C-MACC Sunday Executive Summary

Standing Outside the Fire: Industries Restructuring Under Capital Pressure and Competitive Heat

- Procurement-led synergy engines, not scale alone, are increasingly becoming the primary determinant of industrial competitiveness in a high-cost-capital, low-growth world increasingly defined by structural volatility.

- Vertical integration into midstream and logistics infrastructure supports cash-flow resilience, quietly reshaping valuation drivers across energy, chemicals, and advanced manufacturing amid rising systemic complexity.

- Consolidation is evolving into a strategic capability, an institutionalized operating system, enabling advantaged firms to repeatedly compound synergies in ways competitors cannot replicate to drive higher relative returns.

- Control of interconnected supply, processing, and infrastructure nodes will determine the 2026 industrial hierarchy, separating structurally advantaged platforms from fragmented players facing rising systemic friction.

- Otherwise, this report spotlights structural ethylene rationalization, North American LPG dominance, nuclear-powered baseloads, and integrated climate systems as underappreciated drivers of competitive advantage.

- Companies Mentioned: AkzoNobel, Amcor, Axalta, Azek, Berry Global, Carpenter, Civitas, Constellation Energy, Diamond Plastics, Enterprise, ExxonMobil, Hapag-Lloyd, Home Depot, Huntsman, Issaquena Green Power, James Hardie, JM Eagle, Kumho Petrochemical, Lowe’s, LyondellBasell, Microsoft, Navigator Gas, North American Pipe, OxyChem, PTTGC, RPM International, Sherwin-Williams, Shintech, SM Energy, Westlake, WL Plastics, RWE

- Products Mentioned: Oil, Natural Gas, NGL, LPG, Propane, Ethylene, Polyethylene, Polypropylene, Polyvinyl Chloride, Naphtha, Titanium Dioxide, Solvents

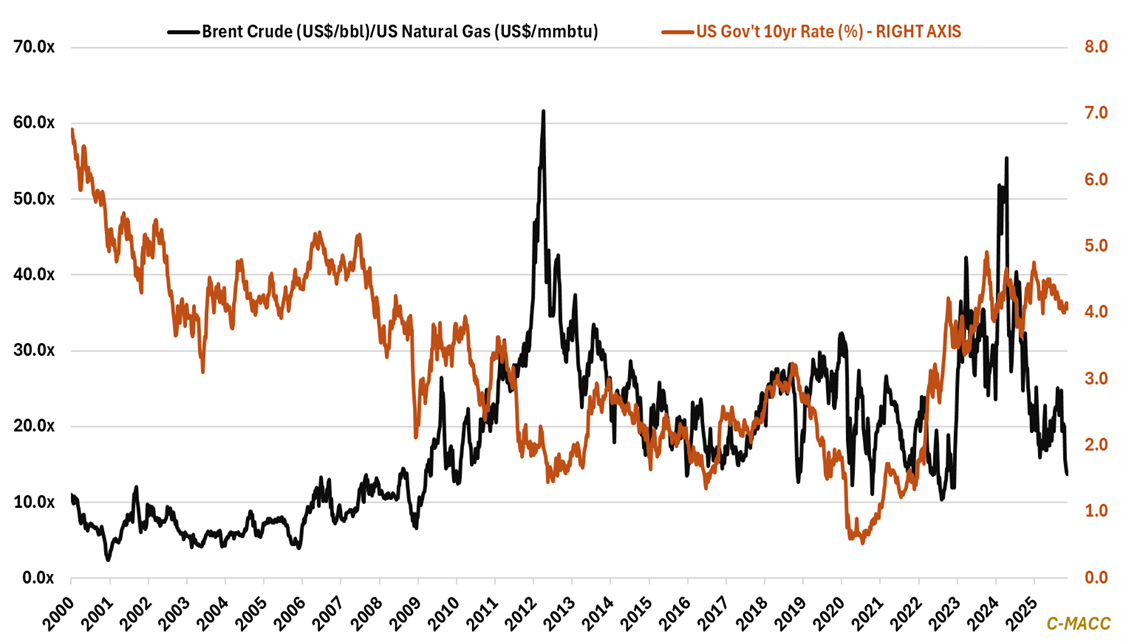

Exhibit 1: Oil-to-gas spreads and rising capital costs have jointly redefined post-COVID global industrial competitiveness.

Source: C-MACC Estimates, November 2025

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!