Base Chemical Global Analysis

Global Weekly Catalyst No. 314

- General Thoughts: Energy volatility, logistics, and policy shape margins across chemicals, agriculture, and fuels, favoring low-cost, disciplined operators as global markets transition toward execution-driven balance through 2026.

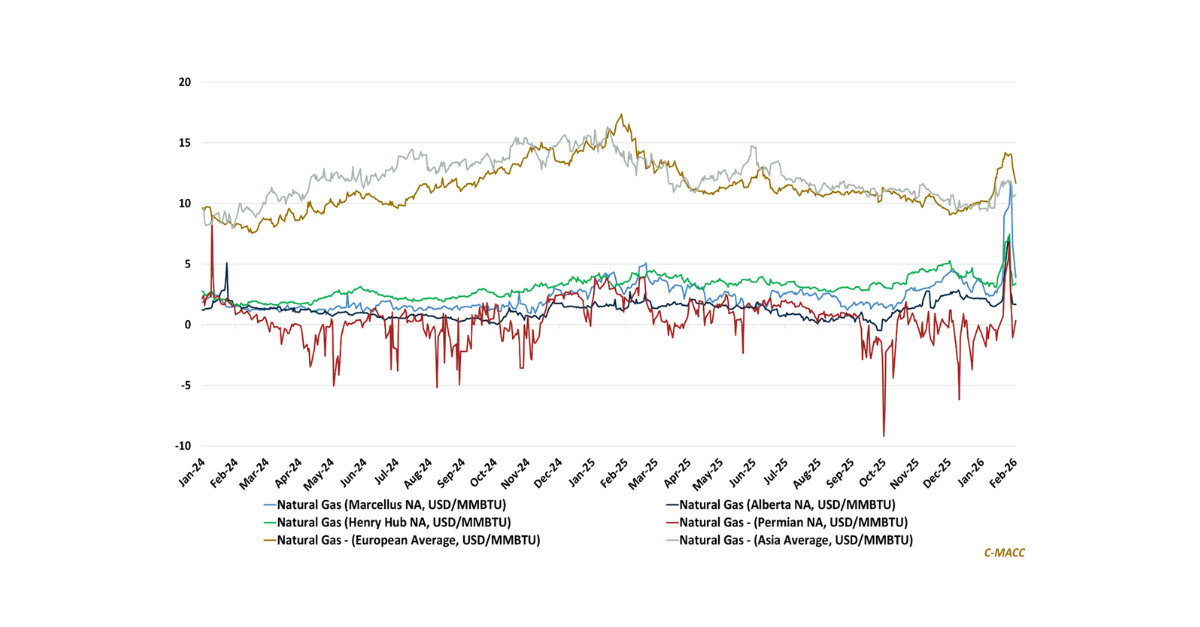

- Feedstocks & Energy: Weather-driven gas volatility lifts gas-linked feedstocks, crude stays range-bound, chemical margins tighten, and low-cost, capital-disciplined operators outperform amid dispersion in 1Q26.

