Global Market Analysis

Consolidate, Integrate, Or Liquidate – Cost Curve Shifts & Oversupply Pressures Reshape Global Chemical Markets

Key Findings

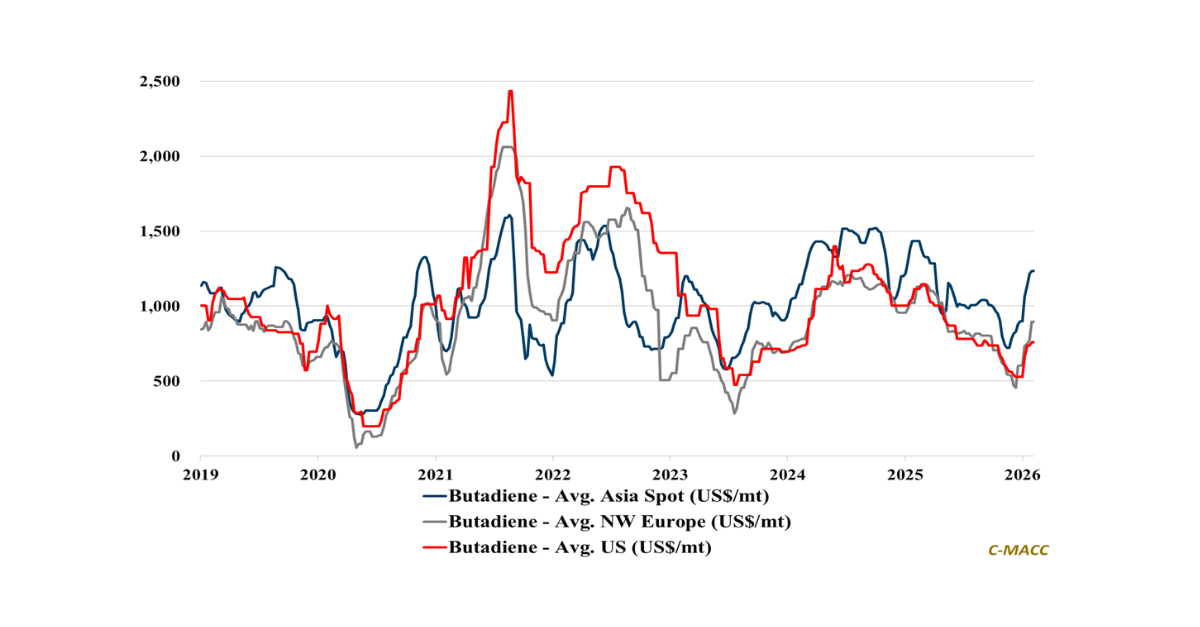

- General Thoughts: The global petrochemical cost curve has significantly flattened YoY, adding risk to already oversupplied markets, and sector restructuring and consolidation activity is gaining much-needed momentum.

- Supply Chain/Commodities: We discuss the OMV and ADNOC consolidation of Borealis and Borouge and their planned purchase of Nova Chemicals. Shell is also considering divesting its US and European chemical businesses.

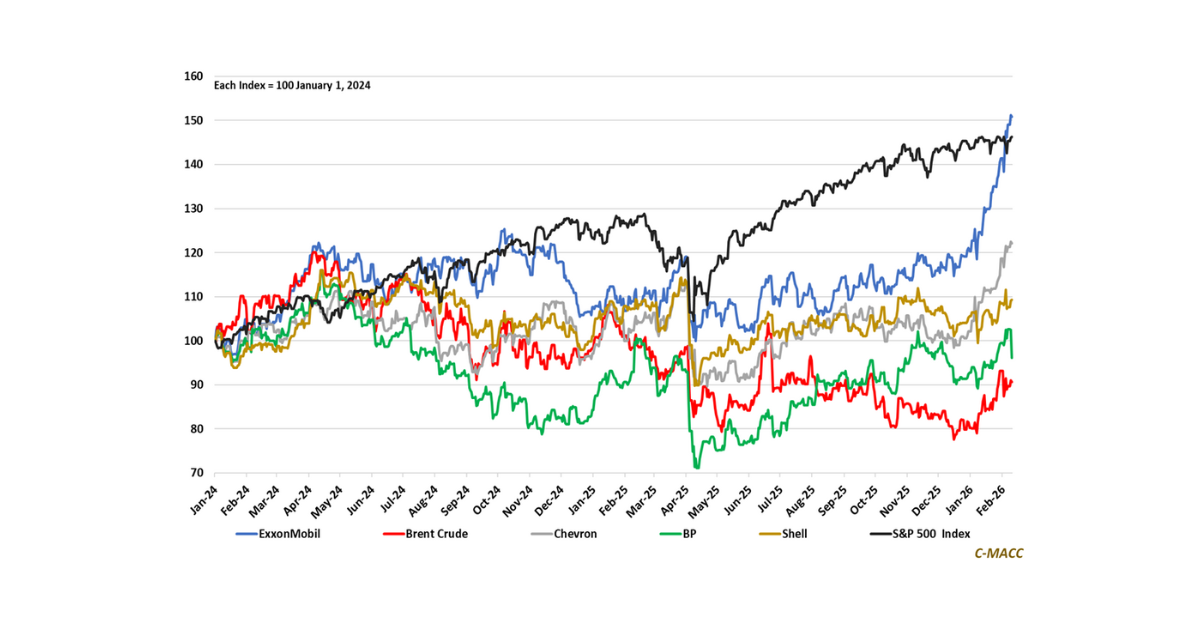

- Energy/Upstream: Aramco reported 4Q24 results this week, and we joined its earnings call this morning, where management discussed the benefits of integration and pushing its upstream products downstream into chemicals.

