Global Market Analysis

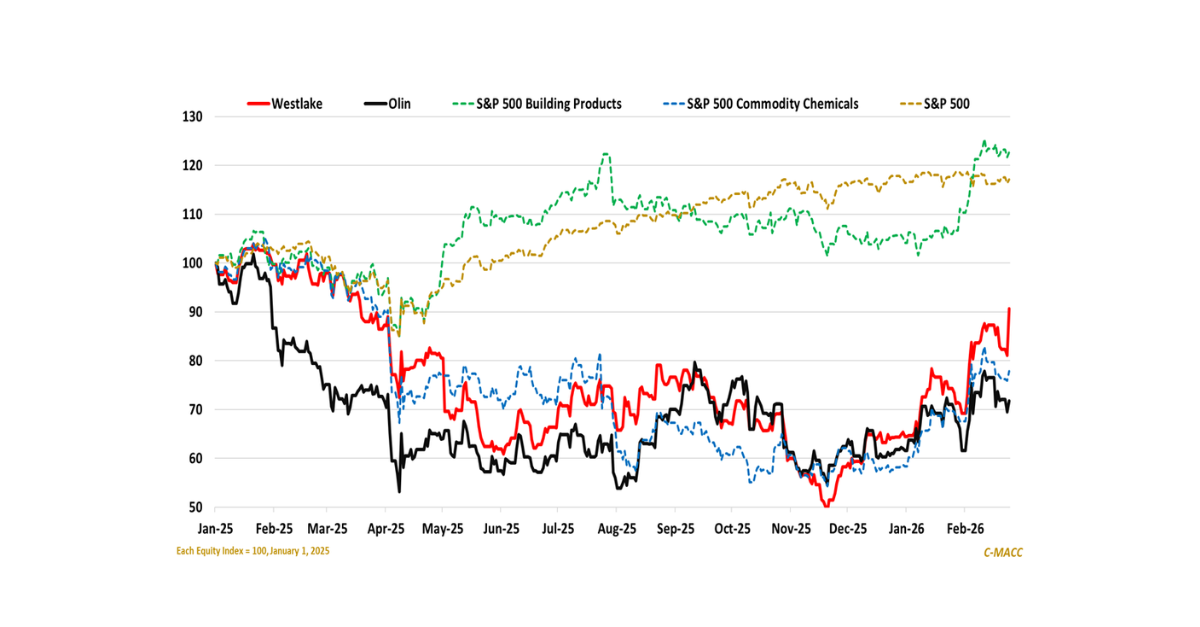

Slicked Back: Restructuring Clears the Field, Global Alignment Drives the Outlook

Key Findings

- General Thoughts: Global chemical restructuring optimizes footprints, shrinks effective supply, and embeds optionality, positioning low-cost, low-carbon assets like Dow’s Path2Zero to lift returns in the cycle ahead.

- Supply Chain/Commodities: Structural closures and Asian consolidation are curbing chemical supply ahead of demand, improving market balance in 2026 and lifting the odds of operating leverage expansion in 2027.

