Polymer Global Analysis

Resin To Riches: Weekly Plastic Market Insights

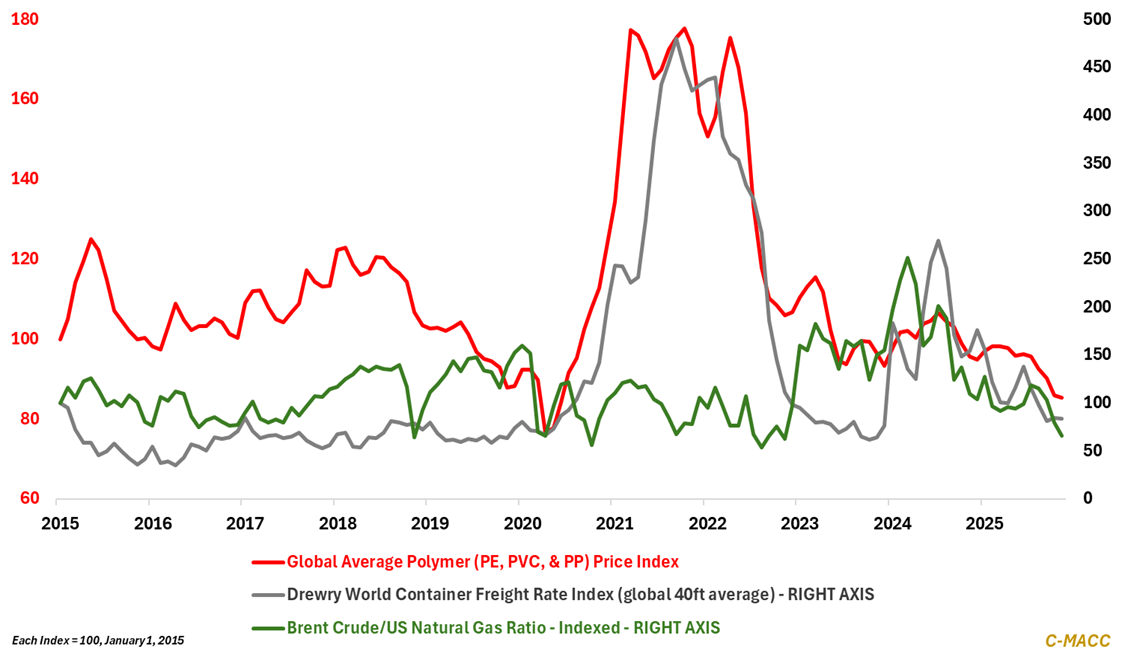

- General Thoughts: Weak manufacturing, collapsing freight, and flattening cost curves are exerting relentless oversupply pressure on global polymers, revealing fragile price floors held in part with the hope of rebalanced positions into 2026.

- Polyethylene (PE): Global PE markets balance modest Western firmness against lingering Asian price weakness as capacity additions, muted demand, and thinning margins constrain recovery despite signs of price discipline emerging.

- Polypropylene (PP): Global PP markets stabilize unevenly as firmer Western prices, flat Asian benchmarks, and tight PP-to-PGP spreads signal fragile support amid export market price aggression and generally weak downstream demand.

- Polyvinyl Chloride (PVC): Global PVC markets diverge sharply as Western stabilization contrasts with persistent Asian weakness, while India’s benchmark resets and construction-linked price hikes shape early-2026 demand expectations.

- Other Sector Developments: US natural gas prices have increased to a 2025 high relative to crude oil, as freight rates moderate and global manufacturing remains weak, signaling the need for greater supply chain discipline into 2026.

Exhibit 1 – Chart of the Day: Flattened freight and cost curves compress global polymer prices amid weak demand.

Source: Bloomberg, C-MACC Estimates, December 2025

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!