The Hydrogen Economy #80

All Stop and All Change

Key Points

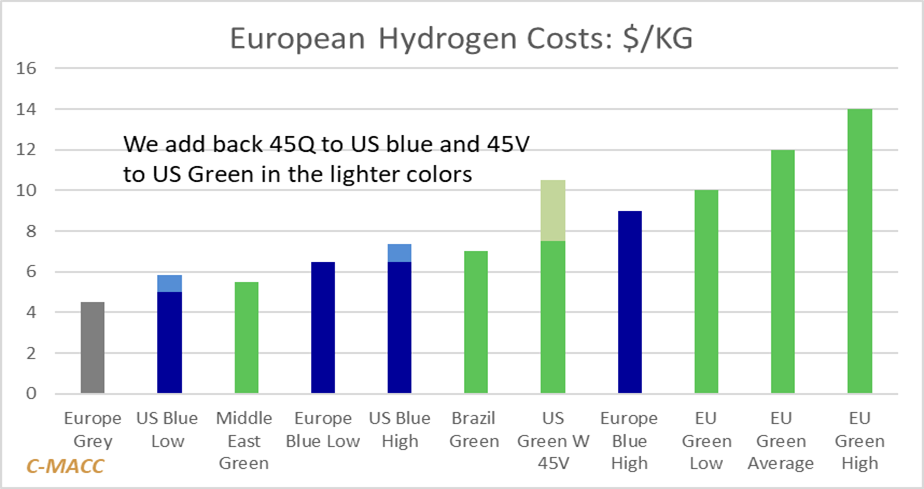

- This will be an uneasy time for everyone engaged in the US hydrogen business. Even the best-run industrial gas companies have some exposure to 45V and 45Q subsidies, while other companies cannot survive without them.

- We believe that 45Q is safe, but we worry that the new administration will quickly unearth some very poorly rushed through DOE-backed loans, which may taint the hydrogen sector even more and delay any 45Q clarity.

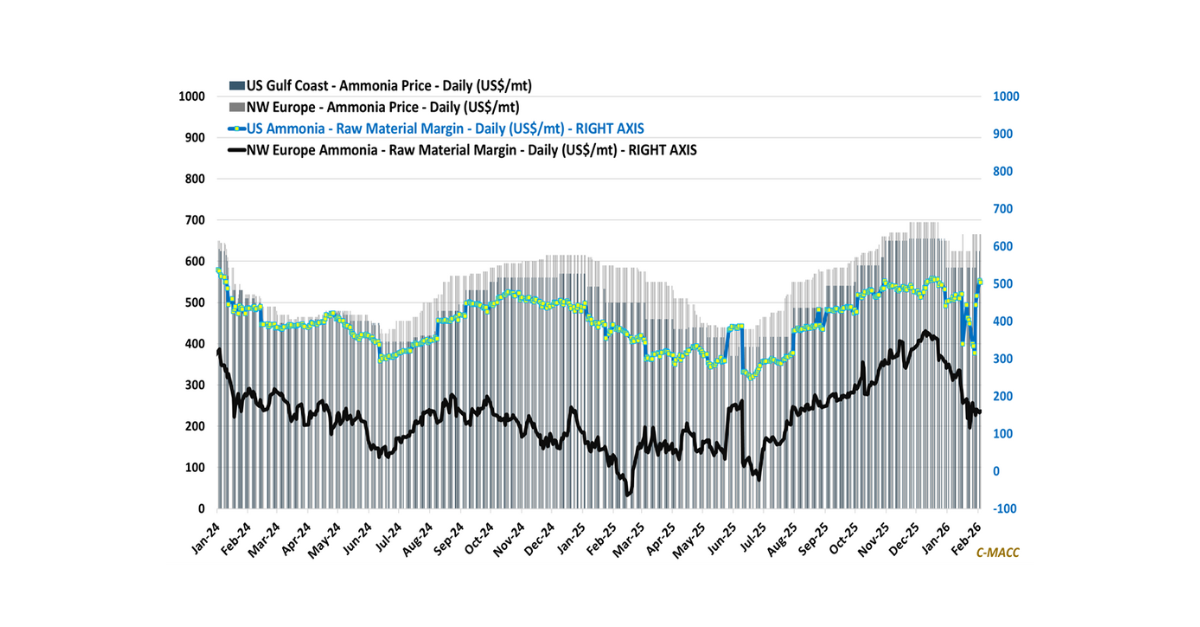

- In the meantime, the pressure is on Europe, and we are comfortable in our view that Europe will relax some of its (too expensive) regulations, opening the door for US blue ammonia and methanol – but we need 45Q

- Governance changes at Air Products may drive some changes in the hydrogen projects on the books, with a couple of the US projects very dependent on tax credits. Incentive certainty will be key to any changes.

- Otherwise, we see negative as well as positive headlines – but expect the negative share to pick up through 2025. Projects are focused on European fuels but still look uneconomic.

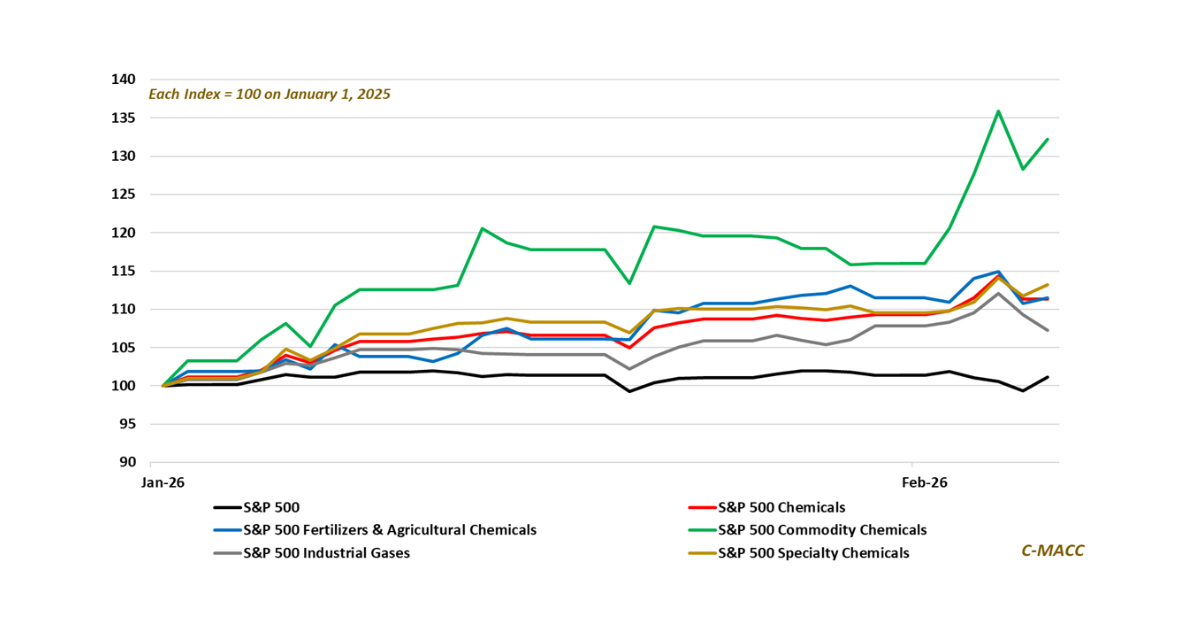

Exhibit 1: Unsubsidized US hydrogen, even with costs of transport, can compete in Europe in many cases

Source: Capital IQ and C-MACC Analysis

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!