Daily Chemical Reaction

Whole Lotta Shakin’ Going On – From Consolidation to Management Shifts, Efforts to Boost Value Are Rising!

Key Findings

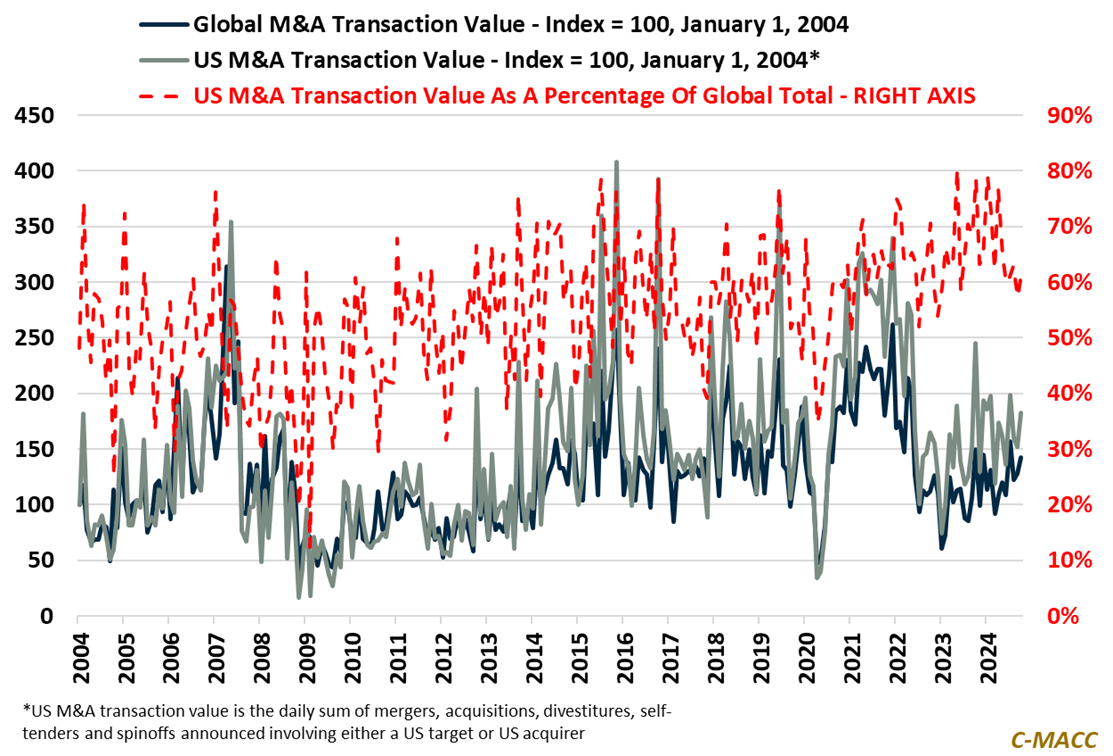

- General Thoughts: Global M&A transaction values have fallen from their 2021/22 highs, but they are recovering from their 2023 lows – the potential for lower interest rates and better demand in 2025/26 favors more activity.

