Global Market Analysis

Something In The Orange: Are Nitrogen Bulls Ignoring The Corn Belt Warning Light?

Key Findings

- General Thoughts: Nitrogen’s outlook hinges on acreage elasticity, not ammonia rhetoric: a corn-to-soy shift could reset demand, pricing power, and capital discipline, especially if low-carbon demand disappoints.

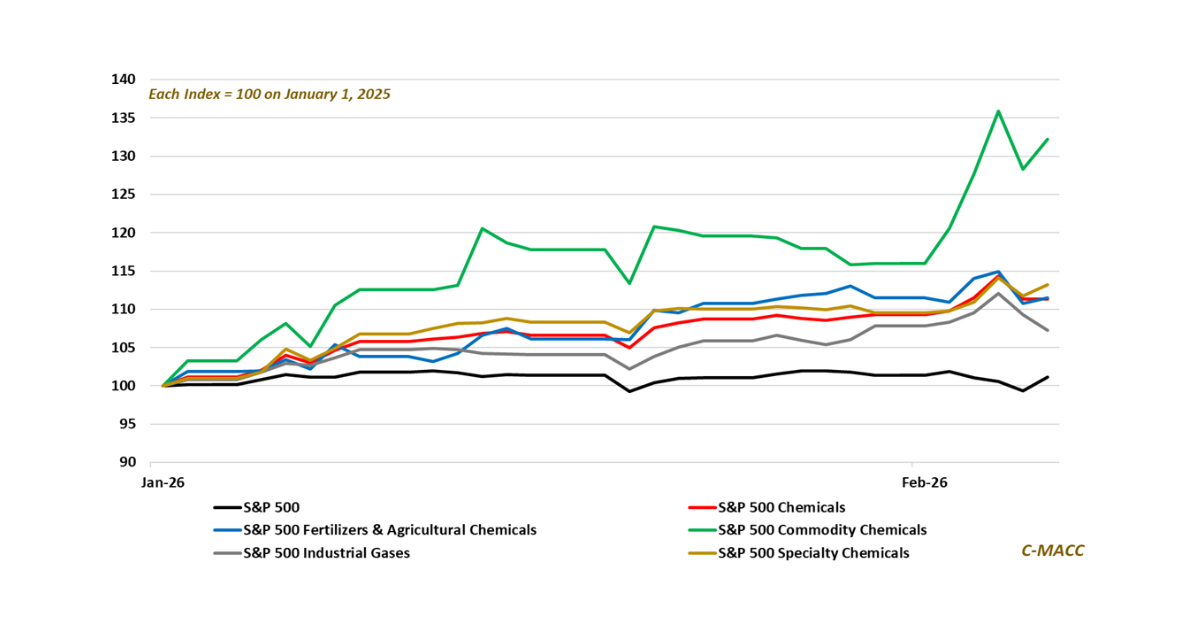

- Supply Chain/Commodities: Elevated nitrogen prices are triggering short-cycle supply responses that may reset seaborne benchmarks, as logistics and policy frictions sustain inland premiums and earnings dispersion.

- Energy/Upstream: Structural Henry Hub–TTF spreads anchor ammonia cost curves today, but incremental LNG supply could compress differentials, shifting advantage toward integration and feedstock optionality.

- Sustainability/Energy Transition: Low-carbon ammonia economics hinge on contracts, certification, and policy durability, shifting advantage toward integrated players with routing flexibility and strong financials.

- Downstream/Other Chemicals: Flat acreage and demographic growth anchor nitrogen intensity, yet weak crop margins, precision efficiency, acreage elasticity, and carbon volatility risk mispricing future demand.

