Base Chemical Global Analysis

Global Weekly Catalyst No. 309

- General Thoughts: Chemical feedstock movements drive greater sector margin compression WoW than price shifts, as late 2025 supply adjustments and flatter global cost curves shape competitive dynamics in favor of restructurings.

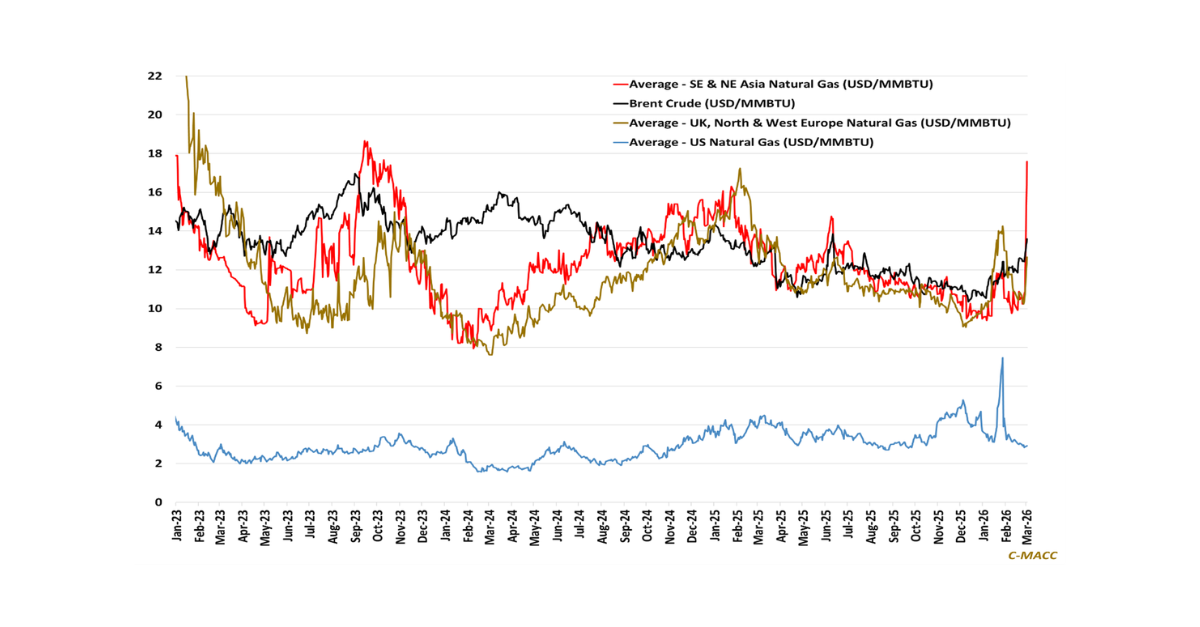

- Feedstocks & Energy: US natural gas and NGL values climbed relative to crude oil and ex-US naphtha and natural gas benchmarks last week, squeezing domestic producers as Europe and Asian cost positions relatively improve.

