Base Chemical Global Analysis

Global Weekly Catalyst No. 307

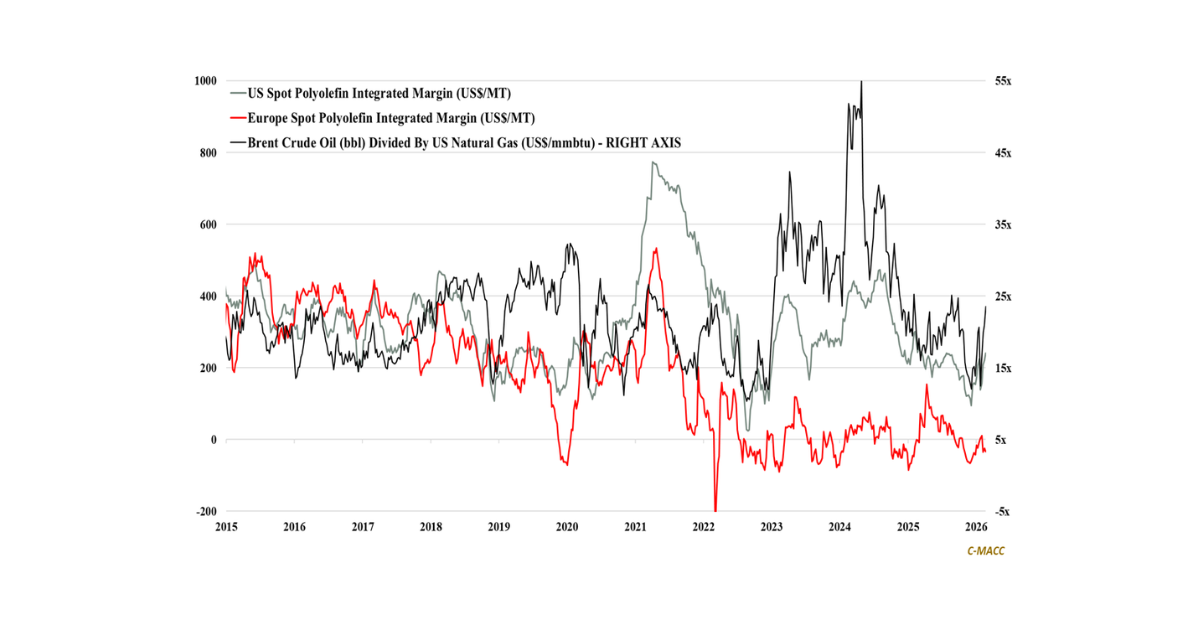

- General Thoughts: Exporting the advantaged US ethane cost position and surplus ethylene amid low oil prices and downstream market oversupply will likely be a bumpy ride into 2026, despite ongoing global restructuring.

