C-MACC Sunday Executive Summary

Sorry, the Cycle Won’t Save Everyone: Global Chemicals Get Smarter or Smaller

- Cycles matter, but winners change as structure evolves; disciplined capital allocation separates chemical sector participants positioning for durable advantage from those who let pessimism delay investment.

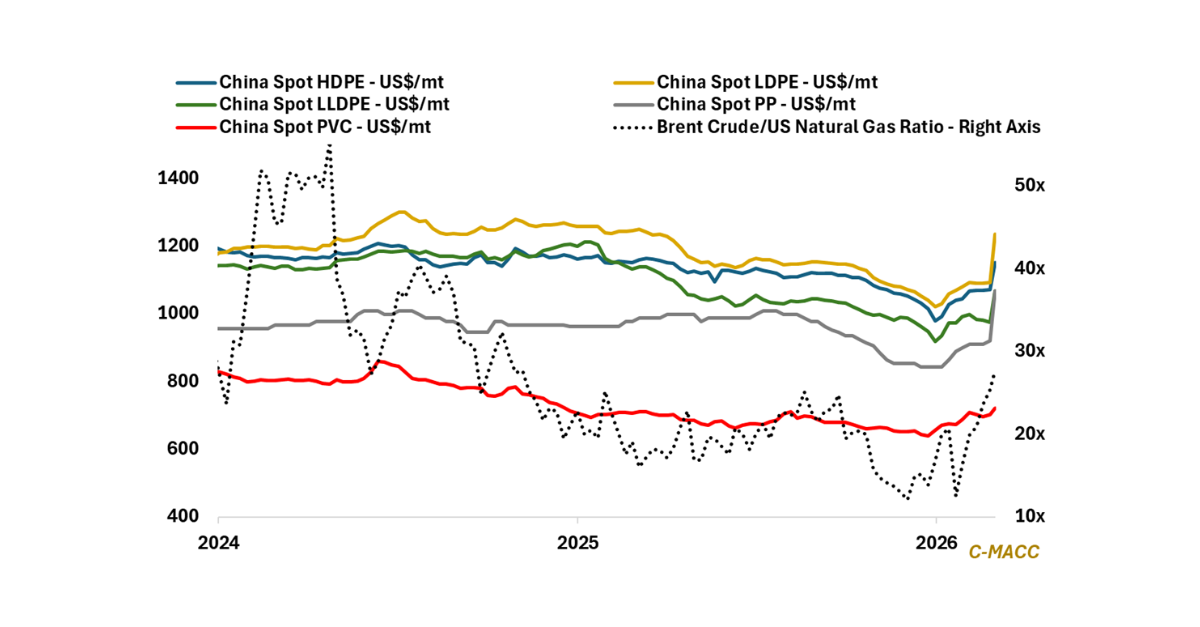

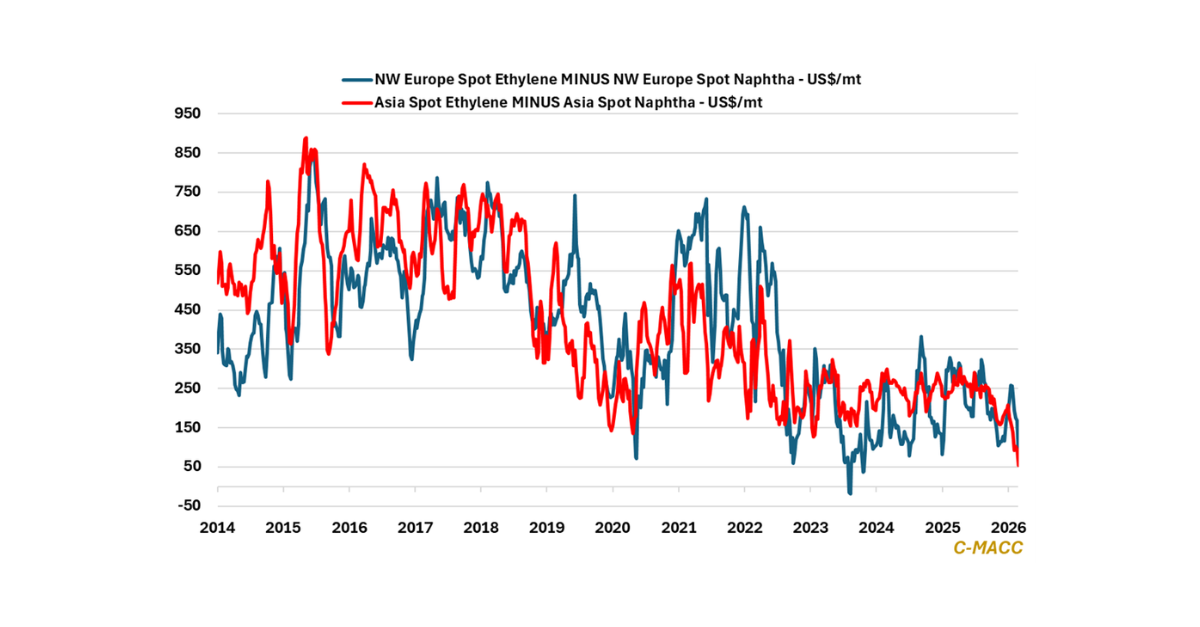

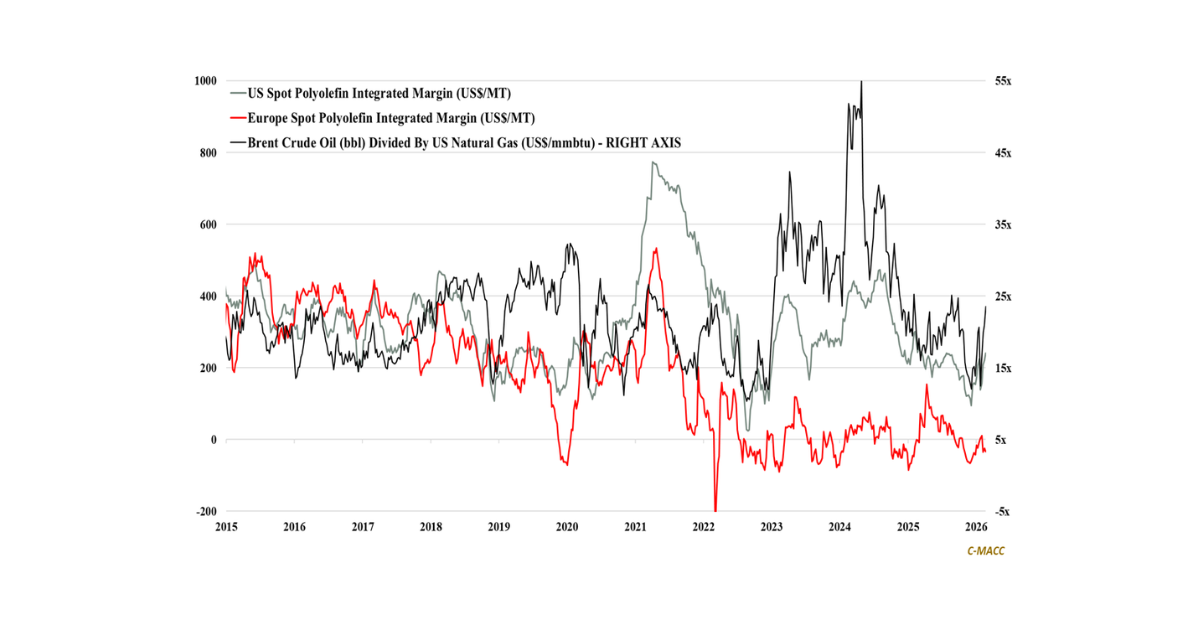

- Early 2026 commodity chemical margins reflect stabilization rather than a durable rebound, though intensive restructuring and self-help curb downside risk despite slow growth and persistent oversupply.

