Global Market Analysis

History is a Study of Surprises – Europe’s Petrochemical Lifeline or Last Stand?

Key Findings

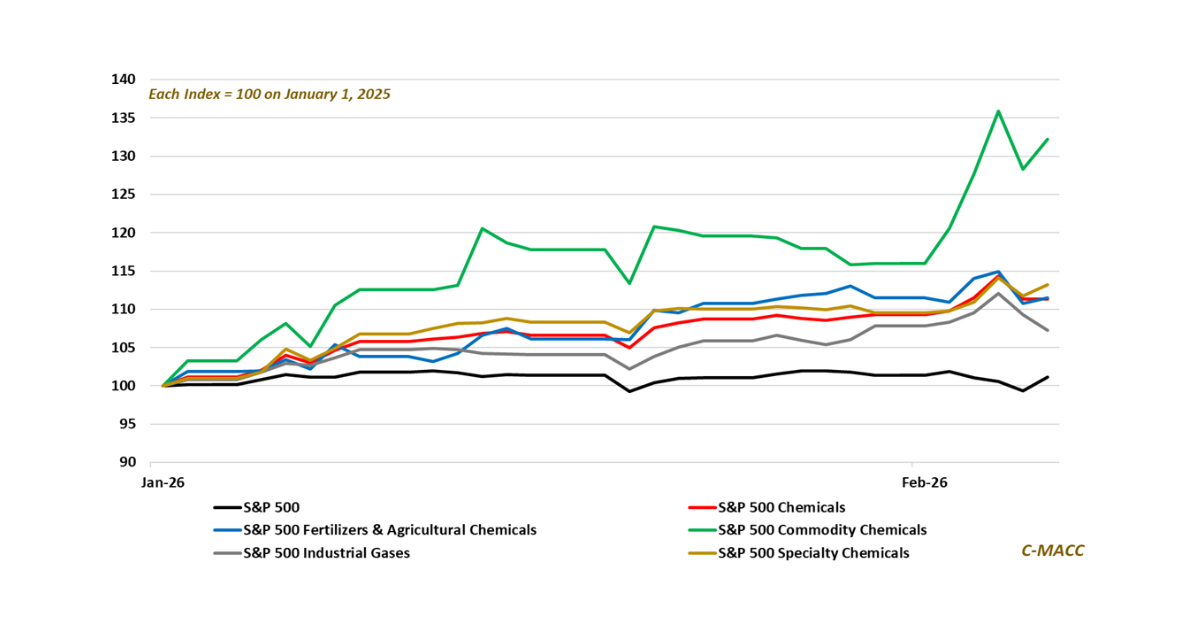

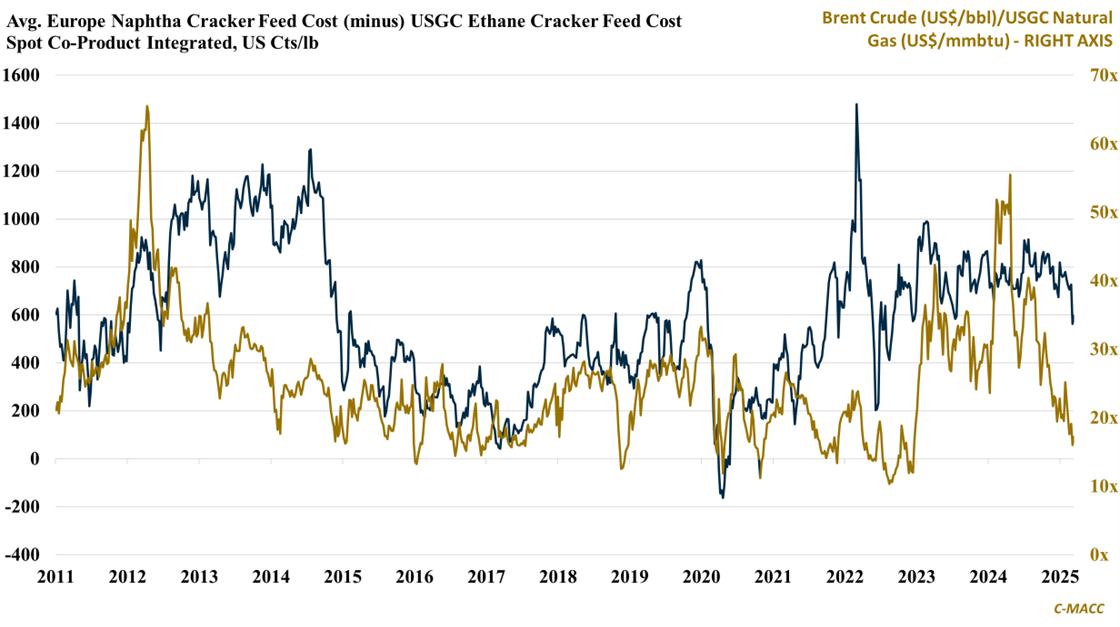

- General Thoughts: We discuss proposed European retaliatory tariffs on US goods, including polyethylene (PE), which is occurring alongside recent improvements in the EU cost position likely to benefit its manufacturers.

- Supply Chain/Commodities: We highlight the recent decline in US spot ethylene, polymer-grade propylene (PGP), and benzene, which implies lower US derivative prices, which continue to face a broadly weak export market.

- Energy/Upstream: We follow our commentary on global refinery margins benefiting from lower crude oil prices to further our discussion of China refinery operating rates movements amid a substantial new facility start-up.

- Sustainability/Energy Transition: We discuss European chemical and refineries using green hydrogen to help their decarbonization efforts. We highlight a recent project at BASF and TotalEnergies, among other European efforts.

- Downstream/Other Chemicals: We discuss the decline in March homebuilder sentiment falling to a multi-month low. We also flag ongoing restructuring across Europe, China industrial activity, and recent US Dollar weakness.

Exhibit 1: NW Europe ethylene production costs have fallen relative to the US, and its margins appear set to improve.

Source: Bloomberg, C-MACC Analysis, March 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!