Global Market Analysis

Natural Gas Sets The Margin, Crude Oil Sets The Acre

Key Findings

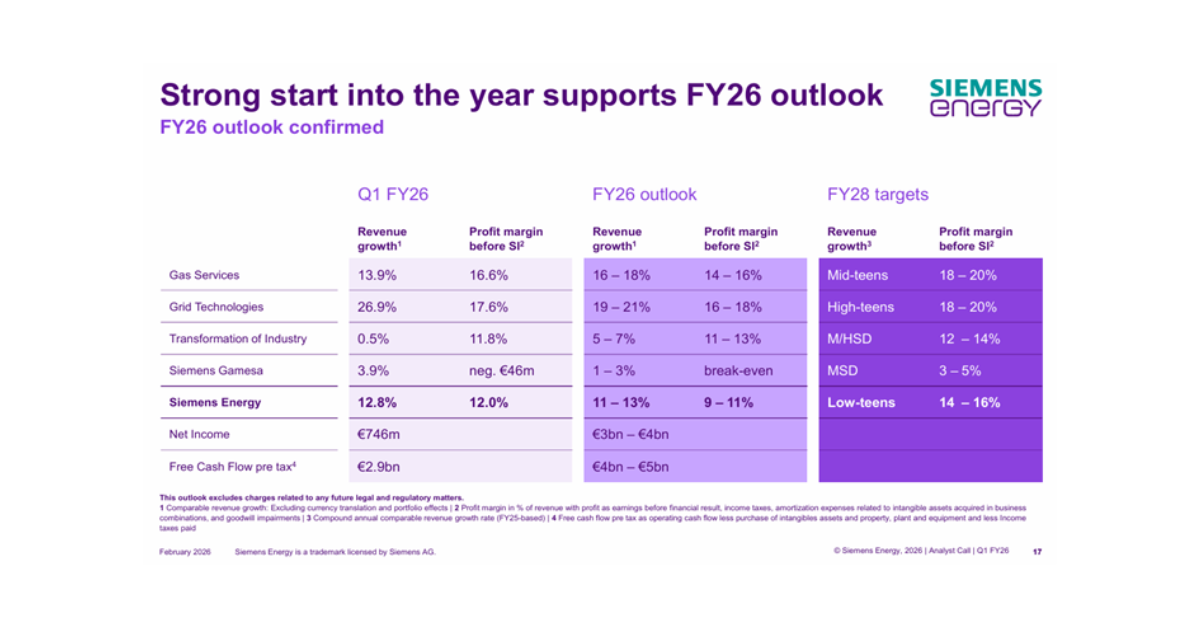

- General Thoughts: Energy-linked corn economics and widening oil–gas dispersion are shifting global marginal cost leadership toward natural gas advantaged, capital-disciplined integrated production platforms globally.

