Monthly Update – Agriculture – Daily Chemical Reactions

Don’t Sell The Farm! Crop Market & Farm Input Health Indicators Turn More Constructive

Key Findings

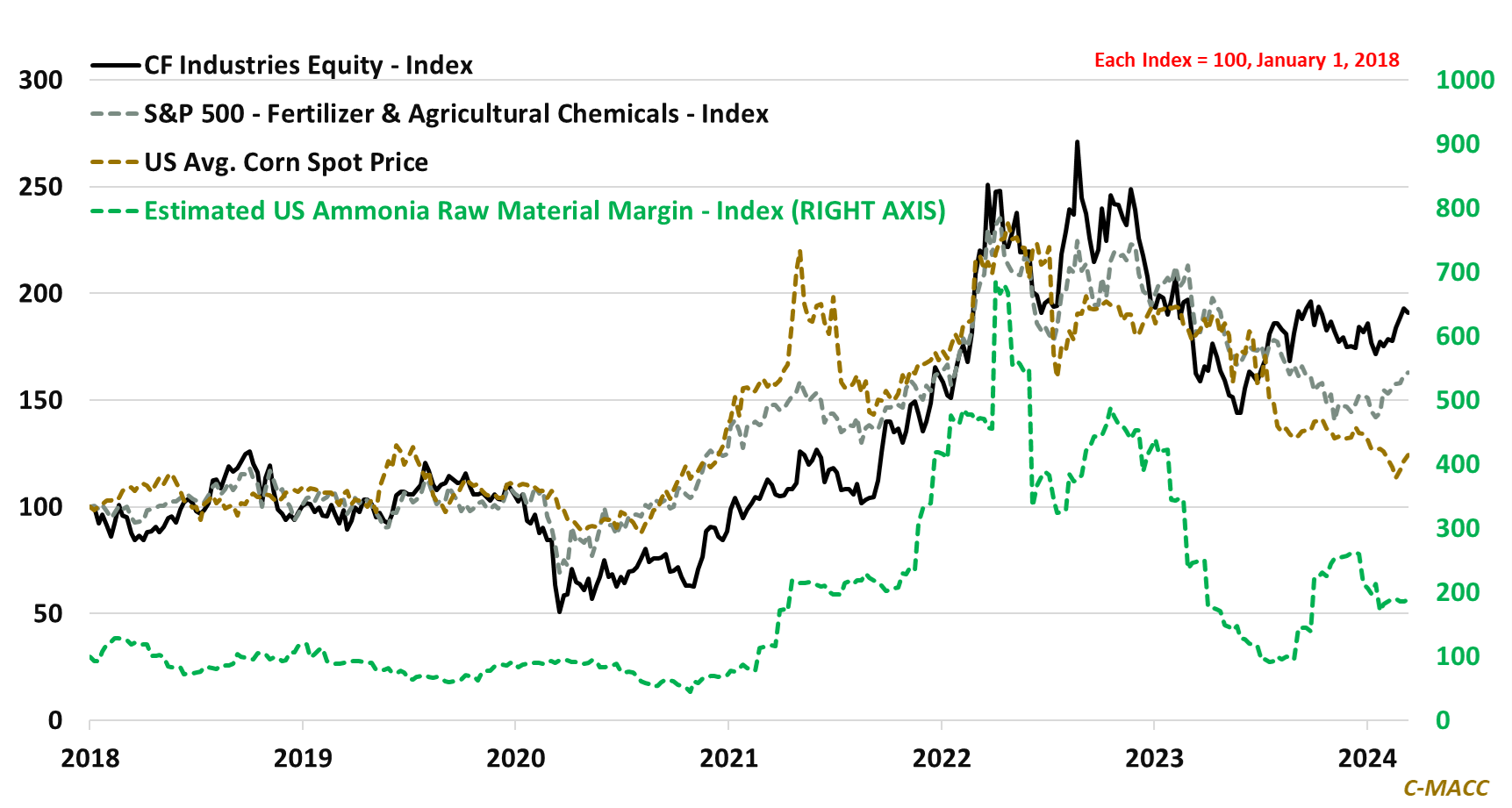

- General Thoughts: Recent crop price strength, following a period of weakness from multi-year highs in 2022, is signaling farmer income may have found a floor, lifting sentiment toward fertilizer & agricultural chemical equities.

