C-MACC Sunday Executive Summary

The Reset Effect: When Structural Strain Becomes Industry’s Strongest Tailwind

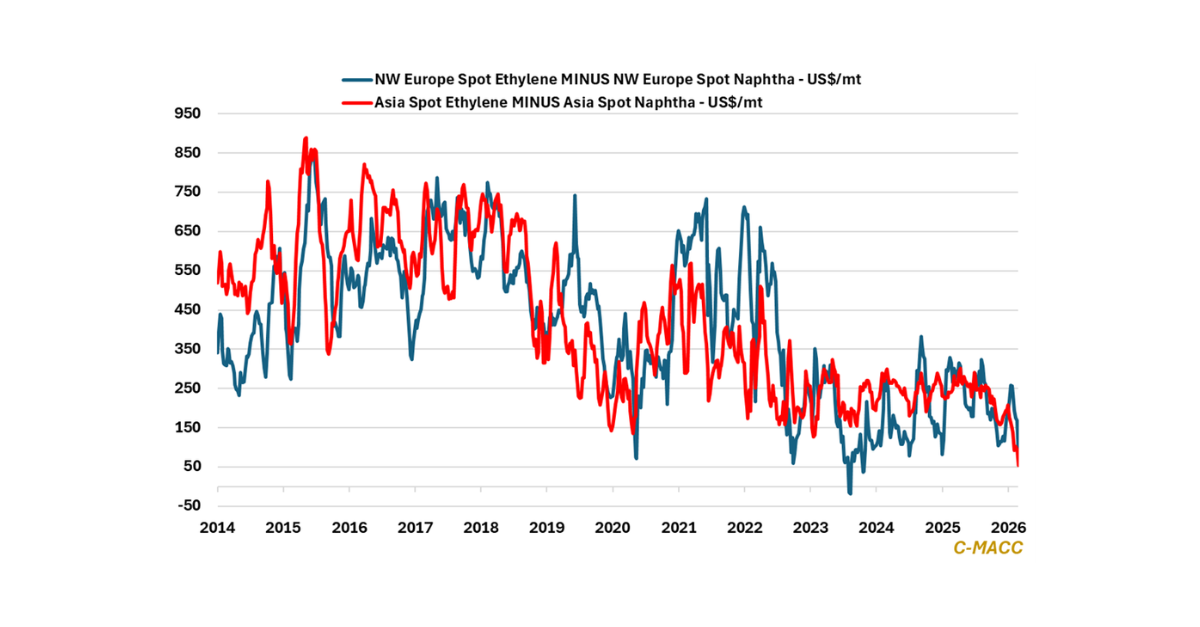

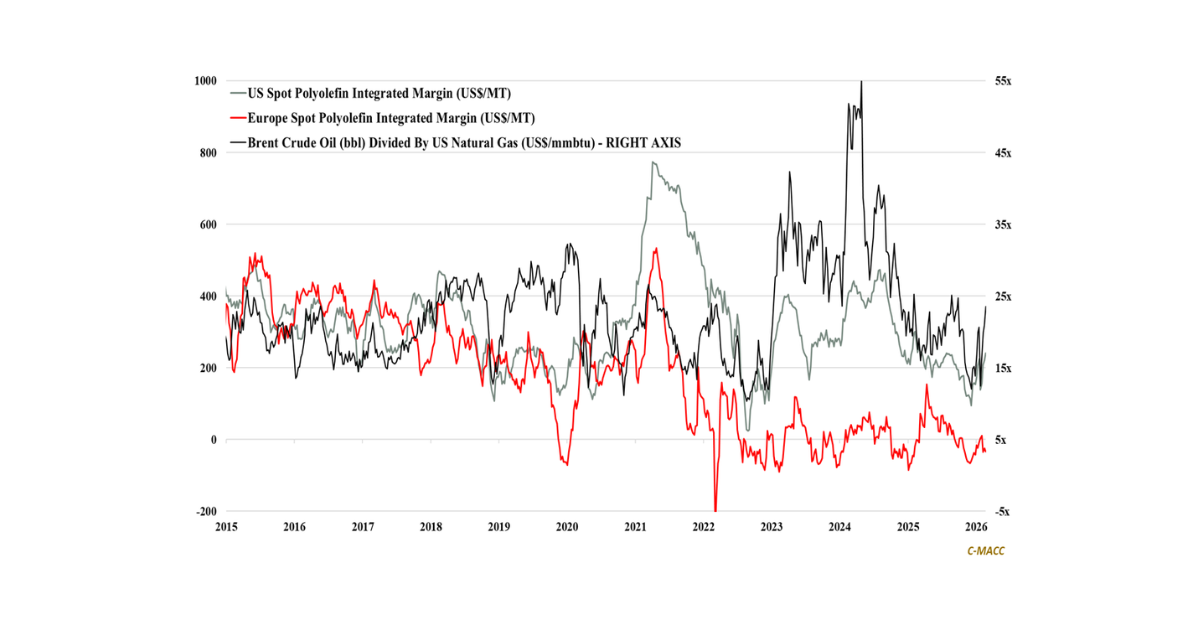

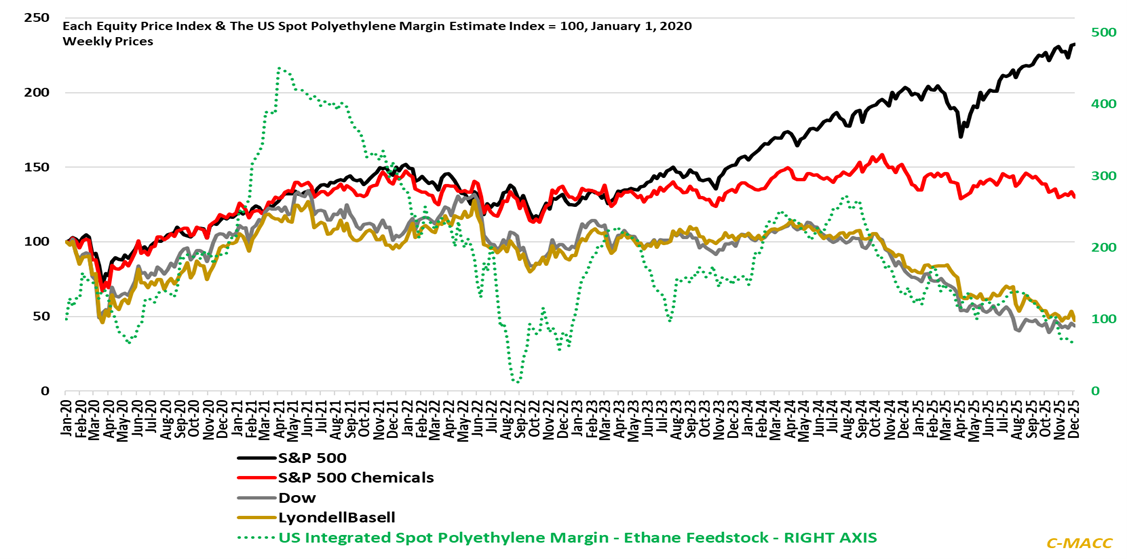

- Collapsing ethylene co-product credits and stubbornly oversupplied polymer markets now erase traditional feedstock advantages, potentially positioning the industry for a 2026 reset offering underappreciated upside.

