C-MACC Sunday Executive Summary

Against All Odds: When Signals Fade, Errors Compound

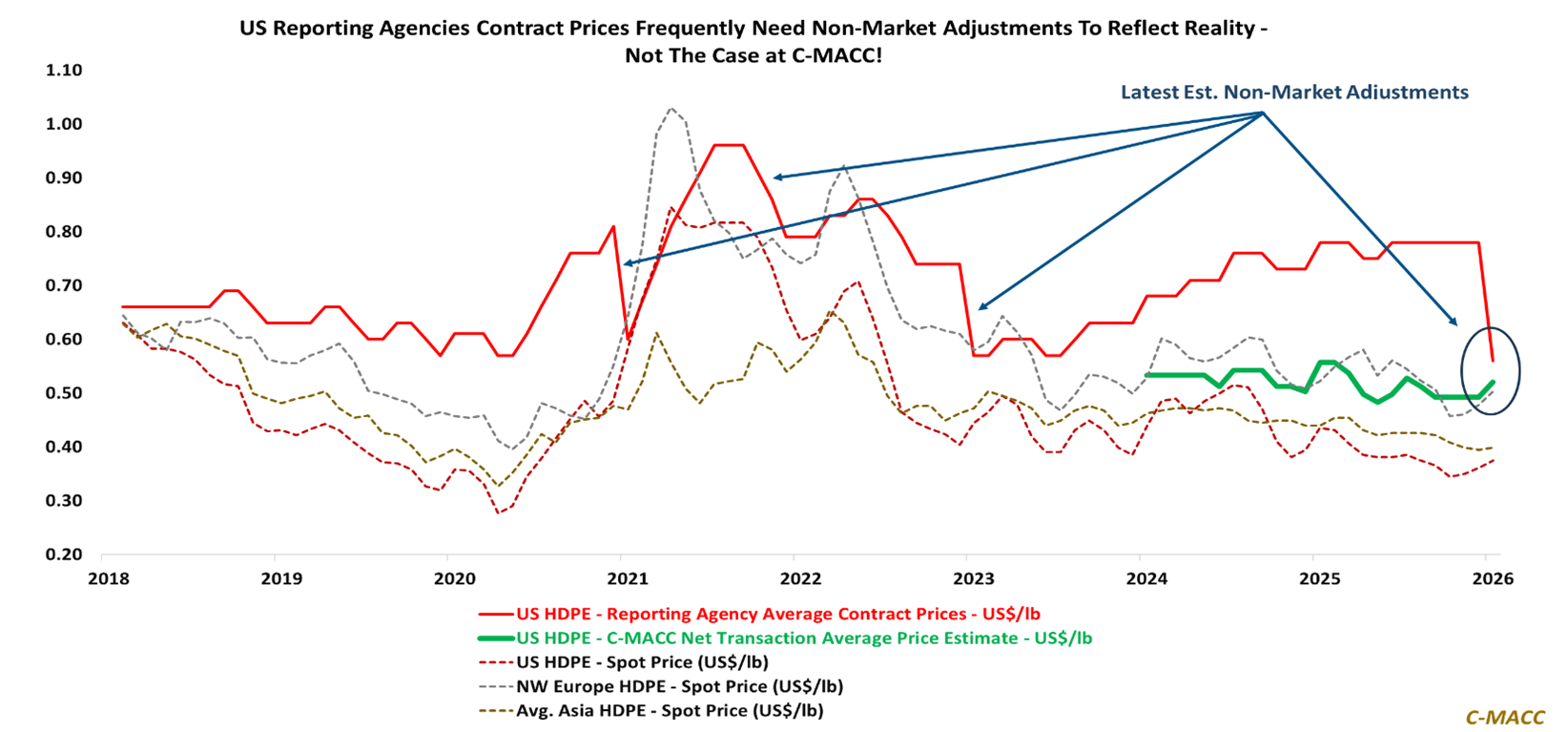

- Are you underwriting capital and pricing decisions using benchmarks that periodically reset to reflect reality, or real-time intelligence that recalibrates risk before global and regional markets reprice your return profile?