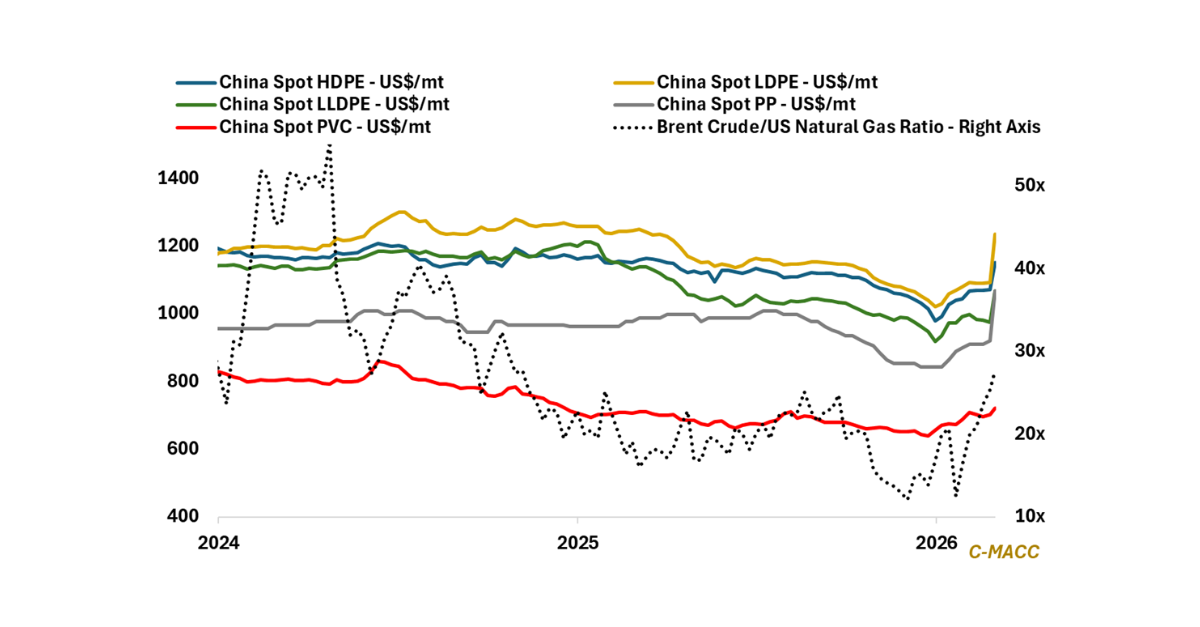

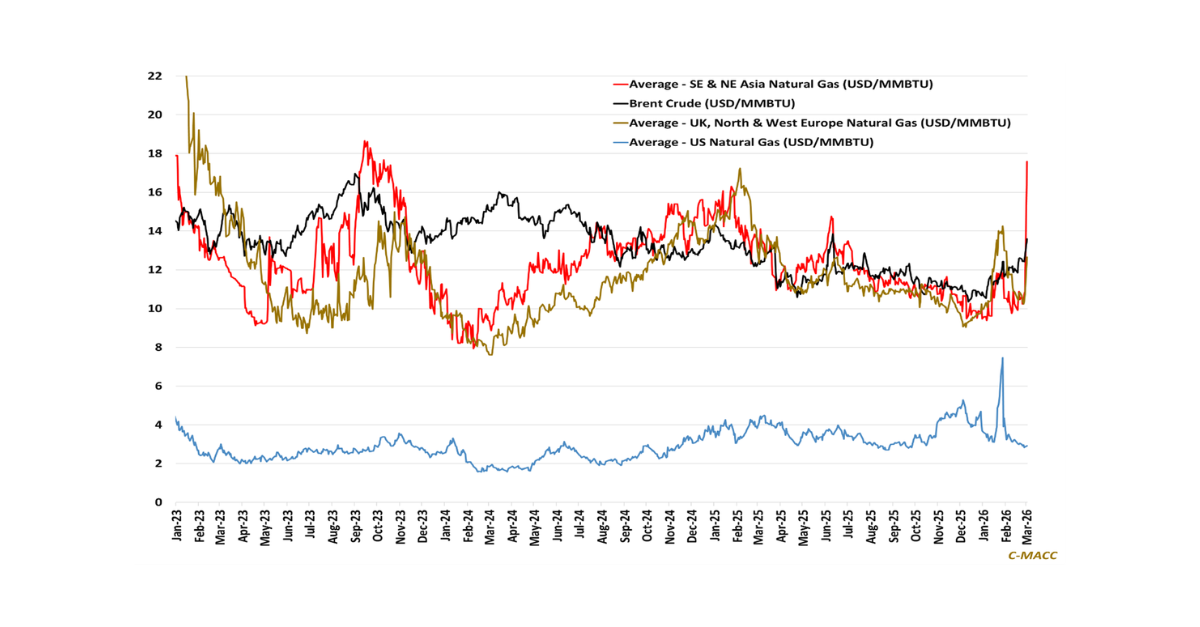

- Feedstocks & Energy: Upstream chemical feedstock cost compression across markets squeezed global average producer margins last week, likely spurring restructuring and setting the stage for better balance in early 2026.

