Polyethylene – February Monthly Price Expectation Report

C-MACC Polymer Pricing Service

Table of Contents:

See the PDF below for the full report

Loading…

Loading…

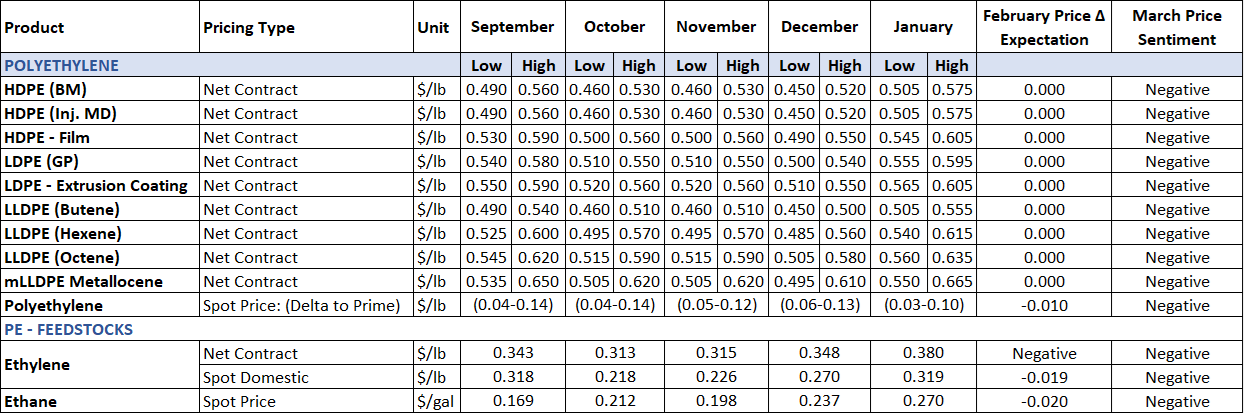

Polyethylene (PE)

Notes: Due to differing underlying variables, some PE grades can have a wider price range than others. For example, Metallocene (mLLDPE) has a wide range because the density is a substantial factor in setting its price, as a .902 density can cost much more than a .918 density, regardless of other fundamental market factors. Their monthly price moves also may not coincide with the rest of the PE market. Hexene is another such case (different hexene grades have different prices). The price assessment report does not report on specialty resins, such as Plastomers.

The February PE Net CP assessment is a rollover.

As we indicated in the January report, any inventory gain and feedstock erosion should reverse the PE price direction. Our model, based on the fundamentals below, does indicate that PE prices in February should have fallen $0.04lb.

- Inventories posted a gain.

- Exports experienced a massive reduction.

- Domestic demand declined.

- DOI gained days.

- Feedstock prices moved lower.

However, despite the fundamental support for a PE decrease, there was no overwhelming corroboration from either buyer or seller that PE prices fell in February. Since our goal is to report on the market and not make the market, our February price assessment is flat.

There are $0.07lb PE increases pending for both February and March.

Despite the plunge in exports, the prices remain the same. There appears to be no push to lower them to move material at the time of this publication.

Tariffs have been the dominant concern for both producers and buyers. Both indicated that passing through a 25% increase will be extremely difficult. Some producers stated they will have to consider eliminating spot material to the US. While others indicated, they are storing more material in the US. Buyers stated it will be difficult to absorb or pass it through as they already are contending with current PE increases while their customer’s demand decreases due to the NMA price adjustment by a major publication.

Multiple GOP Senators reintroduced a bill to eliminate the Superfund excise tax, which passed into law in 2021. The tax targeted 42 different chemicals. Among them are ethylene, propylene, benzene, chlorine, and xylene (monomers for PE, PP, PS, PET, and PVC). The bill was enacted to provide funding for environmental cleanup of plastics. The IRS confirmed that the bill harmed farming, energy production, and manufacturing. The ACC stated that the repeal could help improve the chemical output by $300MM for the chemical industry.

Plastics may see a resurgence under the Trump administration as he signaled a reversal of bans on plastic straws and single-use plastics. Tariffs on aluminum have companies like Coca-Cola signaling a switch back to PET and PP plastic bottles.