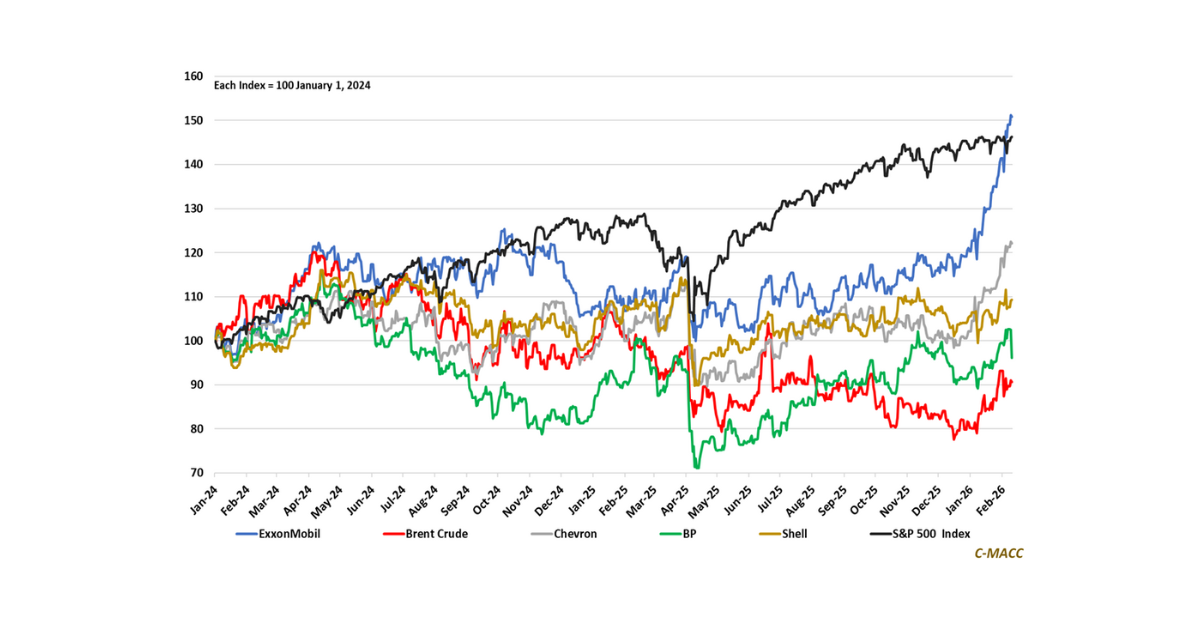

- Weak commodity chemical equity performance reflects feedstock convergence, structural oversupply, trade frictions, and policy recalibration reshaping cost curves and returns, not simply managerial misjudgment.

- ExxonMobil’s outperformance demonstrates how explicit hurdle rates, disciplined reinvestment sequencing, and integrated optionality command valuation premiums as markets increasingly reward return credibility.

- Ammonia producers linking elevated prices to steep global production cost curves and low-carbon trade flows risk underestimating agricultural demand and acreage elasticity that can significantly swing volume.

