Base Chemical Global Analysis

Global Weekly Catalyst No. 318

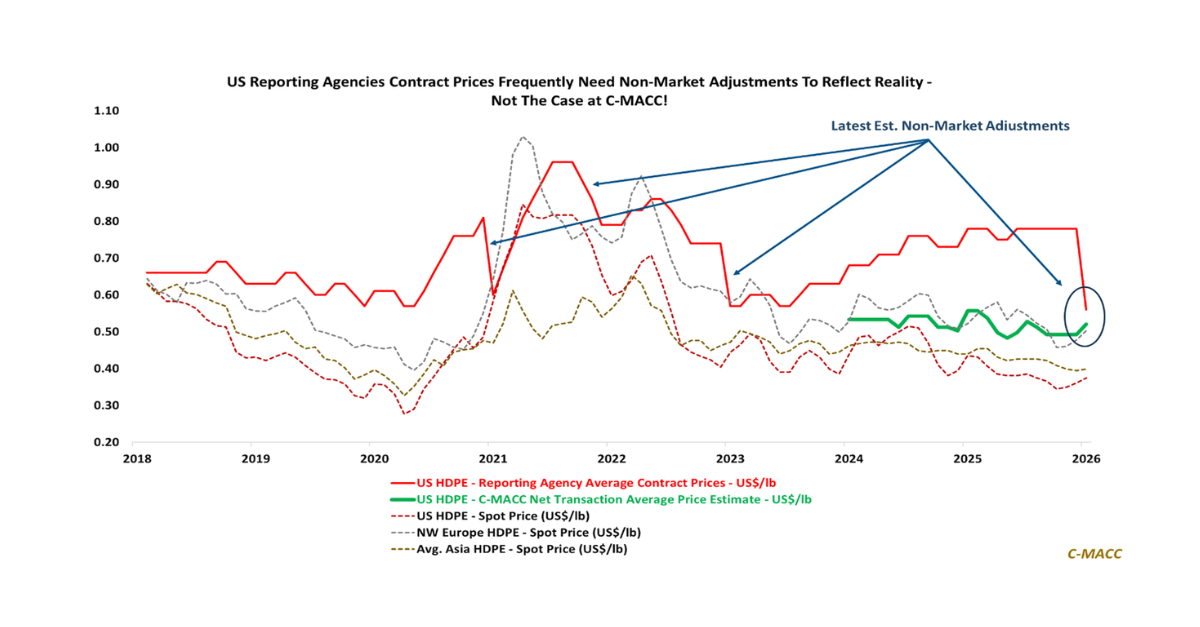

- General Thoughts: Structural global base chemical oversupply delays synchronization, leaving 2026 margins governed by feedstock dispersion, logistics control, and disciplined utilization rather than demand recovery.

- Feedstocks & Energy: Crude firmness versus easing gas widens cost dispersion, sustaining regional chemical bifurcation as export-anchored NGL flows prevent cost deflation and reinforce structural margin divergence.

