Global Market Analysis

Fueling the Future: Alberta’s Natural Gas Advantage and Global Petrochemical Shifts

Key Findings

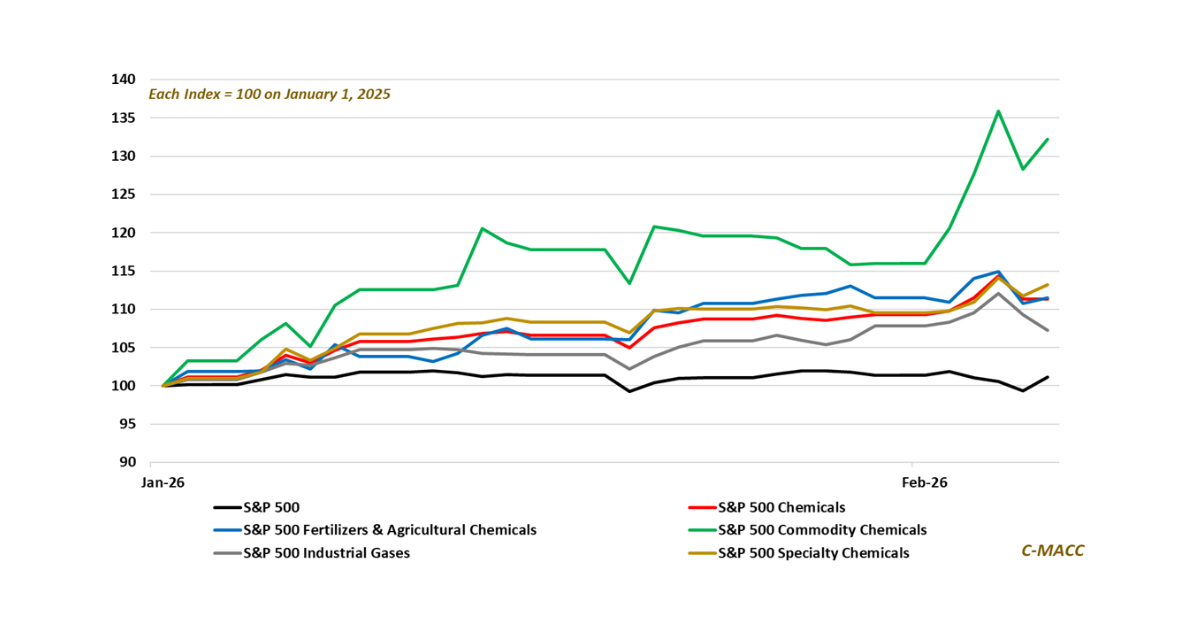

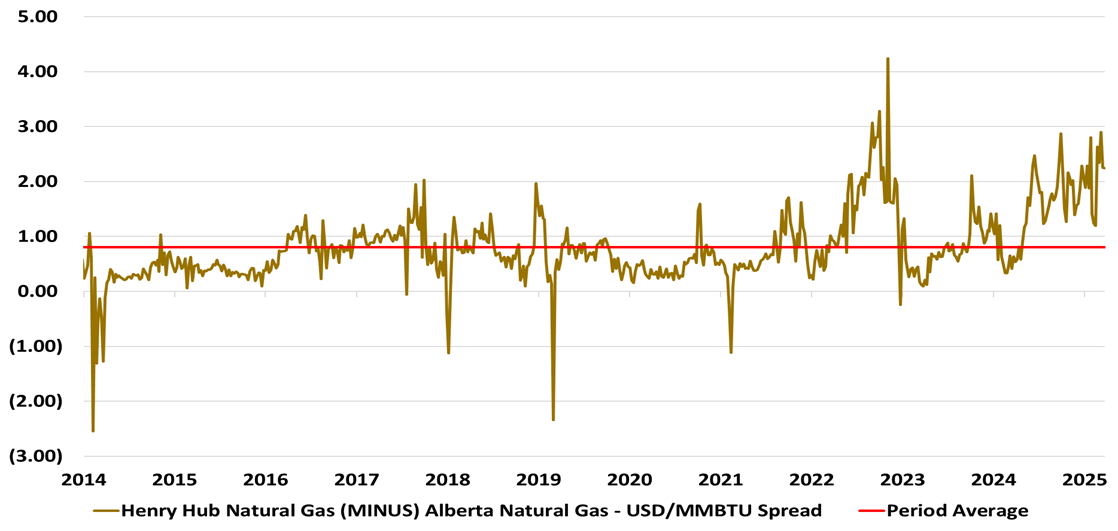

- General Thoughts: We discuss recent weakness in Alberta natural gas prices relative to Henry Hub levels, flagging pipeline expansions in the area that we think will benefit the build-out of the Alberta chemical industry over time.