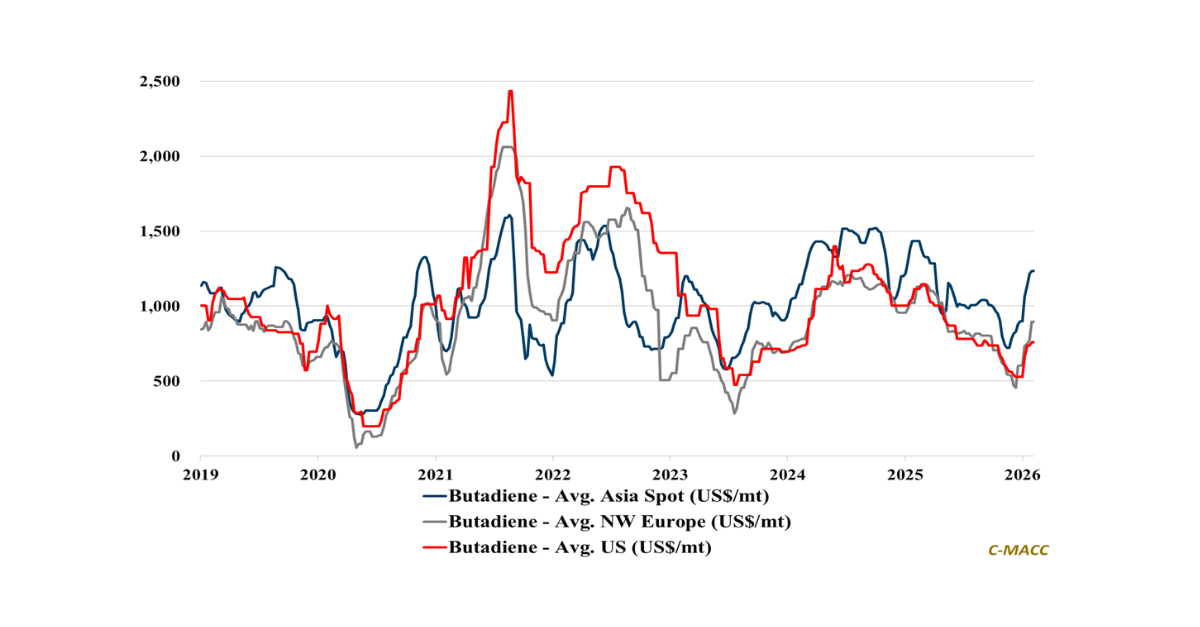

- Otherwise, regional methanol divergence, nitrogen supply elasticity, and grid backlog repricing are materially reshaping capital allocation frameworks, return durability estimates, and reinvestment discipline.

- Companies Mentioned: Kuraray, Celanese, Wacker Chemie, INEOS, Methanex, OCI, Proman, Yara, Fertiglobe, CF Industries, Nutrien, LSB Industries, ExxonMobil, BP, Shell, Chevron, TotalEnergies, Green Plains, The Andersons, Siemens Energy, GE Vernova, Mitsubishi Power, Ansaldo Energia, Hitachi Energy, ABB, Eaton, Schneider Electric, Doosan Enerbility, Rolls-Royce, Woodside, Corteva, ADM, Bunge

- Products Mentioned: Polyethylene, Methanol, Acetic Acid, Vinyl Acetate, VAM, Nitrogen, Ammonia, Urea, UAN32, Phosphates, Sulfur, Natural Gas, LNG, Oil, Corn, Soybeans, Ethanol, Carbon, Electricity, Hydrogen

