add more resins, feedstocks, and regions.

Report Schedule

| Upcoming Report Schedule |

| Monday, December 30th 2024 |

Glossary

| Abbreviation | Term |

| ACC | American Chemistry Council |

| ARB | Arbitrage |

| BD | Butadiene |

| BM | Blow Mold |

| BZ | Benzene |

| CO | Crude Oil |

| CP | Contract Prices |

| DOI | Days Of Inventory |

| EVA | Ethylene Vinyl Acetate |

| FM | Force Majeure |

| FR | Frac Melt |

| GP | General Purpose |

| HDPE | High Density Polyethylene |

| INj | Injection Mold |

| LDPE | Low-Density Polyethylene |

| LLDPE | Linear Low-Density Polyethylene |

| MF | Melt Flow |

| MI | Melt Index |

| NA | North America |

| Net CP | Net Contract Price |

| OP | Operating Rates |

| PDH | Propane Dehydration |

| PE | Polyethylene |

| PGP | Polymer Grade Propylene |

| PP | Polypropylene |

| PS | Polystyrene |

| RMC | Raw material Cost |

| SM | Styrene Monomer |

| TAR | Turn Around |

| VAM | Vinyl Acetate Monomer |

[/restrict]