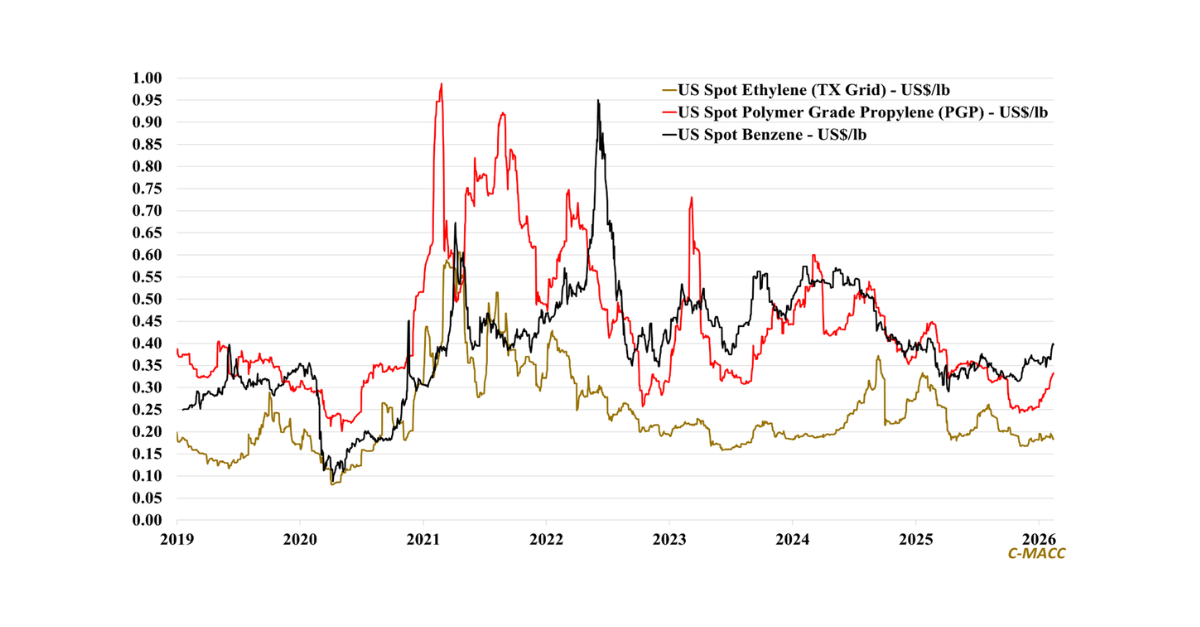

- Olefins: Global ethylene markets remain structurally long, and propylene and C4 tightness reflect greater supply variability, signaling that 2026 rebalancing will hinge on reliability and rationalization rather than demand.

- Other Base Chemicals: Intermediates reprice through logistics and refinery economics, not feedstock relief, favoring integrated operators as Western premiums normalize and power-exposed regions struggle in 2026.

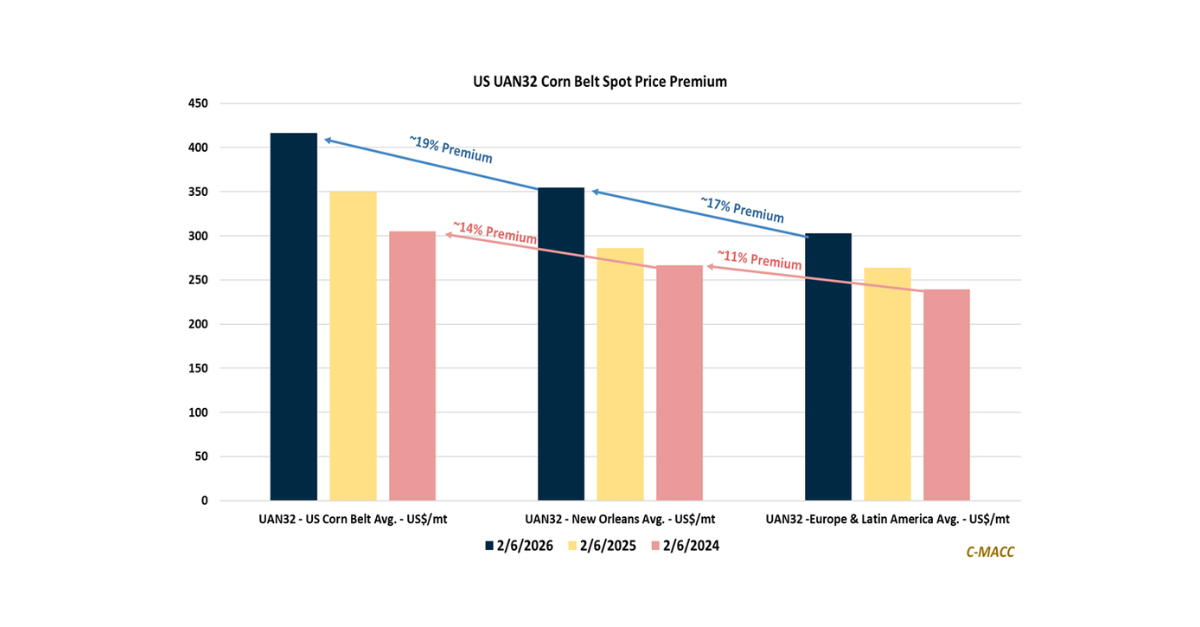

- Agriculture: Global ammonia clears on logistics and gas spreads, not benchmarks, supporting low-cost producers as 2026 volatility centers on basis execution, farmer affordability, and planted acreage decisions.