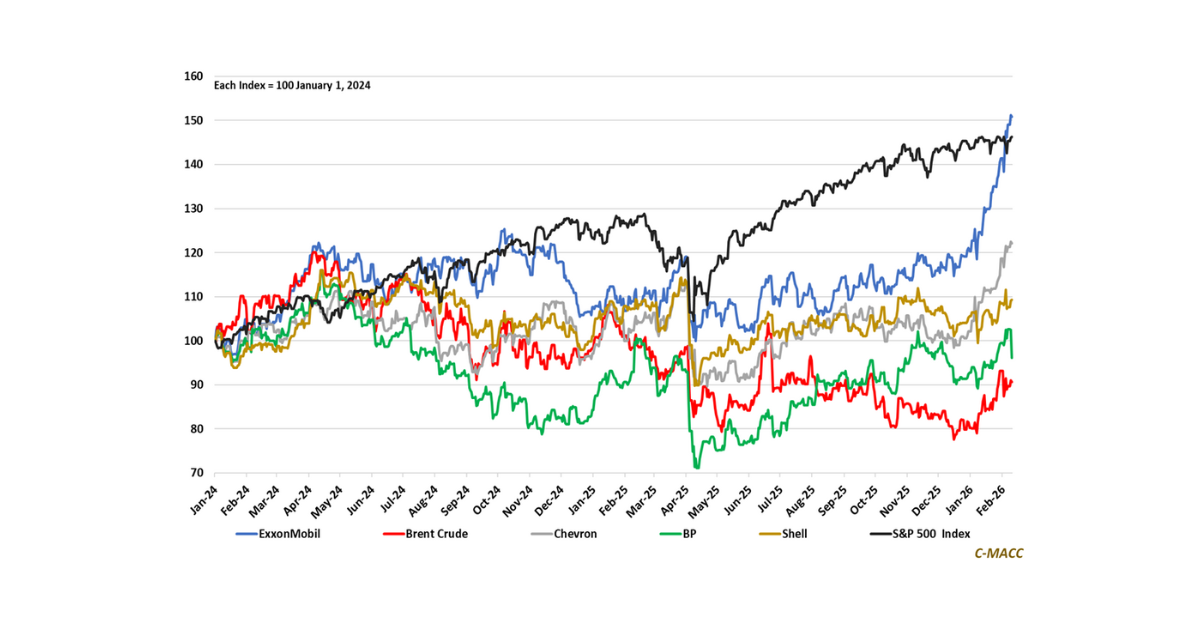

- Supply Chain/Commodities: We highlight our takeaways from Shell’s capital markets event today as it looks for strategic partnerships in the US, plant closures and product upgrading in Europe, and growth from China projects.

- Energy/Upstream: We highlight our takeaways from Shell’s capital markets event today as it looks for strategic partnerships in the US, plant closures and product upgrading in Europe, and growth from China projects.

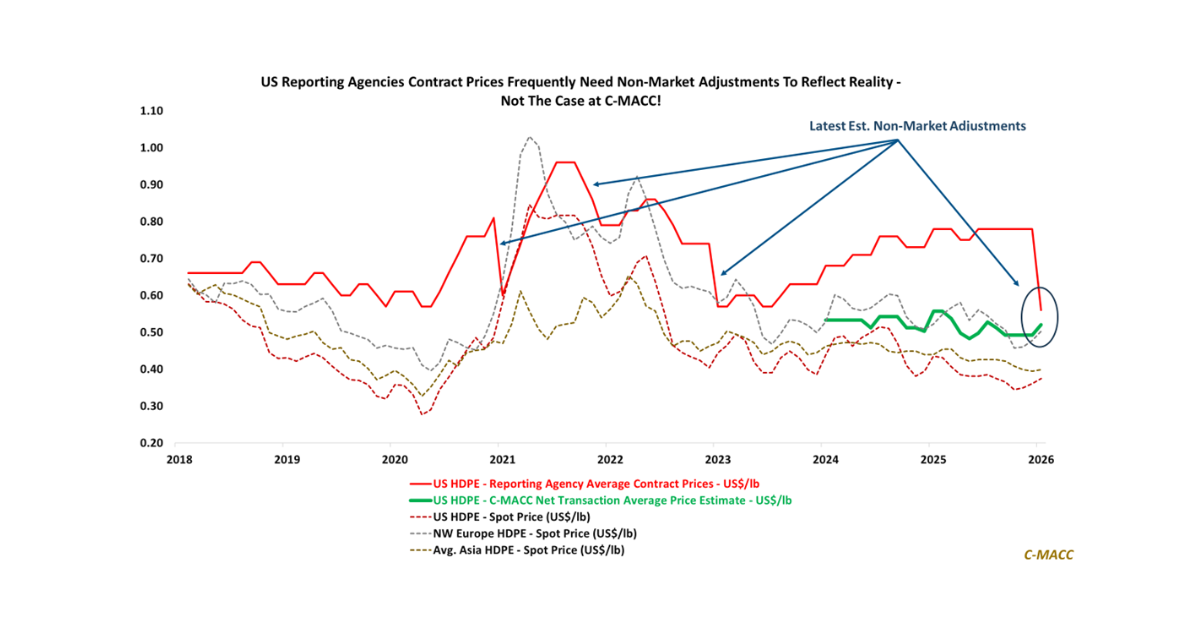

- Sustainability/Energy Transition: We further discuss the difficulties facing many plastic recyclers, highlighting the movements in HDPE bale prices amid falling US exports to some regions and the recent uptick in PP bale prices.

- Downstream/Other Chemicals: We focus on optimistic economic data in Europe, ranging from the latest upturn in an ifo business sentiment survey and the recent rebound in manufacturing activity, but approach it cautiously.

Exhibit 1: The Alberta natural gas cost advantage remains elevated relative to US Henry Hub levels.

Source: Bloomberg, C-MACC Analysis, March 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!