- Sustainability/Energy Transition: We joined the Plug Power 4Q24 conference call following news of its significant restructuring activities called “Project Quantum Leap” – we think “Project Prayer Circle” would be more fitting.

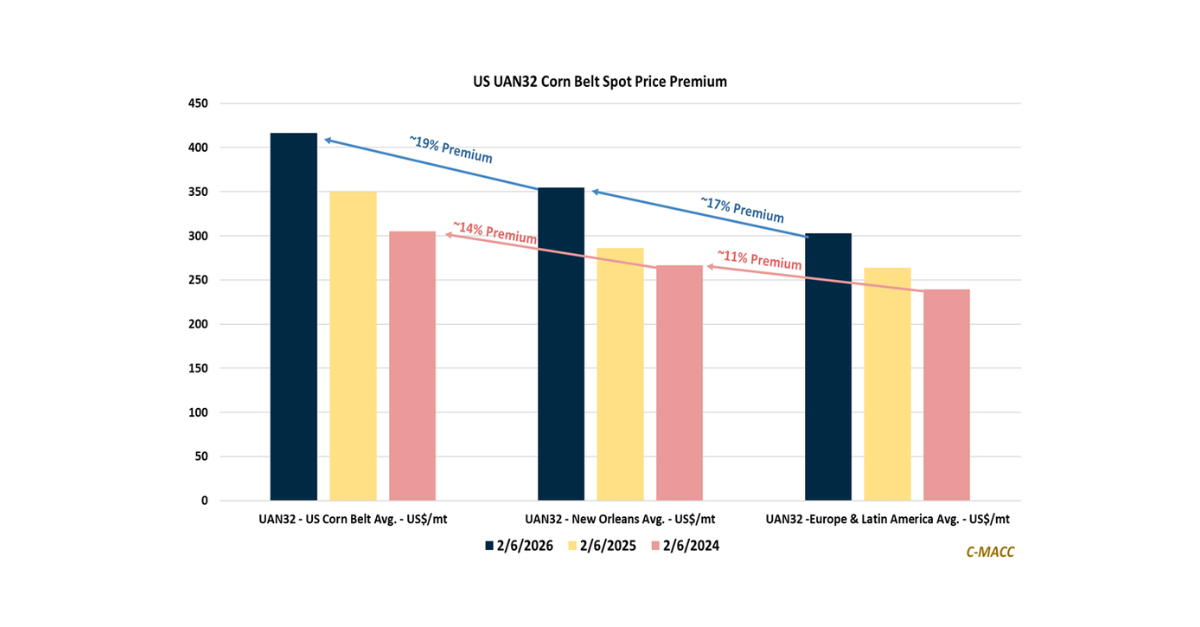

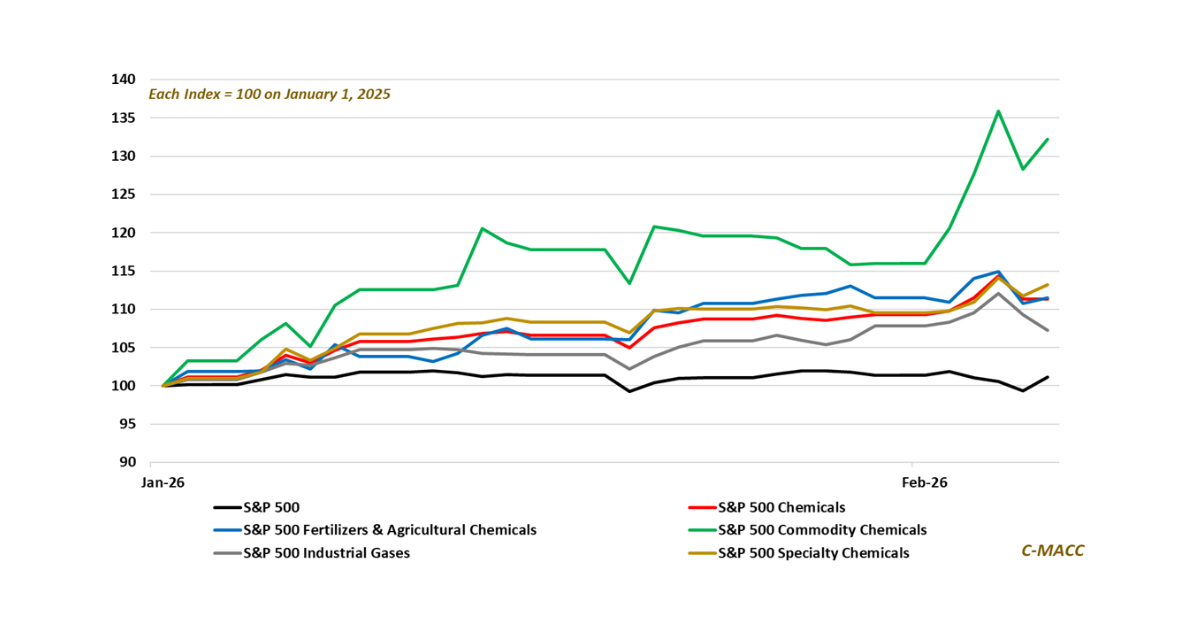

- Downstream/Other Chemicals: We discuss recently imposed US tariffs on Mexico, Canada, and China, our more constructive view on US corn relative to soybeans, and US ethanol exports and potential trade retaliation risk.

Exhibit 1: The Brent Crude Oil price falls to a multi-year low relative to US natural gas – a negative for chemical prices.

Source: Bloomberg, C-MACC Analysis, March 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!