Polymer Global Analysis

Resin To Riches: Weekly Plastic Market Insights

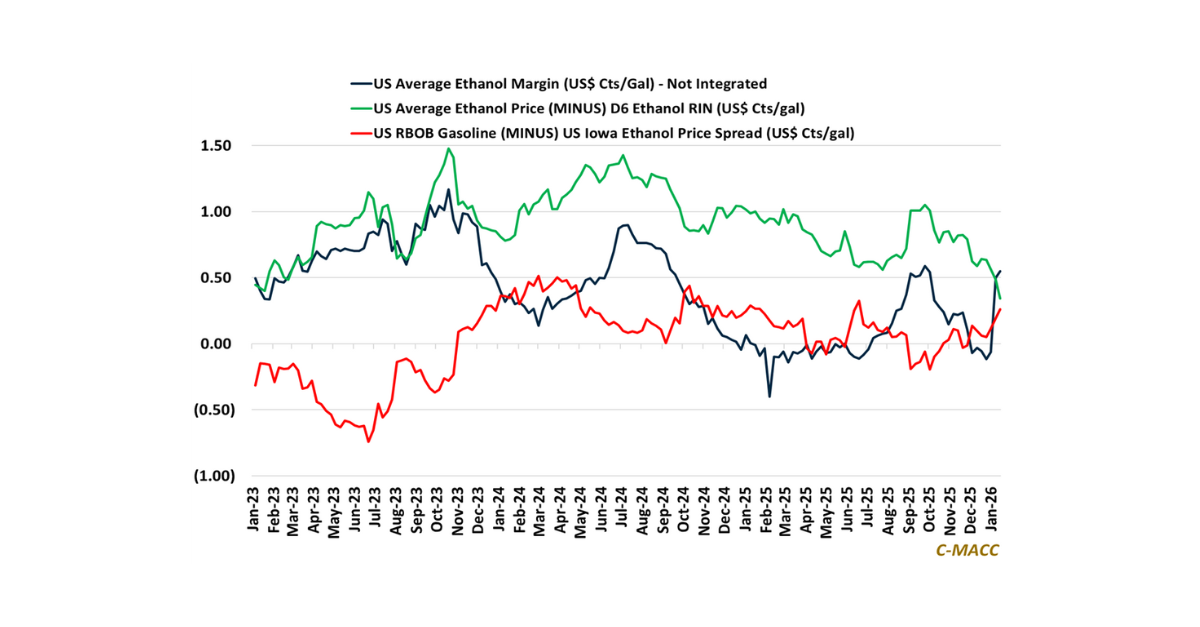

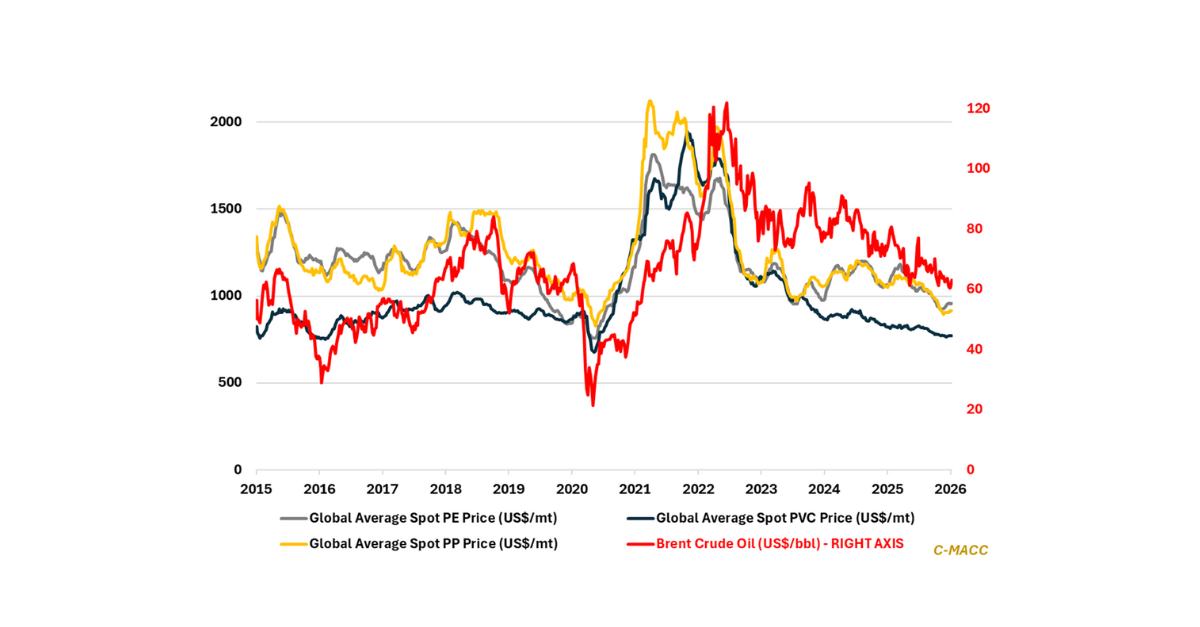

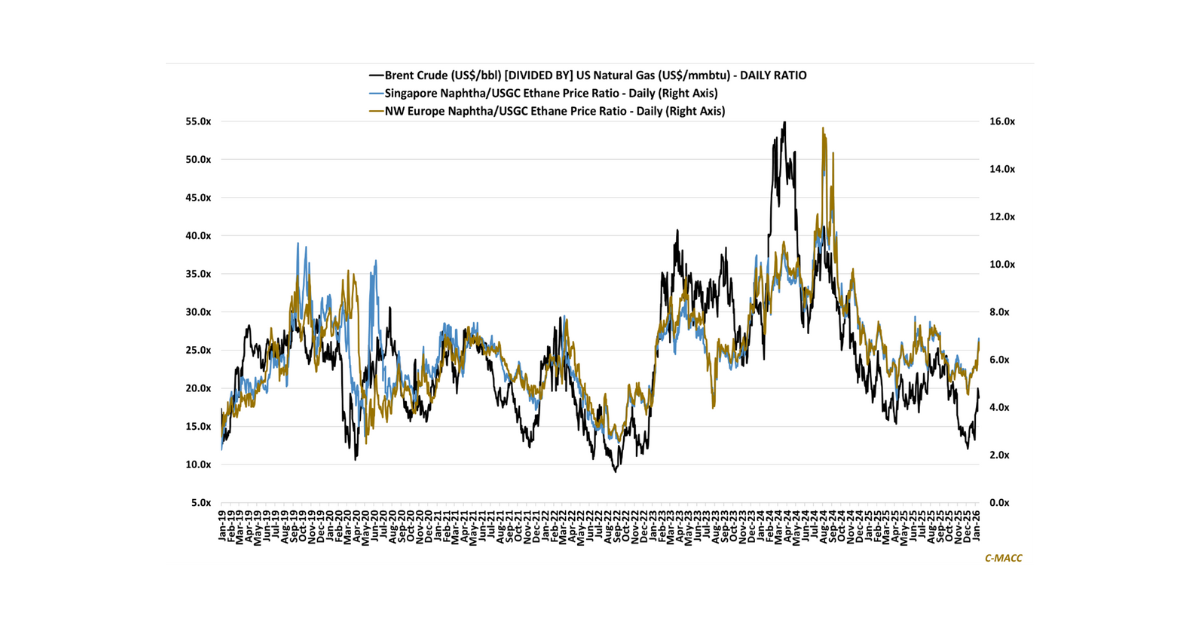

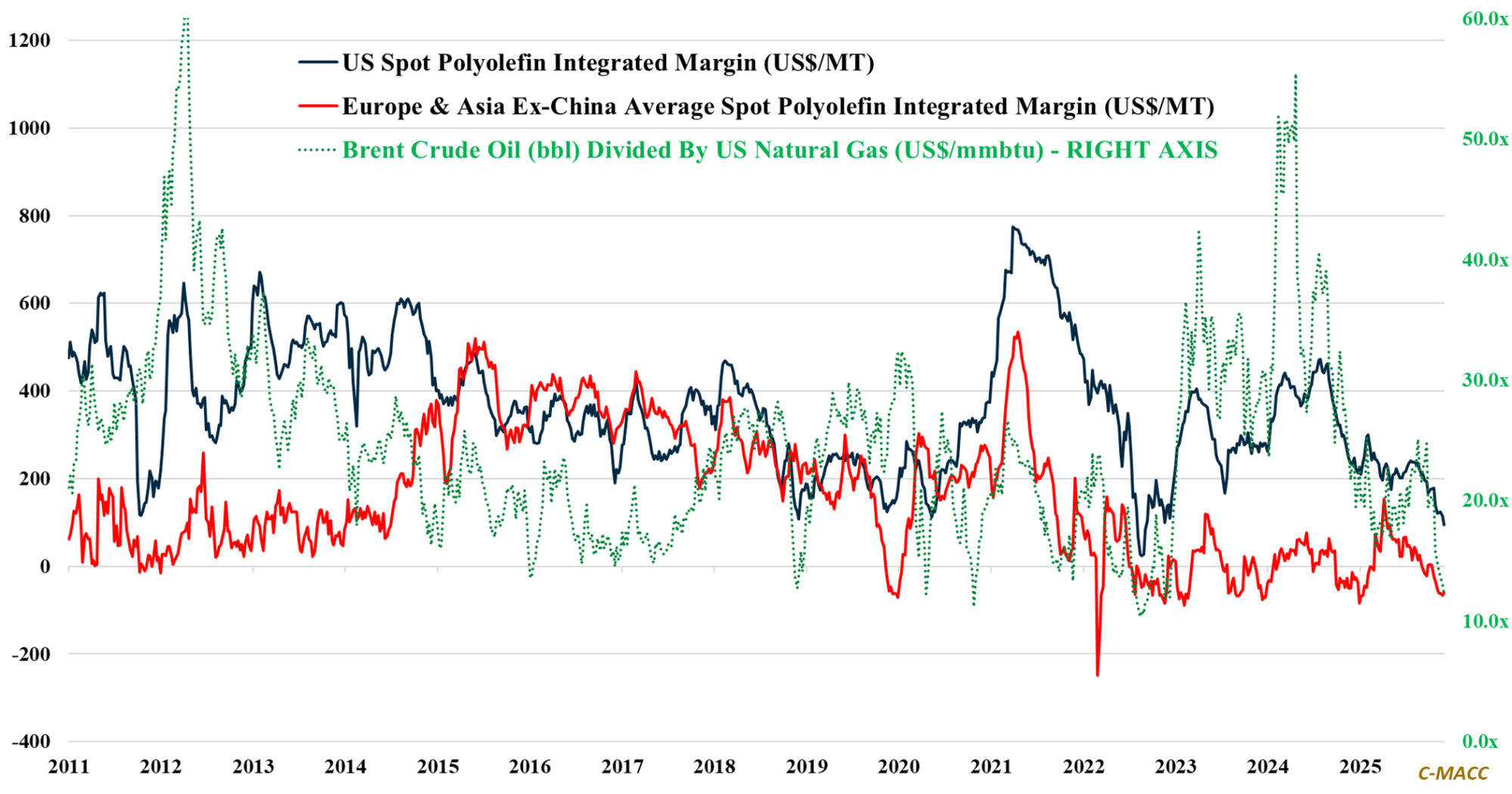

- General Thoughts: Collapsing global polyolefin margins, muted demand elasticity, and an oil-to-gas price ratio at 2025 lows combine to favor an acceleration of global capacity rationalizations, set to shift competitive advantage in 2026.

- Polyethylene (PE): Markets undervalue how China’s persistent oversupply, Europe’s deepening import dependence, and volatile US feedstocks together entrench structurally fragile PE pricing power despite occasional restocking lifts.