Dow announced they are laying off 1500 people globally in a restructuring effort to reduce costs.

According to sources in Europe, PE producers are seeking increases of €100t to €150t in February, but buyers are resisting due to poor demand, stating that an increase of €80t could be the likely outcome. Imports from the US are being offered at higher prices than the previous month.

BP is joining the list of petrochemical companies (Exxon, Sabic, LYB, Dow, and Versalis) that have or are planning to sell, idle or close assets in Europe. BP’s Gelsenkirchen, Germany facility is for sale. The facility can produce 1.65mt of ethylene and 635 kt of propylene annually. These actions will pave the way for more olefin imports from the US.

Prices in Asia trended upwards ($10t-$15/t) per Chemorbis (for more detailed pricing information, visit www.chemorbis.com) for most grades before stabilizing late in the month due to poor demand and buyer resistance to further price hikes.

Feedstocks

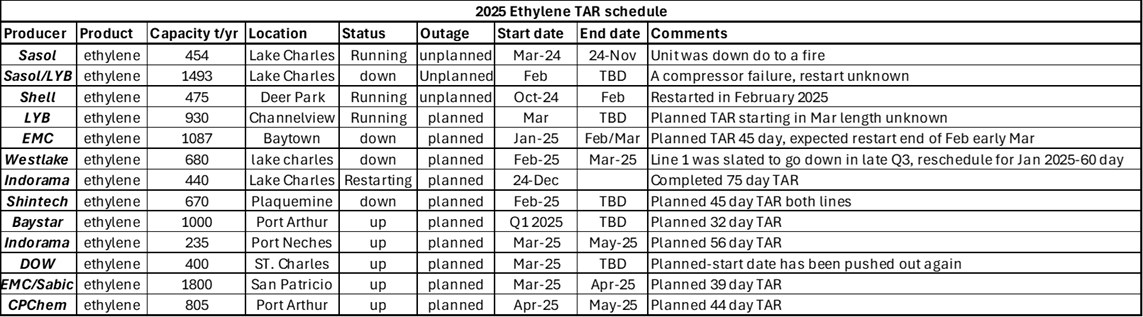

Ethylene: The January CP settled at $0.38lb (+$0.0325lb). Since October 2024, the CP has steadily increased, rising ~28%. Planned/unplanned cracker outages are the primary causes.

February spot prices had a little reprieve from the rising prices after most of the unplanned shutdowns restarted. Spot prices are bouncing around the $0.29lb (MB) and $0.31lb (Choctaw) range.

Price drivers during February:

- The monthly average spot price is ~$0.02lb lower than January.

- The export arbitrage is closed; prices are too high.

- Sasol/LYB Lake Charles cracker outage due to a compressor failure. They are now buyers of spot ethylene.

Below is an updated planned ethylene cracker schedule for 1H2025.

Natural gas: After exceeding the $4.00btu mark in January, NG prices fell near the $3.00btu level in February. In early February, there were periods of warmer weather before shifting colder by the end of the month, this coupled with higher levels of LNG exports, sent NG prices back above the $4.00btu mark. The MoM average price is relatively static.

Crude oil (CO): The WTi MoM average price is ~$4.00bbl lower. Oil producers are optimistic as President Trump has pushed for more oil production and exports. India recently announced they will increase their US energy purchases by $10 billion ($15 billion to $25 billion).

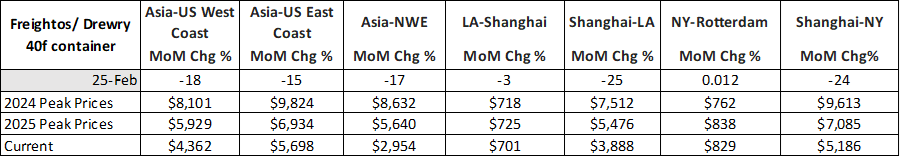

The Major Ocean Freight rates:

