Polymer Global Analysis

Resin To Riches: Weekly Plastic Market Insights

- General Thoughts: Global polymer markets continue to clear tactically, not cyclically, in late 2025 as oversupply, logistics normalization, and discipline overwhelm demand signals, leaving price floors dependent on exits, cost curves, and trade.

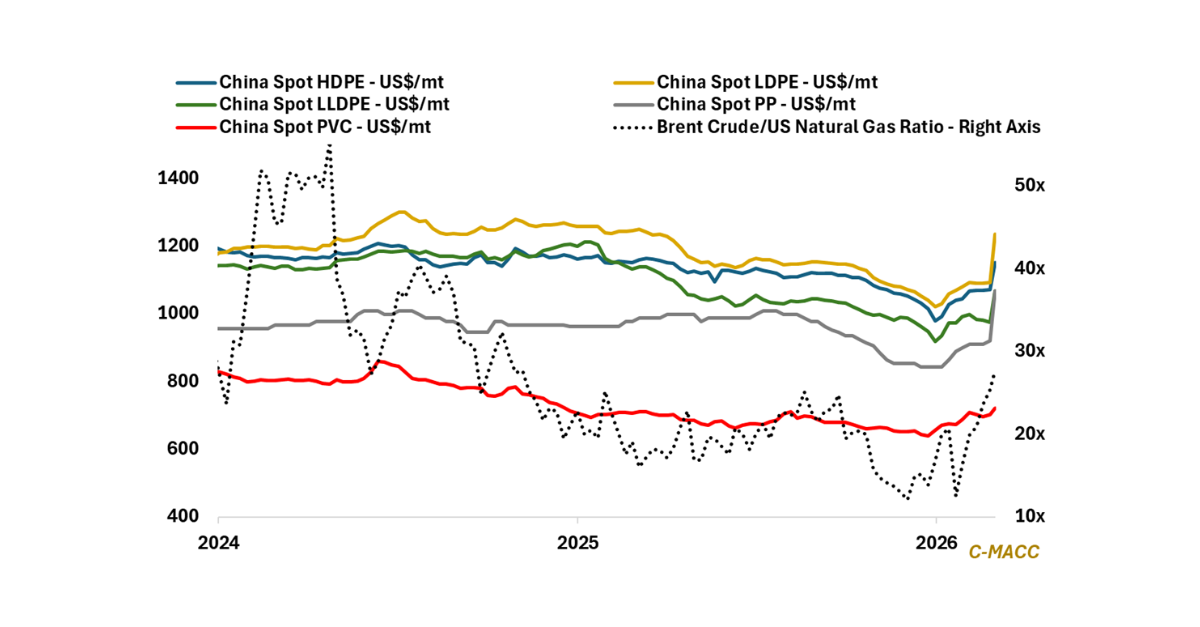

- Polyethylene (PE): Market firmness reflects more positioning than balance, as China anchors clearing prices, grade-level inventories diverge, and pull tightens HDPE while LDPE and LLDPE rebuild as producers right-size operations into 2026.

- Polypropylene (PP): Global PP market pricing power has evaporated in late 2025 as Chinese capacity, inventory overhangs, and exports force hand-to-mouth buying, leaving rebounds brief unless demand improves or capacity exits.

- Polyvinyl Chloride (PVC): Most markets operate in damage-control mode, where restructuring and run-rate discipline offset still weak construction demand, imports cap upside, and recovery hinges on tighter inventories and capacity cuts.