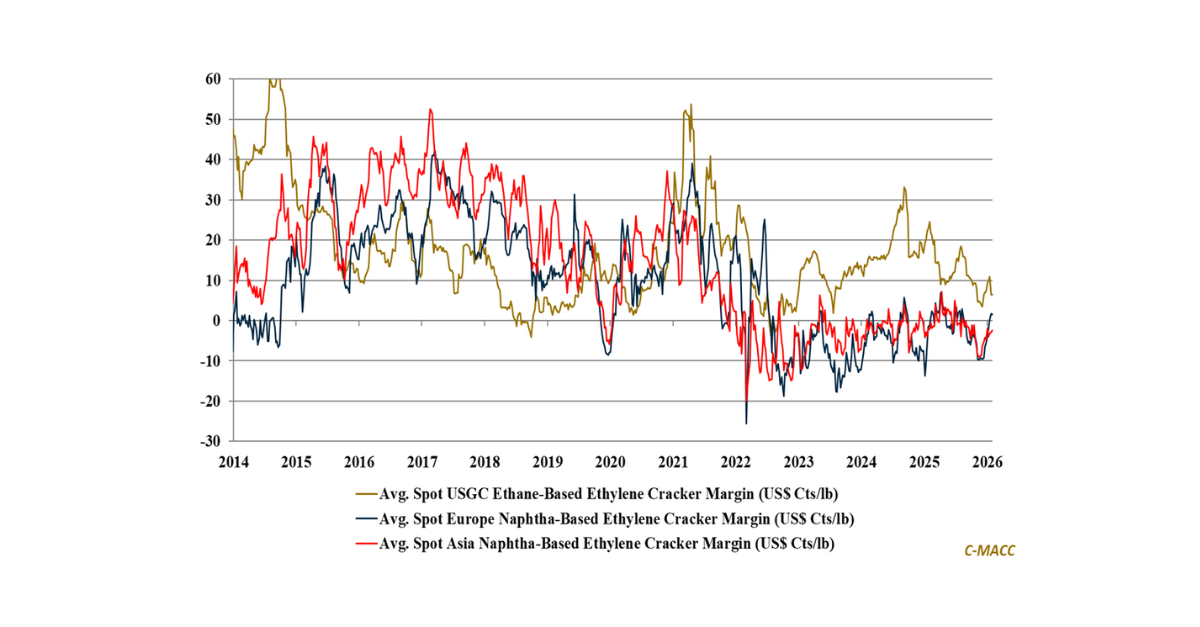

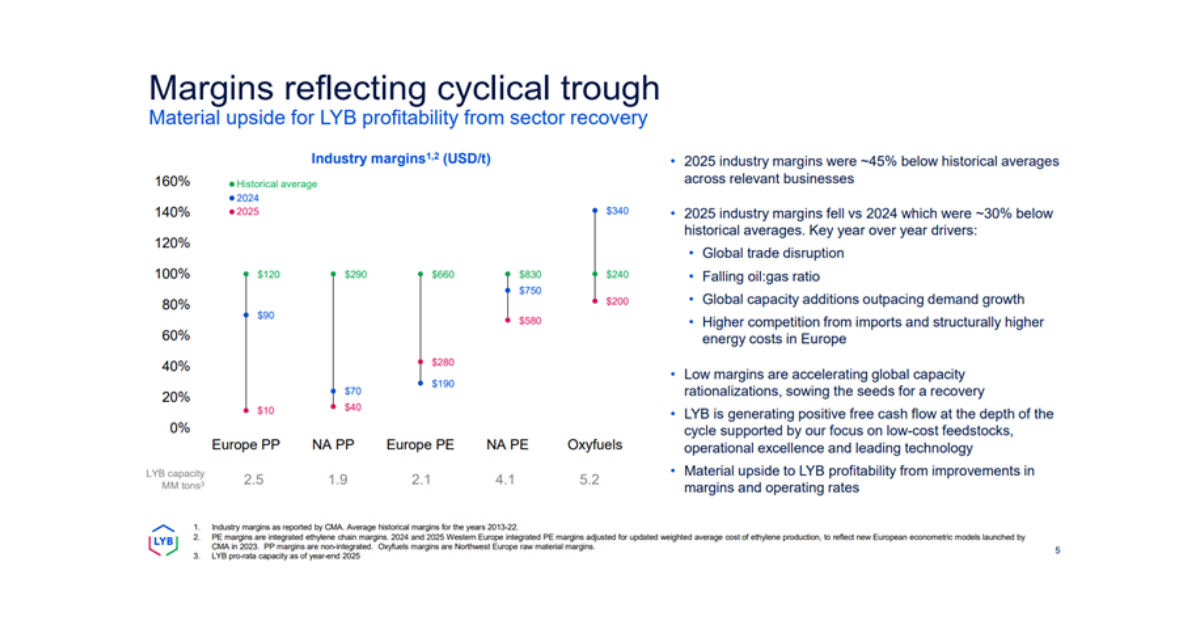

- Olefins: Outage-driven tightness lifts propylene and C4s, ethylene remains oversupplied, margins favor low-cost producers, and olefins markets remain fragmented as downstream pricing power stays limited in early 2026.

- Other Base Chemicals: Production costs outpace pricing across intermediates, squeezing margins, as benzene markets hold relatively firm and disciplined low-cost producers gain advantage in the near-to-medium term.

