The Weekly Catalyst

Western Commodity Chemical Margins Reflect Strength WoW Relative To Asia

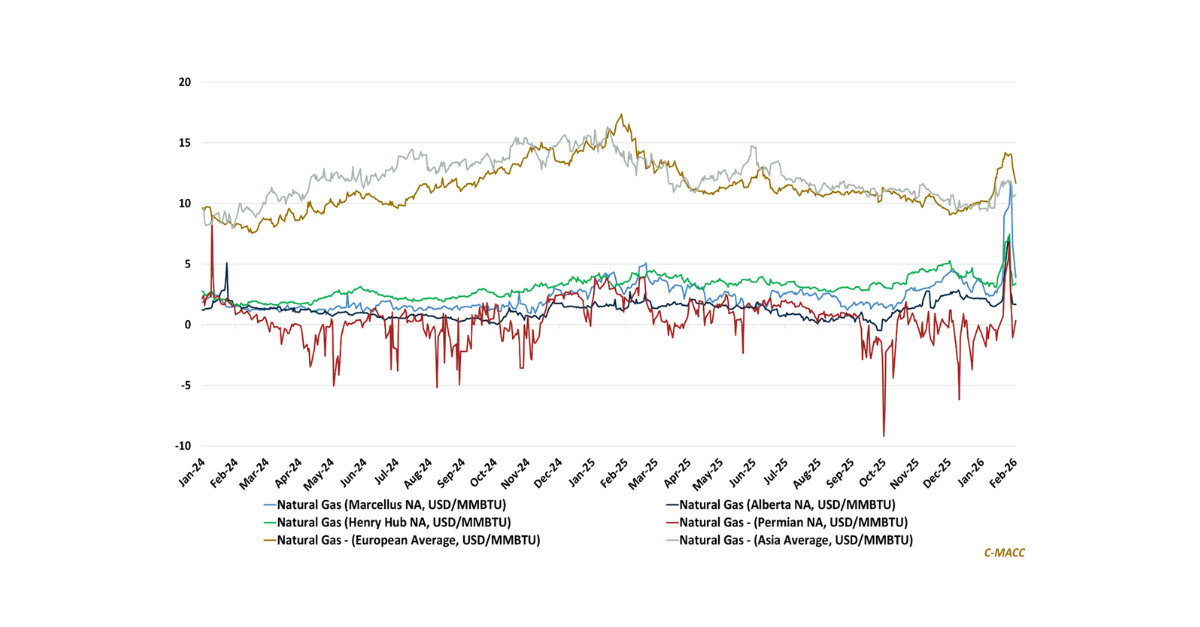

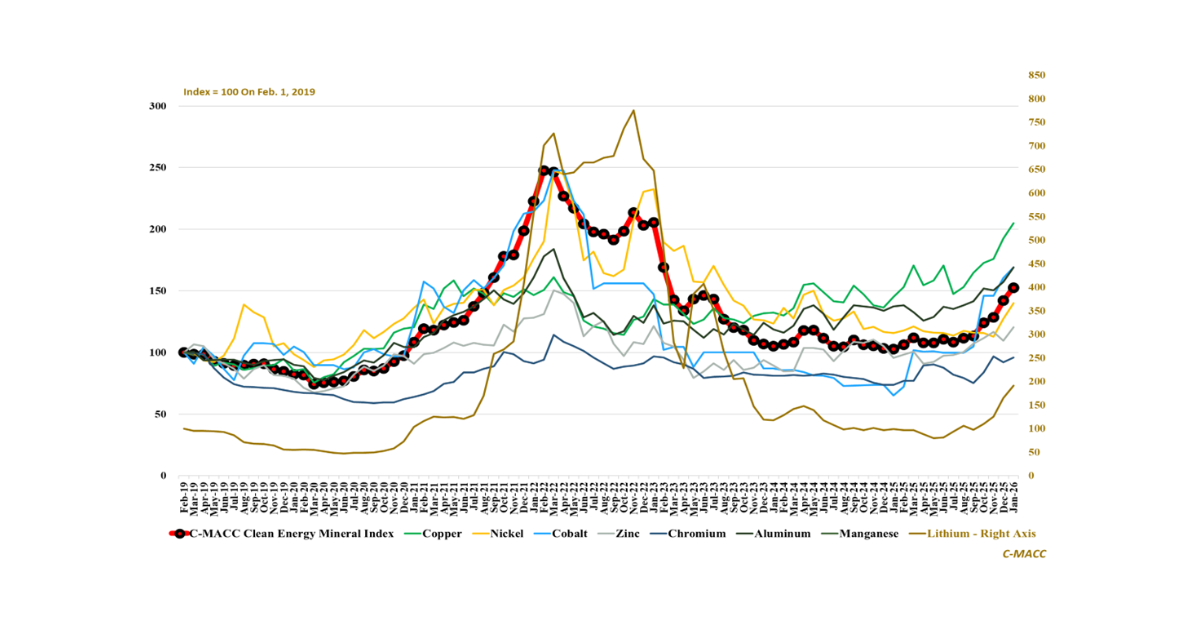

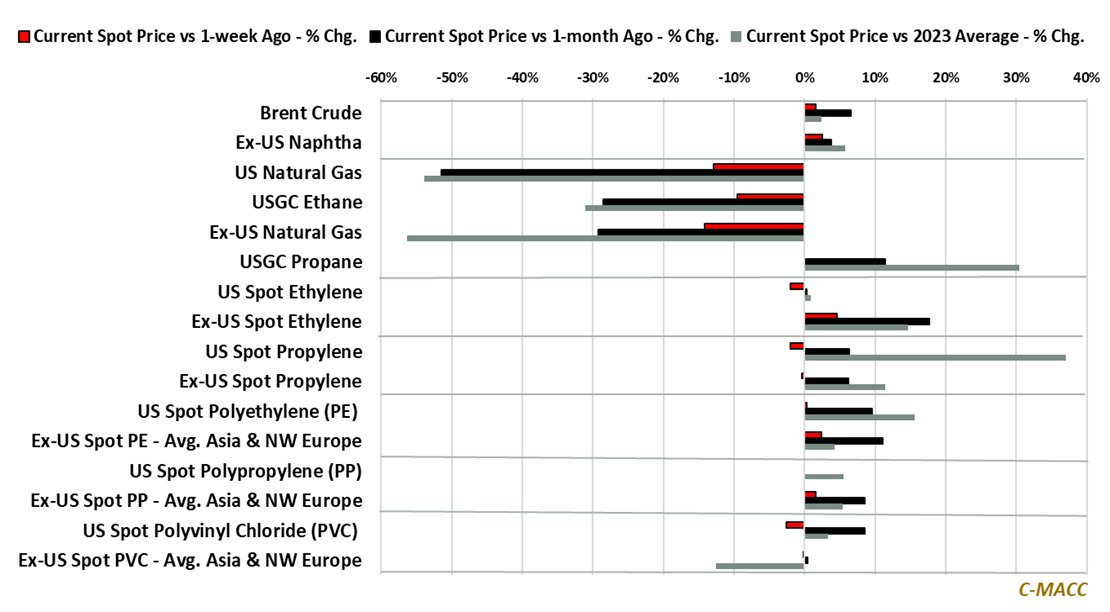

- Feedstock Market Trends: US natural gas and USGC ethane prices slid lower (again) WoW relative to Brent Crude oil and Ex-US naphtha values, broadly benefiting North American ethylene and derivative producers.

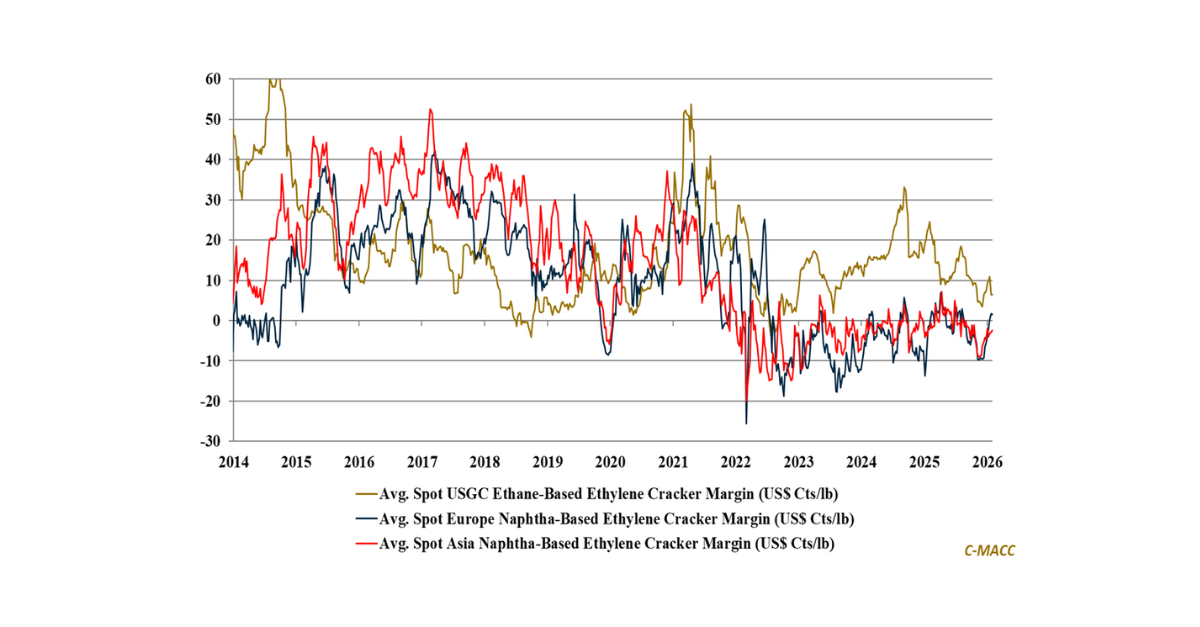

- Chemical Market Trends: NW Europe base chemical prices reflected the most broad-based improvement WoW, pushing NW Europe ethylene production margins positive for the first time in roughly eight months.

- Polymer Market Trends: US integrated spot polyethylene production margins hit a YTD high last week, rebounding to a level last seen in 1H23. Asia polymer margins broadly reflect the greatest weakness WoW.

- Agriculture Market Trends: The Ex-US natural gas price decline WoW led Ex-US ammonia prices lower, and we see this weakness negatively impacting US domestic ammonia prices in 1H24. US Corn prices fell further WoW.

Exhibit 1 – Chart of the Day: Global natural gas prices decreased relative to crude oil and most chemical prices WoW.

Source: Bloomberg, C-MACC Analysis, February 2024

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!