Global Market Analysis

Show Me the Cash Flow: Capital Dumps the Story, Buys the Structure

Key Findings

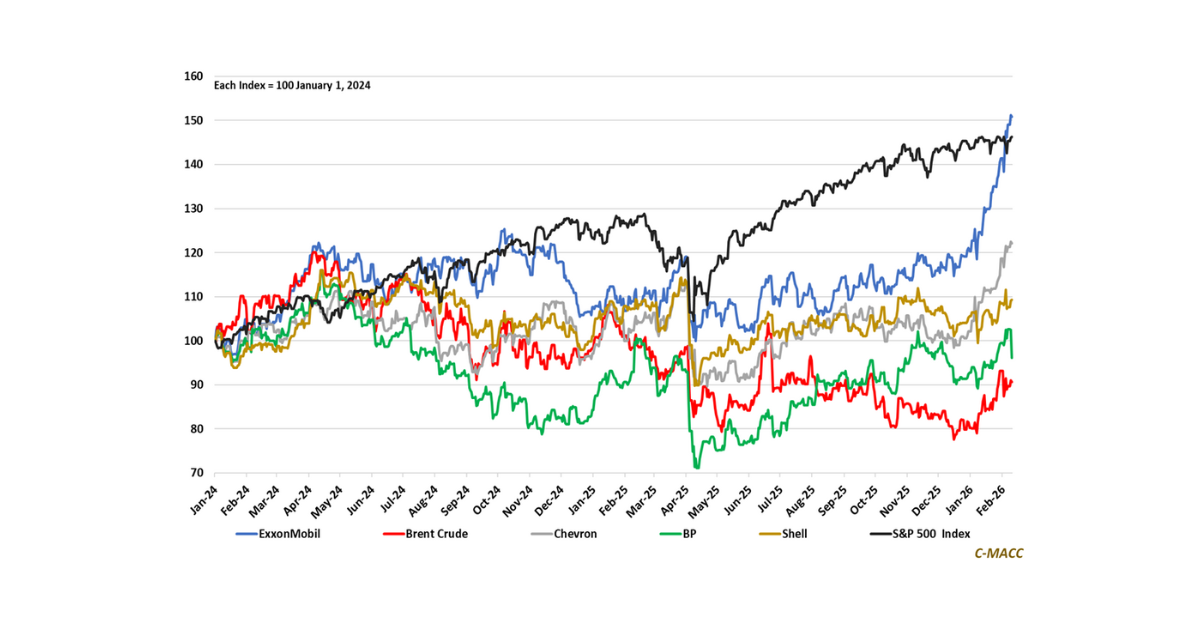

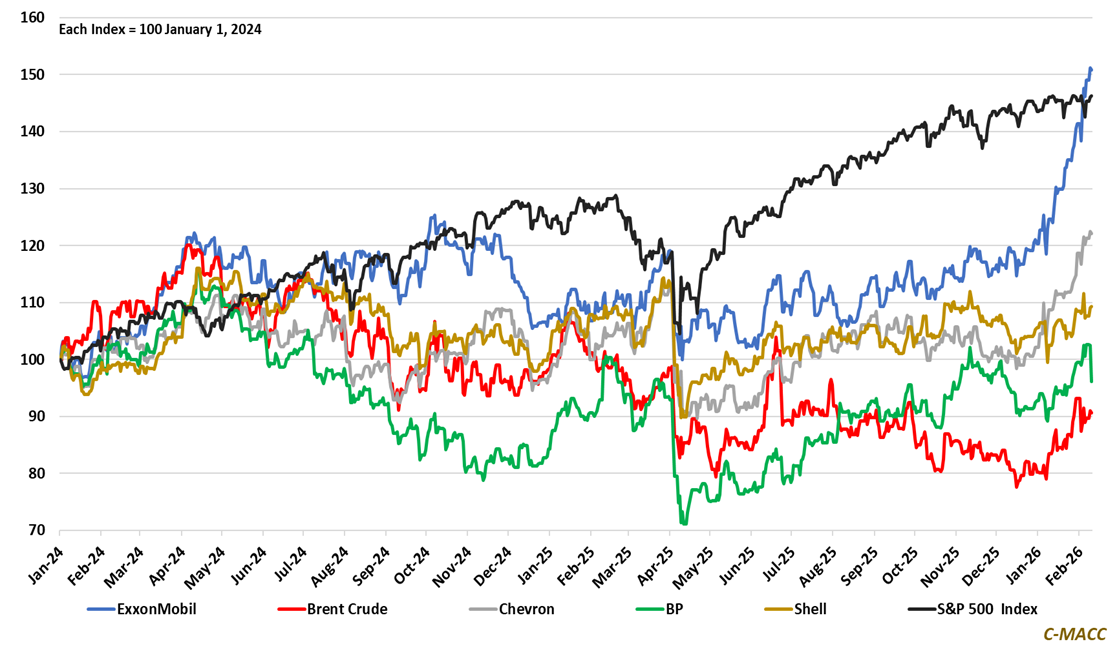

- General Thoughts: ExxonMobil’s outperformance shows markets reward relatively clearer return profiles and capital discipline, a lesson chemicals and industrial players must heed as volatility tests confidence.

- Supply Chain/Commodities: Regional methanol divergence is forcing global acetyls pricing discipline, making Kuraray’s 2HFY26 recovery dependent on execution, mix, and capacity control rather than demand recovery.

- Energy/Upstream: BP’s buyback pause reflects a deliberate reset toward balance sheet durability and reinvestment optionality, seeking to close structural gaps with peers as markets reprice return resilience.