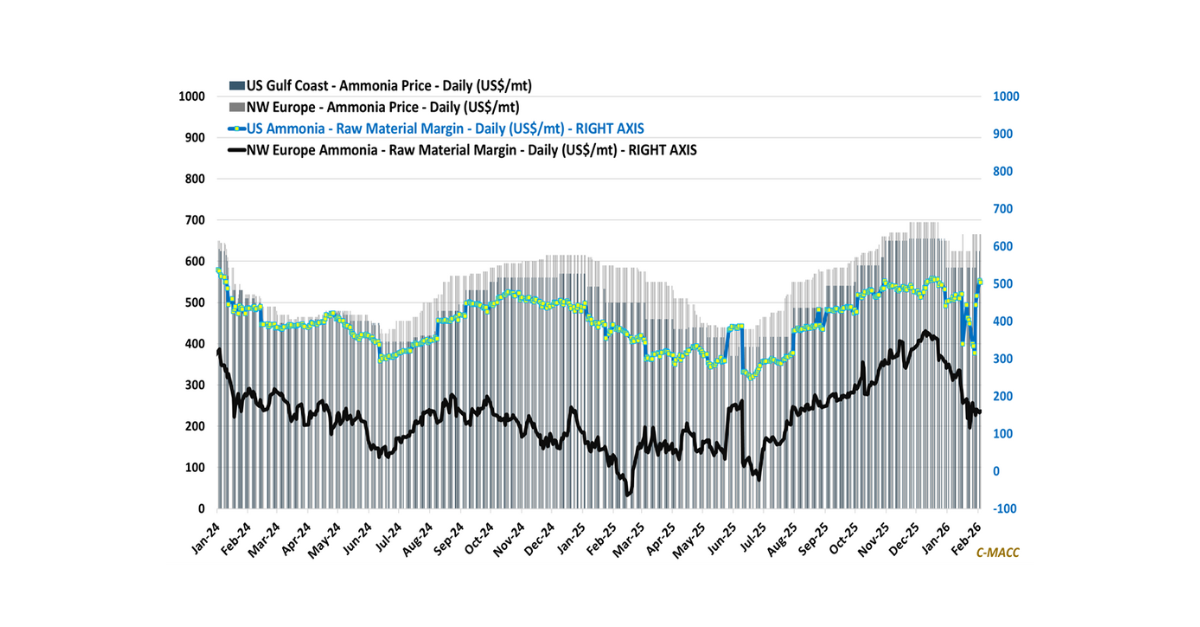

- Agriculture: Ammonia markets shift from scarcity to balance in early 2026 as logistics drive regional dislocations, corn economics support nitrogen intent, and production margins hinge decisively on cost position and execution.

- Refining & Biofuels: Global refining margins increase on distillate strength while US ethanol producer profits surge on corn relief and exports, with policy, execution, and feedstock discipline shaping returns into late 2026.

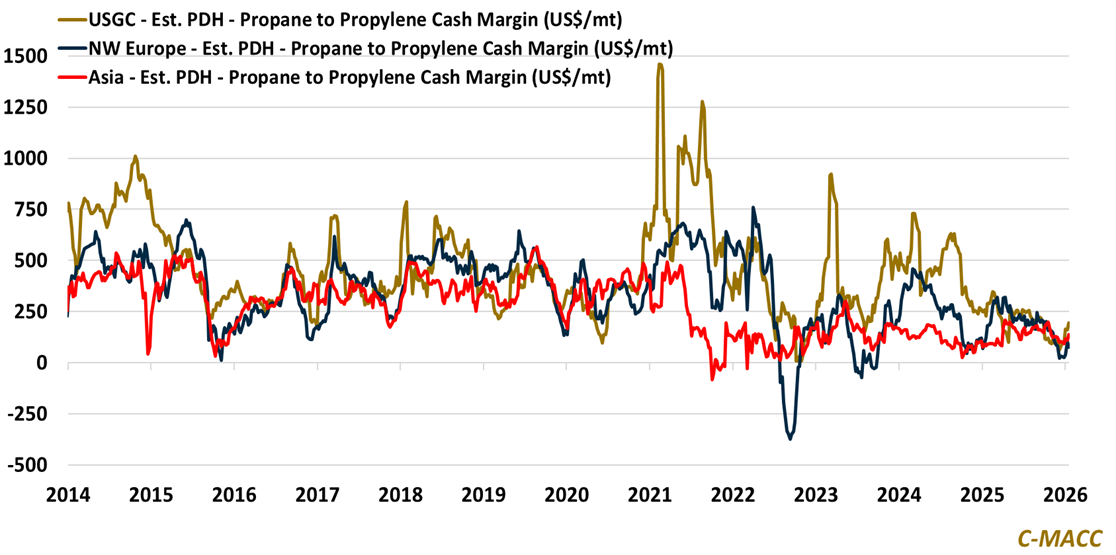

Exhibit 1 – Chart of the Day: Global PDH margins rebound from recent lows as propylene prices reflect YTD strength.

Source: Bloomberg, C-MACC Estimates, January 2026

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!