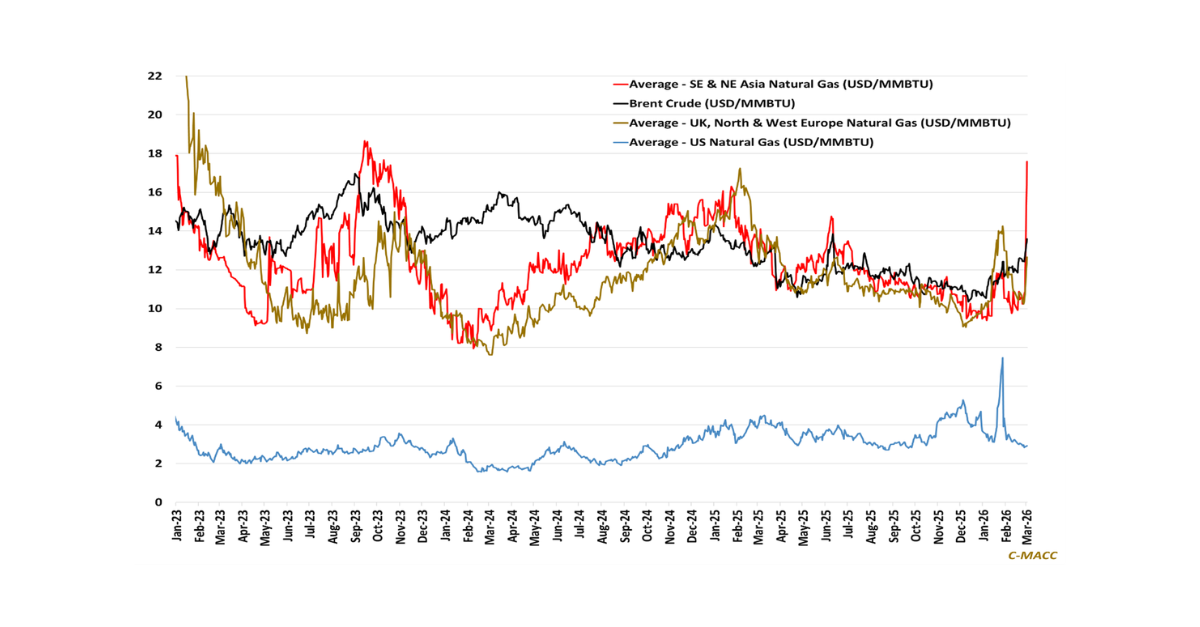

- Capital is rotating from aspirational hydrogen optionality toward bankable reliability, exposing risk to non-integrated assets as feedstock volatility elevates hurdle rates and performance dispersion.

- Differentiation and regional cost curves increasingly drive returns, as polyolefin premia persistence and ammonia margin dispersion show cycles reward execution, integration, and capital discipline.

- Otherwise, structural oversupply, feedstock volatility, logistics control, policy cost shifts, and downstream mix changes are reshaping margins and return profiles; are strategies aligned to execute through 2026?

- Companies Mentioned: LyondellBasell, Dow, ExxonMobil, Cummins, Bloom Energy, Enterprise Products, MPLX, Phillips 66, Borouge, CF Industries, Nutrien, Lotte Chemical, LG Chem, OMV, Shell, Chevron Phillips Chemical (CP Chem), Chevron, Amcor, PepsiCo, Procter & Gamble, Maersk, Hapag-Lloyd

- Products Mentioned: Propylene, Polypropylene (PP), Ammonia, Natural Gas, NGLs, Ethane, LPG, LNG, Hydrogen

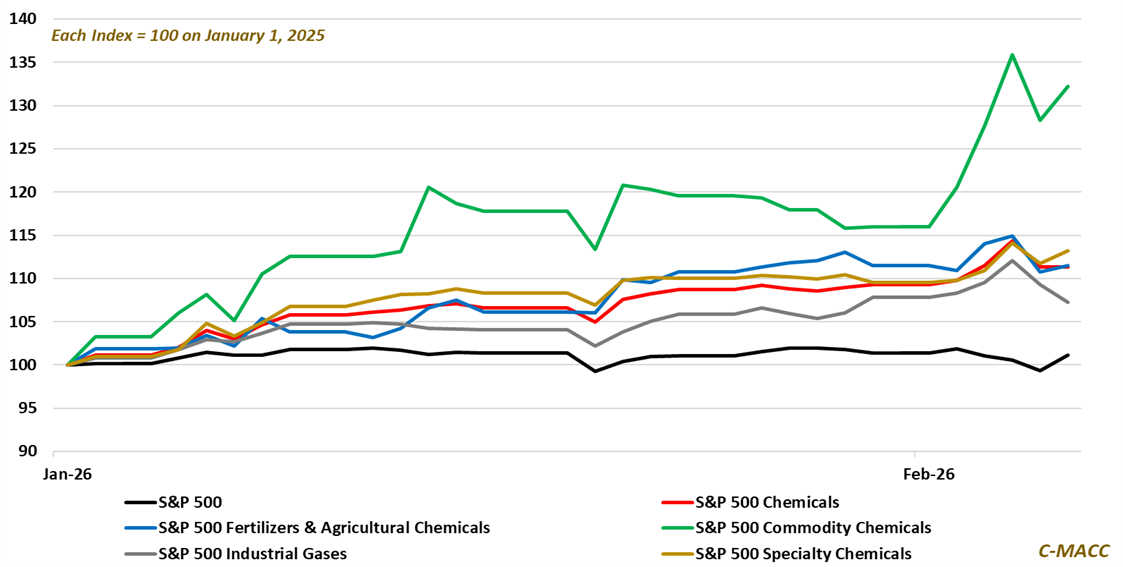

Exhibit 1: US commodity chemical equities reprice structural change despite persistent sector pessimism.

Source: Bloomberg, C-MACC Analysis, February 2026

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!