Base Chemical Global Analysis

Global Weekly Catalyst No. 317

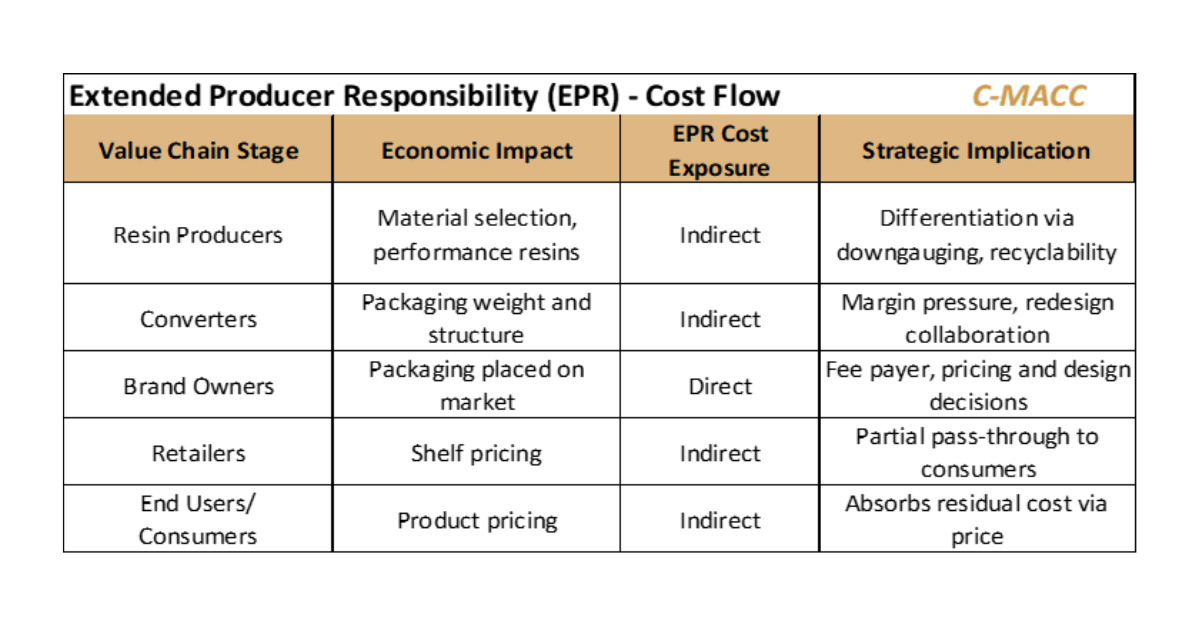

- General Thoughts: Global chemical markets are fragmenting across feedstocks, chemicals, and fuels, rewarding logistics, integration, and discipline, while exposing structurally misaligned assets to prolonged margin erosion.

