Global Market Analysis

The Streak: Chemical Producers Run For Safety, As Capital Selectively Turns The Other Cheek

Key Findings

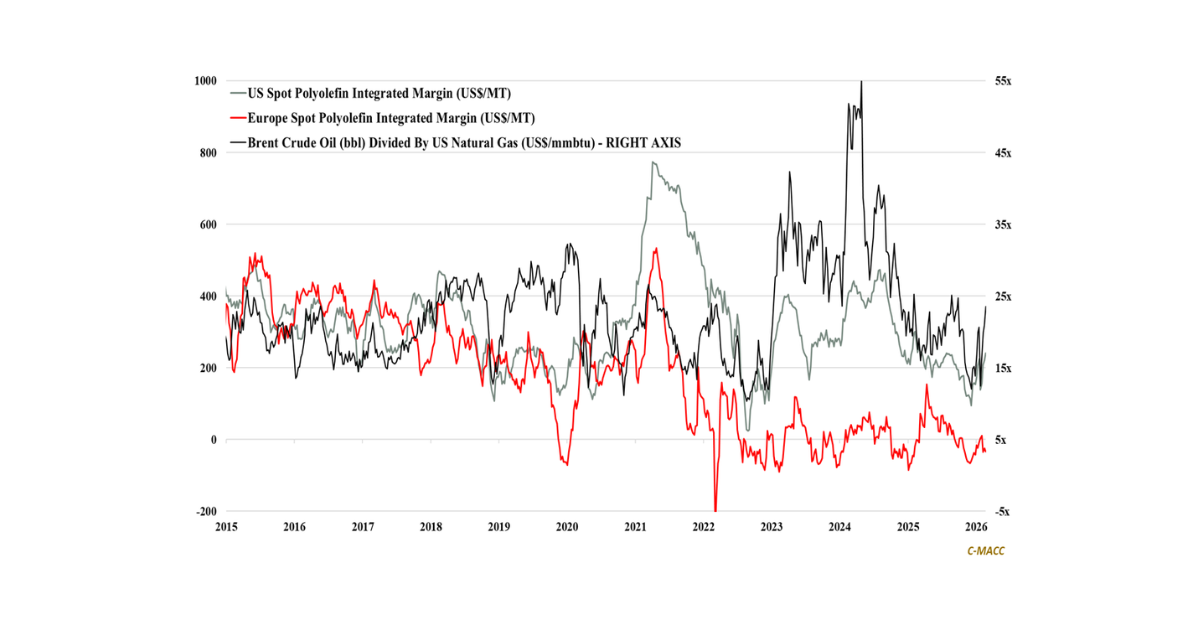

- General Thoughts: Global chemical downturn into 2026 will force ownership change and capital discipline, restructuring across Europe and Asia ex-China, while redefining low-cost integration as defense, not growth.