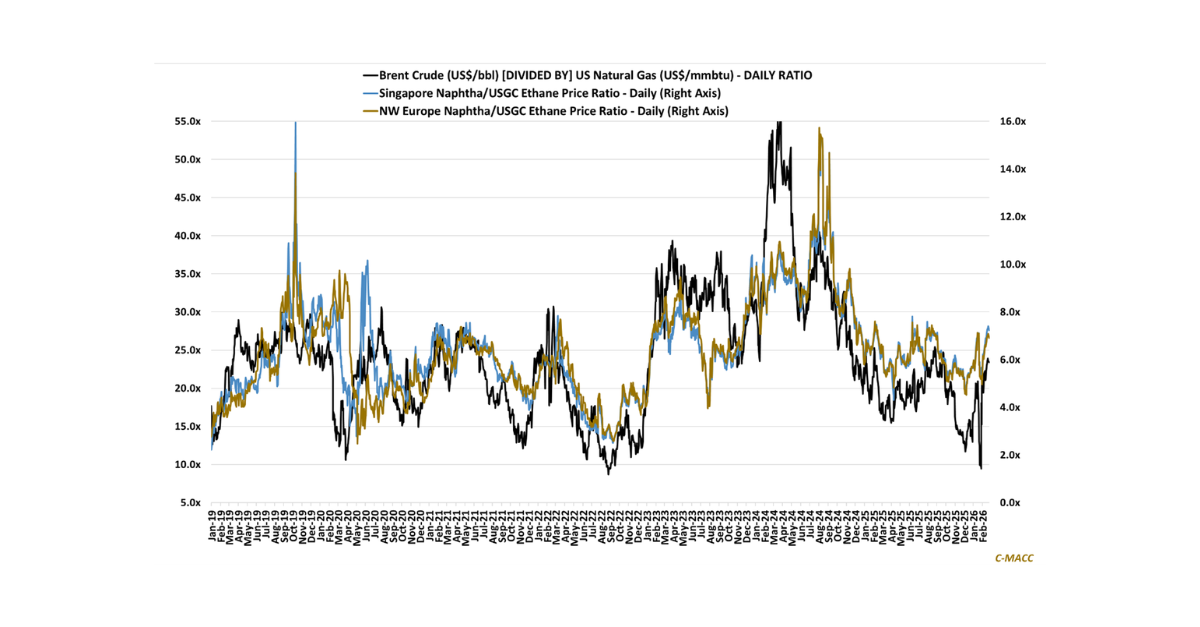

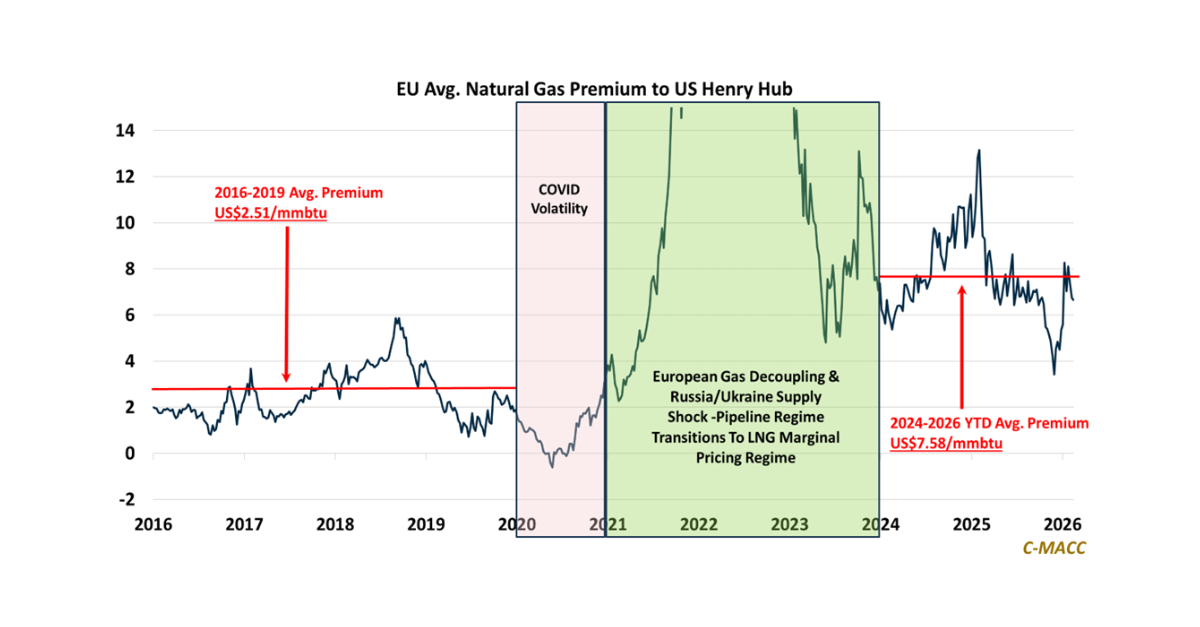

- Energy/Upstream: Rising power needs put natural gas among the fastest reliability solutions, as timeline constraints shift capital toward grid hardening, on-site generation, and service-backed power models.

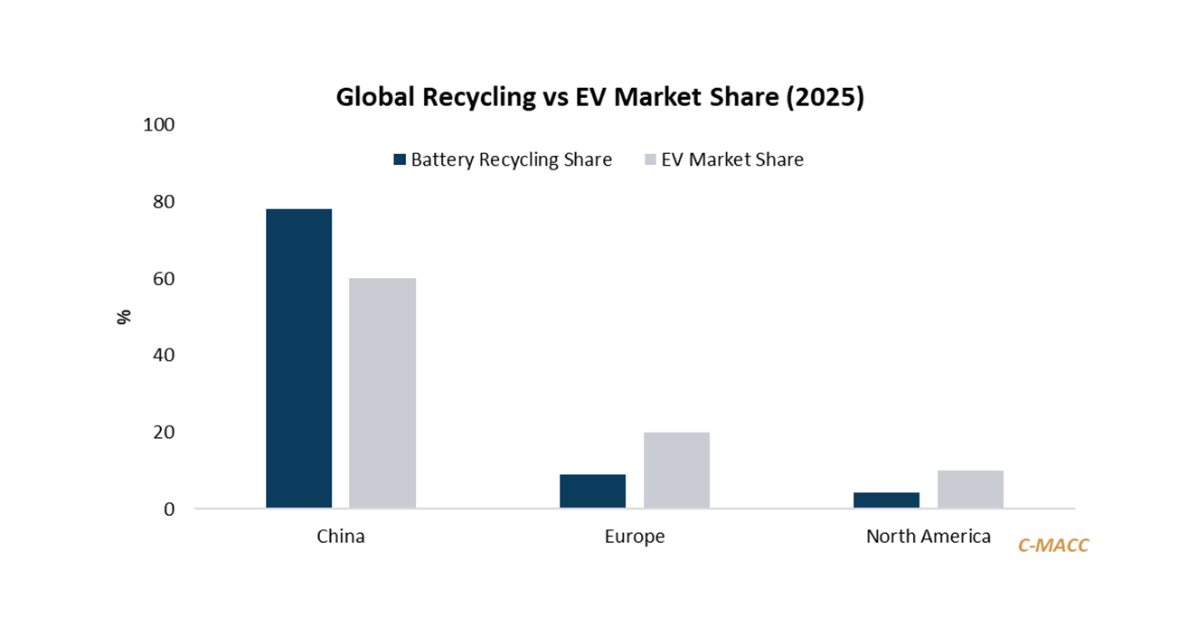

- Sustainability/Energy Transition: Grid bottlenecks are the electricity market pacing constraint, shifting value to power, transmission, and electrification backlogs, where pricing power and returns can compound.

- Downstream/Other Chemicals: US Dollar volatility is reshuffling value by reinforcing commodity floors and inflating costs abroad, strengthening US export advantages as policy challenges import competitiveness.

Exhibit 1: Dow Path2Zero embeds Alberta NGL optionality for advantaged returns in a tighter 2030 cycle.

Source: Dow – 4Q25 Earnings Presentation, January 2026

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!