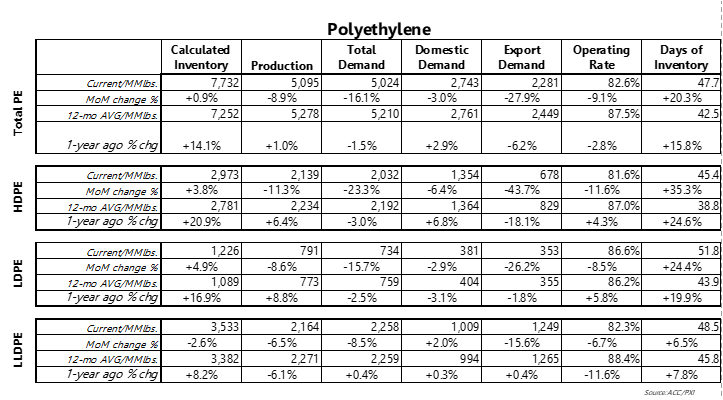

The ACC preliminary January MoM supply/demand results

The March PE Net CP assessment is pegged as “negative.” Demand in February has been deemed poor by both producers and buyers, with little expectation of improvement in March. The potential tariffs are creating a cautious overtone. Demand in other regions is also pegged as soft, which could create a negative scenario again for exports.

Methodology & Disclaimer

This service is structured to capture and report on the market and make directional estimates, not to set market prices. It focuses on net contract prices and is designed to help buyers/sellers decide on pricing. For example, regarding PP, we will move the PP price relative to PGP, but we will not make arbitrary decisions on whether to add/delete margin. If the market reports they are taking an increase above the PGP settlement, we will report that.

We have established a high-low number to capture the market price variances and to avoid making non-market adjustments. The prices reflect reasonable prices for small, medium, and large buyers. We will provide a two-month historical price settlement and short-term forward price movements (current and 1-month market sentiment). For example, the PP Homopolymer assessment may appear as Dec $0.59/lb.-$0.63/lb. Jan $0.62/lb.-$0.66/lb. Feb +$0.03/lb., March, Positive (+) or Negative (-). The market sentiment is geared toward providing what the tone of the market feels and/or how the market fundamentals are trending. Does the market believe an increase or a decrease is possible? What direction are the price drivers moving?

We do not intend to report the extreme lows and highs in net contract prices but capture a range representing the bulk of the markets. Again, note that these are “net” contract price estimates – after discounts.

We will base the assessments on the following:

- Feedback from buyers, producers, brokers, and traders.

- Market fundamentals

- Feedstocks

- Supply/Demand

- Production

- Inventory draws/gains

- Outages (planned/unplanned)

- Spot prices

- Imports/exports

- Global event impacts

- Logistics/Supply Chain

- Weather events

- Labor/Strikes

Not all the fundamentals will hold the same weight every month on the influence of the polymer price direction.

For example, if there are no weather events, it may have little to no value in the price assessment.

Because this report is designed for the market, we welcome any feedback from participants on how to improve it and add value to meet your needs. As we grow, we will also add more resins, feedstocks, and regions.

Report Schedule

Upcoming Report Schedule | ||

| Thursday, March 27th | ||

Glossary

| Abbreviation | Term |

| ACC | American Chemistry Council |

| ARB | Arbitrage |

| BD | Butadiene |

| BM | Blow Mold |

| BZ | Benzene |

| CO | Crude Oil |

| CP | Contract Prices |

| DOI | Days Of Inventory |

| EVA | Ethylene Vinyl Acetate |

| FM | Force Majeure |

| FR | Frac Melt |

| GP | General Purpose |

| HDPE | High Density Polyethylene |

| INj | Injection Mold |

| LDPE | Low-Density Polyethylene |

| LLDPE | Linear Low-Density Polyethylene |

| MF | Melt Flow |

| MI | Melt Index |

| NA | North America |

| Net CP | Net Contract Price |

| OP | Operating Rates |

| PDH | Propane Dehydration |

| PE | Polyethylene |

| PGP | Polymer Grade Propylene |

| PP | Polypropylene |

| PS | Polystyrene |

| RMC | Raw material Cost |

| SM | Styrene Monomer |

| TAR | Turn Around |

| VAM | Vinyl Acetate Monomer |