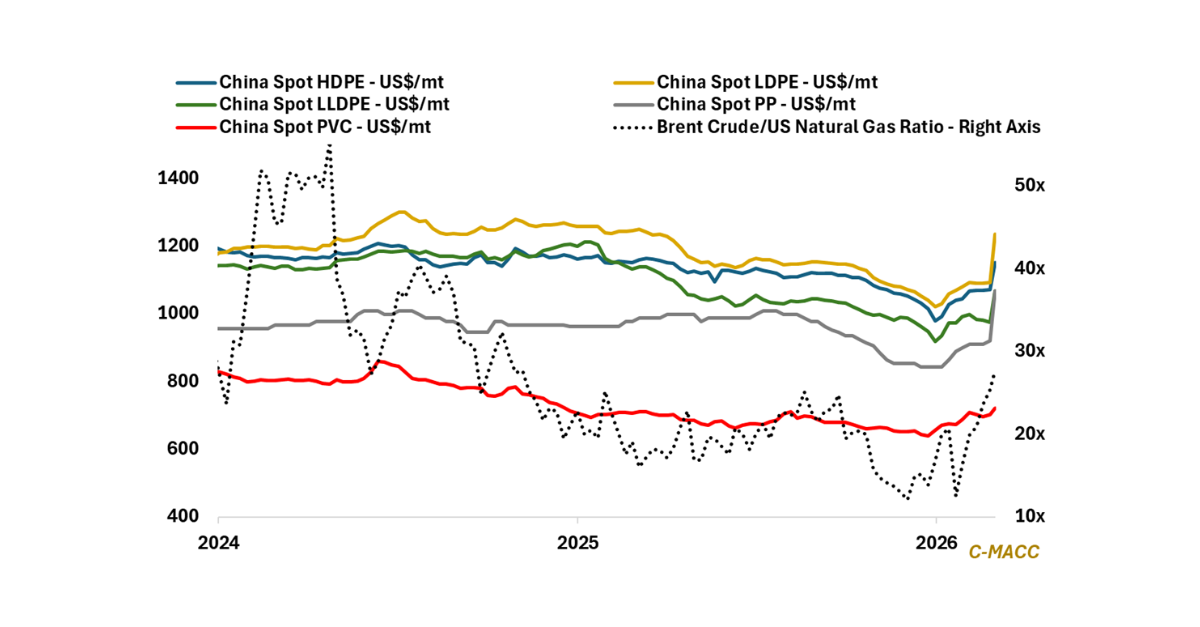

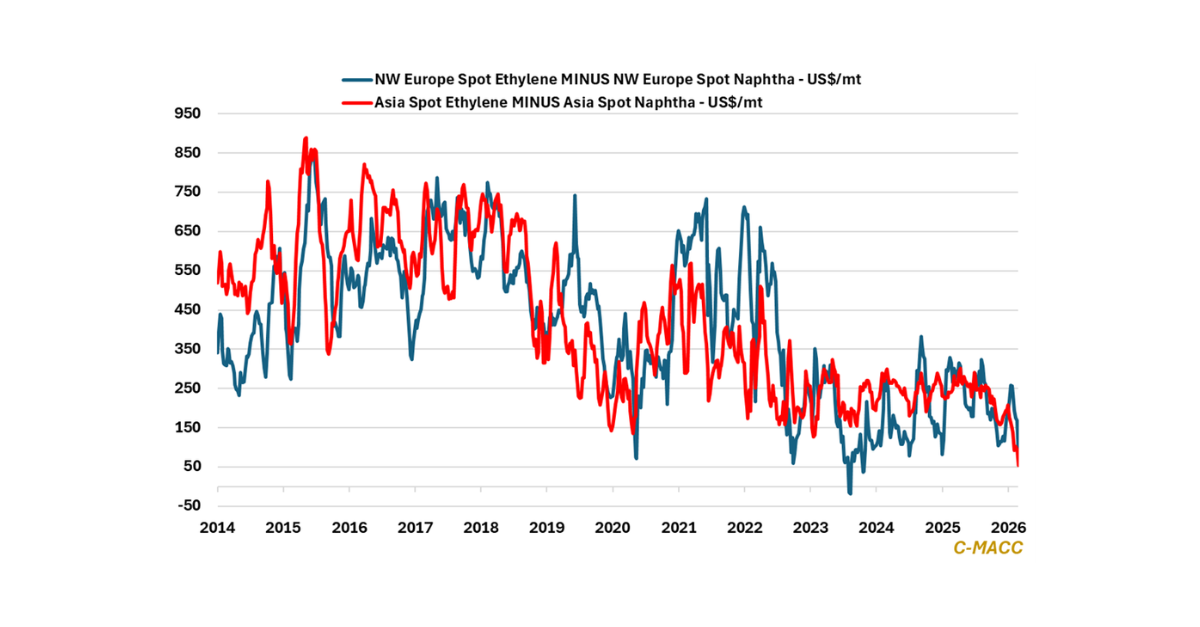

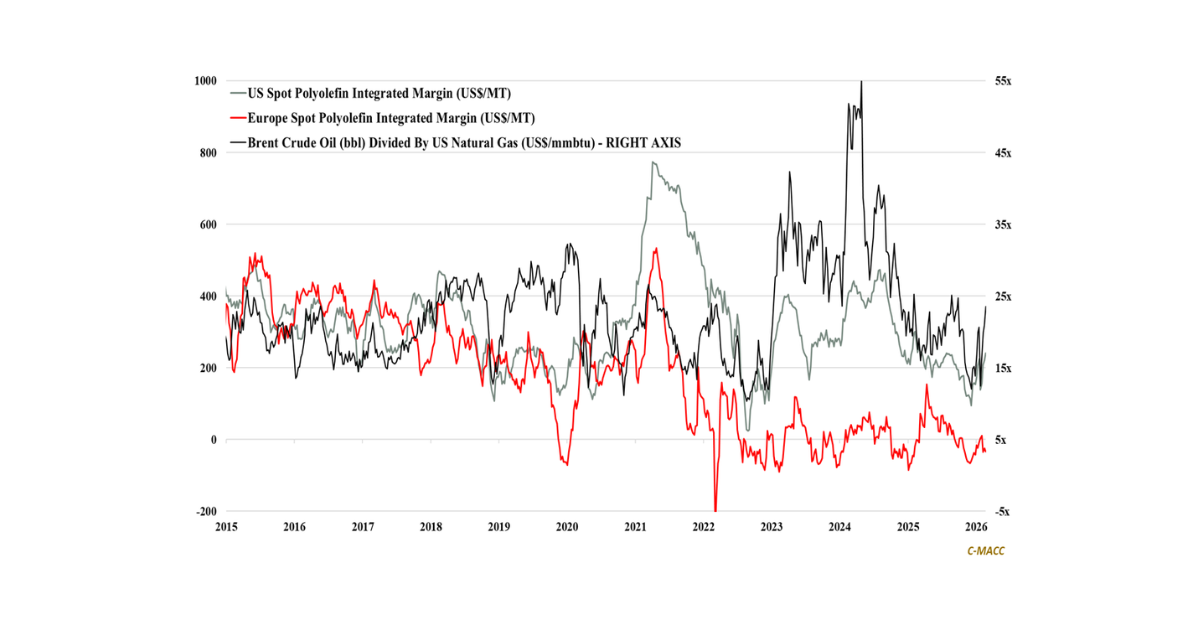

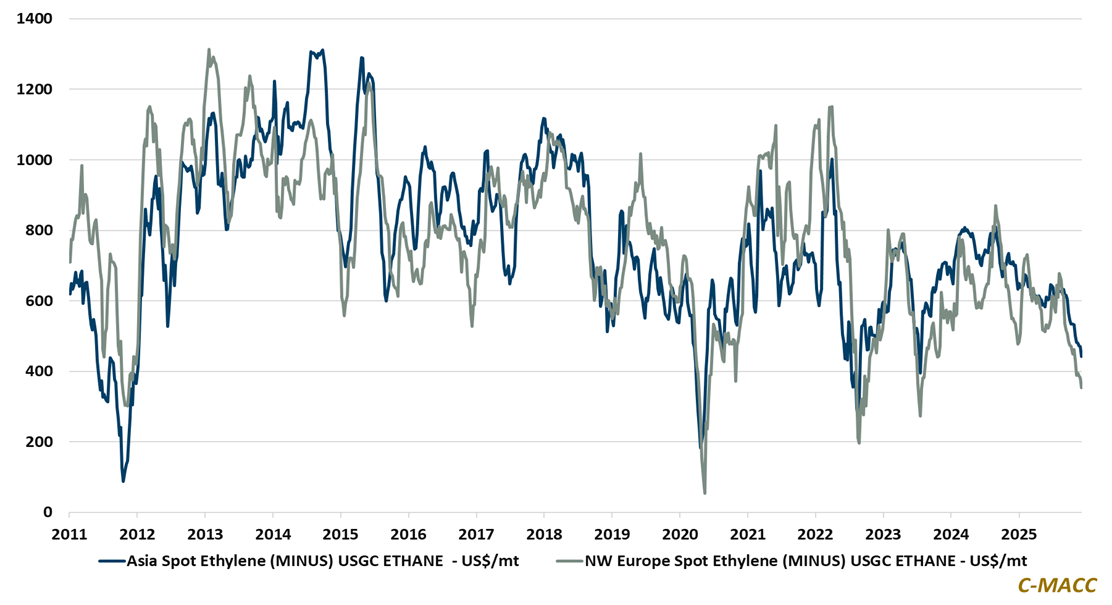

- Olefins: Olefin markets reflect mixed conditions WoW, though oversupply continues to keep producer margins under pressure. US spot ethylene margins are near 2025 lows, and global cracker co-products are also depressed.

