C-MACC Sunday Executive Summary

Sow, Crack, and Roll: Markets Quietly Replant Risk

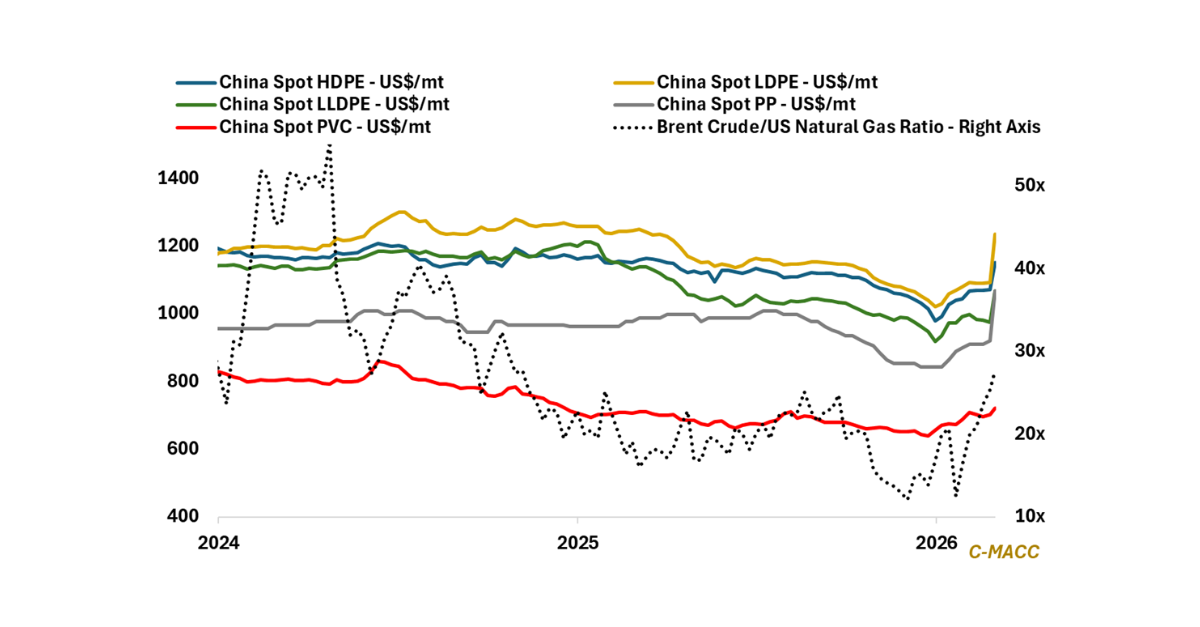

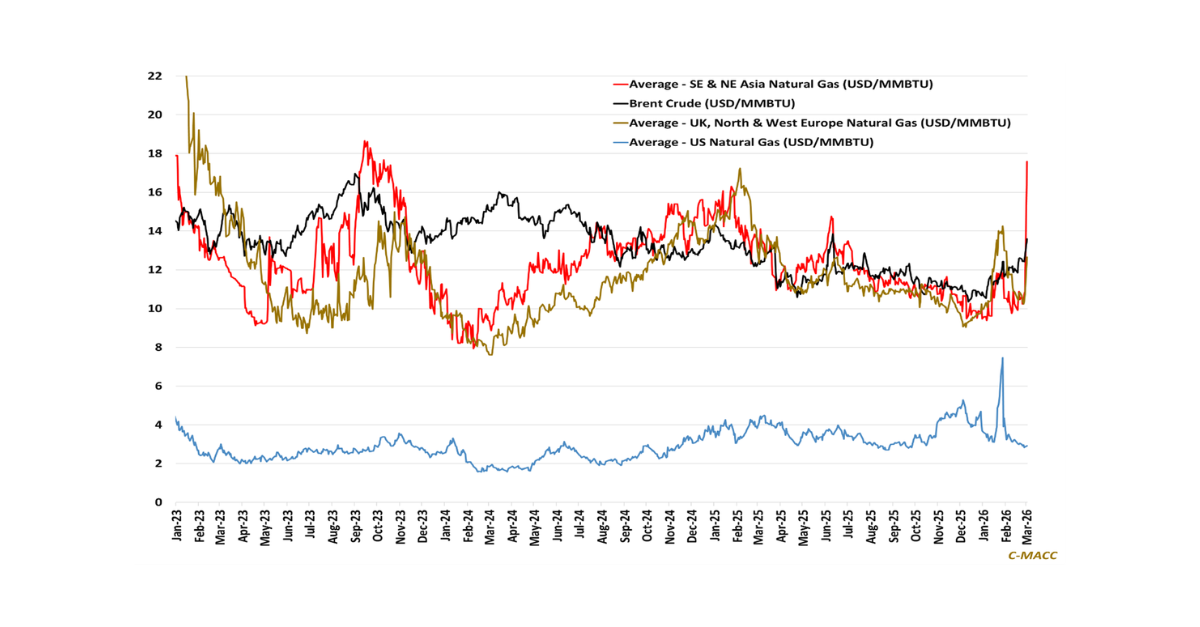

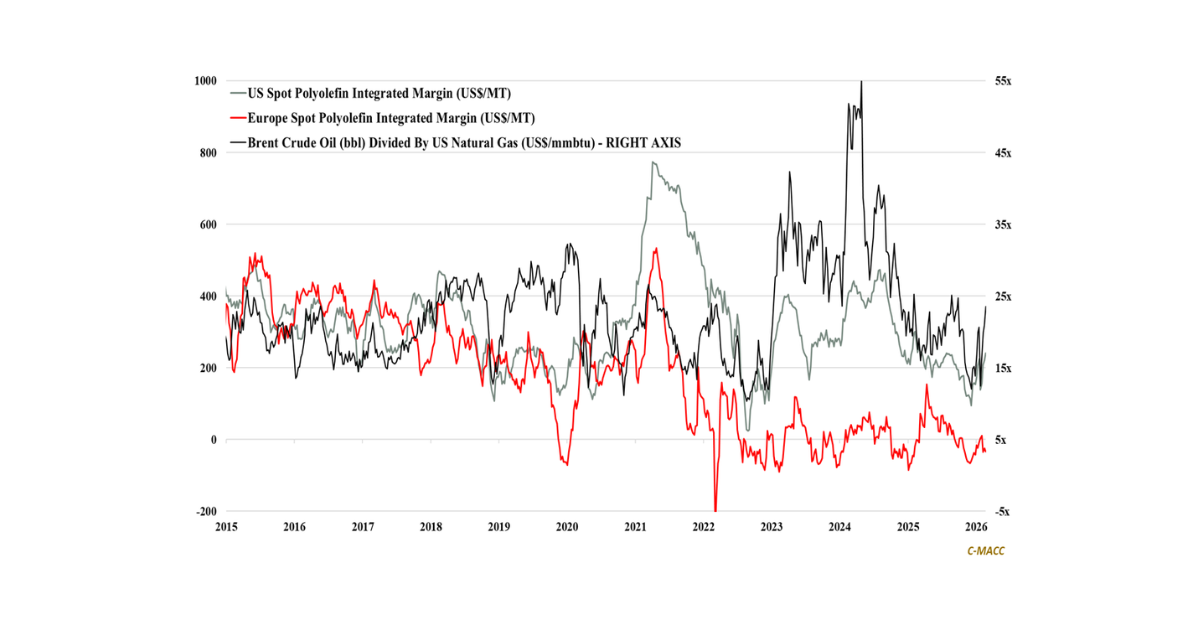

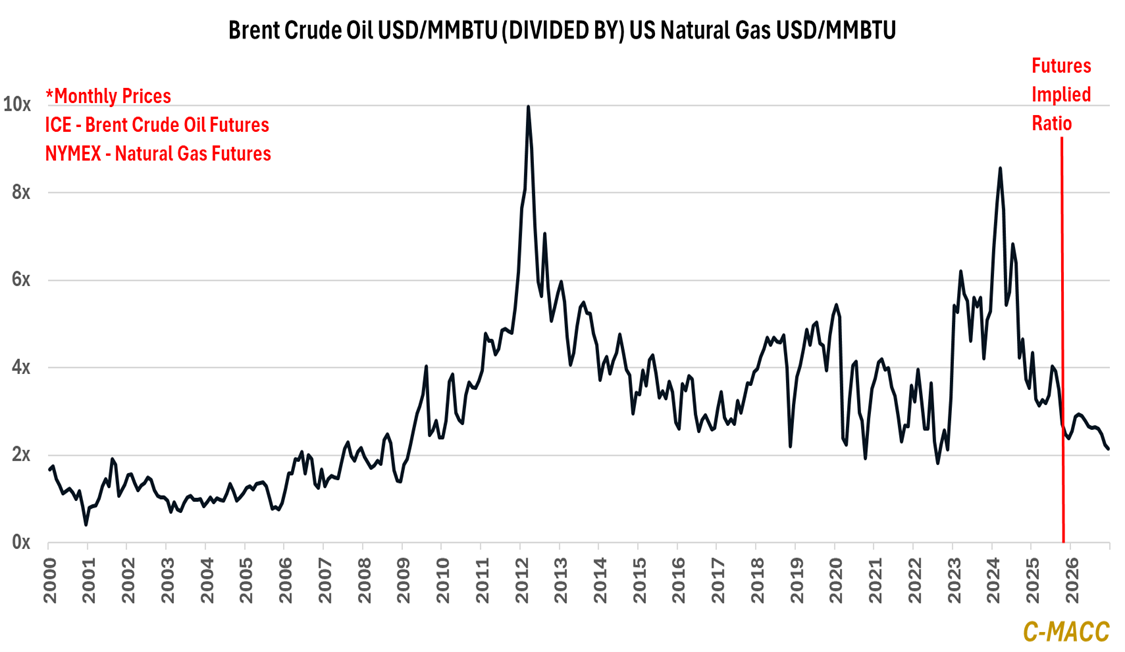

- Depressed oil-to-gas ratios and elevated soy-to-corn prices shift chemical-sector risk profiles: commodity chemical underperformers in 2025 face low expectations in 2026, whereas agriculture faces the reverse.