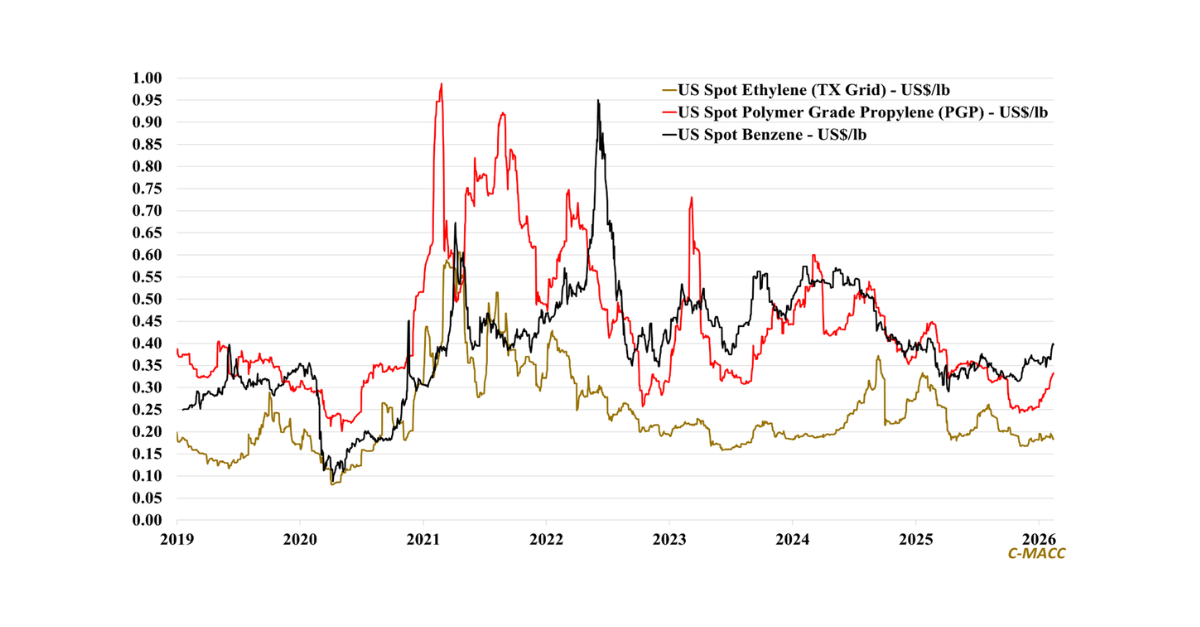

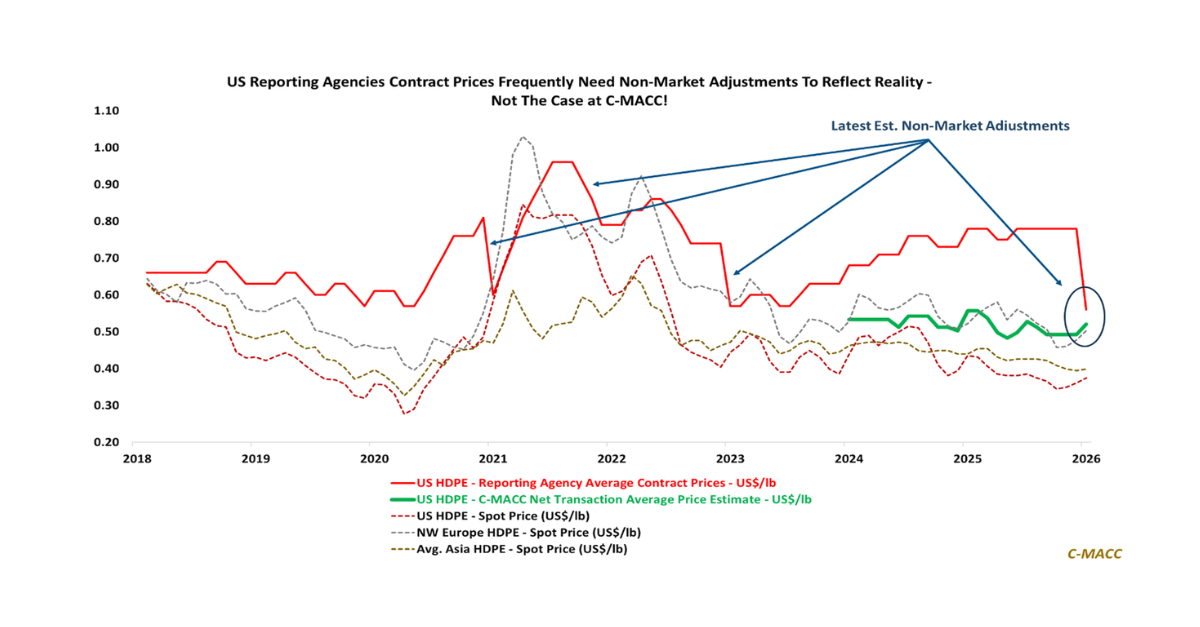

- Supply Chain/Commodities: Rising crude and tightening global capacity sustain benzene pricing strength, favoring integrated aromatics producers while pressuring margins for non-integrated derivative producers.

- Energy/Upstream: Accelerating North American NGL export expansion and sustained oil–gas dispersion increasingly anchor global petrochemical cost curves to shale-linked feedstock and logistics advantages.

- Sustainability/Energy Transition: Diversifying global offtake and higher return thresholds are accelerating blue ammonia scale, while green projects advance selectively under power and financing constraints.

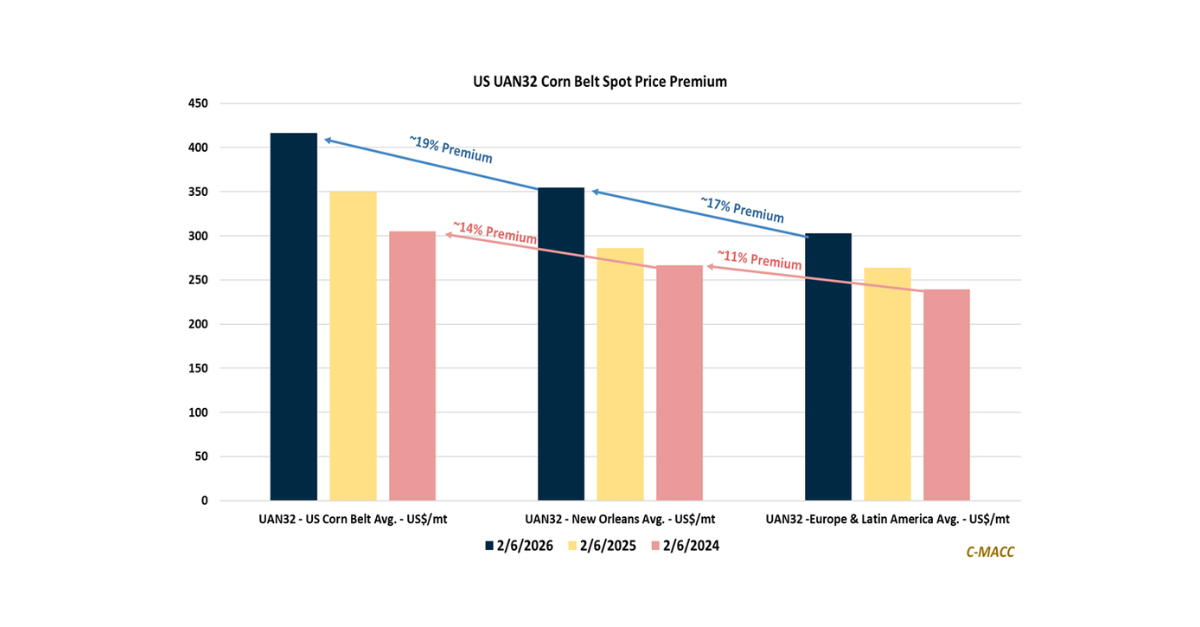

- Downstream/Other Chemicals: Projected 2026 US crop margin improvement disproportionately benefits input suppliers over farmers, reinforcing pricing power and entrenching elevated cost baselines into 2027.

Exhibit 1: Crude oil-corn relationship anchors energy-agriculture feedback loop driving nitrogen demand.

Source: Bloomberg, C-MACC Analysis, February 2026

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!