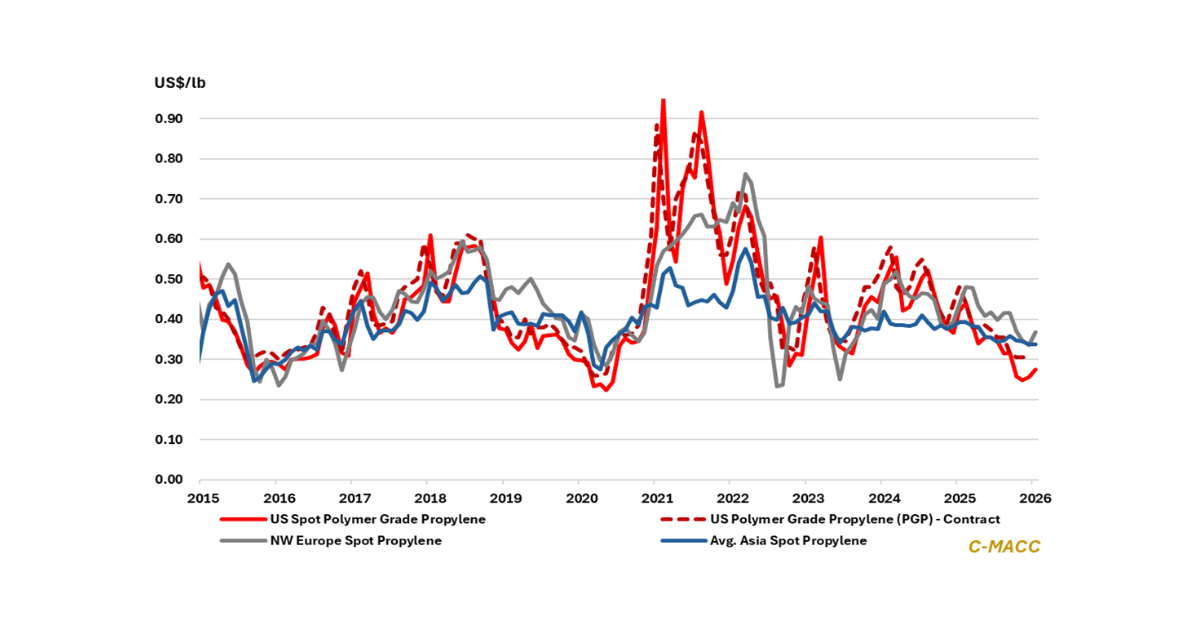

- Polypropylene (PP): Tight global PP-to-PGP spreads, rising Chinese exports, and Asia ex-China and Europe’s accelerating restructuring converge to compress margins and concentrate competitiveness among integrated global producers.

- Polyvinyl Chloride (PVC): India’s unprecedented price capitulation, China’s PVC export surge, and Europe’s energy burdens collectively redefine PVC’s global floor, with downside risk appearing low relative to current levels in 1H26.

