Base Chemical Global Analysis

Global Weekly Catalyst No. 315

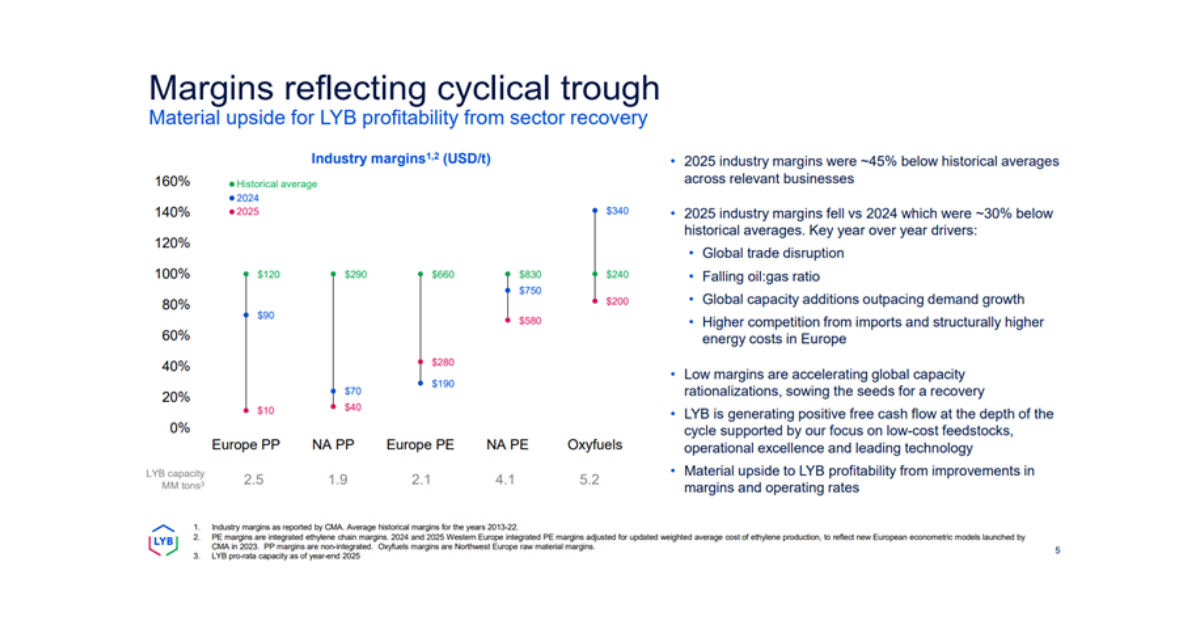

- General Thoughts: Energy volatility and weather shocks are shifting margins across chemicals and fuels, as producers with cost advantages and logistics strength outperform. Execution will matter more through 2026.

