Global Market Analysis

Margin Defense Mode Activated: Cost Curves Strike Back Globally

Key Findings

- General Thoughts: Early 2026 chemical sector updates signal margin defense over volume, as pricing, self-help, and restructuring offset weak demand, policy uncertainty persists, and capacity shifts shape outcomes.

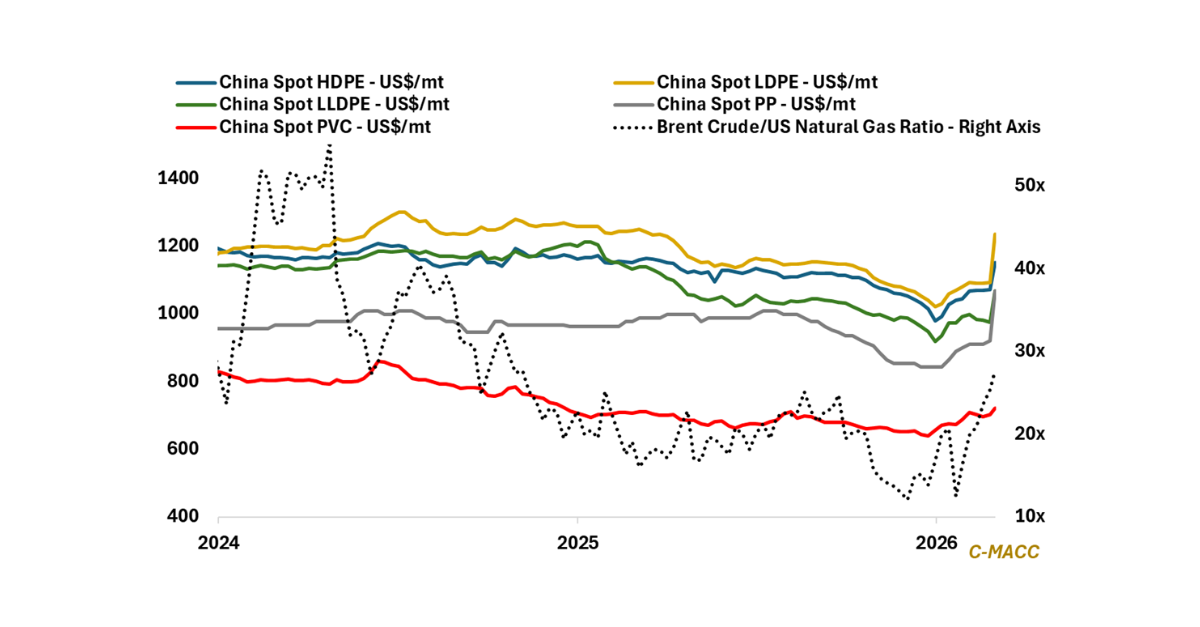

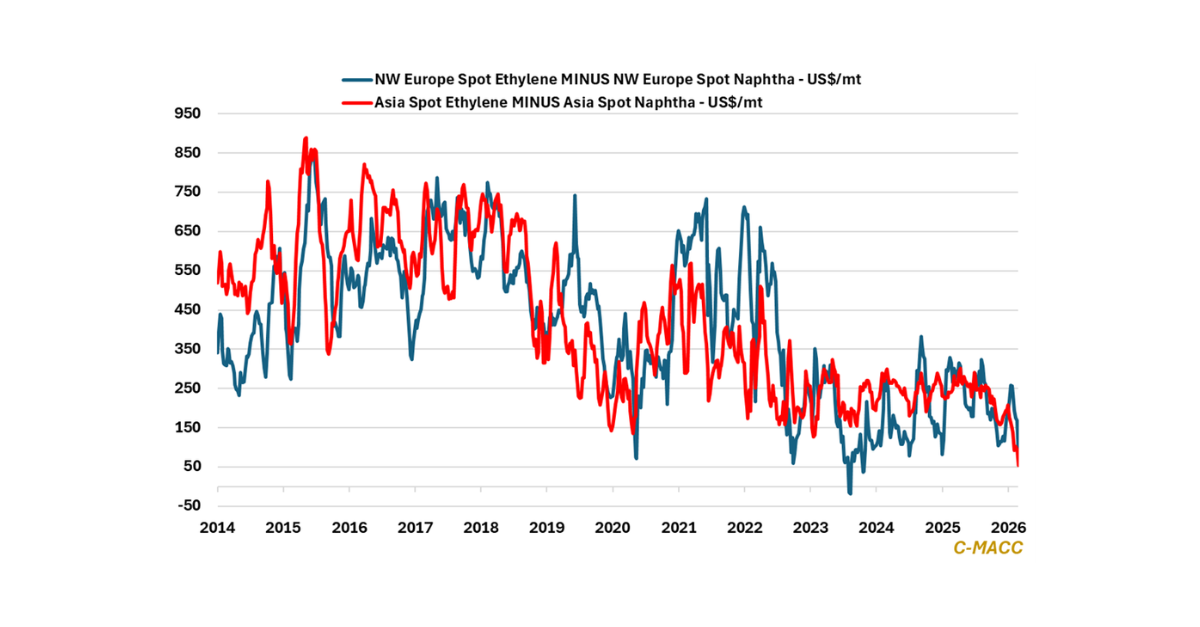

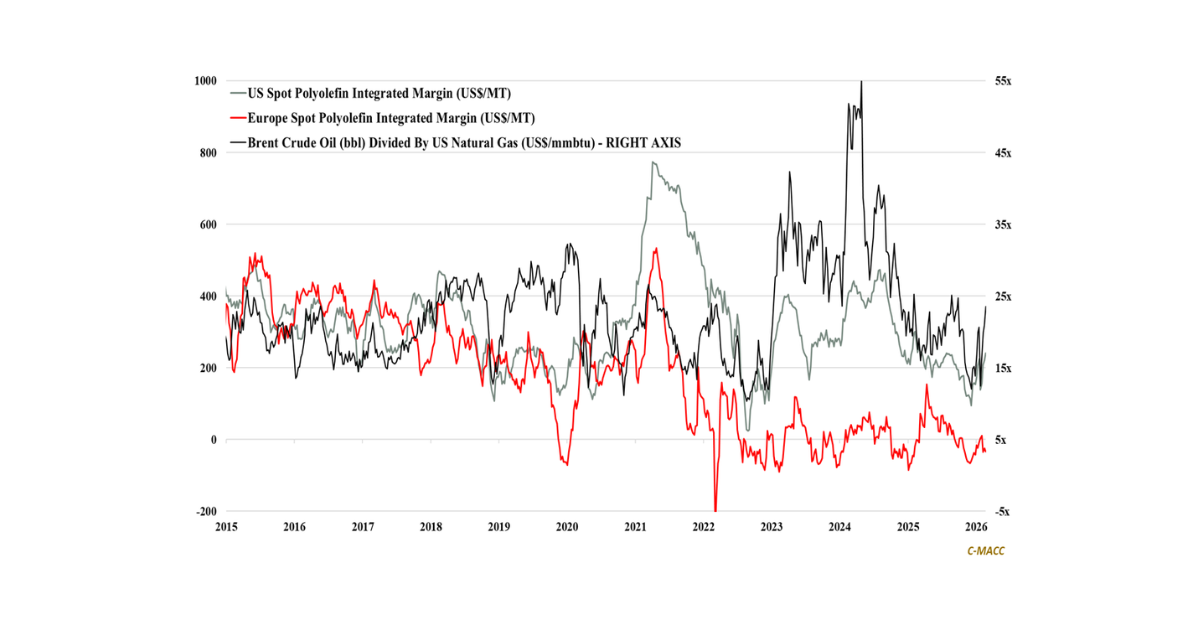

- Supply Chain/Commodities: Cost shifts anchor polymer markets, with price stabilization favoring disciplined global producers, as feedstock divergence and restructuring pressures redefine margin profiles in 2026.

