Global Market Analysis

Crack Less, Feed More: Capital Feeds Fertilizer, Midstream, and Specialties as Plastics Starve

Key Findings

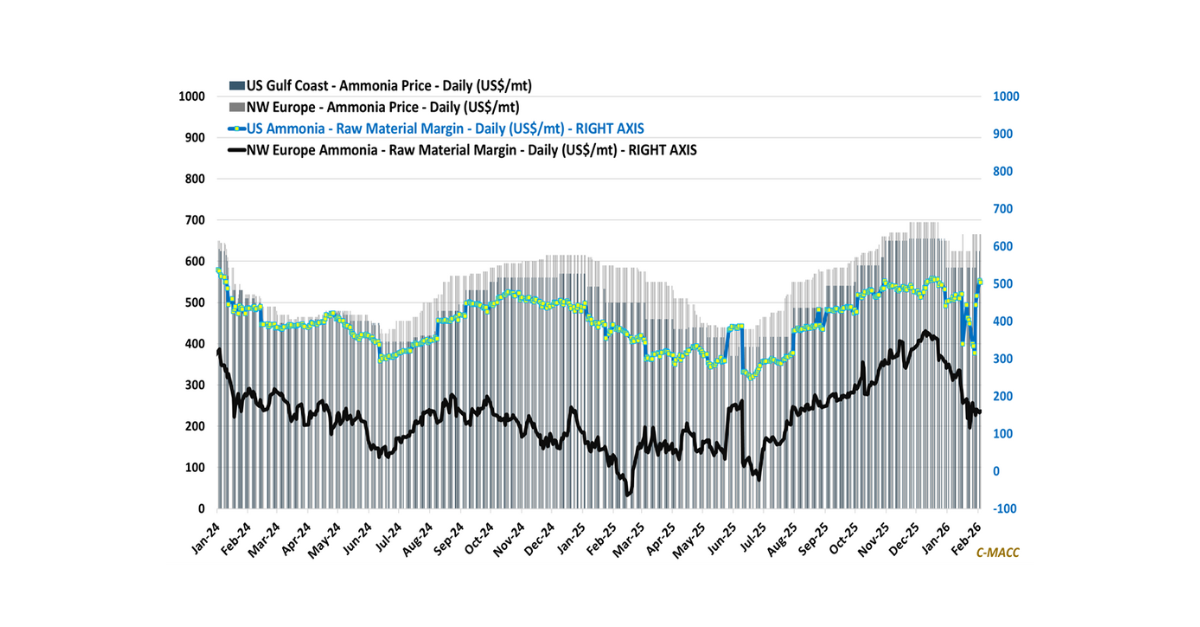

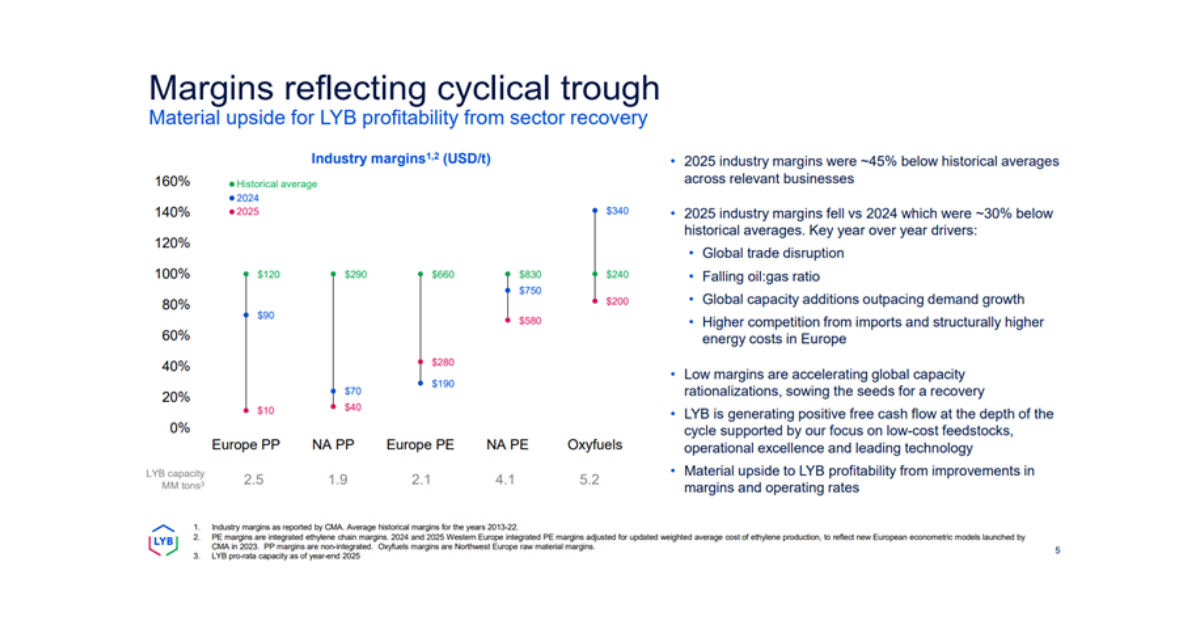