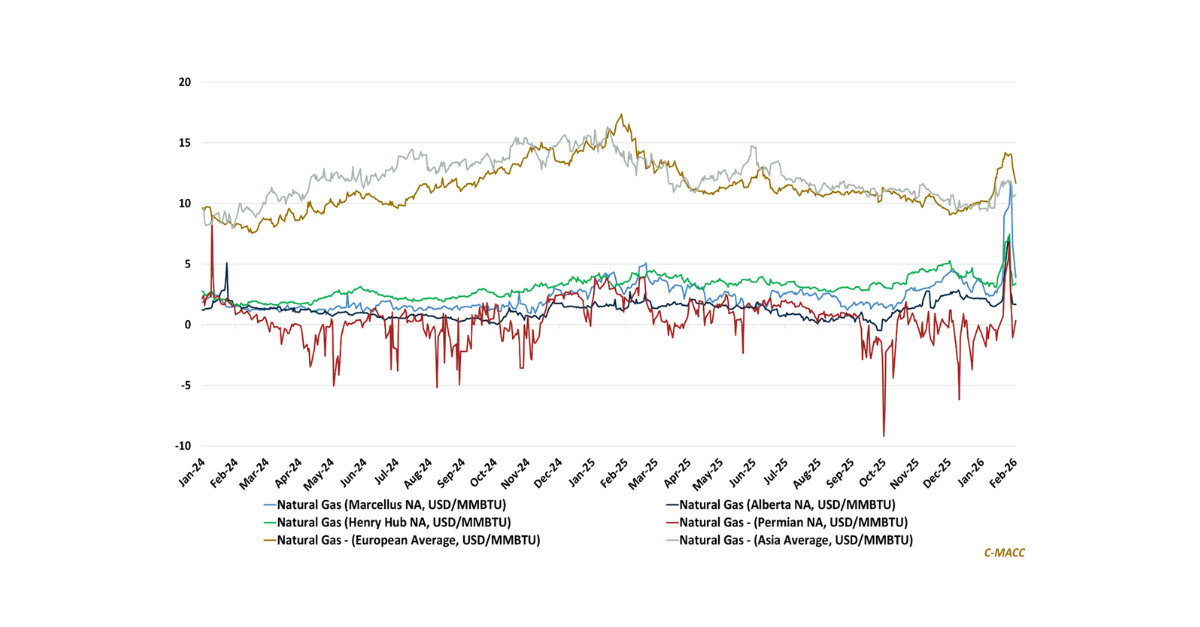

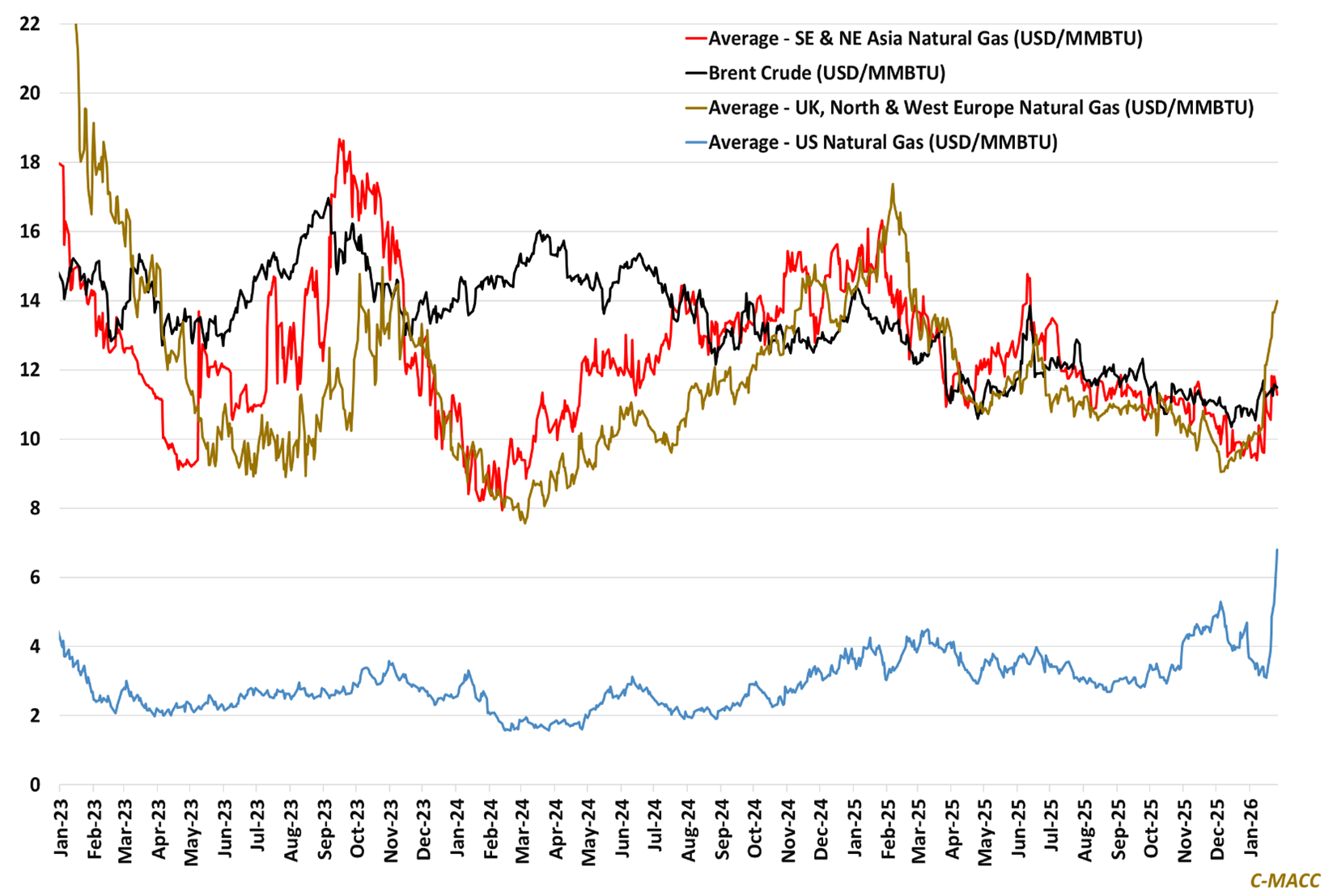

- Feedstocks & Energy: Freeze-driven natural gas price spikes are lifting global cost floors, as crude remains broadly range-bound, with petrochemical margins staying compressed if dispersion persists into late 1Q26.

