Polyethylene – May Monthly Price Expectation Report

C-MACC Polymer Pricing Service

Table of Contents:

See the PDF below for the full report

Loading…

Loading…

Polyethylene (PE)

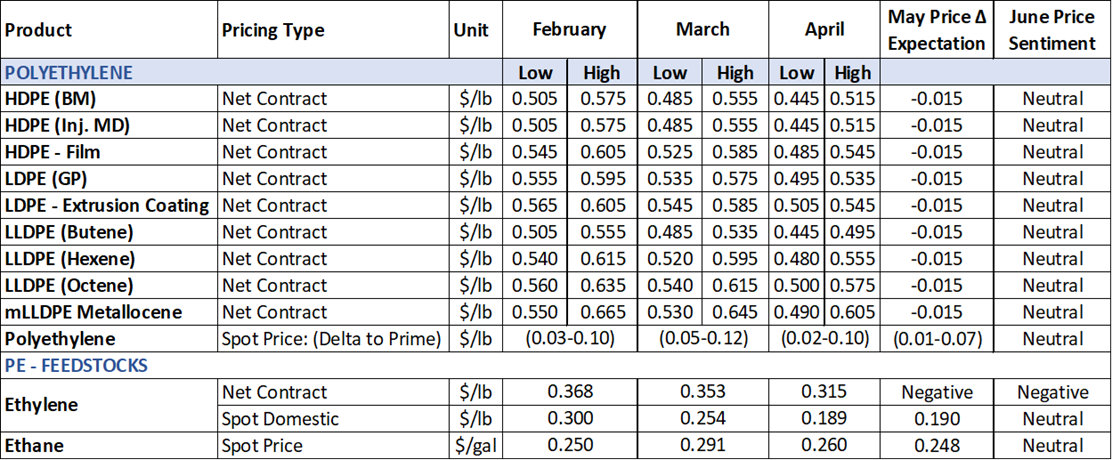

Notes: Due to differing underlying variables, some PE grades can have a wider price range than others. For example, Metallocene (mLLDPE) has a wide range because the density is a substantial factor in setting its price, as a .902 density can cost much more than a .918 density, regardless of other fundamental market factors. Their monthly price moves also may not coincide with the rest of the PE market. Hexene is another such case (different hexene grades have different prices). The price assessment report does not report on specialty resins, such as Plastomers.

The May PE Net CP assessment is minus $0.015lb.

The declines in the cost to produce PE, export volume, export prices, and domestic demand contribute to the mild dip in the May CP assessment.

Prices in the spot market have decreased from $0.01 per pound to $0.03 per pound. Export prices declined dramatically, ranging from $0.28 per pound to $0.35 per pound.

Tariffs, along with constant delays, are creating uncertainty in the market. Buyers and sellers report that orders are down; no one knows what they will be paying, and they stated that the delays are creating more chaos than the actual implementation. Holding onto cash is the preferred approach under the current circumstances.

Tariffs on China have been reduced, while tariffs on Canada remain unresolved. Recently, there has been speculation that the Trump administration may increase tariffs on Canada.

China, to minimize the tariff’s effect on local businesses, announced a Stimulus plan that includes lowering interest rates, easing reserve requirements, and increasing subsidies for factories.

Major retailers have announced that they will raise prices to offset the tariffs. The question is, how will consumers react? UPS is feeling the tariff effect with declines in Amazon deliveries. This, along with automation, has prompted UPS to lay off 20,000 employees and close three facilities. They also stated that another two hundred facilities could close due to automation.

Braskem announced that it is shifting away from cracking heavy feeds (CO) and moving to light feeds (ethane) as a cost-saving measure. They opened an ethane import terminal in Mexico to enable the Ethylene XXI complex to run at full capacity, with plans to potentially expand polyethylene (PE) production at the site to take advantage of more consistent and cost-advantaged ethane feedstock.

AccuWeather is estimating 13-18 named storms and 7-10 hurricanes for the 2025 hurricane season. Producers have already begun to announce “hurricane” increases with a +$0.05lb for June.

Plant Outages

- CPChem ethylene cracker at Cedar Bayou is restarted.

- Nova’s PE (840MMLbs) site in Ontario, Canada, is down for TAR. The expected restart is in early July. Both the HDPE and LDPE units will be down.

Feedstocks

Ethane: Early May prices inched up from increased exports and higher natural gas prices, but by the end of the month, prices began to relax and dropped ~$0.01gal. Ethane is also the favored feedstock at the refinery level.

Ethylene: The April CP settled at $0.3125lb (-$0.0375lb). Ethylene CP has fallen ~$0.065lb YTD.

Ethylene price dynamics in May:

- CPChem Cedar Bayou had an unplanned outage.

- Spot prices have increased to $0.005lb since April.

- Ethylene exports have improved.

Natural gas (NG): LNG exports are ramping up, prompting US energy firms to approve 99 million tons per year of new export capacity. In April, LNG exports reached 2.9 million barrels per day, setting a new record. Nat. Gas prices in May have been erratic, with severe swings in either direction. The May monthly average price is approximately $ 0.015/btu above the April price.