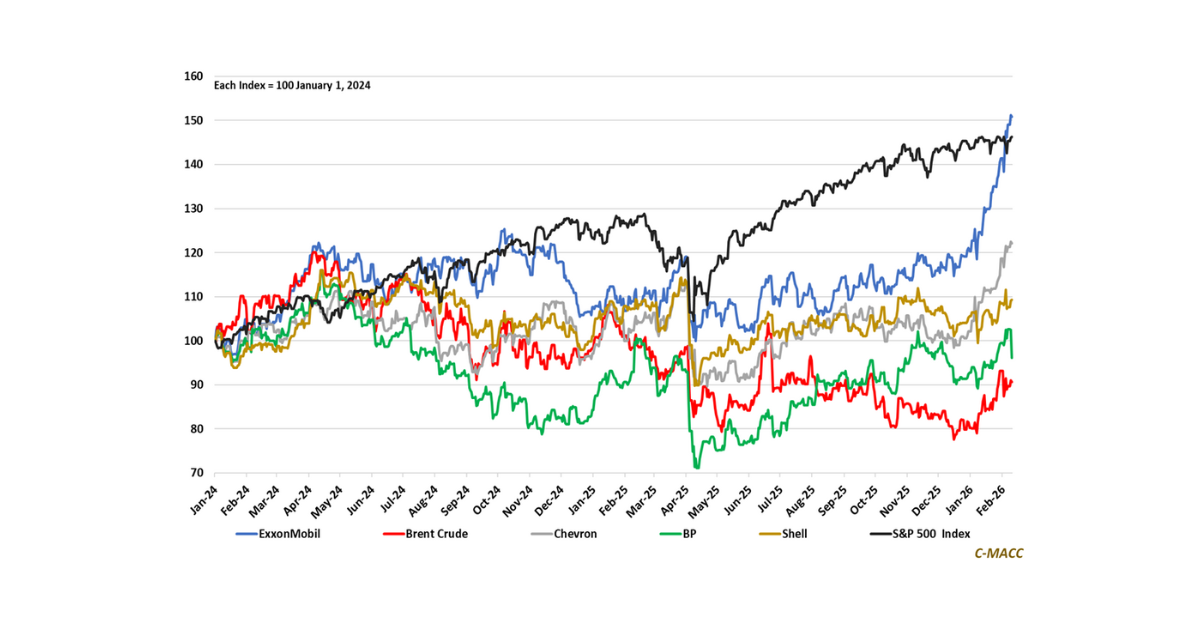

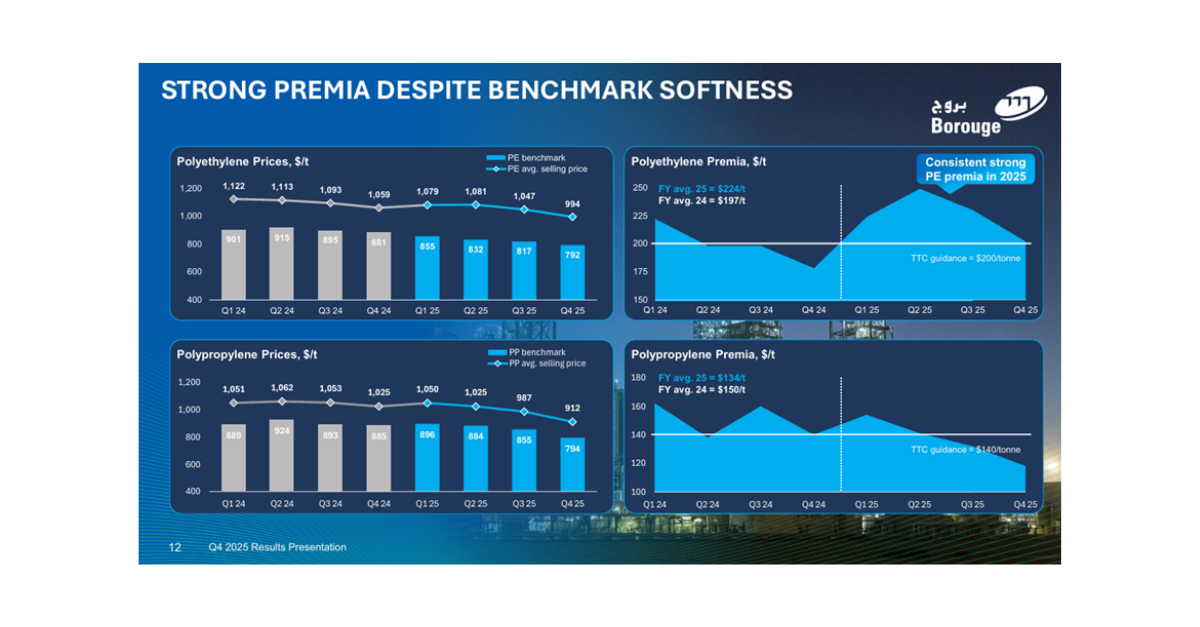

- Feedstocks & Energy: Diverging crude and natural gas prices are reopening regional feedstock wedges, reinforcing US and ME cost advantages while accelerating capacity rationalization and competitive dispersion.