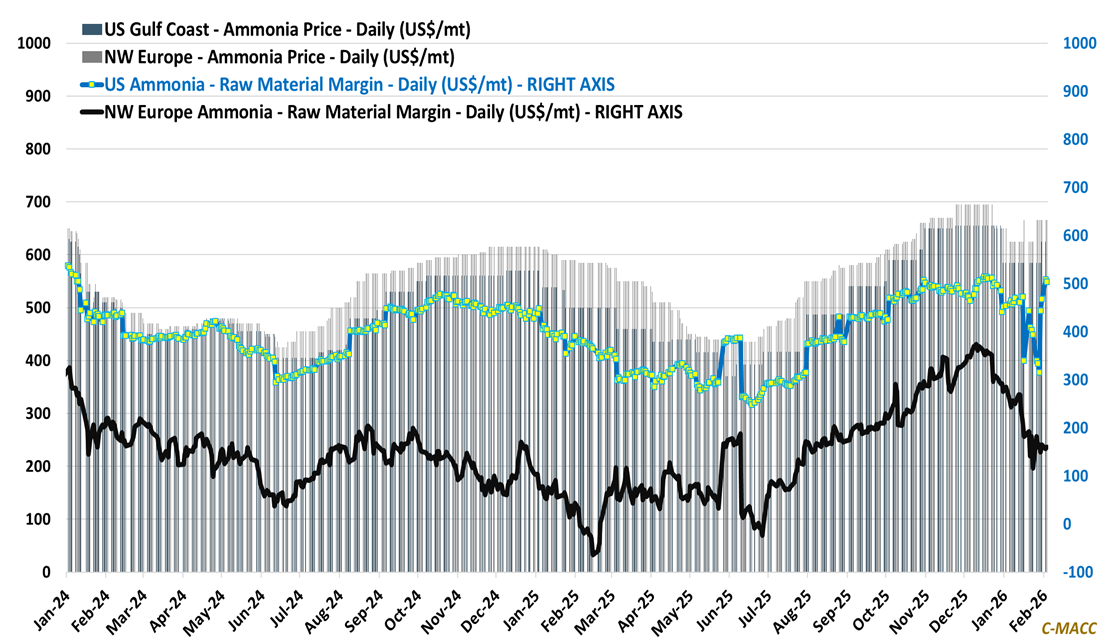

- General Thoughts: Ammonia’s fertilizer-anchored cycle diverges from most chemicals, signaling tight supply and investment incentives, while petrochemicals face surplus-driven signals discouraging growth capital.