Crude oil (CO): The WTI YTD price is down $ 8.00/bbl, with a Monthly decline of $ 2.00/bbl in May. More production and soft demand are the catalysts for erosion. The forecast for 2025 is for prices to drop into the $50bbl range. OPEC+ announced that it will increase production in May by 411,000 barrels per day, with another rise in June that will total 800,000 barrels per day uptick in two months.

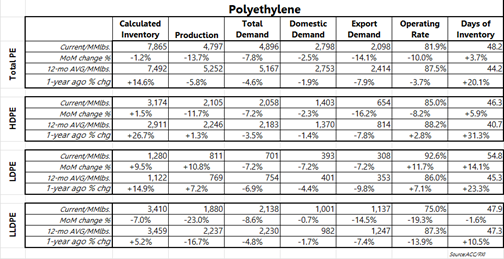

The ACC preliminary April MoM supply/demand results.

Except for the DOI, all aspects of the total PE supply and demand data posted negative results. DOI grew by 1.7 days despite the double-digit drop in production and operating rates. The lack of domestic demand and exports offset the reductions in production.

LDPE was the only polymer with a positive gain (>11%) in operating rates. This was significantly greater than demand and exports, thus generating approximately a 7 DOI gain. The DOI is ~10 days above the 12-month average.

LLDPE experienced the most significant decline in operating rates (19%) year-to-date. Exports, demand, and DOI all saw a reduction. However, the DOI remains above the 12-month average.

HDPE had the most significant drop in exports (16.2%) of the three polymers. Putting them well below the 12-month average. Despite an 8% drop in operating rates, DOI improved by more than 2 days due to the steep decline in demand and exports.

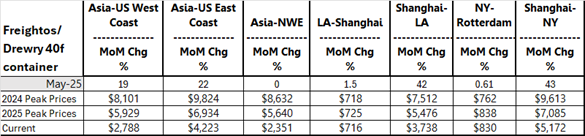

The Major Ocean Freight rates are back at pre-pandemic levels. Tariffsare negatively impacting the flow of traffic at most ports in NA with some reporting activity down ~50%. Most major freight routes saw price increases.

The June PE Net CP assessment is pegged as “neutral.” The tariff delay is expected to end in June, which could prompt increased buying (higher demand) as seen in March. In addition, the hurricane season will be starting, adding more risk of outages. A hint of a hurricane and producers will attempt to increase prices.

Methodology & Disclaimer

This service is structured to capture and report on the market and make directional estimates, not to set market prices. It focuses on net contract prices and is designed to help buyers/sellers decide on pricing. For example, regarding PP, we will move the PP price relative to PGP, but we will not make arbitrary decisions on whether to add/delete margin. If the market reports they are taking an increase above the PGP settlement, we will report that.

We have established a high-low number to capture the market price variances and to avoid making non-market adjustments. The prices reflect reasonable prices for small, medium, and large buyers. We will provide a two-month historical price settlement and short-term forward price movements (current and 1-month market sentiment). For example, the PP Homopolymer assessment may appear as Dec $0.59/lb.-$0.63/lb. Jan $0.62/lb.-$0.66/lb. Feb +$0.03/lb., March, Positive (+) or Negative (-). The market sentiment is geared toward providing what the tone of the market feels and/or how the market fundamentals are trending. Does the market believe an increase or a decrease is possible? What direction are the price drivers moving?

We do not intend to report the extreme lows and highs in net contract prices but capture a range representing the bulk of the markets. Again, note that these are “net” contract price estimates – after discounts.

We will base the assessments on the following:

- Feedback from buyers, producers, brokers, and traders.

- Market fundamentals

- Feedstocks

- Supply/Demand

- Production

- Inventory draws/gains

- Outages (planned/unplanned)

- Spot prices

- Imports/exports

- Global event impacts

- Logistics/Supply Chain

- Weather events

- Labor/Strikes

Not all the fundamentals will hold the same weight every month on the influence of the polymer price direction.

For example, if there are no weather events, it may have little to no value in the price assessment.

Because this report is designed for the market, we welcome any feedback from participants on how to improve it and add value to meet your needs. As we grow, we will also add more resins, feedstocks, and regions.

Report Schedule

Upcoming Report Schedule | ||

| Friday, June 27th | ||

Glossary

| Abbreviation | Term |

| ACC | American Chemistry Council |

| ARB | Arbitrage |

| BD | Butadiene |

| BM | Blow Mold |

| BZ | Benzene |

| CO | Crude Oil |

| CP | Contract Prices |

| DOI | Days Of Inventory |

| EVA | Ethylene Vinyl Acetate |

| FM | Force Majeure |

| FR | Frac Melt |

| GP | General Purpose |

| HDPE | High Density Polyethylene |

| INj | Injection Mold |

| LDPE | Low-Density Polyethylene |

| LLDPE | Linear Low-Density Polyethylene |

| MF | Melt Flow |

| MI | Melt Index |

| NA | North America |

| Net CP | Net Contract Price |

| OP | Operating Rates |

| PDH | Propane Dehydration |

| PE | Polyethylene |

| PGP | Polymer Grade Propylene |

| PP | Polypropylene |

| PS | Polystyrene |

| RMC | Raw material Cost |

| SM | Styrene Monomer |

| TAR | Turn Around |

| VAM | Vinyl Acetate Monomer |