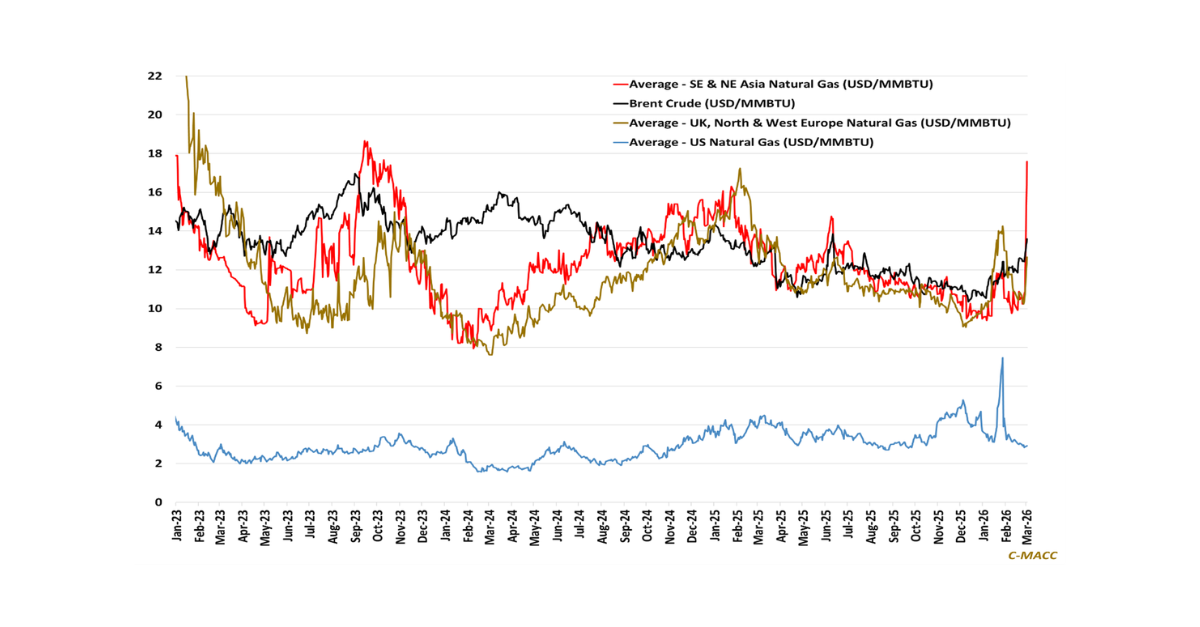

- Energy/Upstream: North American natural gas remains structurally advantaged, with LNG contracting lifting feedgas demand as upstream supply expansions underpin regional price spreads through 2026.

- Sustainability/Energy Transition: Across decarbonization and critical minerals, execution, processing depth, and economics outweigh ambition, shaping 2030 outcomes around bankability, policy, and concentration.

- Downstream/Other Chemicals: Maersk’s Red Sea re-entry signals freight rate deflation and a restoration of cost-curve discipline, intensifying restructuring pressure across shipping and chemical markets through 2H26.

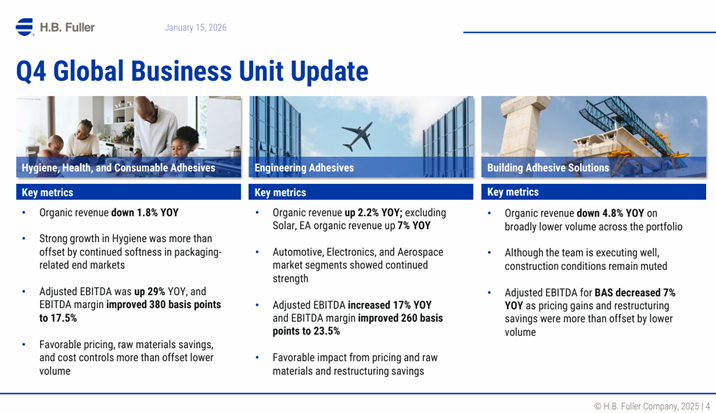

Exhibit 1: HB Fuller 4Q25 segment results show input-cost-led margin gains with likely limited 2026 repeatability.

Source: HB Fuller – 4Q25 Results, January 2026

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!