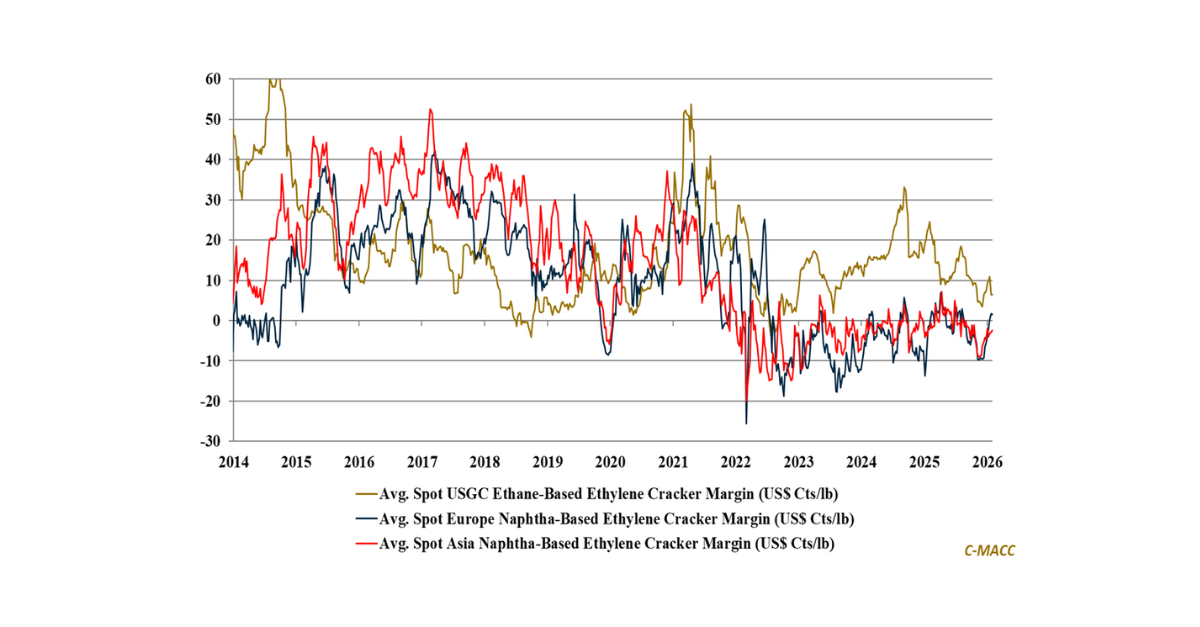

- Supply Chain/Commodities: Asian petrochemicals face structural oversupply, with pricing, not demand, driving losses, forcing restructuring, cost exits, and portfolio shifts that favor early movers through 2026.