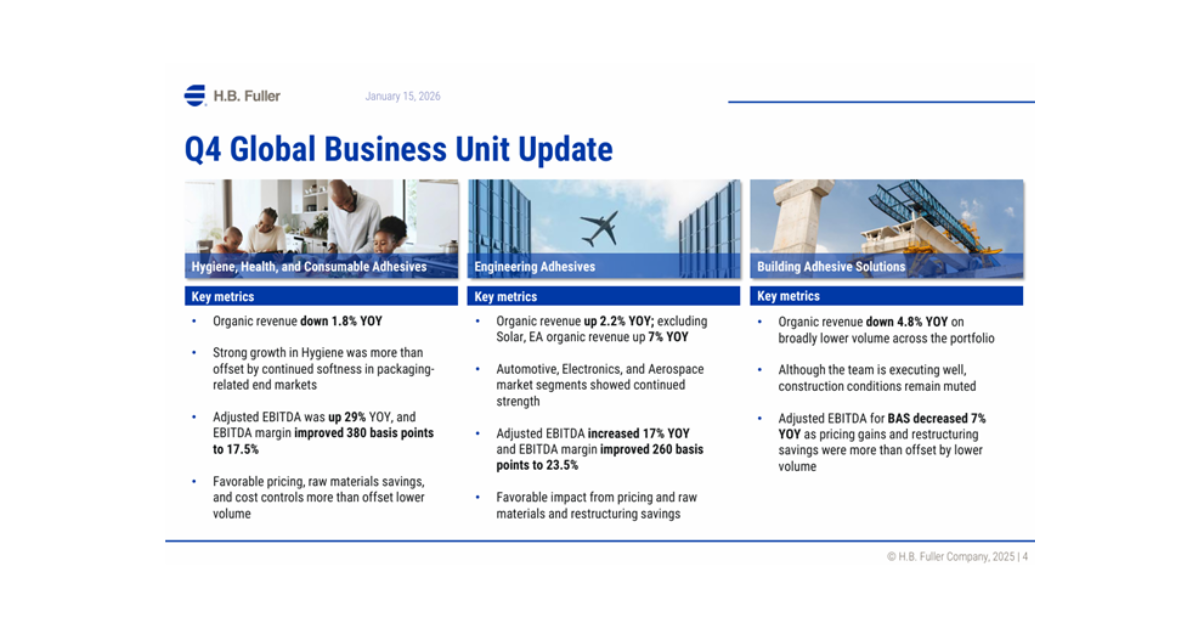

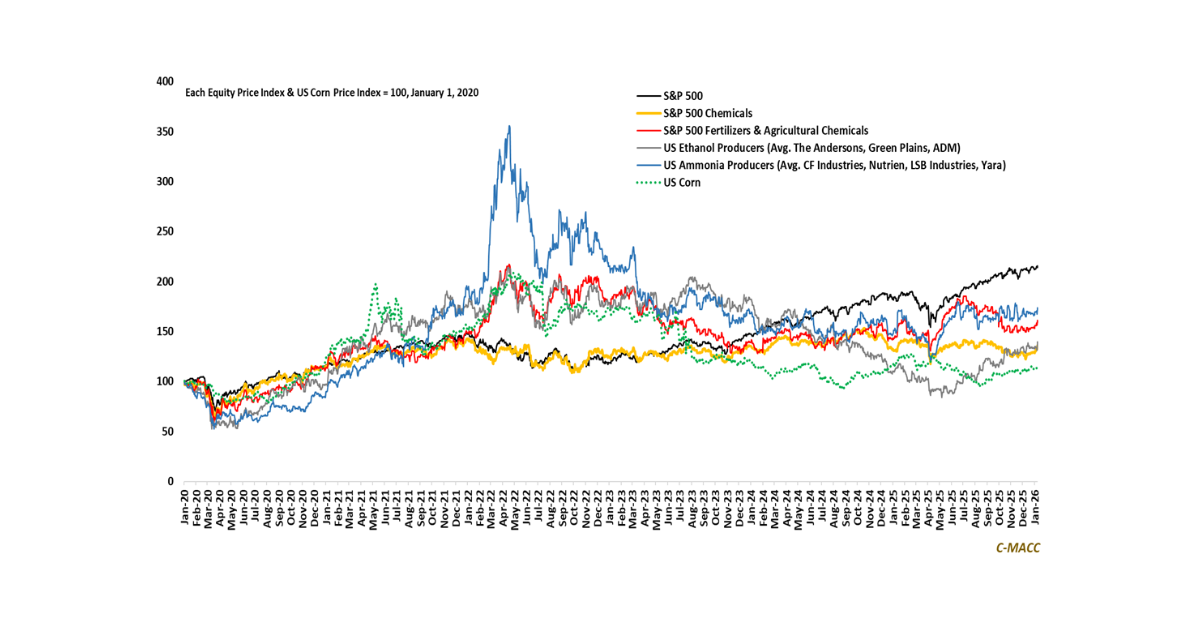

- Other Sector Developments: Weak polymer end-market demand and shifting feedstock and power markets, along with 2026 uncertainties, are not only swinging regional margins; they are also keeping most global growth capex on hold.

Exhibit 1 – Chart of the Day: Global average polyolefin margins retreat to 2025 lows as cost curve flattens in 4Q25.

Source: Bloomberg, C-MACC Estimates, December 2025

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!