Global Market Analysis

Dancing In The Dark – Most Chemical Markets Expected A Slowdance In 2025, But Get A Breakdance Battle Royale Instead

Key Findings

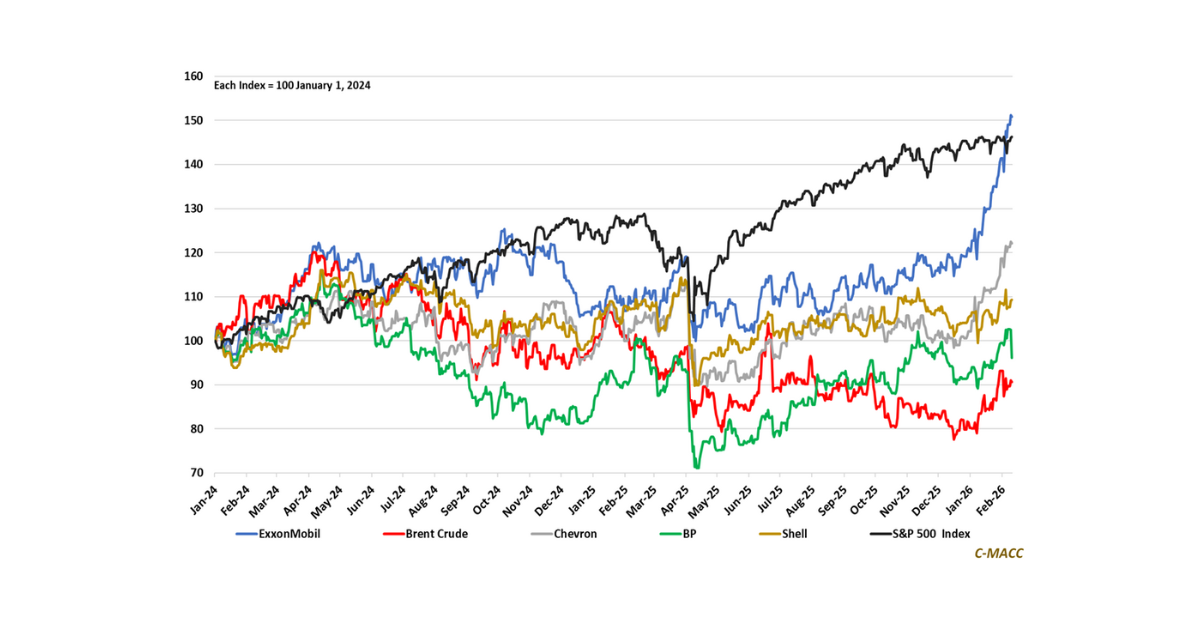

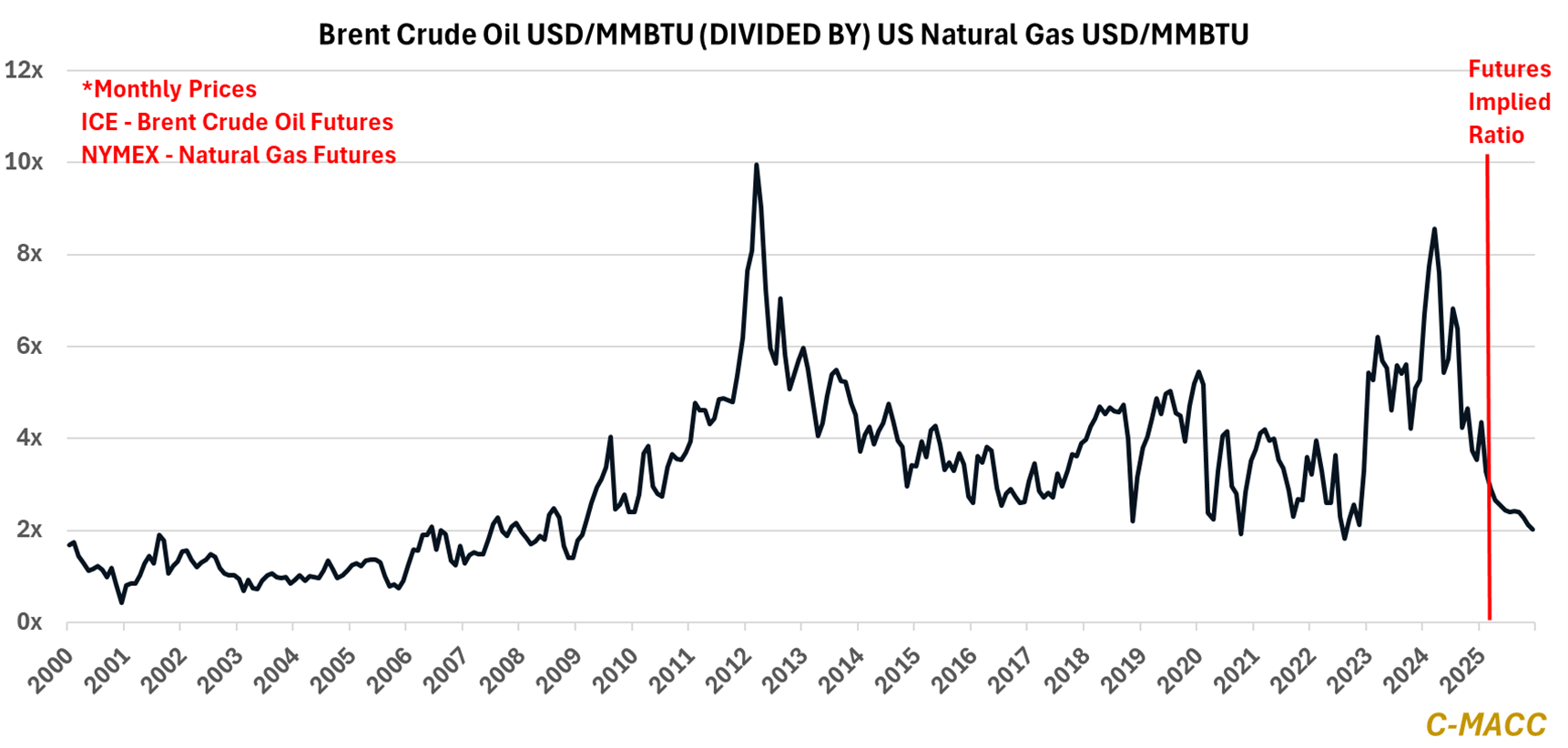

- General Thoughts: Futures markets suggest Brent crude oil prices will trend to the low end of their 15-year range relative to US natural gas prices through year-end, indicating lower global chemical prices and tighter US margins.

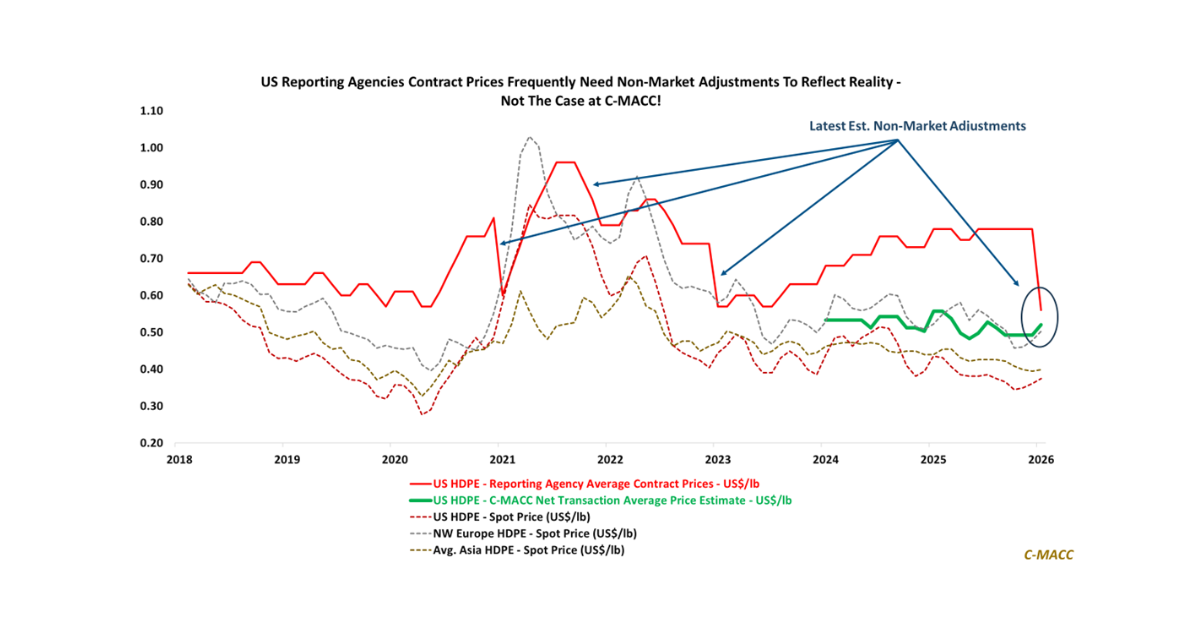

- Supply Chain/Commodities: We discuss weakness in US spot ethylene prices on an absolute basis and relative to Asia and Europe levels, which will put downward pressure on US contract prices despite higher ethane costs.

- Energy/Upstream: We discuss the US LNG export market following Cheniere’s Corpus Christi Stage 3 expansion and our observation that rising construction and labor costs are pushing some projects to renegotiate contracts.

- Sustainability/Energy Transition: We highlight takeaways from a recent PureCycle business update, discussing its aggregate price estimates for R-PP provided on its 4Q24 earnings call relative to regional virgin PP spot prices.

- Downstream/Other Chemicals: The Asia-Pacific region is one of the most significant product exporters to the US, and we discuss how US tariffs on cheap Chinese goods will likely further pressure Asia Ex-China manufacturers.

Exhibit 1: The futures market shows the oil to US natural gas price spread nearing multi-year lows by year-end 2025.

Source: Bloomberg, C-MACC Analysis, March 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!