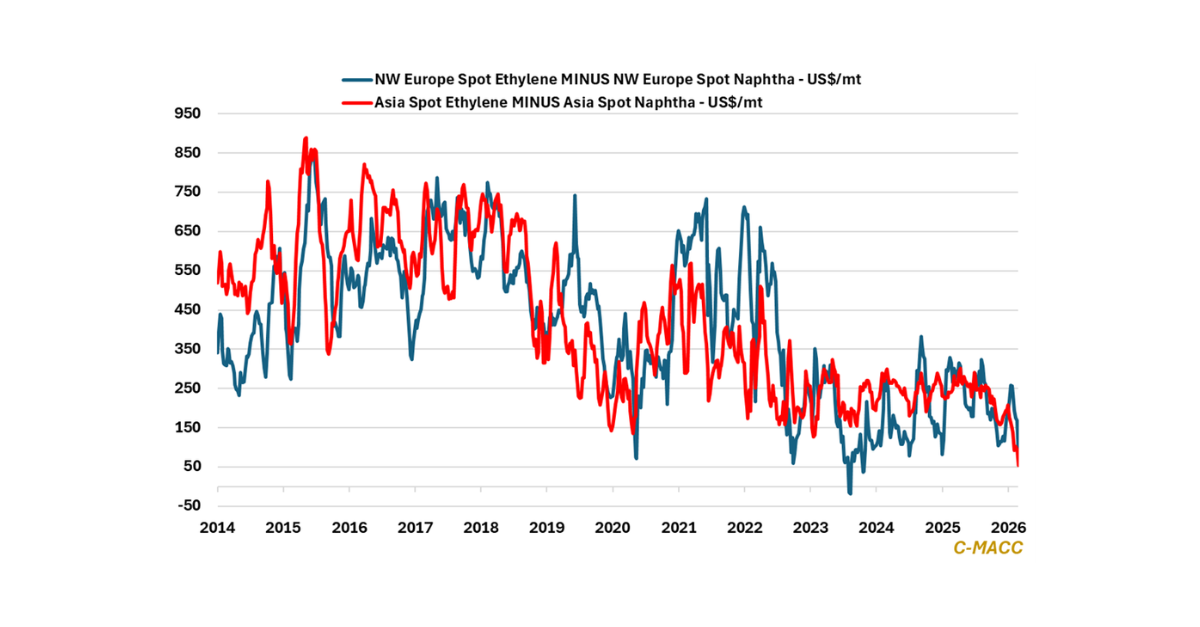

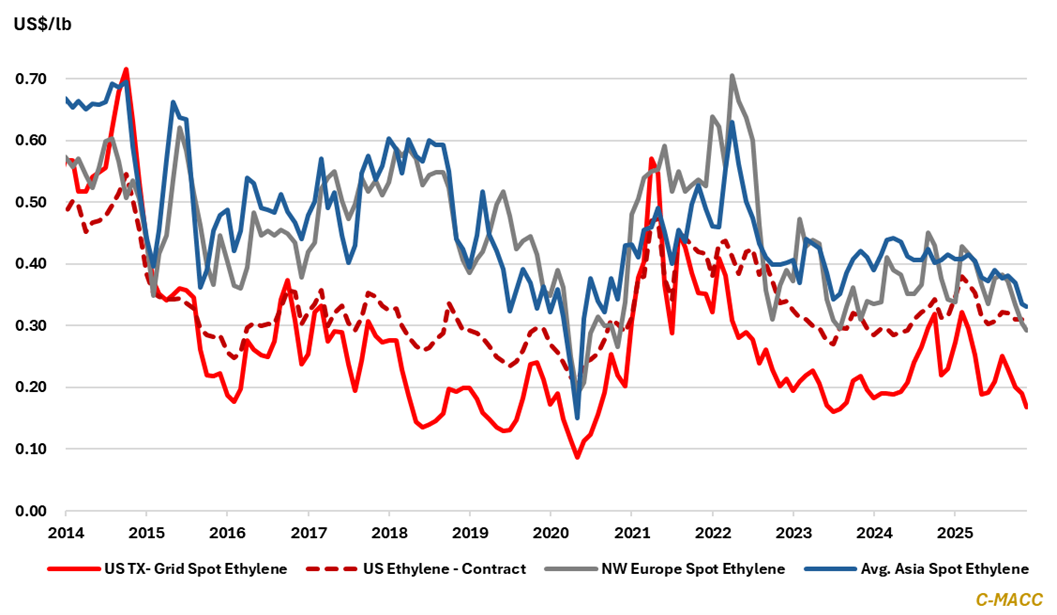

- Olefins: Olefin markets weakened across all major markets last week amid lower Asian and European feedstock costs, curtailed run-rates, and inventory destocking. US, Asian, and European spot ethylene reflect YTD lows.

- Other Base Chemicals: Western spot methanol prices declined relative to Asia, but prices fell more than costs in all primary markets WoW. Western benzene spot prices rose relative to Asia, a trend unlikely to persist into 2026.