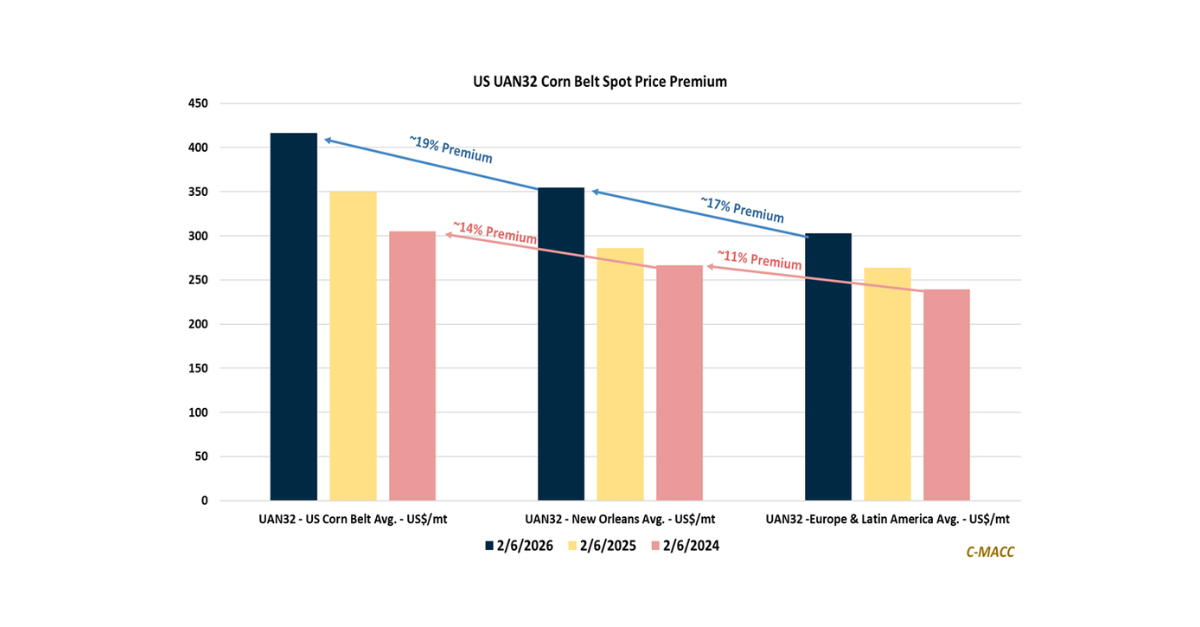

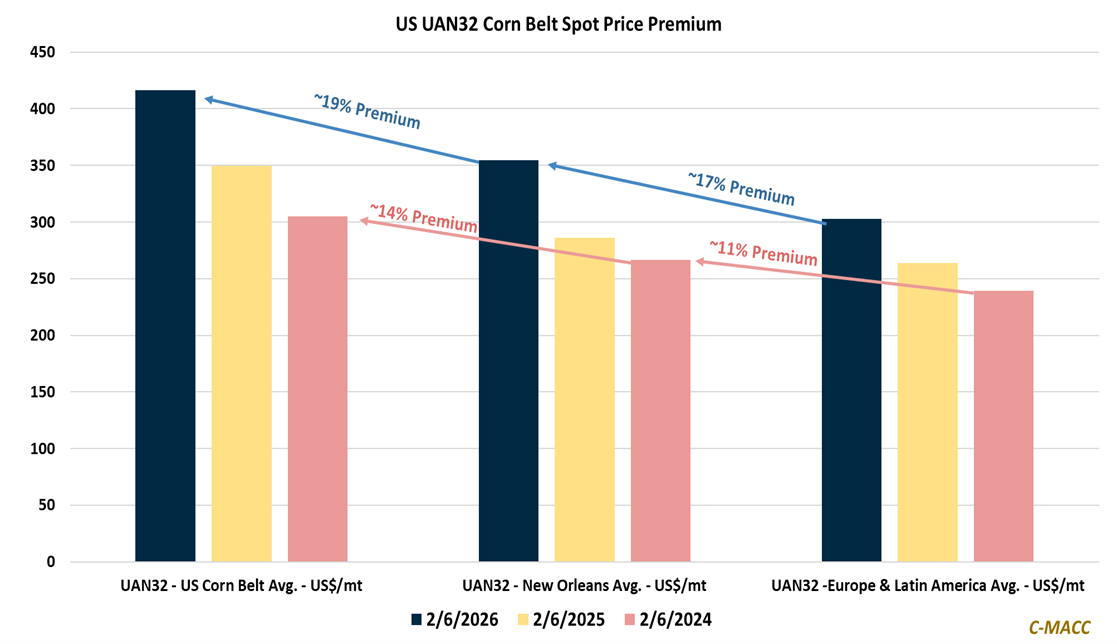

Exhibit 1: US corn belt UAN32 price premium persists, prolonging farmers’ nitrogen fertilizer cost shock in 2026.

Source: Bloomberg, C-MACC Analysis, February 2026

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!