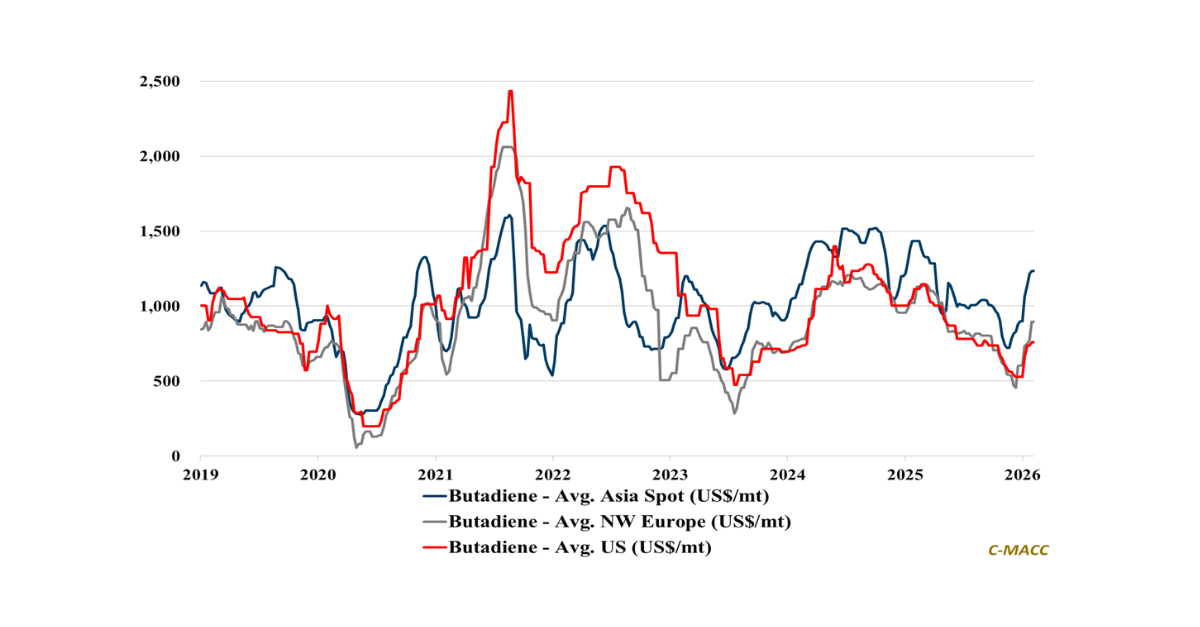

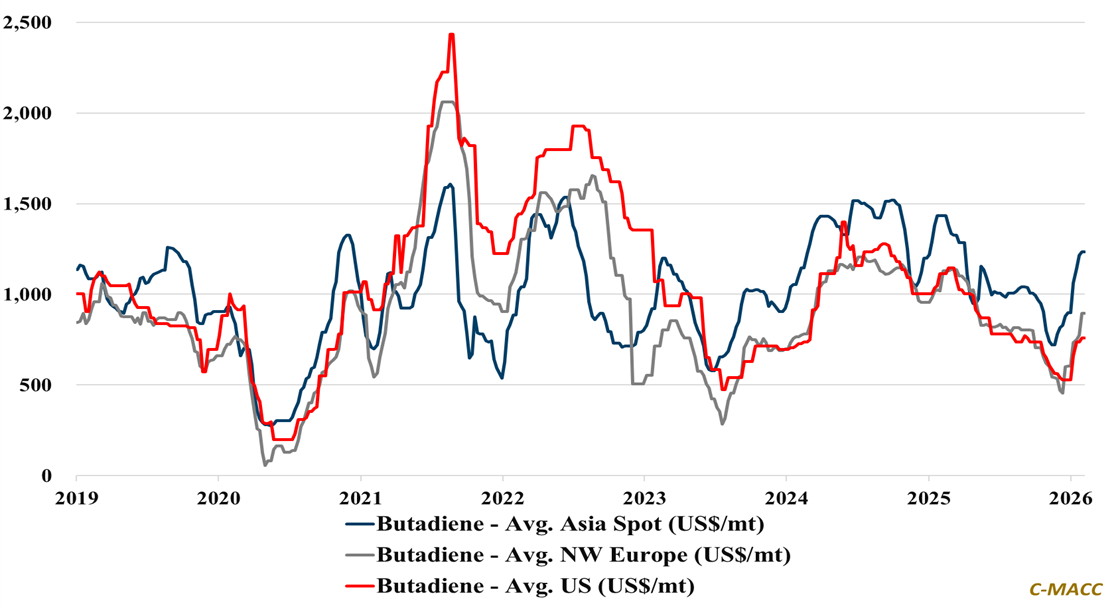

- Olefins: Global olefin markets tighten unevenly, with propylene and butadiene driven by outages and restructuring. At the same time, ethylene remains constrained by lingering global structural oversupply.