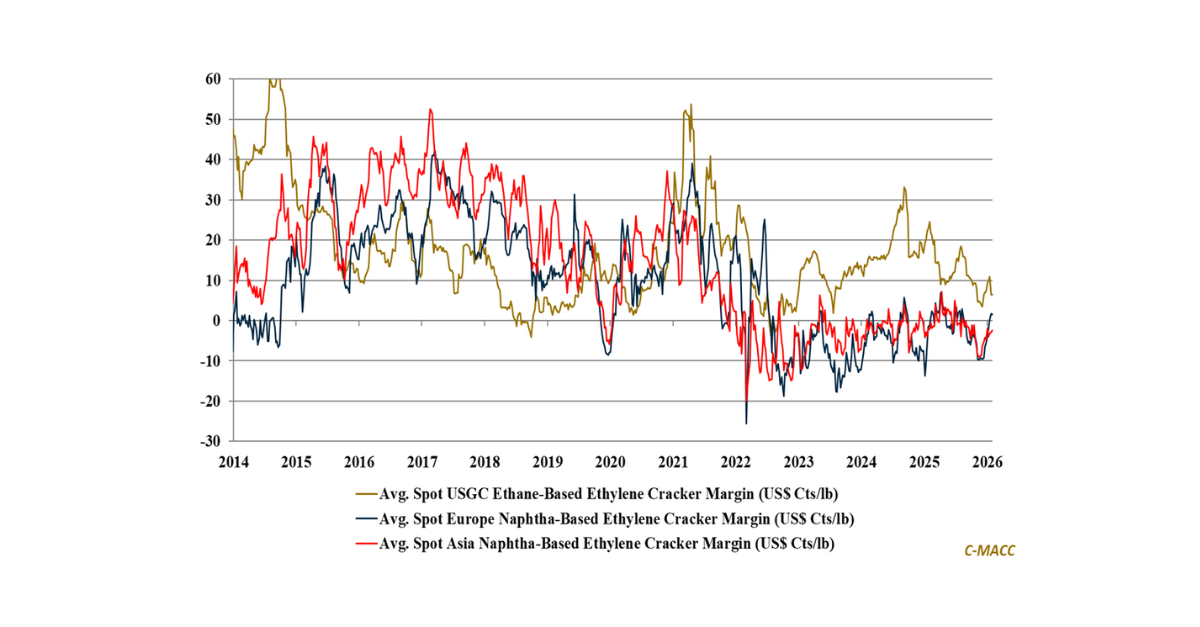

- Olefins: Weather outages and PDH disruptions are supporting propylene and C4 pricing; ethylene oversupply continues to cap upside, as fragmented olefins markets favor low-cost relative global producers in 2026.

- Other Base Chemicals: Energy volatility is driving selective repricing across global intermediates; methanol is the cleanest weather-driven mover so far, but US storm risk supports firmer domestic prices where logistics tighten.

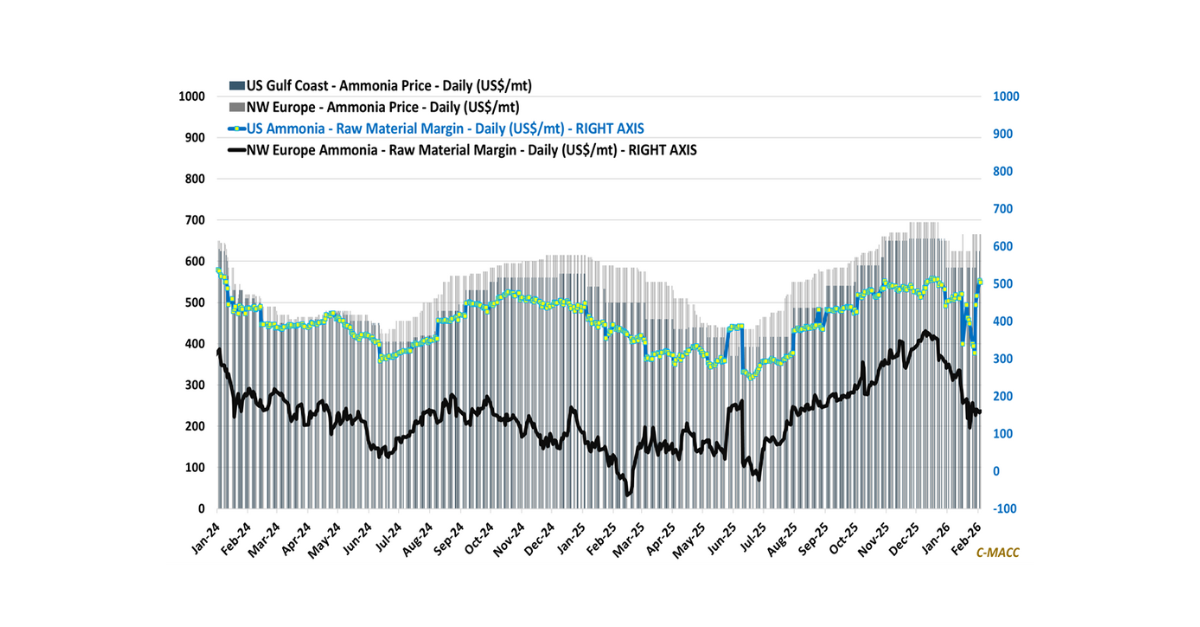

- Agriculture: Ammonia markets are shifting toward balance as inland firmness, affordability risks, and logistics concerns guide buying behavior. Global margins skew lower as gas costs pressure marginal producers in 1Q26.

- Refining & Biofuels: Winter conditions are supporting distillate-led refining margins in a largely range-bound crude oil setting; ethanol benefits from corn relief and exports, as policy and reliability shape forward returns.

Exhibit 1 – Chart of the Day: Gas volatility reasserts global cost dispersion, supporting prices, but contracting margins.

Source: Bloomberg, C-MACC Estimates, January 2026

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!