- Refining & Biofuels: Global refining profits normalize as winter fades and crude markets stabilize, while negative ethanol crush and acreage shifts heighten 2026 sensitivity to policy clarity, export demand, and utilization rates.

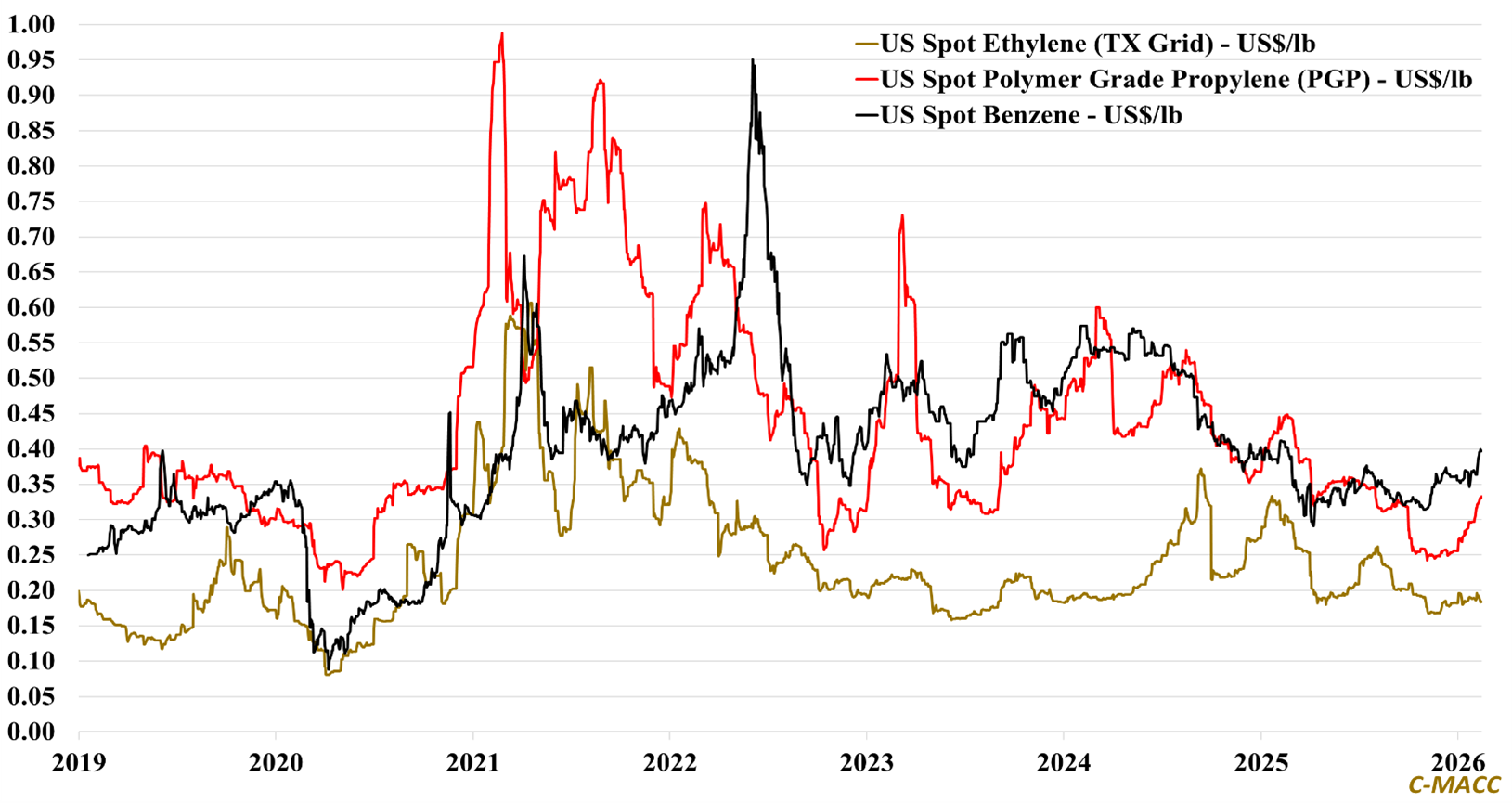

Exhibit 1 – Chart of the Day: US spot propylene and benzene decouple from structurally long ethylene in 1Q26.

Source: Bloomberg, C-MACC Estimates, February 2026

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!