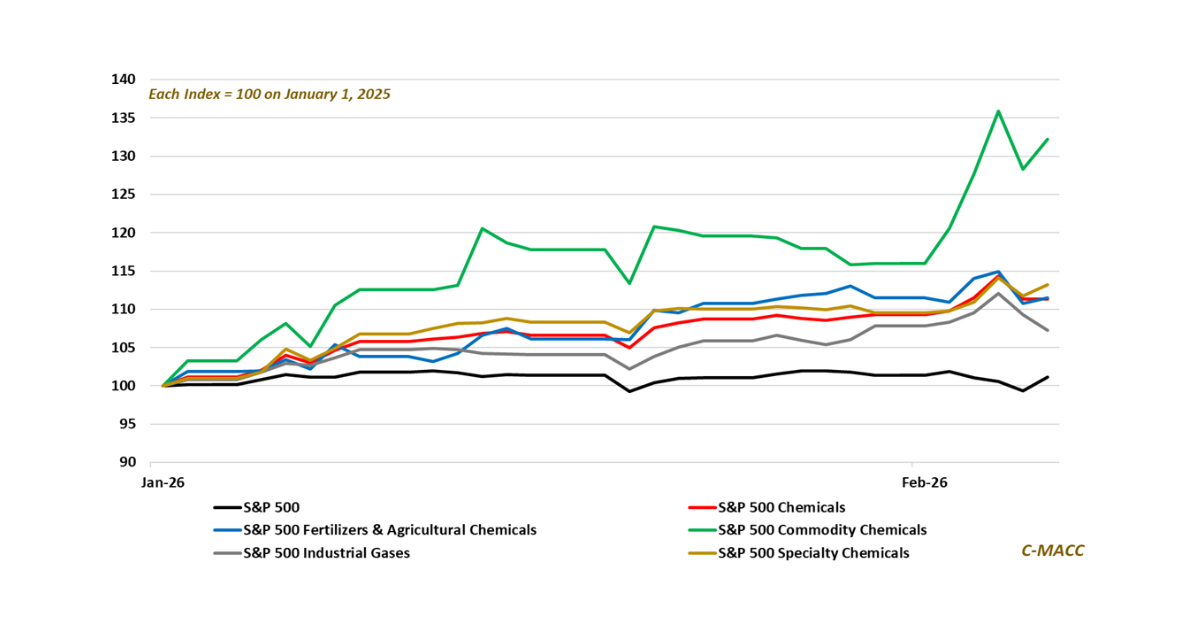

- Other Base Chemicals: Intermediates diverge as logistics, power, and balances drive selective pricing, lifting methanol and benzene regionally, while chlor-alkali rewards disciplined, integrated players amid tepid demand.

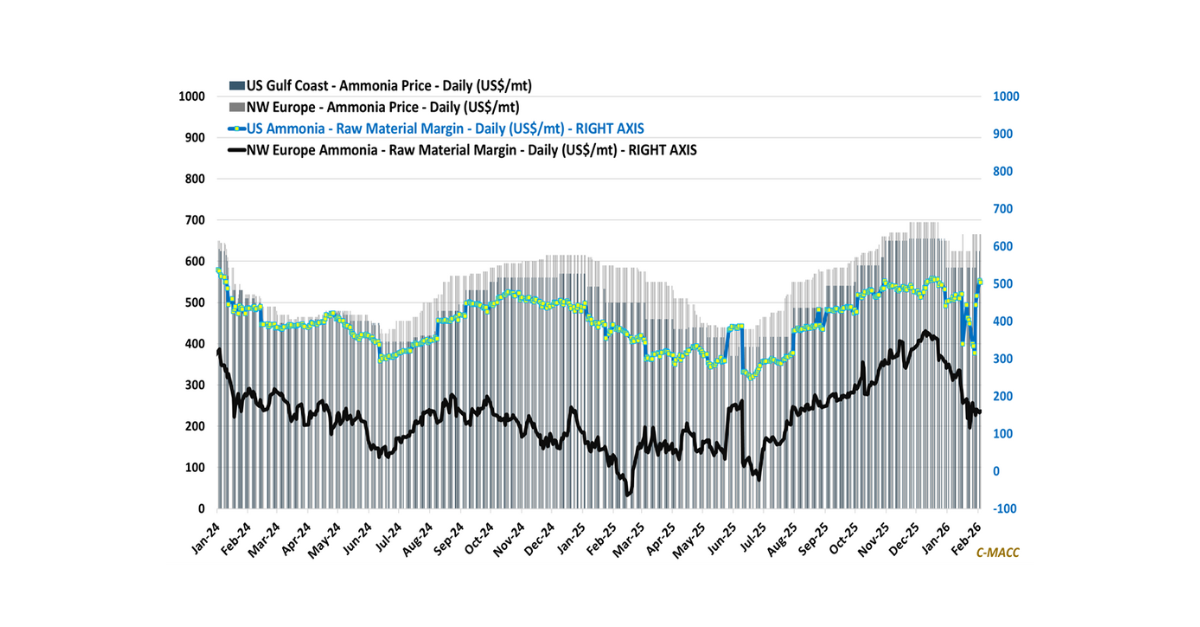

- Agriculture: Ammonia pricing remains basis-driven, with stable global ports, weaker North America, easing gas costs, and logistics-driven spreads favoring disciplined suppliers despite end-user affordability constraints.

- Refining & Biofuels: US refining margins stabilize as winter fades, while ethanol margins turn negative on price-cost pressure, leaving disciplined operations, exports, and policy execution as the primary profit drivers.

Exhibit 1 – Chart of the Day: Global butadiene prices rebound sharply from 4Q25 lows as regional cycles diverge.

Source: Bloomberg, C-MACC Estimates, February 2026

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!