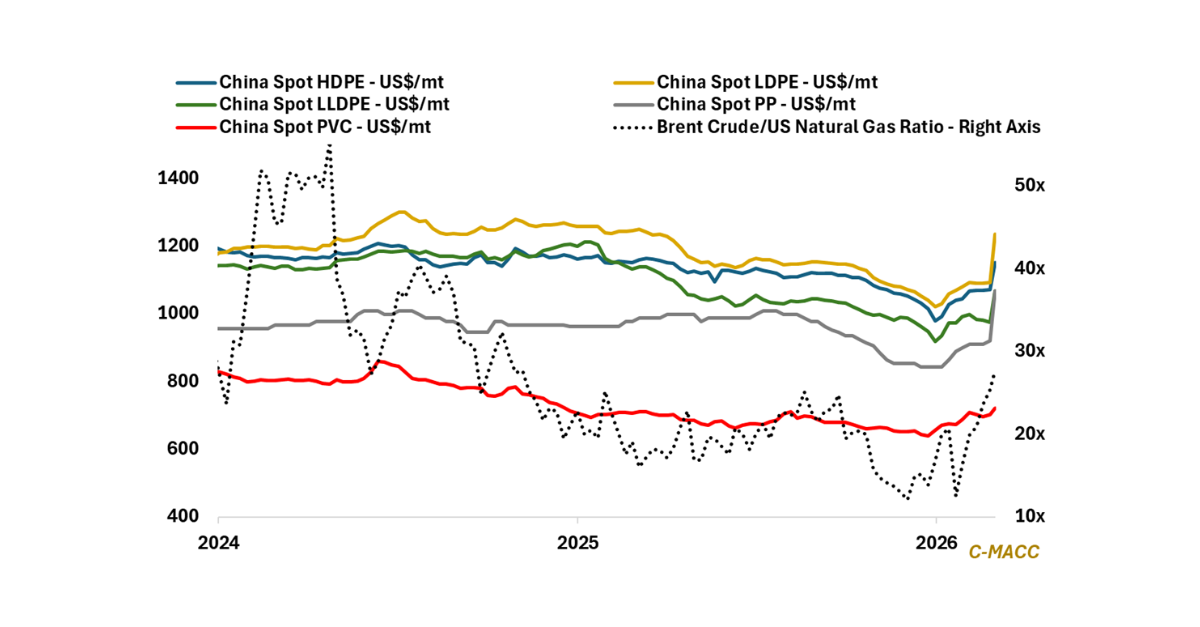

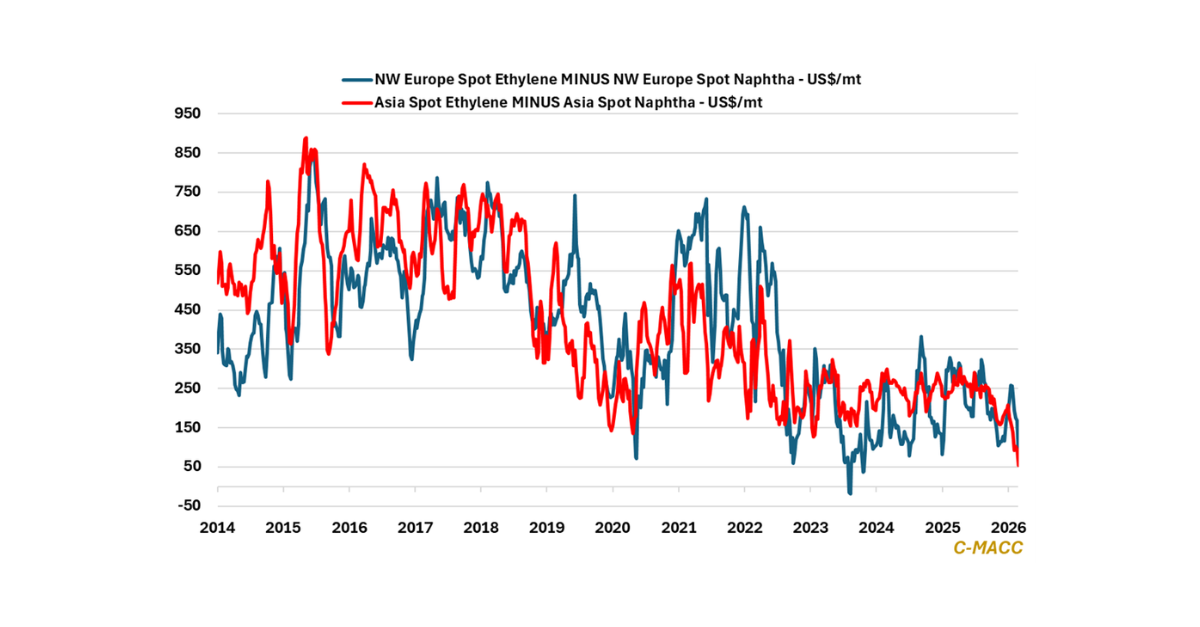

- Supply Chain/Commodities: Flat cost curves, persistent oversupply, and selective arbitrage are accelerating restructuring, favoring low-cost producers while forcing Europe and Asia ex-China to optimize assets or exit.