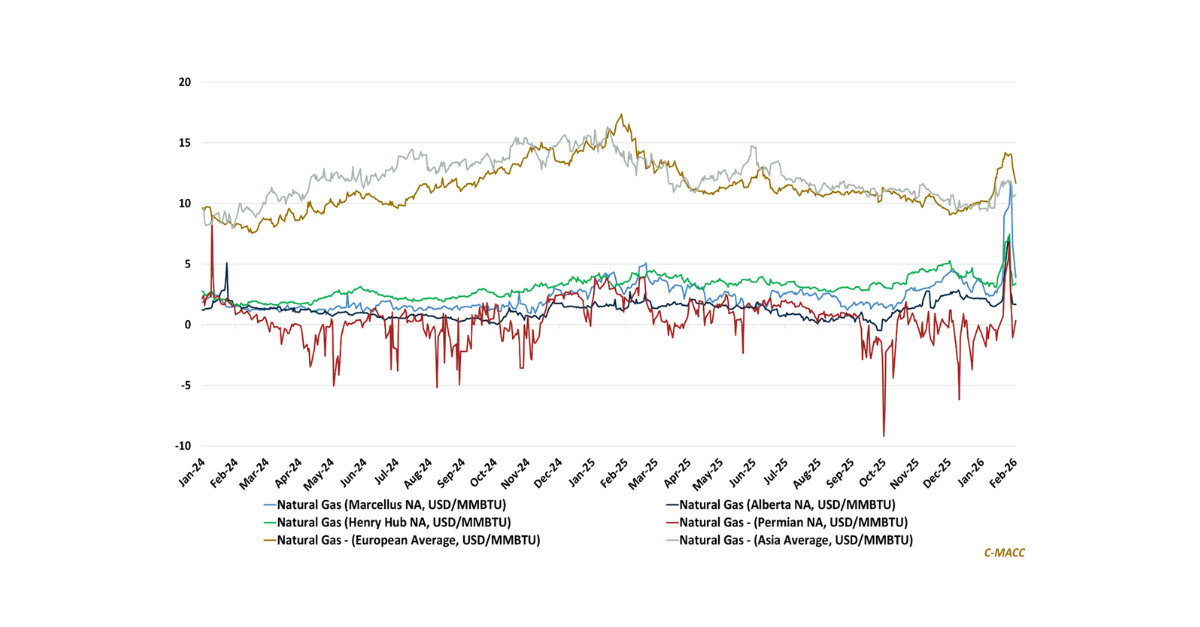

- Energy/Upstream: US midstream integration and export scale anchor resilience, shifting chemical gravity to advantaged regions while bottlenecks, not oversupply, emerge as the underappreciated margin risk.

- Sustainability/Energy Transition: Carbon price volatility fails to offset Europe’s natural gas disadvantage, leaving CBAM supportive at borders but capital flows driven by energy economics and execution in 2026.

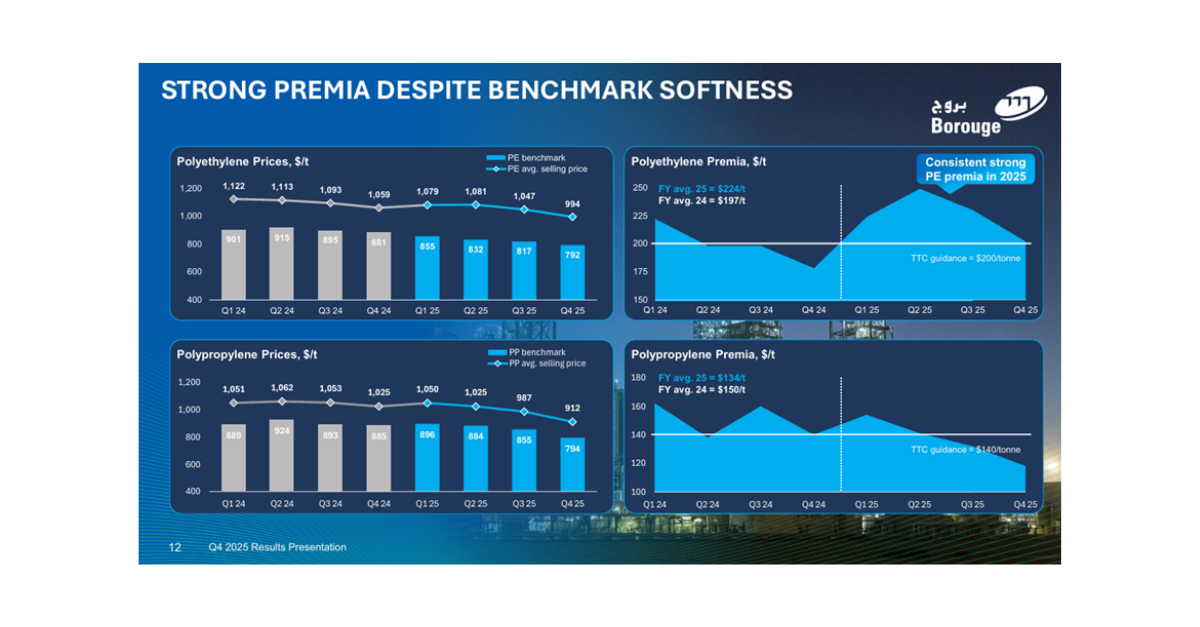

- Downstream/Other Chemicals: Auto softness shifts chemical pricing power downstream, as mix, contracts, and aging fleets support specialties while tariffs, lost volume, and regionalization cap commodity margins.

Exhibit 1: Fertilizer demand and natural gas costs split ammonia producer margins across farming regions.

Source: C-MACC Estimates, February 2026

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!