- Other Base Chemicals: Methanol pricing diverged from regional natural gas trends WoW, while benzene strengthened globally on fuel pull and supply cuts despite weak styrenics, reinforcing cost-driven profit variability.

- Agriculture: Global ammonia prices held near their 2025 highs last week, as surging US natural gas prices tightened USGC margins while falling European and Asian gas costs elevated producer profits to annual highs.

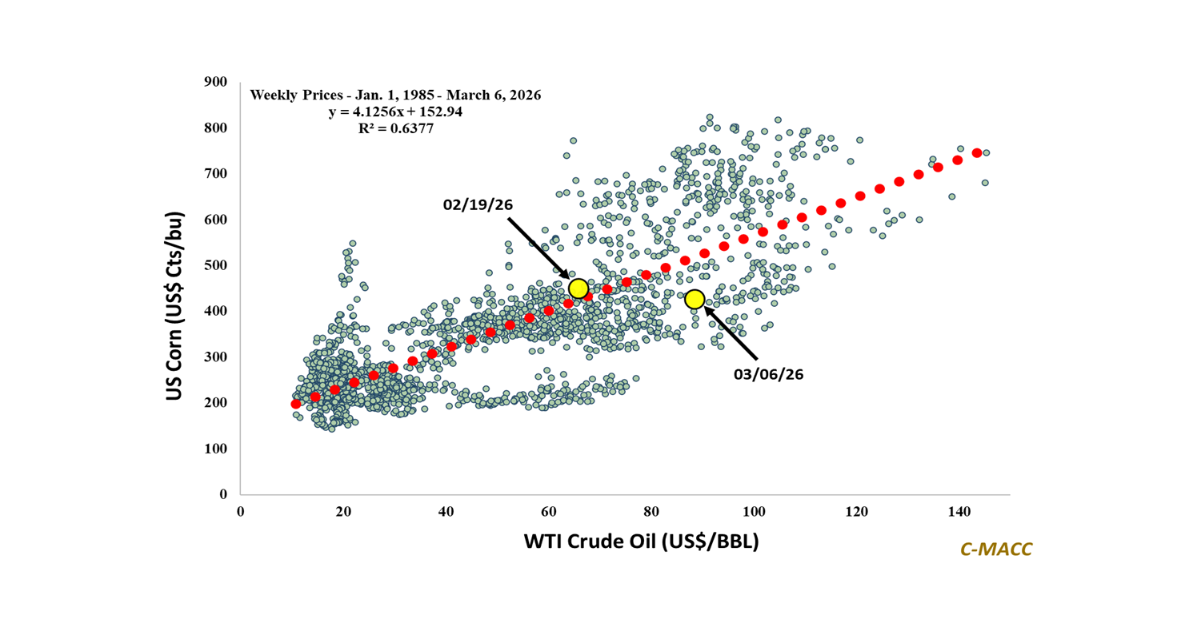

- Refining & Biofuels: Refining and biofuel margins softened WoW, with US refinery cracks easing and ethanol profit slipping to breakeven per our model, as sturdy feedstocks and weak downstream prices broadly developed.

Exhibit 1 – Chart of the Day: Asia and European spot ethylene prices sink to a YTD low relative to USGC ethane.

Source: NYMEX, C-MACC Estimates, December 2025

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!