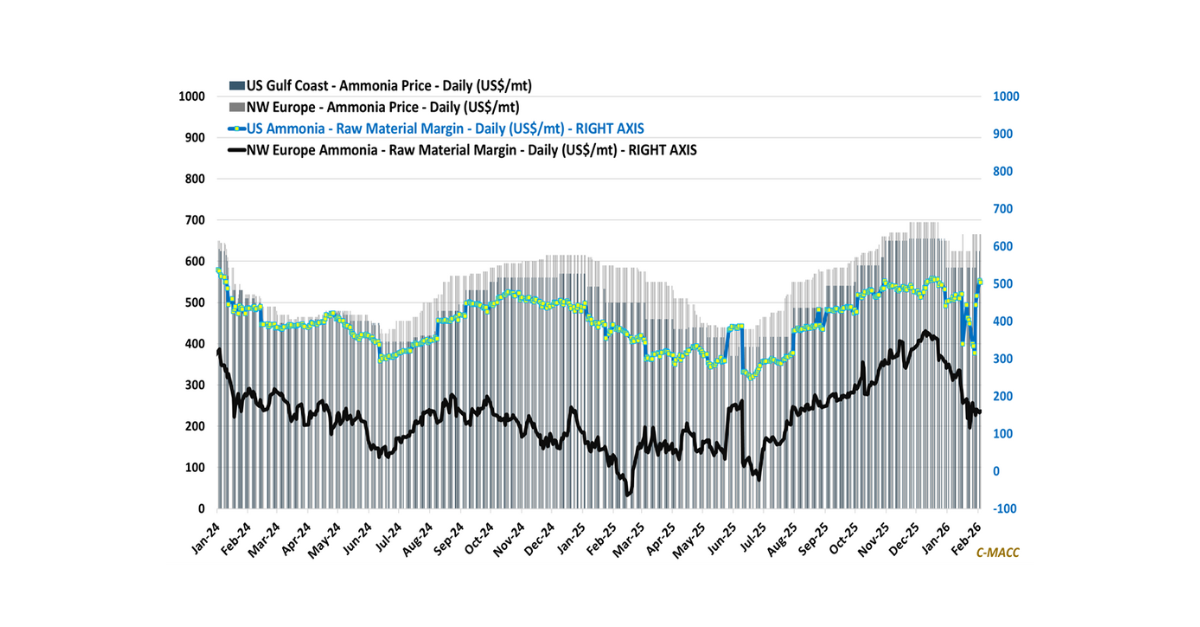

- Supply Chain/Commodities: We discuss recent support in US ammonia production margins relative to European levels, our constructive agriculture market takeaways from CERA, and flag a few notable fertilizer market headlines.

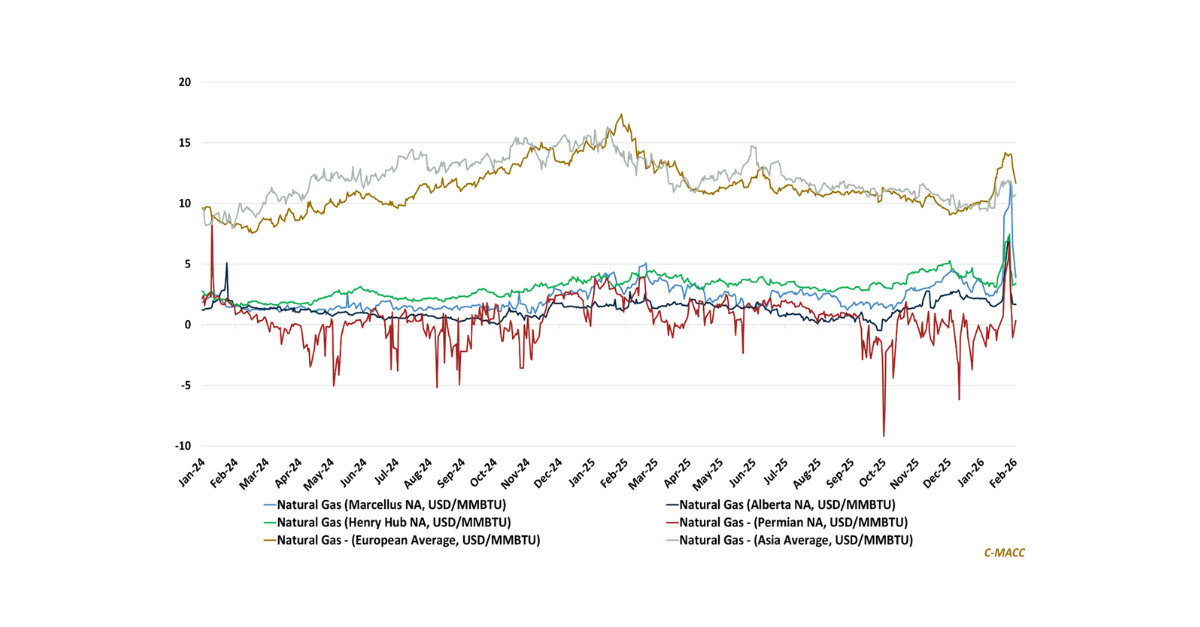

- Energy and Agriculture: North American ammonia producers hold a sizable cost advantage relative to Europe and Asia, and we highlight regional natural gas prices to display this development at the feedstock level in early 2024.

- Sustainability/Energy Transition: We highlight the global ammonia average price relative to gray, blue, and green production costs to display challenges facing the green build-out and separately show US ethanol margin trends.

- Downstream, Crop Supply/Demand: We highlight the recent improvement in crop prices following our recent comments on tighter gasoline markets. We note food and fuel price inflation in March may exceed most estimates.

Exhibit 1: In 2023, US Fertilizer equities outperformed the S&P Fertilizer & Agricultural Chemical Index, but both have trended higher YTD amid increasingly positive sentiment toward the 1H24 Northern Hemisphere planting season.

Source: Bloomberg, C-MACC Analysis, March 2024

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!