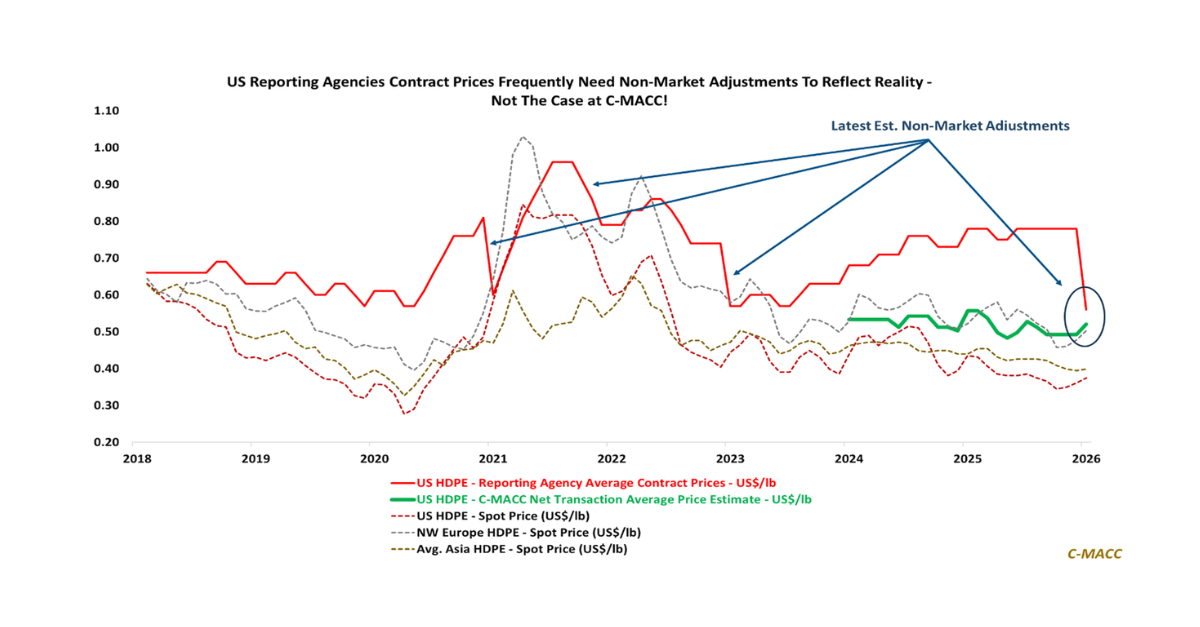

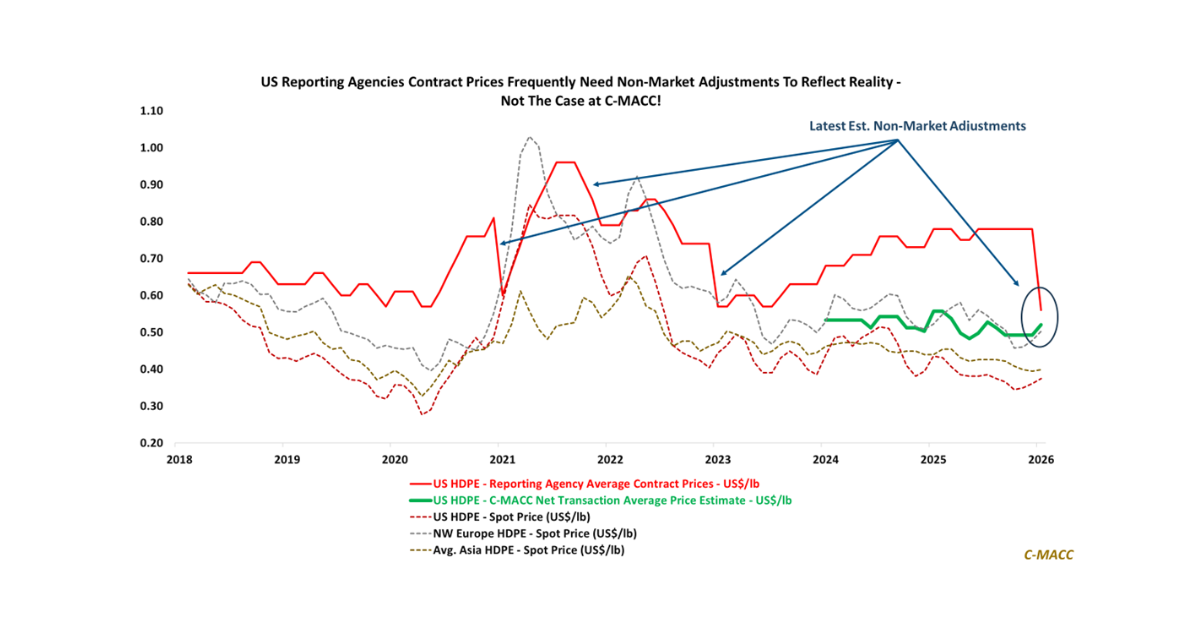

Exhibit 1: Recurring non-market adjustments (NMAs) in US PE prices reveal gaps between benchmarks and reality.

Source: Bloomberg, C-MACC Estimates, February 2026

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!