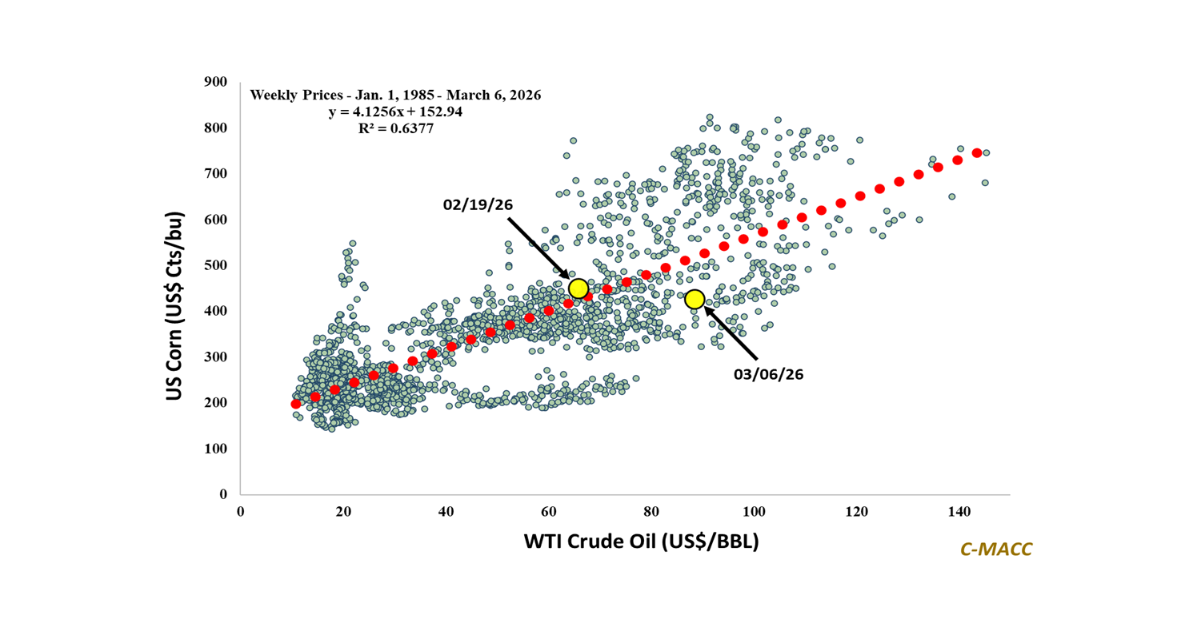

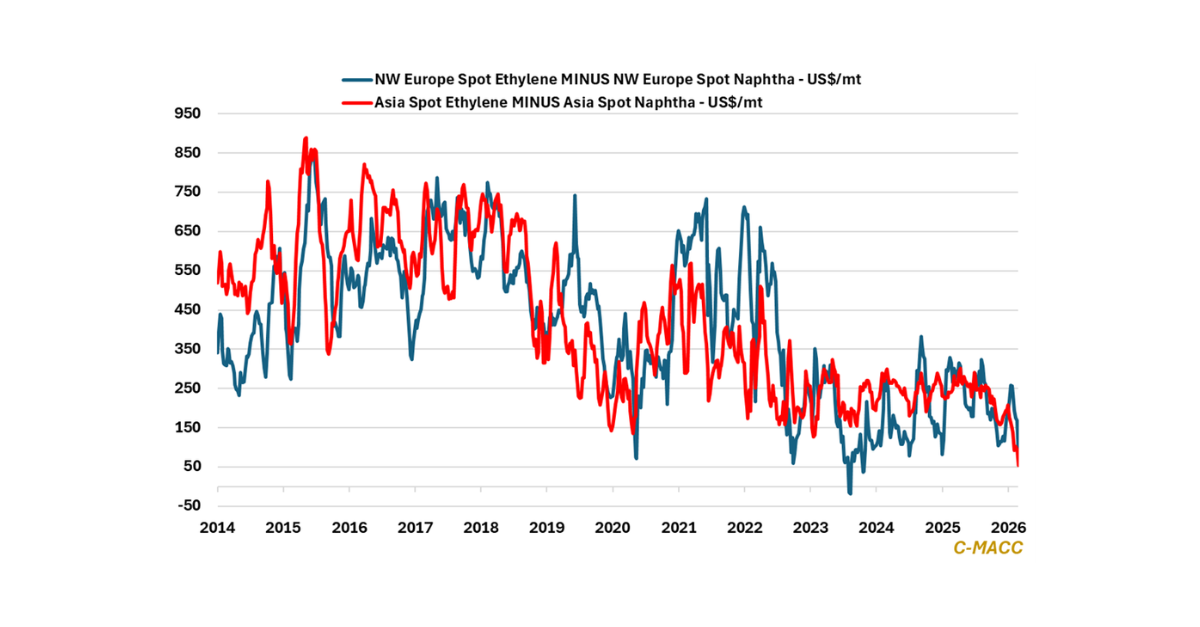

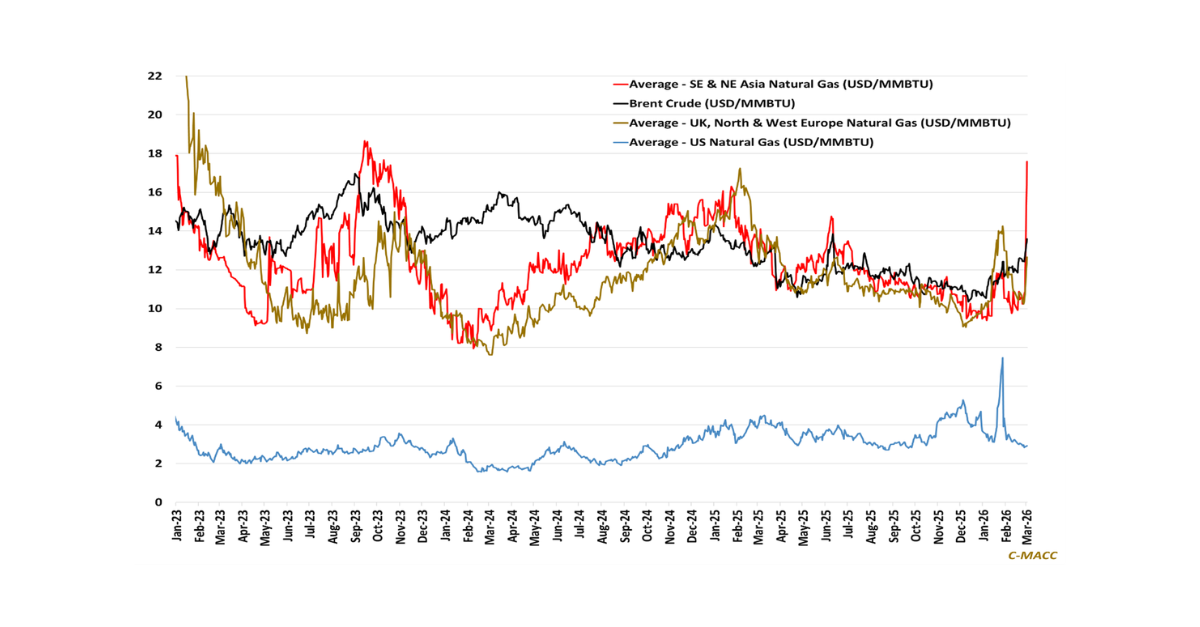

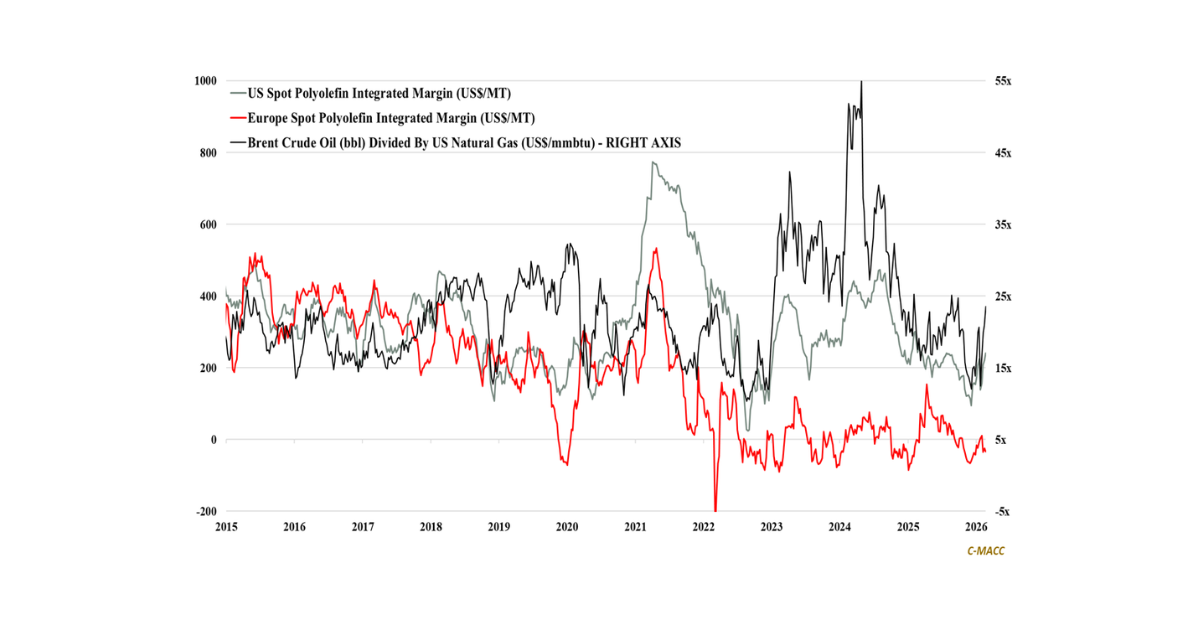

- Other Sector Developments: Feedstock volatility matters less than cost-curve position, as ethane advantage persists, naphtha systems struggle, and logistics normalization erodes arbitrage and inventory cushions globally.

Exhibit 1 – Chart of the Day: Asia PE-to-US ethylene cash-cost spreads declined in 2025, reframing 2026 margin risk.

Source: Bloomberg, C-MACC Estimates, December 2025

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!