- Sustainability/Energy Transition: US ethanol margins are resetting before policy stabilizes, making 2026 outcomes decisively hinge on blending economics, corn costs, carbon monetization, and logistics execution.

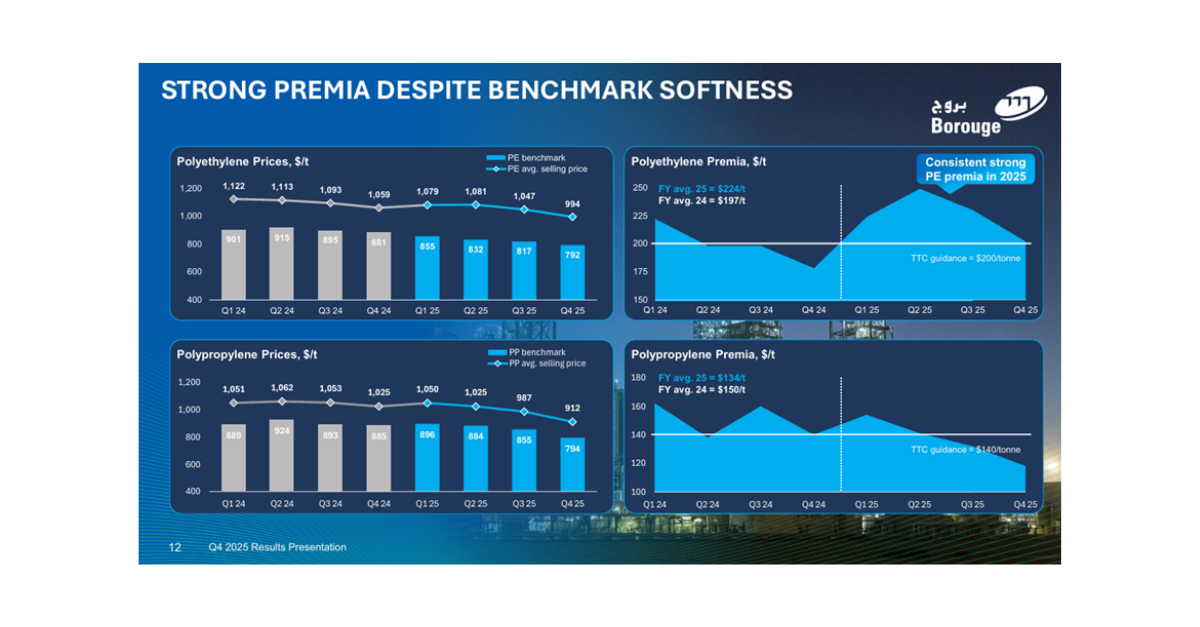

- Downstream/Other Chemicals: Soybean price strength reflects trade leverage and balance tightness, but corn demand certainty anchors most swing acreage, shaping 2026 planting intentions and input strategies.

Exhibit 1: Equity markets reward return clarity and reinvestment discipline as ExxonMobil outperforms BP.

Source: Bloomberg, C-MACC Analysis, February 2026

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!