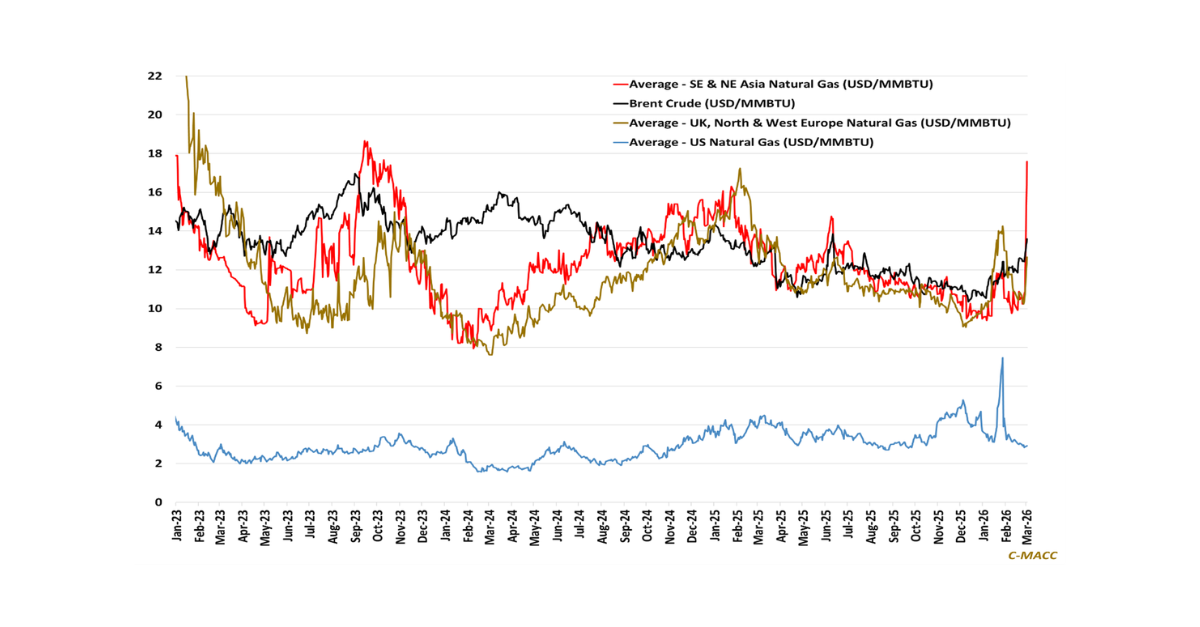

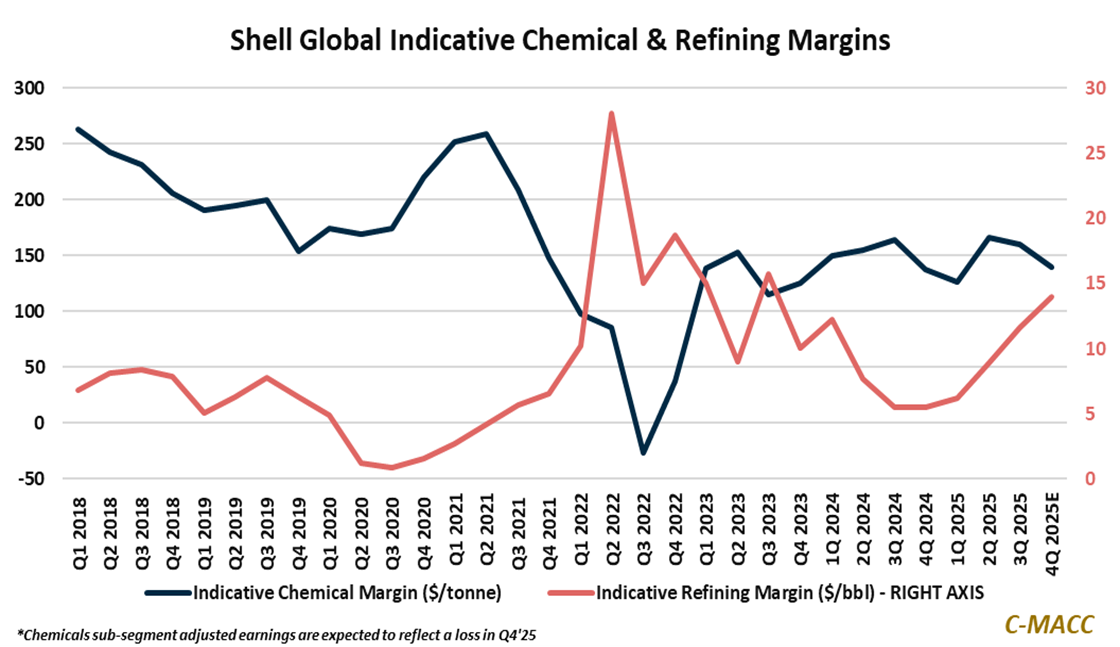

- Energy/Upstream: Global crude oil refining flexibility outperforms petrochemicals as oversupply, feedstock divergence, and capital discipline favor low-cost integrated players and reshape global cost-curve dynamics.

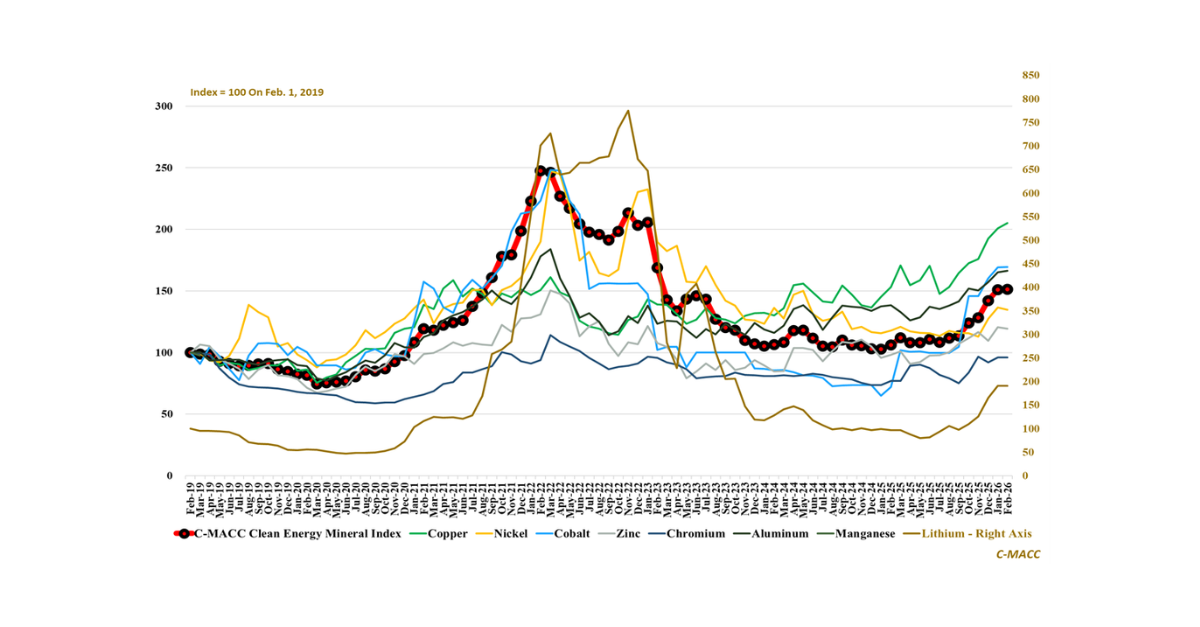

- Sustainability/Energy Transition: Across decarbonization and critical minerals, execution, processing depth, and economics outweigh ambition, shaping 2030 outcomes around bankability, policy, and concentration.

- Downstream/Other Chemicals: Subscale demand, cheap logistics, and policy uncertainty delay rebalancing, extending oversupply risks and pushing 2026 outcomes toward restructuring, discipline, and selective exits.

Exhibit 1: Shell reports chemical margin weakness as refining recovers amid global market imbalance.

Source: Shell – 4Q25 Business Update, January 2026

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!