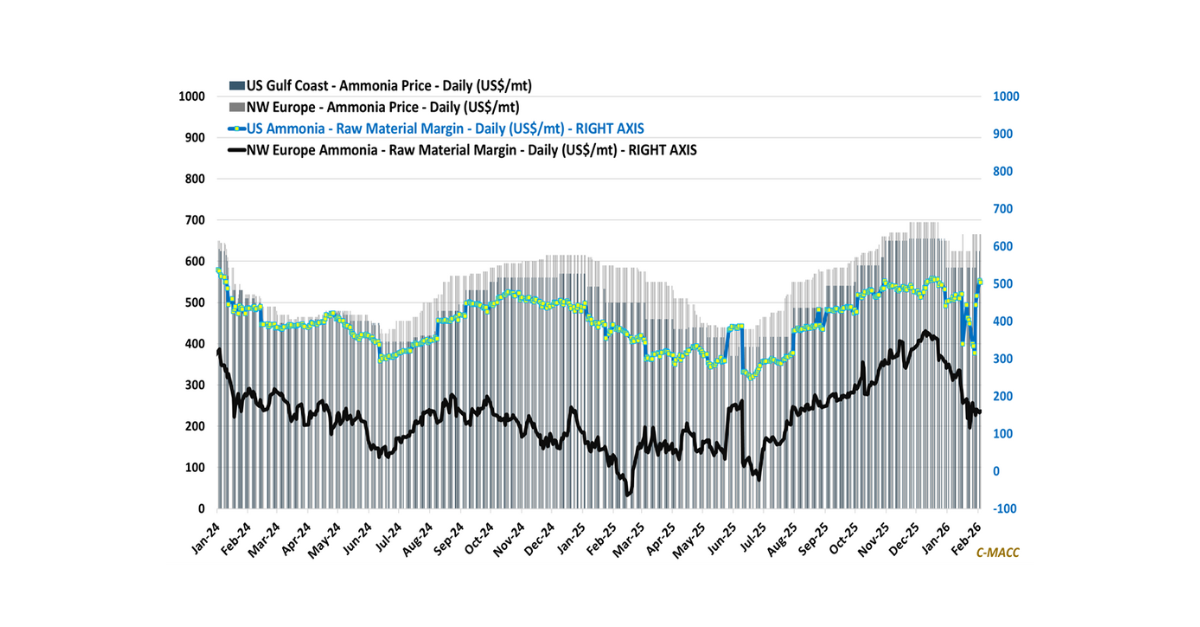

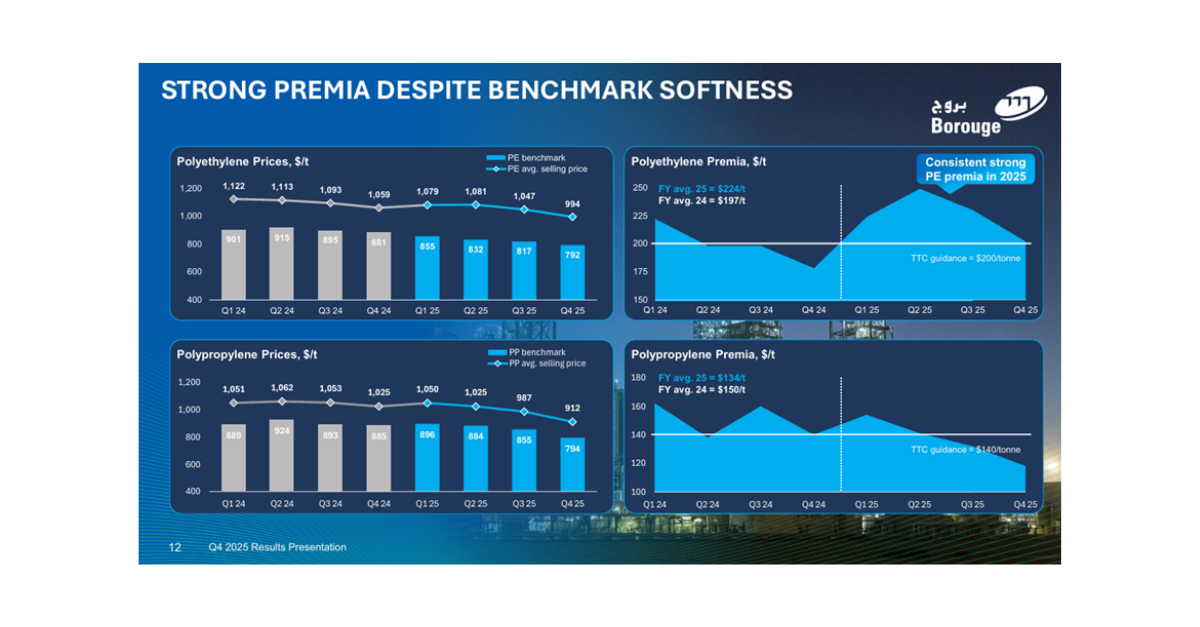

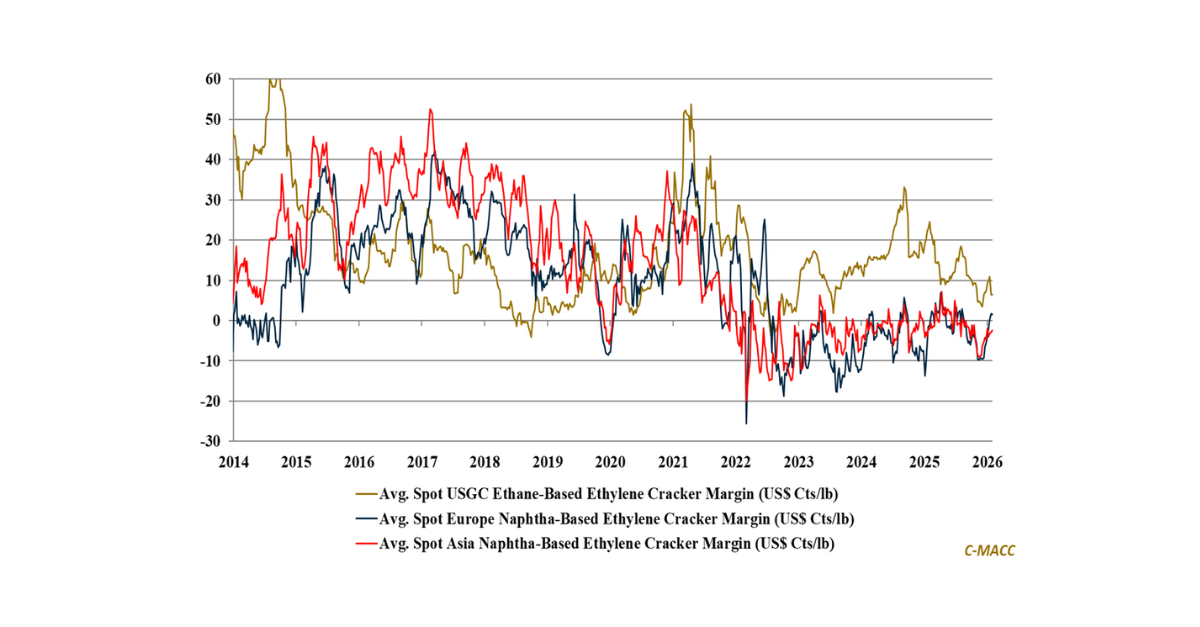

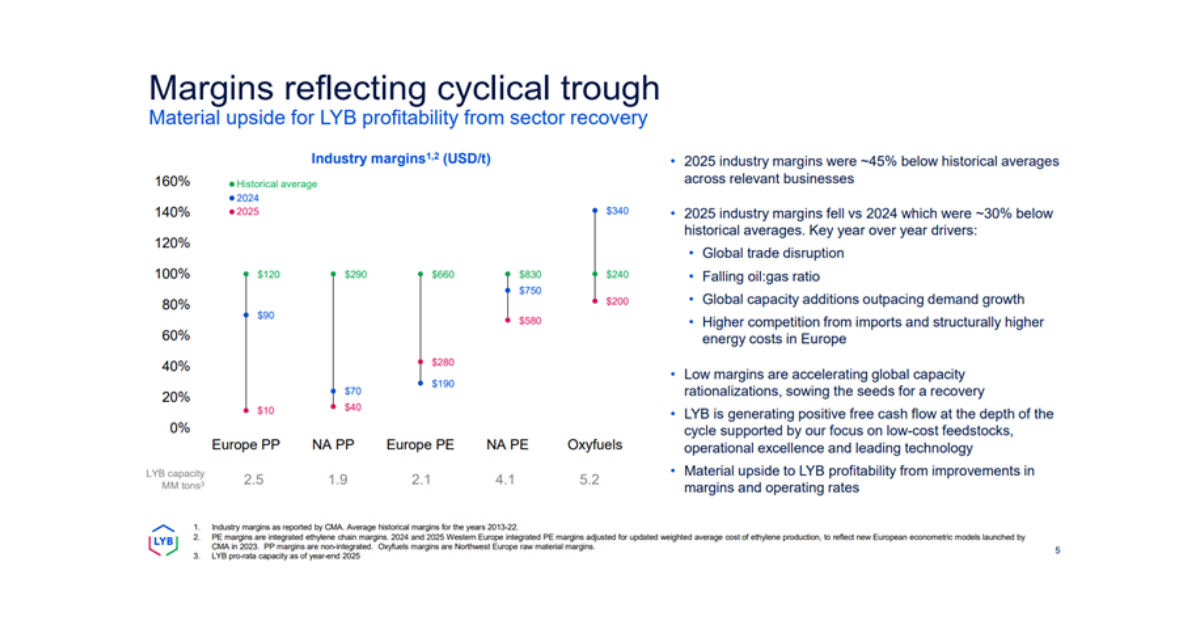

- Supply Chain/Commodities: We discuss the Air Products announcement of two potential board candidates, flag our recent reports on global trade and polymers, an upcoming report on this topic, and other industry trends.

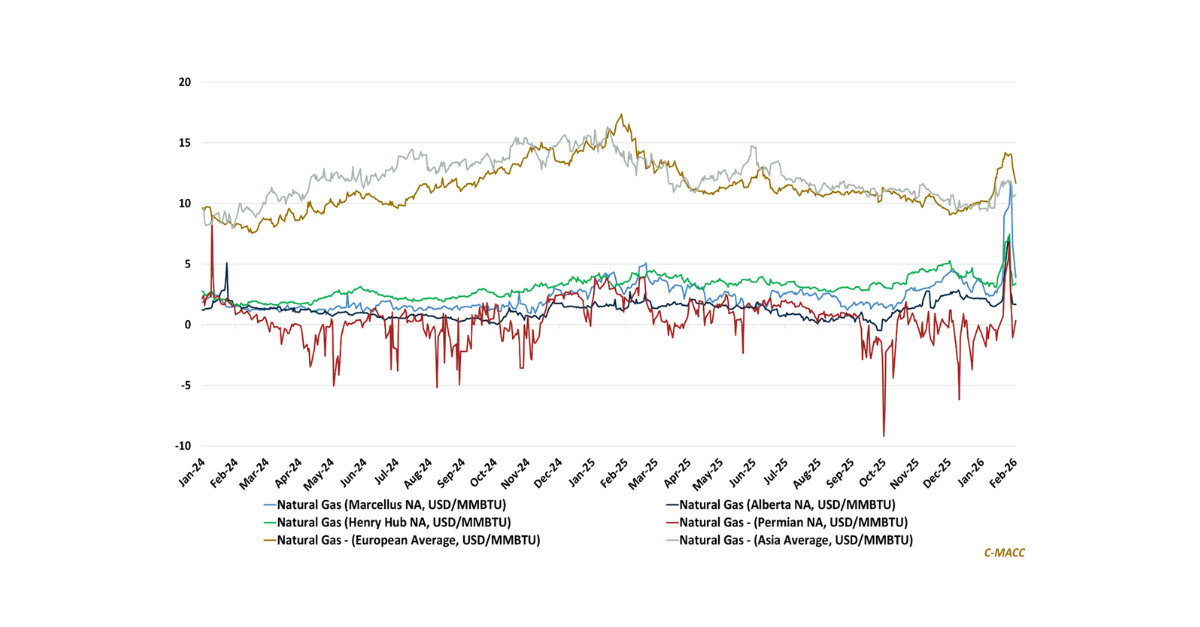

- Energy/Upstream: We highlight weakness in gasoline values in the US ahead of the Thanksgiving holiday, and we broaden the discussion to comment on the current level of US refinery margins and the EIA outlook for 2025.

- Sustainability/Energy Transition: We discuss the valuation decline in downstream companies tied to solar and wind, and other clean energy sector components that are selectively spurring M&A activity in this area.

- Downstream/Other Chemicals: We discuss worsening economic conditions in Germany, as displayed by a recent ifo survey showing survivability concerns for some companies, and other global chemical end-market news.

Exhibit 1: US M&A transaction growth has outpaced the global average, as shown by the index below, since the start of 2023, though both remain depressed relative to 2021/22 levels and primarily reflect levels seen in early 2019.

Source: Bloomberg, C-MACC Analysis, November 2024

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!