- Agriculture: Global ammonia spot prices remained flat to slightly higher for another week, with most markets reflecting levels near their 2025 highs. Higher US natural gas costs continue to keep domestic margins in check.

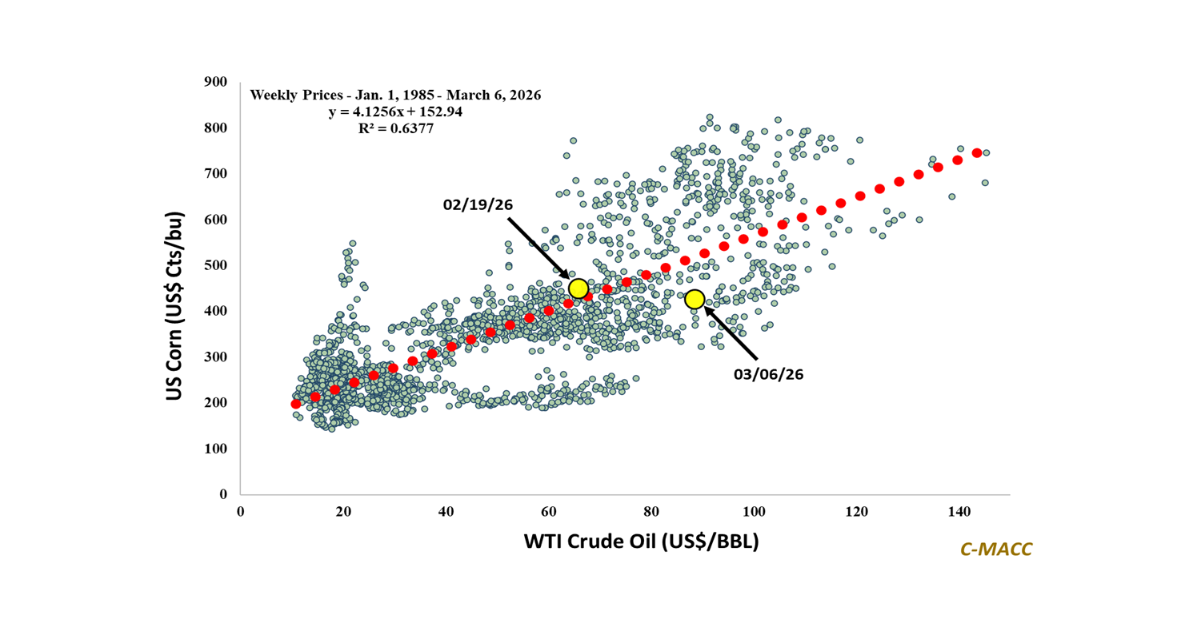

- Refining & Biofuels: US refining and biofuel trends diverged last week. US refinery margins decreased modestly despite lower crude oil prices. At the same time, US ethanol producers saw margins rise amid lower corn prices.

Exhibit 1 – Chart of the Day: Spot ethylene falls to 2025 low across major regions; global average margin at YTD low.

Source: Bloomberg, C-MACC Estimates, November 2025

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!