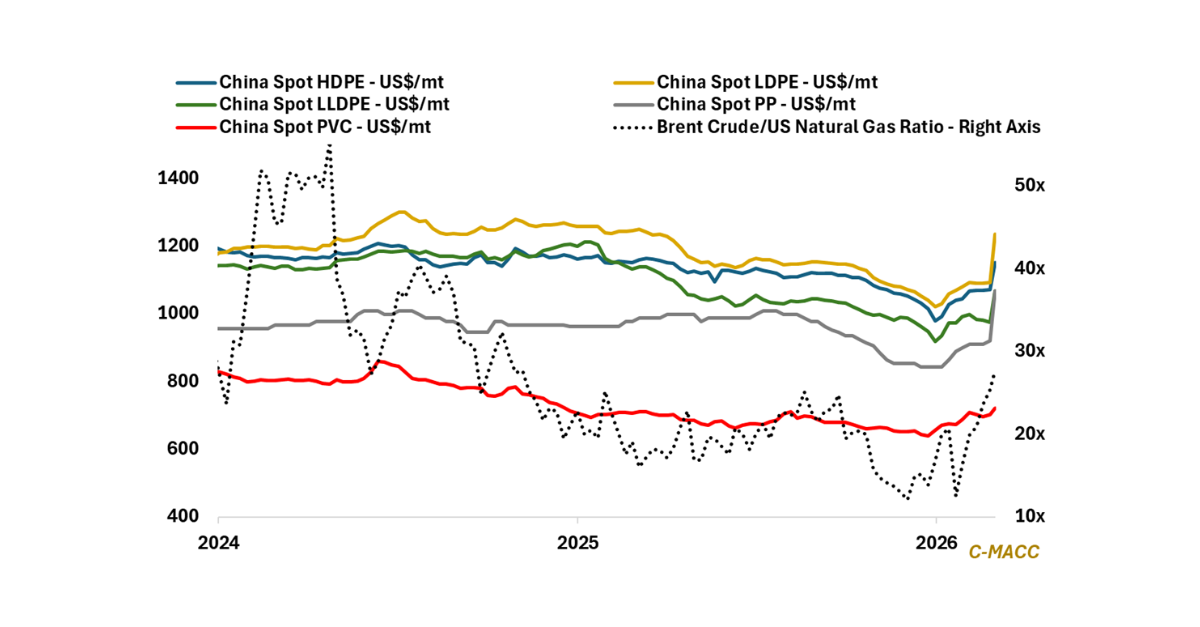

- Global cost-curve flattening, cheap freight, and Asian oversupply have rattled historical pricing relationships, forcing producers to rethink return strategies as investors increasingly demand action to restore profitability.

- Propane’s recent disconnect from cracking economics reveals deep systemic stress across olefins, signaling a turning point at which restructuring and consolidation become catalysts shaping competitive outcomes.

- US commodity chemical equities embed extreme pessimism, creating a setup in which valuation re-rating potential exceeds expectations if demand growth and supply attrition unite to more than offset excess capacity.

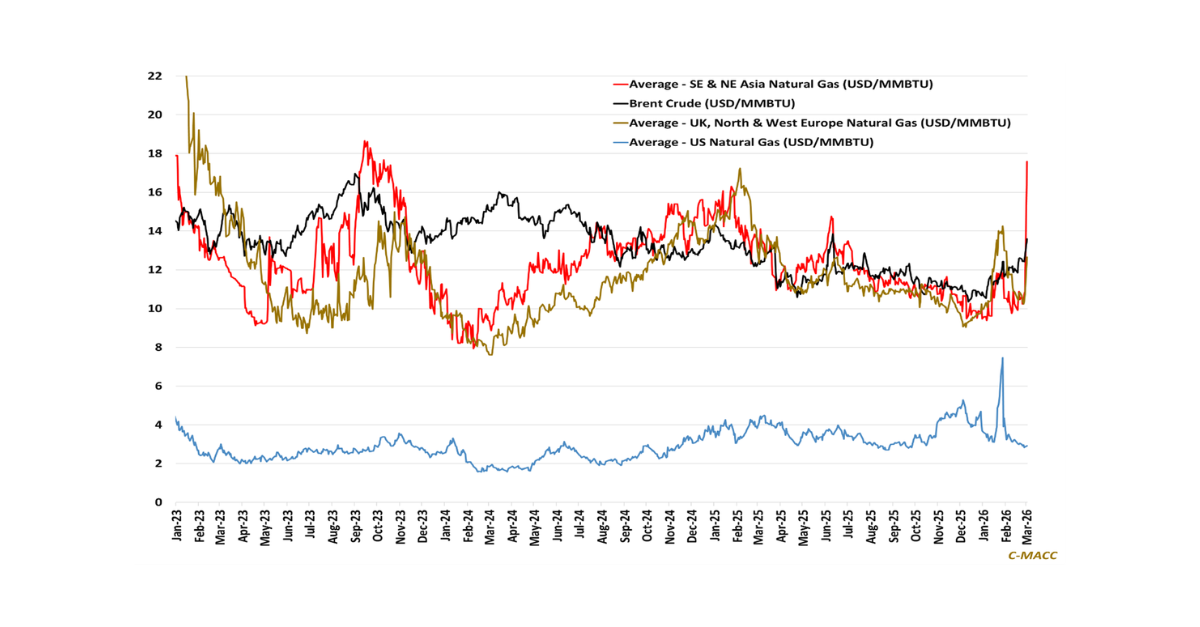

- Otherwise, we discuss surging US natural gas prices relative to European markets, persistently tight ammonia markets, and shifting freight, FX, and mineral dynamics that are shaping global cost competitiveness and trade.

- Companies Mentioned: Dow, LyondellBasell, ExxonMobil, CF Industries, Fertiglobe, Rio Tinto, Glencore, Albemarle, Ganfeng, Lithium Americas, Codelco

- Products Mentioned: Polyethylene, Ethylene, Ethane, Propane, Butadiene, Propylene, Ammonia, Natural Gas, Crude Oil, Gasoline, Diesel, LNG, LPG, Naphtha, Methanol, Corn, Phosphate, Soybeans, Copper, Lithium, Nickel, Cobalt, Zinc, Manganese, Aluminum, Steel

Exhibit 1: US petrochemical commodity equities underperform amid compressed cost positions and low expectations.

Source: C-MACC Estimates, December 2025

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!