- Commodity chemical producers face multi-year-low per-unit margins, expectations of continued oversupply, and weak return profiles heading into a year that favors restructuring and increased upside risk.

- Agriculture will likely exit 2025 amid still relatively high expectations, though shifts to less nutrient-heavy soybean acres relative to corn, compressed global natural gas spreads, and rising supply favor downside risk.

- Equity markets will reward business models across the chemicals sector that convert volatility into resilience, with risk-adjusted return profiles in focus amid restructuring and demand and trade uncertainties in 2026.

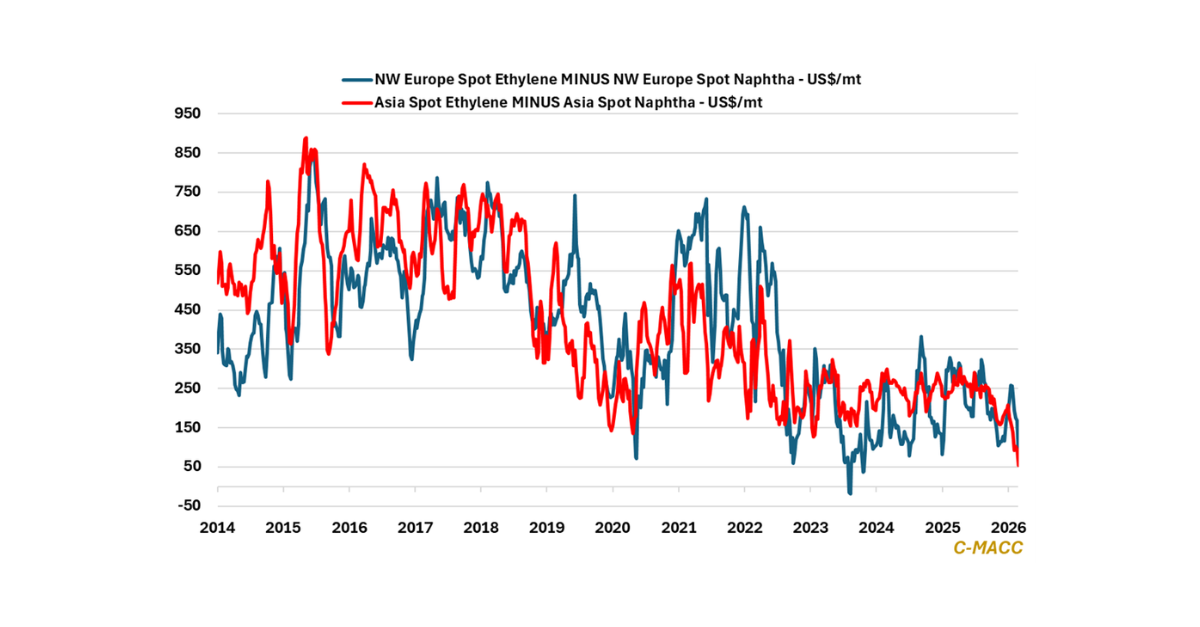

- Otherwise, we discuss structural ethylene rationalization amid compressed ex-US naphtha-to-USGC ethane cost spreads and falling ethylene spreads between regions, as well as crop price trends in late 2025 and 2026.

- Companies Mentioned: INEOS, Satellite Petrochemical, Wanhua, Lotte Chemical, HD Hyundai Chemical, ExxonMobil, OCI Global, AGROFERT, ADNOC, Celtic Renewables, Gevo, Revcoo, CF Industries, LSB Industries, Nutrien, Corteva, John Deere, Bayer, ADM, Cargill, Bunge, Methanex, Navigator Gas, BASF

- Products Mentioned: Crude oil, Natural gas, LNG, Naphtha, Ethane, Propane, Ethylene, Polyethylene, Propylene, Butadiene, Benzene, Methanol, Chlor-alkali, Ammonia, UAN, Phosphate, Potash, Corn, Soybeans, Ethanol, Gasoline, Vegetable oil, Renewable diesel, Biomethane, Cement, Steel, Hydrogen

Exhibit 1: Lower crude oil prices relative to US natural gas compress the global petrochemical production cost curve.

Source: Bloomberg, C-MACC Estimates, November 2025

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!